Plan For Your Retirement Over Your Career

Remember that retirement planning is not a singular event, but rather something you do over the course of your career.

Keep this mindset and continually review your retirement planning progress and account balances. If you havent started to save for retirement, its never too late.

Talk to your HR department about retirement planning options, or open up an IRA, or even basic savings account to get started putting money aside for your future.

Thursday, 21 Oct 2021 11:13 PM

Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site . These offers do not represent all account options available.

Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

User Generated Content Disclosure: These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

What About Using Unclaimed Property Funds Maintained By Some States

It may be a viable option to transfer remaining balances to a state unclaimed property fund via the escheatment process in the state of the participants last known residence or work location. Because there are variations in how this process works, please consult the applicable state before proceeding.

Next Steps For Your Money

If your old 401 plan is still with a former employer, one option is to leave the money there. But you may not pay as much attention to the account, which could lead to a portfolio thats not appropriate for your age and risk tolerance.

If youre still working and have a 401 at your new job, another option is to roll over the funds into your existing plan, assuming your employer allows it. Another option is to roll the money into an IRA. Having your savings in one place will make it easier to manage your investments.

If youve lost track of a pension, request a pension benefits statement from the plan administrator. Give the administrator your address and phone number so it can reach you to begin payments. You may need to prove your work history and eligibility for the pension you can do so by providing the plan administrator with old W-2 forms or an earnings statement from Social Security, which you can get by filing Form SSA-7050. You can get this form at www.socialsecurity.gov/online/ssa-7050.pdf or by calling Social Security at 800-772-1213.

Read Also: How To Calculate Your 401k Contribution

Search The Abandoned Plan Database

If you cant find your lost money by contacting your old employer, searching the National Registry of Unclaimed Retirement Benefits, or the FreeERISA website, you have one last place to check, the Abandoned Plan Database offered by the U.S. Department of Labor.

Searching is simple, you can search their database by Plan Name or Employer name, and locate the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

You May Like: Which Is Better 401k Or Ira

What To Do When You Find An Old 401

Once youve reconnected with your old 401, its time to decide what to do with it:

- Leave it with your old employer. If you contributed at least $5,000 to your old 401, you might consider leaving it where it is. But this may only be worthwhile if the account has competitive fees or offers access to unique investments. Otherwise, itll be yet another account to keep track of come retirement, and you may be better off rolling it over.

- New 401 rollover. Has your new employer offered you a 401? Consider consolidating your retirement funds by rolling your old retirement account into a new 401.

- IRA rollover. If you dont have a new 401 to move your old retirement funds into, consider rolling over into an individual retirement account. That way, your funds retain their tax-advantaged status.

- Cash it out. Consider this a last resort because cashing out a 401 ahead of schedule can result in major penalties.

- If youre older than 59 ½, you can access funds without penalty.

- If youre under 59 ½, withdrawals are subject to a 10% tax penalty and other fees.

Lost And Abandoned Pension Resources

The Pension Benefit Guaranty Corporation is a U.S. government agency. It provides information on pension-related topics to help people understand and find their pensions. A few resources that you can use to find a lost or abandoned pension include:

- The National Registry of Unclaimed Retirement Benefits: This website can help former government and non-government employees find their retirement plan account balances that are left unclaimed.

- Abandoned Plan Program: The Abandoned Plan Program helps terminate and distribute the benefits from pension plan accounts that have been terminated by their employers. You can search this database to help you find your abandoned plan.

- Department of Labor: The Department of Labor can help you find your lost or abandoned pension through its Form 5500 search.

Don’t Miss: How Do I Draw From My 401k

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds — provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

The Final Form 5500 For A Terminating Plan Cant Be Filed Until All Balances Have Been Paid What Happens If All Of These Options Have Been Exhausted But There Are Still Some Missing Participants

If the above actions do not result in a current location, the DOL provides several options for how to handle the plan balances. The preferred option is to rollover the account into an IRA in the participants name. This would work just like the automatic IRAs that are set up under themandatory cash-out rules, and if the plan already has an automatic IRA provider, that same provider should be able to help here.

Don’t Miss: What Do You Do With Your 401k When You Quit

What To Do When You Find Your Old 401 Plan

If find your lost 401, congratulations! However, its not time to celebrate by blowing it all on a fancy vacation or a shopping spree. You invested that money to build a retirement nest egg and thats exactly where those funds should stay.

