Stay Within The Limits

Hardship withdrawals must stay within the limits of the actual financial hardship, however thats defined by the plan. For example, a 401 hardship withdrawal is limited to the immediate financial need. So you cannot take out more than you need in any one hardship scenario.

Your 401 plan may limit your hardship withdrawal to your own contributions, as well. So youll want to carefully check how much you are able to access and stay within the rules.

In the case of IRAs, you can avoid a 10 percent penalty on IRA withdrawals related to medical hardship, among other reasons. But the hardship amount must be the difference between the actual need and 10 percent of your adjusted gross income. So youre footing the bill for that first 10 percent and only then may you receive a penalty-free withdrawal on the subsequent amount.

In either case, abide by the plans rules carefully.

How To Determine If You Want To Cash Out Your Retirement

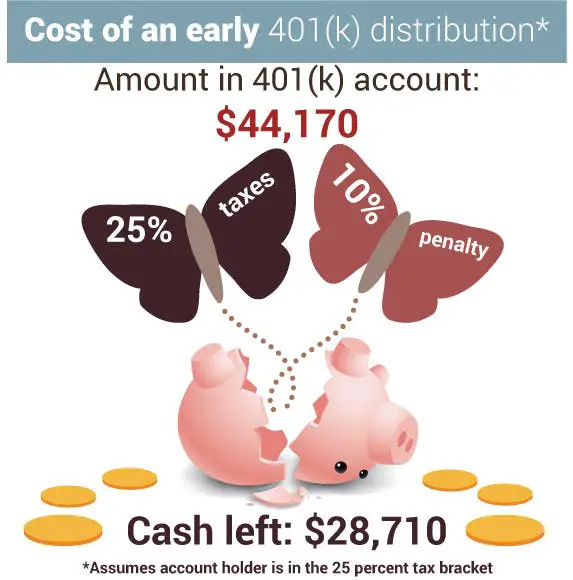

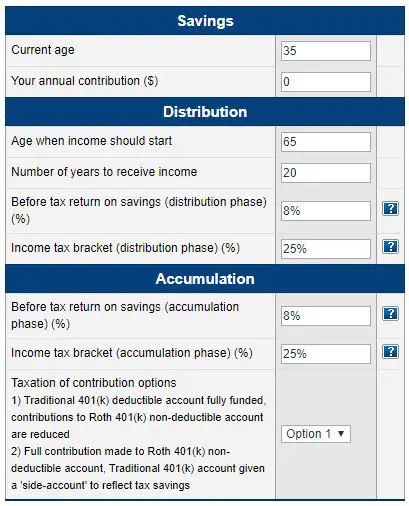

Deciding to cash out your 401k depends on your financial position. If debt is causing daily stress, you may consider serious debt payoff plans. Early withdrawal from your 401k could cost you in taxes and fees as your 401k has yet to be taxed. Meaning, the gross amount you withdraw from your 401k will be taxed in full, so assess your financial situation before making a decision.

How Much You’ll Pay For A 401 Loan

Typically you pay an interest rate on a 401 loan thats equal to a percentage point or two above the prime rate, which would currently mean between 4.5 and 5.5%. By contrast, putting your taxes on your credit card bill could sock you with an interest rate of 15% or so.

And unlike a 401 withdrawal if you can get your employer to let you have one you usually wont incur any income taxes or tax penalties with a 401 loan.

Due to these advantages, we often see an uptick in 401 loan requests around tax time by small-company owners and individual contract employees whove set up solo 401 plans, said Meadows. Their tax bills can be quite enormous.

Recommended Reading: Is There A Limit On Employer 401k Match

Do I Have To Pay Taxes On My Ira After Age 65

When you withdraw the money, presumably after retiring, you pay no tax on the money you withdraw or on any of the gains your investments earned. … To take advantage of this tax-free withdrawal, the money must have been deposited in the IRA and held for at least five years and you must be at least 59½ years old.

How Much Tax Will I Pay On A 401 Withdrawal

Because you donât pay taxes on your contributions, your withdrawals will be taxed at your ordinary income rate in retirement. But if you withdraw money from your 401 prior to age 59½, not only will you have to pay taxes, youâll also be hit with a 10 percent penalty. , you wonât pay taxes on your withdrawals in retirement because the money you put in was already taxed â however, you can still be assessed taxes and penalties for taking out your money prior to 59½.)

