If You Have A 401 Do You Need An Ira Too

Dear Carrie,

I already have a 401. Does it make sense to open an IRA, too?

A Reader

Dear Reader,

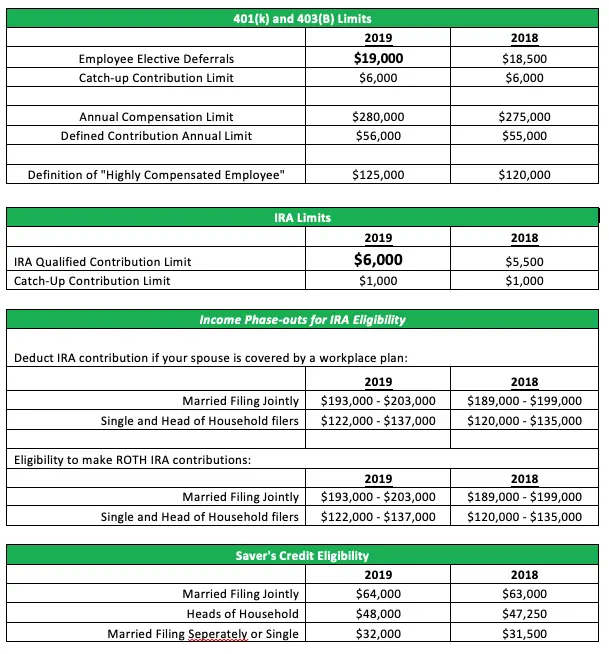

A 401 or other employer-sponsored retirement planif you’re lucky enough to have onecan be considered the backbone of your retirement savings. Contributions are easy because they automatically come out of your paycheck you may get an upfront tax deduction and annual contribution limits are sizeable$20,500 for tax-year 2022, plus a $6,500 catch-up for those age 50 or older.

That means, depending on your age, you could contribute up to $27,000 in 2022. Plus, if you get an employer match, that’s extra savings in your pocket. Add tax-deferred growth of earnings, and what’s not to like?

But as positive as all this is, there’s a good case for having an IRA in addition to your 401. An IRA not only gives you the ability to save even more, it might also give you more investment choices than you have in your employer-sponsored plan. And if you have a Roth IRA, there’s also the potential for tax-free income down the road.

But the type of IRA that makes sense for you personally will depend on your filing status and your income, so there’s a bit more to consider.

Other Retirement Account Combos

You can save to both a traditional IRA and a Roth IRA if you dont have a 401 through work, as long as your combined savings dont exceed the $6,000 or $7,000 annual limit.

It might not make sense to save to a traditional IRA and 401 in the same year, because these two kinds of accounts are designed to do the same thing. The only difference is that IRAs have much lower contribution limits than 401s.

You can save to a small business retirement plan, such as a , if you earn income from freelance or contracting work.

Why This Rule Of Thumb Generally Works

This rule of thumb works for most people because it first prioritizes maxing out the employer match to make sure you don’t miss out on free money. Then it prompts you to get your money into the Roth IRA so the money has the maximum amount of time to grow tax free. Finally, you can stash more funds in your 401 and get additional tax benefits, up to the annual limit, if you can afford to make additional retirement contributions.

It’s a straightforward plan that takes the guesswork out of retirement savings.

Read Also: Can I Use 401k To Invest In Real Estate

How To Use This Retirement Savings Rule Of Thumb

This rule of thumb ensures that you’ll take advantage of company matching upfront, then it allows you to make additional retirement contributions where you get the best tax benefits. Following a specific set of steps for a long-term plan keeps you on track and eliminates the need to refigure your plan every year.

How Much Can I Contribute To An Ira

The annual contribution limit for 2023 is $6,500, or $7,500 if youre age 50 or older . The annual contribution limit for 2015, 2016, 2017 and 2018 is $5,500, or $6,500 if you’re age 50 or older. Your Roth IRA contributions may also be limited based on your filing status and income. See IRA Contribution Limits.

Don’t Miss: How Can I Start A 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Can You Contribute To A Roth Ira And A 401

Many, if not most, retirement investors can contribute to both a Roth IRA and a 401 at the same time.

You can and should have both a Roth IRA and a 401, says Gregory W. Lawrence, a certified financial planner and founder of retirement planning firm Lawrence Legacy Group. Future tax rates are heading higher, possibly much higher, so maxing out both a Roth IRA and a 401 will give you more net after-tax dollars in retirement.

If your employer offers a 401 plan, you can choose to contribute to either a traditional 401 account or a Roth 401 account . The difference is when you pay income taxes: Upon making withdrawals in retirement with the former, or when youre making contributions in the present with the former.