To invest your old 401, you can do whats known as a rollover to avoid early withdrawal penalties. You can roll over the funds into an individual retirement account or into another retirement plan, such as your current employers 401.

In both cases, you can avoid withholding taxes if you roll over the funds directly via the plan administrator. If a distribution is made directly to you, you have 60 days to deposit it into your new retirement account in order to avoid taxes and penalties.

Found It Do The 401 Rollover

Once youve found your 401, what do you do with it?

You could roll it over to your new employers 401 plan. Then your savings old and new will be in one place.

But a 401 might come with limited investment options or higher fees. To avoid these, you might consider rolling the cash to a traditional or Roth Individual Retirement Account . A traditional IRA would keep your money tax-deferred a Roth IRA would require you to pay taxes on the rolled-over amount, but with no taxes taken out when you withdraw it in retirement.

And the next time you switch jobs, dont forget to pack your 401 with you.

Its your money the longer you wait between jobs, the more difficult and murky it becomes finding it, Preovolos says.

Related NerdWallet stories:

Don’t Miss: How To Roll Over Old 401k

You Found Your 401 Plan Now What

If find your lost 401, congratulations! However, its not time to celebrate by blowing it all on a fancy vacation or a shopping spree. You invested that money with the purpose of building a retirement nest egg and thats exactly where those funds should stay.

To invest your old 401, you can do whats known as a rollover to avoid early withdrawal penalties. You can roll over the funds into an individual retirement account or into another retirement plan, such as your current employers 401.

Rolling over your 401 into an IRA is a relatively simple process. First, you need to open an IRA, which you can do though most banks, brokerage firms and robo-advisors. The funds from your old 401 then can be sent directly to your new IRA. If you prefer to keep all your investments in one place and your current employer offers a decent 401, then you may want to consider rolling over the funds into that account .

In both cases, you can avoid withholding taxes if you roll over the funds directly via the plan administrator. If a distribution is made directly to you, you have 60 days to deposit it into your new retirement account in order to avoid taxes and penalties.

How To Search For Unclaimed Retirement Benefits: 401

You can take a few steps to search for your unclaimed 401 retirement benefits. The first step is to gather as much information as you can about your former employer. If your employer is still in regular operation, there is a chance that your 401 is still in the account that you had when you were with the company.

If you need to do a bit more digging, here are some steps you can take.

Don’t Miss: How To Invest Without A 401k

Find Lost 401k: How To Find Out If You Have Lost Or Forgotten Retirement Accounts

Here is a guide for how to find lost money a lost 401k or other unclaimed retirement benefits.

Finding a lost 401k or other retirement account is more tedious than metal detector treasure hunting,but perhaps more rewarding.

A few years ago, I received a strange notice in the mail: a former employer was discontinuing their retirement plan and I had 30 days to either roll my balance into a different account or receive a distribution from the plan. This sort of thing happens quite often when people change jobs and leave their retirement account in the old employers plan. The strange thing about this notice was, I had no idea Id been participating in the plan while I worked there!

Could the same thing have happened to you? If youre looking for ways to increase your retirement savings, you just may want to look for lost or forgotten retirement accounts.

How Can Plan Sponsors Avoid Having The Issue Of Lost Participants In The First Place

One of the most effective steps is to distribute benefits to former employees as soon as possible after termination of employment, before they have an opportunity to become missing.

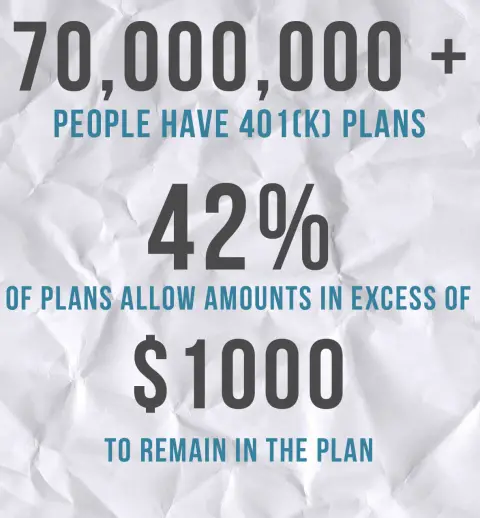

The IRS has rules in place that dictate when terminated participants can/must take distributions of their account balances from 401 plans. Embedded within those rules are certain options that can facilitate the efficient payout of smaller balances to many former employees.

