How Much Do I Need To Retire

How much you need to retire depends on how much you plan to spend in retirement. How much will you want to shell out on travel? What about saving for medical expenses? These considerations and more make planning your retirement paycheck difficult for many people, especially when theyre decades from retirement.

Which 401k Plan Is Better For Me

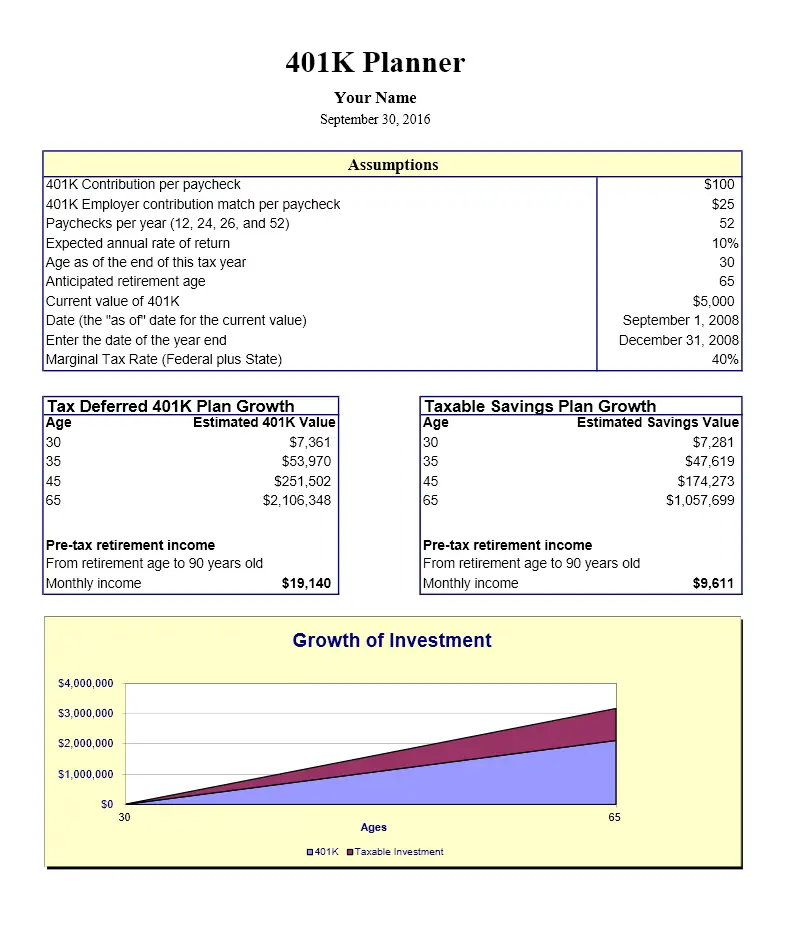

Contributions to a Traditional 401 plan are made on a pre-tax basis, resulting in a lower tax bill, and higher take-home pay. Contributions made to a Roth 401 are made on an after-tax basis, which means that taxes are paid on the amount contributed in the current year. The reverse is true once you are eligible to make 401 withdrawals. Withdrawals from Traditional 401 plans are taxable, while those made from a Roth 401 are not.

How To Use The Roth Ira Vs 401k Calculator

Simply fill out the fields in the Roth IRA vs. 401k calculator featured above, using a value for each of the following items:

- Annual Contribution

- Expected Tax Rate in Retirement

Not sure what these terms mean? Not sure what numbers to put in?

Use the section below as a guide for your Roth IRA vs. 401k calculations.

Then, as you fill in each field with numbers customized to your situation, the calculator will automatically update to reveal two projected inflation-adjusted values for your retirement savings one if you invested your contributions in your Roth IRA and the other if you invested them in your 401k.

Don’t Miss: How Can I Take A Loan Out Of My 401k

Whats The 401k Contribution Deadline

What is the 401k contribution deadline? The 401k contribution deadline does land at the very end of the calendar year on December 31, 2021.

However, the IRS will allow you to contribute to your IRA account right up to the tax filing deadline of the coming year that is to say, April 15, 2022 of this next year.