Meanwhile, contributions to a Roth IRA are always made after you pay income taxesand qualified withdrawals in retirement are always tax-free. Heres the catch: You can only contribute to a Roth IRA if your annual income is below certain thresholds:

Don’t Miss: How To Turn 401k Into Ira

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Simplified Employee Pension Ira

Another option for self-employed folks is the SEP-IRA. Theyre primarily used by small-business owners who want to help their employees with retirement, but freelancers and the self-employed can also use this option. An advantage of the SEP-IRA is a much higher contribution limit than traditional and Roth IRAs, but unfortunately, there is no Roth option. You can contribute to your own retirement this way, but again, you cant exceed either 25% of your income or $66,000 .7

This is a good plan to consider if youre thinking about hiring employees in the future as your business grows. But remember, contributions made to yourself must be the same percentage made to your employees. So, if you put 15% of your salary into your account, you must also contribute 15% of your employees salary into their plan.

Now, lets explore another retirement option for small-business owners with employees.

Don’t Miss: Which Is Better 401k Or Roth Ira

The Benefits Of Diversifying Your Retirement Accounts

We’ve touched on the difference between traditional and Roth retirement accounts. It’s important to consider each in regards to your current financial situation and your retirement goals.

Matching contributions by an employer are a great incentive to contribute towards a 401. Additionally, the tax-free retirement distributions of Roth IRAs and Roth 401s are something to consider as well.

Moreover, the investment options provided by a 401 plan are significantly limited to the options provided in an IRA. By spreading out your retirement savings between 401s and IRAs, you can take advantage of your employer’s 401 match and invest in a broader array of investments in an IRA.

What To Do If You Contribute Too Much To An Ira Or 401

Contributing too much money to your IRA or 401 plan could lead to additional tax. Excess contributions and any interest or gains they earn are taxed at 6% per year for each year the money remains in your retirement account. This tax cannot exceed 6% of the combined value of your IRA accounts at the end of the year.

Don’t Miss: Why Rollover Old 401k To Ira

Ira Benefits And Drawbacks

The investment choices for IRA accounts are vast. Unlike a 401 plan, where you’re likely to be limited to a single provider, you can buy stocks, bonds, mutual funds, ETFs, and other investments for your IRA at any provider you choose. That can make finding a low-cost, solid-performing option easy.

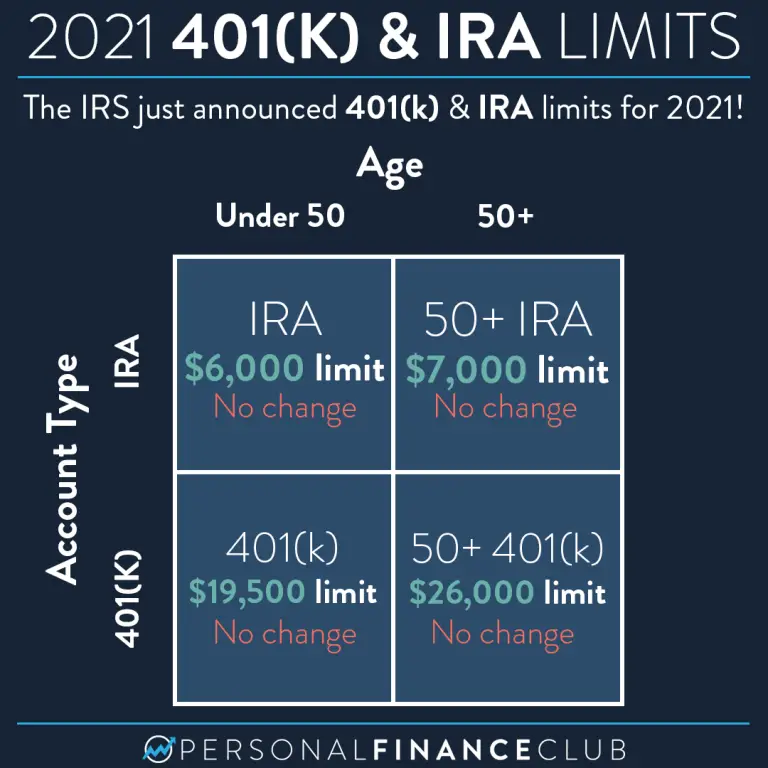

However, the amount of money that you can contribute to an IRA is much lower than that for 401s. For tax years 2022 and 2023, the maximum allowable contribution to a traditional or Roth IRA is $6,000 a year and $6,500, respectively. The catch-up contribution for 2022 and 2023 is $1,000 if you are age 50 or older. If you have both types of IRAs , the limit applies to your IRAs combined.

An added attraction of traditional IRAs is the potential tax deductibility of your contributions. But, the deduction is only allowed if you meet the modified adjusted gross income requirements. Also, it is subject to phase out if you have a workplace retirement plan and make a salary above a certain amount.

Roth Ira Contribution Limit

A Roth IRA may receive the same monthly amount as a standard IRA. You may put 6 percent of your taxable income in 2022 and 6 percent in 2023. Anyone who will be 50 or older by December 31 of that year is eligible to make a $7,000 Roth IRA contribution that year. When the year 2023 rolls along, this sum will increase to $7,500.

Also Check: How Do I Start A 401k For My Business

Are There Any Other Retirement Options

In addition to a DC or IRA, you may also want to explore retirement plans like:

- A solo 401, aka Solo-k, meant for a business owner and his or her spouse that allows you to pick your tax advantage. Sole proprietors, independent contractors, and freelancers all fall under this umbrella.