- Balance Over $5,000: Generally, a participant who has a vested account balance in the plan of at least $5,000 is permitted to keep their money in the plan as long as they wish, subject to Required Minimum Distributions on attainment of age 70 ½.

- Balance Under $5,000: Participants with balances below that threshold can be forced to take their money out of the plan as long as they are given appropriate notice 30 to 60 days prior to the payment.

For plans with $5,000 force-out option, it is important these are processed on a consistent and timely basis such as each quarter.

Don’t Miss: Do You Pay Taxes On 401k Withdrawals

Contact Your Old Employer About Your Old 401

Employers will try to track down a departed employee who left money behind in an old 401, but their efforts are only as good as the information they have on file. Beyond providing 30 to 60 days notice of their intentions, there are no laws that say how hard they have to look or for how long.

If its been a while since youve heard from your former company, or if youve moved or misplaced the notices they sent, start by contacting your former companys human resources department or find an old 401 account statement and contact the plan administrator, the financial firm that held the account and sent you updates.

You may be allowed to leave your money in your old plan, but you might not want to.

If there was more than $5,000 in your retirement account when you left, theres a good chance that your money is still in your workplace account. You may be allowed to leave it there for as long as you like until youre age 72, when the IRS requires you to start taking distributions, but you might not want to. Heres how to decide whether to keep your money in an old 401.

The good news if a new IRA was opened for the rollover: Your money retains its tax-protected status. The bad: You have to find the new trustee.

Dols Abandoned Plan Database

When a company goes out of business, it is required to notify 401 plan participants so that they can collect any funds owed to them. If the deceased wasn’t notified, you can use the Department of Laborâs Abandoned Plan Search to trace the missing 401. You can search the 401 by plan name or employer. If there is a record, you will see the plan administratorâs information, which you can use to contact the plan administrator directly.

Don’t Miss: How Much Employer Contribute To 401k

National Registry Of Unclaimed Retirement Benefits

You may be able to locate your retirement account funds on the National Registry of Unclaimed Retirement Benefits. This registry is a secure search website designed to help both employers and former employees. Employees can perform a free database search to determine if they may be entitled to any unpaid retirement account money. Employers can register names of former employees who left money with them. Youll need to provide your Social Security number, but no additional information is required.

States Unclaimed Property Agency Website

In most states, lost, missing, and unclaimed assets must be transferred to the state’s unclaimed property agency. This agency protects state residents by ensuring that monies owed to them are returned instead of the funds being held by the financial institutions. Also, if the deceased person was an employee of a state or local government, the state unclaimed assets agency may have some records.

Also Check: How Do I Start My 401k Plan

Use A 401 Lookup Database

The Capitalize team has created a database and search tool to help locate a missing 401 account. Simply input your company name below to get started.

Usually, we can locate the account instantly. If we cant, our in-house team will track it down for you and help you move into an account of your choice.

Other databases also enable you to look for unclaimed property, like the Employee Benefits Security Administrations Abandoned Plan Search and the National Registry of Unclaimed Retirement Benefits. One of these databases may be able to reveal the location of your old 401.

Determine If Your 401 Account Was Rolled Over To A Default Ira Or Missing Participant Ira

One possibility is your employer rolled the funds over into a Default IRA.

If your employer tried to contact you for instructions as to what to do with your account balance, and you fail to respond, you may be deemed a non-responsive participant.

If they are unable to locate you altogether, you may be deemed a Missing Participant.

In either scenario, if the plan is being terminated, your employer may have put the funds in a Missing Participant Auto Rollover IRA.

This is an IRA account set up on your behalf to preserve your retirement assets until they are claimed by you or your beneficiaries under Department of Labor regulations.

To qualify for a Missing Participant or Default IRA, the account balance must be greater than $100 but less than $5,000 unless the funds are coming from a terminated plan, then the $5,000 ceiling is waived.

Finding a Missing Participant IRA

If your money has been transferred to a Missing Participant IRA, you should be able to find it by searching the FreeERISA website.

This search is slightly more time consuming than the national registry. Registration is required to search the database, which contains 2.6 million ERISA form 5500s, covering 1.3 million plans and 1 million plan sponsors.

If you know your money has been transferred to one of these default accounts, you should get it out into a standard IRA account.

Typically, these accounts must be interest-bearing, bear a reasonable rate of return, and be FDIC insured.

Here’s the bad part:

Read Also: How Much Can I Contribute To Solo 401k