How Much Does A Couple Need To Retire

Much like an individual, how much a couple needs to save to retire comfortably will depend on their current annual income and the lifestyle they want to live when they retire. Many experts maintain that retirement income should be about 80% of a couples final pre-retirement annual earnings. Fidelity Investments recommends that you should save 10 times your annual income by age 67.

You May Like: How To Calculate Max 401k Contribution

What Is The Average Balance For A 401

The Internal Revenue Service sets yearly limits for how much employees can contribute to their 401 each year. For 2022, workers under age 50 may contribute $20,500 per year. Those 50 and older may contribute an additional $6,500.

According to a recent report by Vanguard, savings rates are increasing slightly, most likely due to automatic contribution plans. The average percentage contributed by employees for 2021 was 7.3%, and 11.2% with employer matches.

The overall average amount in a 401 account is $141,542, but this number includes balances for workers across all experience levels and tenure. When broken down by age, the average account amounts are significantly different.

- 65 and older$279,997

These numbers are only part of the overall retirement savings picture. Self-employed people may invest in individual retirement accounts or taxable brokerage accounts. Public employees and military personnel, among others, have their own employer-sponsored retirement plans. And, of course, people with 401 accounts may have long-term investments outside their employer-sponsored plans.

Stay On Track For Retirement By Knowing How Much You Need To Save By What Age

A key part of retirement planning is to answer the question: How much do I need to save to retire? The answer varies by individual, and it depends largely on your income now and the lifestyle you want and can afford in retirement.

Knowing how much you need to save based on how old you are now is just the first step, but it starts you on the path to help you reach your retirement goals. There are a few simple formulas that you can use to come up with the numbers.

Recommended Reading: How Do You Get Money From Your 401k

Making The Most Of Your 401k

If youre falling short with your current savings, dont fret. Its not too late to get on track.

Here are a few avenues for making improvements to your retirement plan.

Impact Of Inflation On Retirement Savings

Inflation is the general increase in prices and a fall in the purchasing power of money over time. The average inflation rate in the United States for the past 30 years has been around 2.6% per year, which means that the purchasing power of one dollar now is not only less than one dollar 30 years ago but less than 50 cents! Inflation is one of the reasons why people tend to underestimate how much they need to save for retirement.

Although inflation does have an impact on retirement savings, it is unpredictable and mostly out of a person’s control. As a result, people generally do not center their retirement planning or investments around inflation and instead focus mainly on achieving as large and steady a total return on investment as possible. For people interested in mitigating inflation, there are investments in the U.S. that are specifically designed to counter inflation called Treasury Inflation-Protected Securities and similar investments in other countries that go by different names. Also, gold and other commodities are traditionally favored as protection against inflation, as are dividend-paying stocks as opposed to short-term bonds.

Our Retirement Calculator can help by considering inflation in several calculations. Please visit the Inflation Calculator for more information about inflation or to do calculations involving inflation.

Don’t Miss: Can You Invest With Your 401k

Why Is Roth 401k

Why Your 401 Should Have a Roth 401 Tax Option to Diversify Your Retirement Savings. Various cubes. Save more for your retirement with the Roth 401k. Forced saving. Younger members benefit the most from the Roth 401k. Time is on your side. You can inherit your familys Roth IRAs. Roth 401k Tax Strategy for Contributors to a Cash Settlement Plan. Eat your cake and eat it too.

You May Like: How Do You Transfer 401k

Check On Your 401 Periodically

As mentioned, itâs essential to check how much is in your 401 throughout the year. Ideally, more than once, however, annual checks are enough.

The reason to monitor your retirement savings is to keep up with your retirement goals. For instance, as you near retirement, you may want to move your money to safer investments like bonds. Or, if one area has over-performed others, you might decide to reallocate your money to limit your exposure to one category.

Typically these drastic swings in your portfolio wonât happen that quickly. But by scheduling an annual check of your 401 balance, youâll get a good picture of your 401 portfolio.

Tags

You May Like: Can I Have A 401k Without An Employer

Also Check: How To Borrow From 401k To Buy A House

Roth Ira Calculator: Our Assumptions

For the best results, youâll want to use information that matches your current finances. If you donât have that information ready, hereâs what weâll assume for you.