- Guaranteed income annuities are annuities that individuals can purchase to create their own pension.

- Profit-sharing plans may be offered to employees as an incentive to reward loyalty and productivity.

- The Federal Employees Retirement System is a retirement-planning tool consisting of a basic defined plan, Social Security, and the Thrift Savings Plan .

- Cash-balance plans are a variation of a defined benefit or pension plan. The difference is that you are promised a hypothetical account balance. Itâs often based on your contribution credits and investment credits.

- General investment options via robo-advisors or online stockbrokers like Ally Invest.

I Am Over Age 70 Must I Receive Required Minimum Distributions From A Sep

Both business owners and employees over age 70 1/2 must take required minimum distributions from a SEP-IRA or SIMPLE-IRA. There is no exception for non-owners who have not retired.

The SECURE Act made major changes to the RMD rules. For plan participants and IRA owners who reach the age of 70 ½ in 2019, the prior rule applies and the first RMD must start by April 1, 2020. For plan participants and IRA owners who reach age 70 ½ in 2020, the first RMD must start by April 1 of the year after the plan participant or IRA owner reaches 72.

Recommended Reading: What To Do With Your 401k When You Change Jobs

Can You Contribute To A 401 And A Roth Individual Retirement Account In The Same Year

Yes. You can contribute to both plans in the same year up to the allowable limits. However, you cannot max out both your Roth and traditional individual retirement accounts in the same year. The annual limit is the total for all of your IRAs. So, for example, you could contribute $4,000 to your Roth IRA and $2,000 to a traditional IRA, reaching the maximum allowable limit of $6,000 for the year. If youre age 50 or older, your limit is $1,000 higher.

Limitations On Having Both An Ira And 401

As mentioned, while you are always eligible to contribute to both retirement accounts, if your income is too high, you may not be eligible for the tax benefits of both. To work through this yourself you need to answer two questions:

If you answered no to the first question, then youre set. However, if you or your partner participate in a work-sponsored retirement plan such as a 401, you will be ineligible to deduct your IRA contributions because your income exceeds whats known as the phase-out limit.

If you are filing as single or head of household, the phase-out limit is between $64,000 and $74,000. If your income is less than $64,000, you are eligible for full tax deduction of your contribution to an IRA. If its over $74,000, you are not eligible, and if you are in between you are eligible for a partial deduction.

If you are filing jointly, the limit is $103,000 to $123,000. The same rules apply .

Also Check: What Is Difference Between 401k And Roth Ira

Contributing To Both Plans

It is relatively uncommon to contribute to both a 401 and a Simple IRA in the same year. An employer can only offer either a 401 or a Simple IRA. Consequently, the only way to contribute to both a 401 and a Simple IRA is if you change employers during the year. It is also possible that your employer could switch from one type of plan to another during the year, although this is unusual.

Perhaps the most common way to contribute to both a 401 and Simple IRA is if you work two jobs for two different employers at the same time. One employer may offer a 401 plan, and one employer may offer a Simple IRA plan. If you qualify for retirement benefits with both employers, you could contribute to both a Simple IRA and a 401 in the same year.

What Is A 401

In simple terms, a is a retirement savings account offered by your employer, with contributions set as a consistent monthly amount, typically as a percentage of your salary.

The main advantage of a traditional 401 is that you can make contributions straight from your paycheck pre-taxsaving you 10% to 37% on your contributions, depending on your income tax rate.

Investment growth in your 401 is also tax-deferred meaning you dont need to pay annual taxes on interest earned. All of this adds up to a big upside for long-term, tax-deferred growth. However, with a traditional 401 you will need to pay income tax on all your earnings when you withdraw from the account.

Another benefit of a 401 is that many employers will match up to a certain contribution amount, effectively doubling your savings. Every company differs in their contribution matching limit, but a common amount is a 50 cents match for every dollar, up to 6% of an employees pay. matching here.)

However, with all the benefits come a few restrictions. The most significant is the contribution limit of $19,500 for employees in 2020. There is also a 10% early distribution penalty tax if you access your funds before age 59½, but the CARES Act may let you if you made an early withdrawal for reasons related to the pandemic, including financial hardship.

Don’t Miss: How To Look Up Your 401k

Are There Contribution Limits

Yes. Each year the IRS sets a maximum amount you can contribute to all your IRAs, including those held outside Robinhood. Matches are not counted toward your annual contribution limit.

For 2022, the contribution limit is $6,000 for people under age 50, and $7,000 for those 50 years and over.

In 2023, those limits will increase to $6,500 and $7,500, respectively.

What If You Miss The Deadline

If you don’t remove your excess contributions before the tax filing deadline, you’ll pay a 6% tax on that money. And since the 6% tax applies for each year the money remains in your account, you’ll likely pay twiceonce for the prior year and again for the current one. Make the corrective withdrawal as soon as possible to avoid paying another 6% when a new year begins.

Don’t Miss: What Happens To Money In 401k When You Quit