Also Check: When Should You Rollover A 401k

Taxes On Roth 401 Plans

Some employers offer another type of 401 plan called a Roth 401. These savings plans take the opposite approach when it comes to taxation: Theyre funded by post-tax income. This means your contributions wont lower your AGI ahead of tax-filing season.

The biggest benefit of a Roth 401 is that because youre paying taxes on your contributions now, you can withdraw the money tax-free later. A few other important notes:

-

You can begin withdrawing money from your Roth 401 without penalty once youve held the account for at least five years and youre at least 59½.

-

You can withdraw money from a Roth 401 early if youve held the account for at least five years and need the money due to disability or death.

-

Roth 401s also require taking RMDs.

Have Investment Income We Have You Covered

With TurboTax Live Premier, talk online to real experts on demand for tax advice on everything from stocks, cryptocurrency to rental income.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: How To Switch 401k To Ira

Series Of Substantially Equal Payments

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. This allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account.

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

Can I Use My 401 To Buy A House

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

For many would-be homeowners, the down payment is the biggest entry barrier to buying a house. While down payments can be as low as 3.5%, 20% is ideal if you want to secure a mortgage without monthly mortgage insurance fees.

If youre having trouble gathering funds for a down payment, you might find yourself considering using your 401 retirement fund as a convenient source of cash. While this is technically allowed, and could help you cover your down payment, it shouldnt be your first choice. There are some factors and drawbacks that you might want to consider before using your 401 to buy a house.

Well break down the pros and cons of making a 401 withdrawal for a home purchase, as well as some alternatives.

