Rollover Money: An Easy Option

If youre still working and you cant get money out of your 401 with any of the techniques above, there might be another approach. If you ever made rollover contributions to your 401 into your existing 401, for example), you might be able to take those funds back out. You wont have access to your entire 401 account balance, but you might get a nice chunk of change outat any time, for any reason. Employers are often unaware of this option, so you may need to ask your employer to do some research with your Plan Administrator.

Again, you may have to pay income taxes and tax penalties, and youre raiding your retirement savings, so only use this option when you have no other choice.

Next Up: Curious About Meeting?

If You Withdraw The Money Early

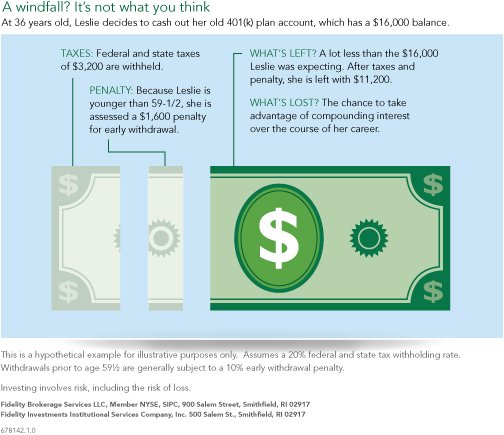

For traditional 401s, there are three big consequences of an early withdrawal or cashing out before age 59½:

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw the $10,000 in your 401 at age 40, you may get only about $8,000.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government another $1,000 of that $10,000 withdrawal.

You will have less money for later, especially if the market is down when you start making withdrawals. That could have long-term consequences.

There are a lot of exceptions. This article has more details, but in a nutshell, you might be able to escape the IRSs 10% penalty for early withdrawals from a traditional 401 if you:

-

Receive the payout over time.

-

Qualify for a hardship distribution with the plan administrator.

-

Leave your job and are over a certain age.

-

Are getting divorced.

Home Equity Line Of Credit

Instead of fixed-term repayment, you get a variable repayment and interest rate. You may opt for an interest-only repayment, but most often that comes loaded with a balloon payment, Poorman says, and may be tough to afford. Keep in mind that with a variable interest rate loan, you could see your rates go up over time.

Also Check: How To Transfer 401k From Previous Employer

What If You Are The Beneficiary Of A 401 Plan

If you are the beneficiary of a 401 plan, you’ll have a little bit different set of rules that apply to taking money out of the 401 plan. Your choices will depend on whether you were the spouse or non-spouse of the 401 plan participant and whether the 401 plan participant had reached age 70 1/2the age for required minimum distributions .

Be Mindful Of Early Distributions

If your distribution doesn’t meet the criteria for a qualified distribution, it’ll be subject to a 10% early distribution penalty. It’s rarely a good idea to take an early withdrawal from your 401. Not only will you pay the 10% penalty and any income taxes owed on the distribution, you’ll forego future tax-advantaged growth.

There are some cases where it’s your best option, though, and the IRS has certain rules that allow you to access your funds early. You may qualify for a hardship distribution, which allows you to withdraw funds from your 401 up to the amount necessary to cover a financial hardship. Eligible funds for a hardship withdrawal include employee elective salary deferrals and employer contributions. You’ll owe income tax on your hardship distribution, but you may be exempt from the additional 10% penalty. For example, if the distribution covers unreimbursed medical expenses in excess of 7.5% of your adjusted gross income, you can avoid the penalty.

Be sure to avoid accidentally taking an early distribution when you roll over your 401 plan. If you ask to roll over your 401 after separating from your old employer, the plan administrator may liquidate your holdings and mail you a check. You’ll have 60 days from that distribution to deposit those funds into an IRA or your new employer’s retirement plan.

Also Check: Why Is A 401k Good

Traditional Ira Vs Roth Ira

Like traditional 401 distributions, withdrawals from a traditional IRA are subject to your normal income tax rate in the year when you take the distribution.