- Year: 2021. The year you make your contributions determines how large they can be as the government periodically raises contribution limits. While you can sometimes invest money in a Roth IRA for a prior year, provided you do so before the federal tax filing deadline for that year, weâre assuming youâre making your contributions from this year on.

- Tax Filing Status: Single. Your relationship status may impact how much youâre able to contribute to a Roth IRA, so youâll want to make sure this field accurately reflects the status you claim when you file your taxes.

- Retirement Age: 66. This is when people generally retire in the U.S., according to Transamerica and Aegon research.

- Rate of Return: 9%. Your rate of return always depends on your investment choices. Weâve picked this figure as itâs close to the historical long-term averages of portfolios with heavy stock components, like financial advisors might recommend. If you prefer a more conservative mix of investments, try a rate of return closer to 8%. Thatâs what portfolios with a 60%/40% split of stocks and bonds have averaged over the long term.

Recommended Reading: Triple Creek Retirement Community Cincinnati Oh 45231

Contribution Effects On Your Paycheck

An employer-sponsored retirement savings account could be one of your best tools for creating a secure retirement. It provides two important advantages:

-

All contributions and earnings are tax-deferred. You only pay taxes on contributions and earnings when the money is withdrawn.

-

Many employers provide matching contributions to your account, which can range from 0% to 100% of your contributions.

Use this calculator to see how increasing your contributions to a 401 can affect your paycheck as well as your retirement savings.

This calculator uses the latest withholding schedules, rules and rates .

Recommended Reading: When Can I Move My 401k To An Ira

Using Ubiquitys 401 Calculator

The Ubiquity 401 calculator paints a picture of what your retirement savings will look like when youre ready to stop working. Start by entering your age, household income, and any current savings.

Enter the amount you currently save towards your 401 each month, the amount you expect to spend each month when you retire, and the age you plan to retire. Then, Ubiquitys 401 calculator will show you what to expect, and if there is a deficit. Unlike other 401 calculators, you might find online, the Ubiquity 401 calculator also accounts for hidden fees associated with your retirement savings that you may not be aware of.

You will see:

- The monthly income you can expect to need when you retire

- The amount you will actually receive from your retirement based on your current savings and monthly contributions

- How close you are to achieving your retirement goalswhether youre on the right track, ahead of the game, or need to beef up your savings

Fidelity’s Smart Way To Convert Your 401 Into Income

© Provided by SmartAsset Image shows a couple reviewing their retirement plan. Fidelity Investments plans to launch a new product next year that will allow individuals to shift a portion of their employer-sponsored retirement plan into an annuity.Creating reliable streams of retirement income is one of the most important elements of a persons financial plan. A retirement industry giant says it now has a new way for retirees to meet this vital challenge.

Fidelity Investments plans to launch a new product next year that will allow individuals to shift a portion of their employer-sponsored retirement plan into an annuity. The offering, called Guaranteed Income Direct, will enable participants of 401 and 403 plans to convert their retirement savings into a guaranteed stream of retirement income akin to pension payouts.

Fidelitys product is not the first of its kind. Since the passage of the SECURE Act in 2019, the financial services industry has begun offering annuities within retirement plans to meet a growing demand for annuitized streams of income.

SPONSORED: Find a Qualified Financial Advisor

Its important to note that annuities are often maligned for their high costs and complex structures. A financial advisor can help you determine whether an annuity is an appropriate investment option for you.

——————

Fidelitys New Product

Recommended Reading: How To Open A 401k Self Employed

Contributions In Excess Of 2021 Limits

Evaluating your estimated contributions for the year ahead and analyzing your contributions at the end of a calendar year can be very important. If you find that you have contributions in excess of the 2021 limits, the IRS requires notification by March 1 and excess deferrals should be returned to you by April 15.

General Pros And Cons Of A 401

Pros

Cons

- Few investment optionsGenerally speaking, 401s have few investment options because they normally originate from employers, they are limited to what is offered through employers’ 401 plans, as compared to a typical, taxable brokerage account.