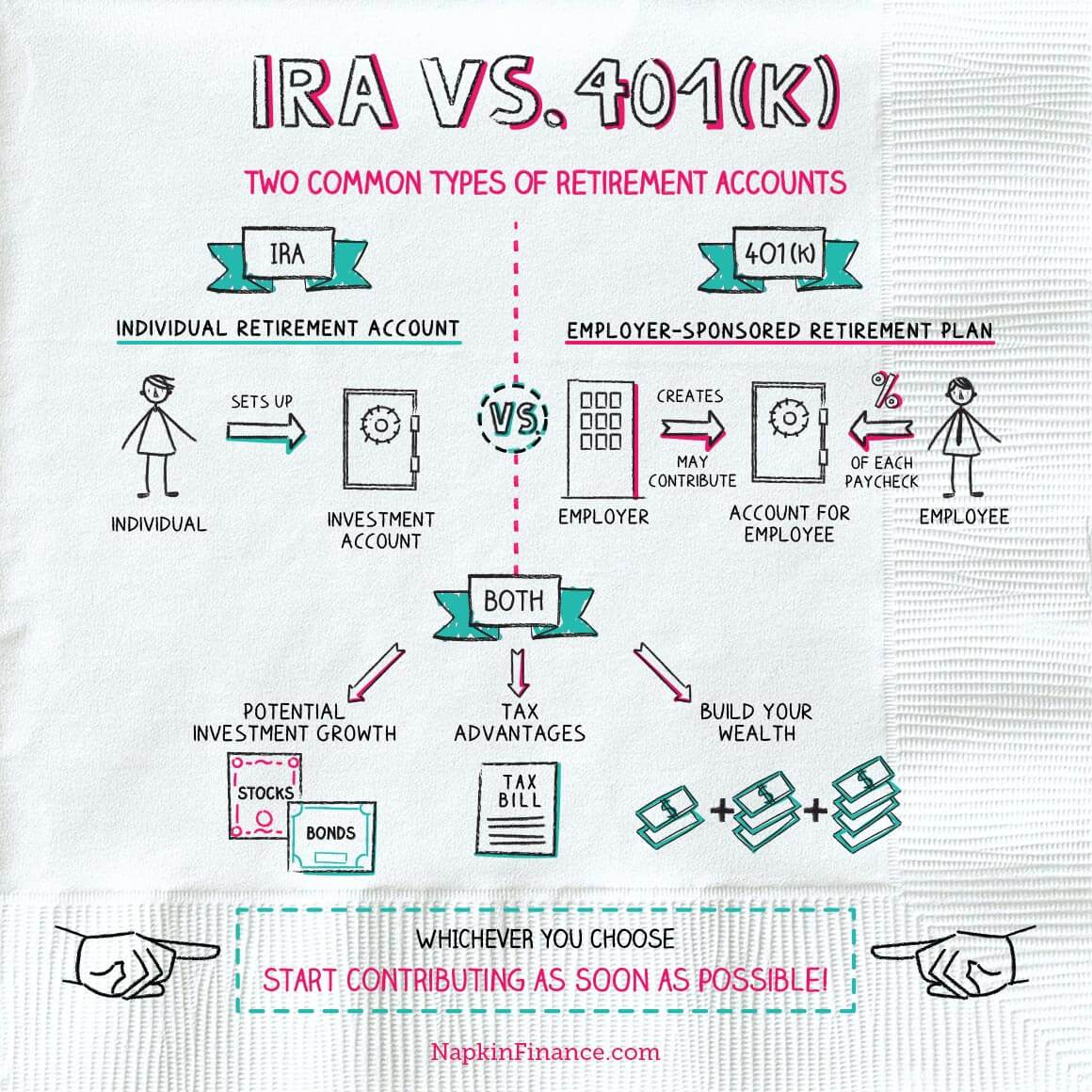

Don’t Miss: Can You Contribute To Both 401k And Ira

Should You Get A 401 Loan To Pay Your Taxes

As Tax Day approaches , you may be looking at a whopper of a tax bill and wondering where youll find the money to pay it.

And then you might think: Hmmm, I have some money sitting in my 401. Maybe I should take out a 401 loan to write a check to the IRS.

About 90% of 401 participants are able to borrow against their balance and roughly 11% do each year. By contrast, you cant borrow against an Individual Retirement Account. So should you take out a 401 loan for your taxes? Maybe.

Do You Pay Tax On 401 Contributions

A 401 is a tax-deferred account. That means you do not pay income taxes when you contribute money. Instead, your employer withholds your contribution from your paycheck before the money can be subjected to income tax. As you choose investments within your 401 and as those investments grow, you also do not need to pay income taxes on the growth. Instead, you defer paying those taxes until you withdraw the money.

Keep in mind that while you do not have to pay income taxes on money you contribute to a 401, you still pay FICA taxes, which go toward Social Security and Medicare. That means that the FICA taxes are still calculated based on the full paycheck amount, including your 401 contribution.

Don’t Miss: How To Close 401k Fidelity

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

A Note About The Cares Act

Signed into law on March 27, 2020, the $2 trillion dollar Coronavirus Aid, Relief and Economic Security Act emergency stimulus bill was drafted to help those affected by the coronavirus pandemic. Under the act, 401 account owners can make a hardship withdrawal of up to $100,000 without paying the 10% penalty. The bill also grants the account holder 3 years to pay the income tax, rather than it being due within that same year.

Read Also: How Do I Transfer My 401k To A Roth Ira

Build An Emergency Fund

This should be the foundation of your financial plan and experts recommend having about six months worth of expenses saved. You can park this money in a high-yield savings account to earn more interest than you would in a traditional checking account. An emergency fund should help you manage most of lifes curveballs.

What Are Some Ways Of Minimizing Risks To Your Retirement

If you decide using a 401 to pay off debt is your best option, here are a few things that could help you lower your financial risk.

Not using your high-interest credit cards once you use your 401 to pay them off. If you continue to use your credit cards, and then have credit cards and the 401 loan payments to make every month, you could end up in even more financial trouble.

Continuing to make contributions to your 401 while youre repaying the loan at least enough to get your employers match.

Not overborrowing. Creating a budget could help you determine how much you can comfortably pay each quarter while staying on track with other goals. And try to stick to taking only the amount you really need to dump your debt and no more.

Don’t Miss: Does Fidelity Offer A Solo 401k

Making A Hardship Withdrawal

Depending on the terms of your plan, however, you may be eligible to take early distributions from your 401 without incurring a penalty, as long as you meet certain criteria. This type of penalty-free withdrawal is called a hardship distribution, and it requires that you have an immediate and heavy financial burden that you otherwise couldn’t afford to pay.

The practical necessity of the expense is taken into account, as are your other assets, such as savings or investment account balances and cash-value insurance policies, as well as the possible availability of other financing sources.

What qualifies as “hardship”? Certainly not discretionary expenses like buying a new boat or getting a nose job. Instead, think along the lines of the following:

- Essential medical expenses for treatment and care

- Home-buying expenses for a principal residence

- Up to 12 months worth of educational tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

The home-buying expenses part is a bit of a gray area. But generally, it qualifies if the money is for a down payment or for closing costs.