Withdrawals from Roth IRAs, on the other hand, are completely tax free if they are taken after you reach age 59½ . However, if you decide to roll over the assets in a traditional 401 to a Roth IRA, you will owe income tax on the full amount of the rolloverwith Roth IRAs, you pay taxes up front.

Traditional IRAs are subject to the same RMD regulations as 401s and other employer-sponsored retirement plans. However, there is no RMD requirement for a Roth IRA.

The $17 Trillion Spending Bill That Congress Passed Last Week Includes Two Big Changes To Required Distributions From Retirement Accounts

The $1.7 trillion spending bill approved by Congress last week includes key provisions for retirement savers. The retirement-related laws are collectively dubbed the Secure 2.0 Act. Many of the changes — like mandatory automatic enrollment in new 401 plans and expanded catch-up contributions for people ages 60 to 63 — are meant to help workers build their nest eggs.

But the bill also includes two important changes to required minimum distributions for retirement-age individuals that will take effect in 2023. Here are the two big changes seniors need to know about.

Image source: Getty Images.

You May Like: How Much Can I Borrow Against My 401k

An Early Withdrawal From Your : Understanding The Consequences

OVERVIEW

Cashing out or taking a loan on your 401 are two viable options if you’re in need of funds. But, before you do so, here’s a few things to know about the possible impacts on your taxes of an early withdrawal from your 401.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Making A Hardship Withdrawal

You May Like: How To Start My 401k

How To Avoid 401 Early Withdrawal Penalties

There are certain exceptions that allow you to take early withdrawals from your 401 and avoid the 10% early withdrawal tax penalty if you arent yet age 59 ½. Some of these include:

- Medical expenses that exceed 10% of your adjusted gross income

- Permanent disability

- If you leave your employer at age 55 or older

- A Qualified Domestic Retirement Order issued as part of a divorce or court-approved separation

Even if you can escape the additional 10% tax penalty, you still have to pay taxes on your withdrawal from a traditional 401. owner owes no income tax and the recipient can defer taxes by rolling the distribution into an IRA.)

To Borrow Or Not To Borrow

You can borrow money from your retirement plan and pay the funds back with lower interest rates than other types of borrowing, such as a credit card. However, a loan may trigger fees, and you may be forced to pay back the entire amount you borrowed if you leave your job, voluntarily or not. You also need to find out how your employer structures these types of loans.

You May Like: How To Request Money From 401k

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Home Equity Loan Or Heloc

If you own a home with equity built up, a home equity loan or home equity line of credit can be a low-interest alternative to a personal loan. This type of loan is often referred to as a second mortgage because the loan is secured by your home. In other words, if you default on the loan, your lender may have a right to foreclose on your home.

One of the major benefits of a home equity loan or HELOC over a personal loan is the interest rate. Loans that are secured by homes including mortgages, home equity loans, and HELOCs often have some of the lowest interest rates on the market. As a result, the loan will cost you less money over the long term.

Its important to proceed with caution if youre considering a home equity loan or HELOC. As we mentioned, these loans are secured by your home. If you cant make your monthly payments, you risk having the lender take your home. As a result, you should avoid this option if you think for any reason you may not be able to repay the loan on time.

Don’t Miss: Which Funds To Invest In 401k

New Retirement Rules: How Your Ira And 401 Are Changing In 2023 And Beyond

The $1.7 trillion federal spending bill for 2023 includes more than 90 changes to rules for retirement accounts.

Right before 2022 ended, the US Congress finally put together a spending package for 2023 that was approved by both houses and President Joe Biden. Along with preventing a partial shutdown of the federal government, the $1.7 trillion federal spending bill for 2023 makes sweeping changes to the rules for retirement accounts like 401 plans, IRAs and Roth IRAs.

These new changes to retirement regulations follow in line with the amendments of the Secure Act of 2019 and are collectively called the Secure 2.0 Act of 2022.