- High feesCompared to other forms of retirement savings, 401 plans charge higher fees, sometimes as a percentage of funds. This is mainly due to administration costs. Plan participants have little or no control over this, except to choose low-cost index funds or exchange-traded funds to compensate.

- Illiquid 401 funds can only be withdrawn without penalty in rare cases before 59 ½. This includes all contributions and any earnings over time.

- Vesting periodsEmployers may utilize vesting periods, meaning that employer contributions don’t fully belong to employees until after a set point in time. For instance, if an employee were to part ways with their employer and a 401 plan that they were 50% vested in, they can only take half of the value of the assets contributed by their employer.

- Waiting periodsSome employers don’t allow participation in their 401s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law.

You May Like: What 401k Funds Should I Invest In

Overall Limit On Contributions

Total annual contributions to all of your accounts in plans maintained by one employer are limited. The limit applies to the total of:

- elective deferrals

The annual additions paid to a participants account cannot exceed the lesser of:

However, an employers deduction for contributions to a defined contribution plan cannot be more than 25% of the compensation paid during the year to eligible employees participating in the plan .

There are separate, smaller limits for SIMPLE 401 plans.

Example 1: In 2020, Greg, 46, is employed by an employer with a 401 plan, and he also works as an independent contractor for an unrelated business and sets up a solo 401. Greg contributes the maximum amount to his employers 401 plan for 2020, $19,500. He would also like to contribute the maximum amount to his solo 401 plan. He is not able to make further elective deferrals to his solo 401 plan because he has already contributed his personal maximum, $19,500. He would also like to contribute the maximum amount to his solo 401 plan.

How Should I Invest For Retirement

Financial advisors recommend that your age should guide your retirement investments. When youre younger, choose more aggressive, stock-based investments that may see higher returns. As you get older, shift investments to increasingly conservative, bond-based funds to keep your retirement balance stable.

Your own personal willingness to take on risk should guide how you approach investing for retirement as well. Check out our guide on how to invest for retirement. And if youd prefer to have someone else manage your retirement investments, consider reaching out to a financial advisor or choose a robo-advisor or a target-date fund.

Recommended Reading: How Much Should I Have In My 401k At 55

What Happens When You Withdraw Retirement Savings

Although you can technically withdraw money from your retirement savings anytime, there are significant tax implications to consider before doing so. If you withdraw IRA or retirement plan assets before reaching age 59½, you will generally be subject to a 10% additional tax on the withdrawal amount. However, there are a few exceptions to this rule, such as if you are using the money to pay for qualified medical expenses or certain types of education expenses.

Once you reach age 59½, all withdrawals from your retirement account will be taxed at the ordinary income tax rate.

Remember that taking money out of your retirement account early can majorly impact your long-term financial security, so weighing your options carefully before making any financial decisions is important.

With The Ssa Announcing An 87 Percent Cola Many Are Wondering How To Calculate Their New Benefit Amount We Will Talk You Through The Process

In December, Social Security beneficiaries will receive a letter from the Social Security Adminstration with information on their 2023 benefit amount, taking into account the 2023 COLA.

The COLA, or Cost-of-living adjustment, applied to benefits starting in January, was announced to be 8.7 percent.

In order to calculate your benefit amount, you multiply 1.087 by your current benefit amount. For instance, if your monthly payment is $1,200, we would multiply that figure by 1.087, which equals $1,304, an increase of $104.

Also Check: How To Know If You Have A 401k Plan

When You Plan To Retire

The age you plan to retire can have a big impact on the amount you need to save, and your milestones along the way. The longer you can postpone retirement, the lower your savings factor can be. Thats because delaying gives your savings a longer time to grow, youll have fewer years in retirement, and your Social Security benefit will be higher.

Consider some hypothetical examples . Max plans to delay retirement until age 70, so he will need to have saved 8x his final income to sustain his preretirement lifestyle. Amy wants to retire at age 67, so she will need to have saved 10x her preretirement income. John plans to retire at age 65, so he would need to have saved at least 12x his preretirement income.

Of course, you cant always choose when you retirehealth and job availability may be out of your control. But one thing is clear: Working longer will make it easier to reach your savings goals.

Read Also: Can You Take A Loan From 401k For Home Purchase