Understanding These Guidelines Can Keep You Out Of Trouble With The Irs

401s are among the most popular retirement plans around. This is largely due to the upfront tax breaks they give participants, but you don’t get out of paying taxes forever. Your tax bill comes due when you take your money out, and how much you’ll owe depends on your age and income when you make the withdrawal.

Below, we’ll look at how the government handles taxes on 401 contributions, withdrawals, and special situations like early withdrawals and 401 rollovers.

Read Also: Is There A Fee To Rollover 401k To Ira

Can The Irs Garnish Or Seize My 401

Yes. While creditors such as your bank typically cannot seize money from a retirement fund to settle up debt, the same rules do not apply to the Internal Revenue Service. If you have outstanding tax debt, the IRS may place a levy on your property in order to satisfy your tax debts.

A tax levy grants the IRS the ability to seize a taxpayers personal assets, including retirement money, savings accounts, and wages in order to make up for taxes owed. In addition to these financial assets, the government can also seize your house or car so that they can recoup the tax dollars owed.

Of course, there are certain conditions that must be in place in order for the IRS to garnish your 401 fund.

Taking Money Out Of A 401k

There are generally two ways to take money out of a 401k retirement plan:

Not all plans 401k plans allow for hardship withdrawals. Thats up to your employers discretion. However, even if your 401k plan does allow for hardship withdrawals, credit card debt usually doesnt qualify as a reason to make the withdrawal under hardship rules. The IRS outlines specific reasons you can make a hardship withdrawal:

So, in most cases, you cant use a 401k hardship withdrawal just because you want to pay off your credit card balances. In this case, youd be required to take out a 401k loan.

What is a 401k loan?

401k loans have specific terms and conditions as outlined by the IRS.

- They always have a term of 5 years

- Payments must be made at least quarterly

- The maximum loan amount is 50 percent of your vested account balance OR $50,000, whichever is less

- The loan will have an interest rate, so you will need to repay the money you took out plus interest

- If you leave your job with the company that you have your 401k through, they may require you to pay the full outstanding balance

Don’t Miss: Can You Leave Money In 401k At Your Old Job

What To Know About Early Withdrawals

Your 401 funds are meant to be your safety net in retirement, so taking money out before retirement isn’t a great idea. But if you’re in a financial pinch, you may not have another choice. Just know you will be responsible for paying taxes on your withdrawals, even if you’re not retired yet. This will raise your tax bill for the year, though how much depends on the size of your withdrawal and how much other income you earn during the year.

If you’re under 59 1/2 when you make your 401 withdrawal, you’ll also pay a 10% early withdrawal penalty unless you qualify for an exception. Exceptions include medical expenses that exceed 7.5% of your adjusted gross income , a first-home purchase, or becoming permanently disabled, among other life events. Note that these exceptions don’t get you out of paying taxes on your withdrawals they only eliminate the 10% penalty.

How Do I Avoid Taxes On Social Security And Retirement Income

Here’s how to reduce or avoid taxes on your Social Security benefit:

Also Check: What Happens To 401k When You Leave Company

When Can You Start Using Your 401

You can start using your 401 as soon as you have vested in the account. The vesting schedule varies from plan to plan, but it is typically between one and five years. To determine how long you need to be employed before becoming vested, you can check your employee handbook or contact your employer. If you dont yet have access to your 401 funds, you can look at alternatives, such as taking out a personal loan or using a credit card.

You May Like: How To Move Money From 401k To Roth Ira

Tax Benefits For Saving

Based on your income and filing status, your contributions to a qualified 401 may lower your tax bill even more through the Saver’s Credit, formally called the Retirement Savings Contributions Credit.

- The saver’s credit directly reduces your tax by a portion of the amount you put into your 401.

- Since its introduction in 2002, this credit for retirement savings has ranged from $1,000 to $2,000.

- Eligible taxpayers calculate their credit using form 8880 and enter the amount on their 1040 tax return.

Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier has you covered. Filers can easily import up to 10,000 stock transactions from hundreds of Financial Institutions and up to 4,000 crypto transactions from the top crypto exchanges. Increase your tax knowledge and understanding all while doing your taxes.

You May Like: How To Withdraw Funds From 401k

What Is An Emergency Fund

An emergency fund is money in a bank account thats set aside for unplanned expenses, such as medical bills or automobile or home repairs. An emergency fund can also help you weather a loss of income, resulting from job loss or extended illness. Using funds earmarked for unexpected bills can reduce the need and the costs associated with high-interest credit cards or personal loans to pay them.