The biggest changes for most Americans with retirement accounts are the extension of the age for required minimum distributions and increased “catch-up” limits for people over 60. But there are more than 90 different retirement changes overall in the giant spending package.

With Biden’s signing, some retirement account changes will take effect immediately, while others will start beginning 2024. Here’s what you need to know.

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period.

When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash.

However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount.

This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

Read More: 7 Essential Steps for Retirement Planning

You May Like: How To Get Your 401k From Walmart

Most People Have Two Options:

Whether youre considering a loan or a withdrawal, a financial advisor can help you make an informed decision that considers the long-term impacts on your financial goals and retirement.

Here are some common questions and concerns about borrowing or withdrawing money from your 401 before retirement.

When Should You Make A 401 Early Withdrawal

Considering the 10% penalty, financial planners often advise taking an early withdrawal from your 401 as a last resort. Since penalty-free withdrawals are available for a number of financial hardships and situations, plan participants who take an early withdrawal with a penalty are often in serious financial straits.

Ive seen people take withdrawals for a number of reasons, Stiger says. Everything from a childs tuition to a spouses burial expenses the hope is that distributions are used for larger, more unexpected expenses like medical emergencies, keeping a home out of foreclosure or eviction, and in a down period, putting food on the table.

Taking an early withdrawal can make sense if you are able to take advantage of a penalty-free exception, use the Rule of 55 or the SEPP exemption. But might make sense to exhaust other options firstcheck out these 10 ways to get cash now. And keep in mind, contributions to a Roth IRA can always be withdrawn without penalty if youre truly in a bind.

You May Like: Can You Roll A Traditional 401k Into A Roth Ira

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

|

no promotion available at this time |

What Are The New Rules For Early Withdrawals From Retirement Accounts

The Secure 2.0 Act of 2022 includes several rule changes that will benefit Americans who need to withdraw money early from their retirement accounts. Normally, withdrawals from retirement accounts made before the owner of the account reaches 59 and a half years old are subject to a 10% penalty tax.

First, Congress added a basic exception for emergencies. Account holders who are younger than 59 and a half can withdraw up to $1,000 per year for emergencies and have three years to repay the distribution if they want. No further emergency withdrawals can be made within that three-year period unless repayment occurs.

The new law also specifies that employees will be allowed to self-certify their emergencies — that is, no documentation is required beyond personal testimony. The law will also eliminate the penalty completely for people who are terminally ill.

Americans impacted by natural disasters will also get some relief with the changes. The new rules will allow up to $22,000 to be distributed from employer plans or IRAs in the case of a federally declared disaster. The withdrawals won’t be penalized and will be treated as gross income over three years. The rule will apply to all Americans affected by natural disasters after Jan. 26, 2021.

Read Also: How Do I Withdraw Money From My 401k Fidelity

A Big Change Coming In 2024

Under current law, RMDs are mandatory during the account-owner’s lifetime for all retirement accounts other than a Roth IRA. But starting in 2024, 401s and other workplace plans with a Roth designation — meaning the account is funded with post-tax dollars and gets tax-free treatment in retirement — will no longer come with RMDs while the owner is still living. As with Roth IRAs, the owner will be able to avoid distributions and leave the entire account to their beneficiaries.

Again, this won’t impact the average person who needs to withdraw from their accounts for retirement expenses. But for affluent taxpayers who can afford to leave that money to their beneficiaries, the new law will make Roth-designated accounts an even more appealing vehicle for building wealth.

The Motley Fool has a disclosure policy.

What Happens If I Stop Contributing To My 401k

If you are considering stopping contributions to a 401k, you would be better served to merely suspend those contributions. A short-term suspension will slow the performance of your retirement fund, but it wont keep it from growing. It also will lessen the temptation to simply withdraw all the funds and wipe out retirement savings in the process.

Don’t Miss: How To Calculate 401k Retirement Income