Plan Establishment And Contribution Deadlines

Solo 401 plans must be established by December 31 of the first plan year for which they are effective. For example, in order to make contributions to a solo 401 plan for 2022, the plan must be established by December 31, 2022.

The contributions themselves, however, dont need to be made until the individual tax filing deadline of April 15, or October 15 with a six-month extension.

Solo 401 Withdrawals And Details

As with all qualified retirement plans, there are rules to when you can and must start taking withdrawals from your Solo 401 plan. You must begin taking the minimum required distribution no later than age 72 . There is a 10% early withdrawal penalty for distributions take before age 59 1/2, but exceptions may apply.

Please refer to the IRS page on individual 401s and review our Solo 401 Guide for additional details.

The Two Approaches To Setting Up And Managing A Solo 401 Plan

Solo 401 plan participants usually dont write their own plan documents they rely on third parties to draft template documents to ensure they comply with applicable laws and regulations. Generally, there are two ways that participants go about obtaining and adopting plan documents: They use a pre-written set of documents provided by a financial institution , or they hire a third-party provider to write the documents to their specifications . Understanding the mechanics and potential benefits and drawbacks of each approach can help individuals better select a plan that meets their needs.

Read Also: How To Transfer My 401k To An Ira

How To Save For Retirement When Youre Self Employed: The Solo 401k

Have you ever heard of the Solo 401k plan? The Solo 401k is the most tax efficient way for small business owners, consultants and contractors to save money for their retirement.The Solo 401k plan is an IRS approved retirement plan which is suited for business owners who do not have any employees, other than themselves or their spouse. Learn more about the Solo 401k and its benefits below.

Withdrawing Funds From A Self

As with traditional 401 plans, the self-employed 401 is intended to help you save money for retirement, and there are regulations in place to encourage you to do so. For example:

- Withdrawals prior to age 59½ may be subject to a 10% early withdrawal penalty, along with any applicable income taxes1

- You must take required minimum distributions from self-employed 401s beginning at age 722

- Plans can be structured to allow loans or hardship distributions3

- Plans can be structured to accept rollovers from other retirement accounts, including SEP IRAs and traditional 401s, into your self-employed 401

- You can roll your self-employed 401 assets into another 401 or an IRA

Because of its high contribution levels, flexible investment options, and relatively easy administration, the self-employed 401 is an attractive option for small-business owners or sole proprietors who want to be able to save aggressively for the future.

If there is the potential that your business might add employees at a later date, however, know that you will either have to convert your self-employed 401 plan to a traditional 401, or else terminate it. But if you’re confident that you will remain a one-person operation, and you want the high savings options that these plans offer, this type of account may be a good fit.

Also Check: How Much You Should Contribute To 401k

Exceptions For Solo 401 Early Distribution Penalties

The IRS may waive the 10% penalty for early withdrawals in certain circumstances. Youll still owe taxes on any contributions or earnings that havent been taxed. The exceptions include:

- Medical expenses that exceed 10% of your adjusted gross income

- Permanent disability

- Certain military service

- A Qualified Domestic Retirement Order issued as part of a divorce or court-approved separation

In the case of a distribution paid to an ex-spouse under a QDRO, the 401 owner owes no income tax and the recipient can defer taxes by rolling the distribution into an IRA.

Unlike an IRA or SEP IRA, a Solo 401 doesnt allow penalty-free withdrawals for higher education expenses or first-time homebuyers.

Next Steps To Consider

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

You May Like: What’s The Maximum I Can Contribute To My 401k

Savings Incentive Match Plan For Employees

You can put all your net earnings from self-employment in the plan: up to $15,500 in 2023 , plus an additional $3,500 in 2023 if youre 50 or older , plus either a 2% fixed contribution or a 3% matching contribution.

Establish the plan:

Cyber Security Tips For Your Business

Cyber security can be defined as the practice of defending computers, servers, mobile devices, electronic systems, networks, and data from malicious attacks, unauthorized access, or criminal use. The Small Business Administration , the U.S. Cybersecurity and Infrastructure Security Agency and the Federal Trade Commission are excellent resources that offer additional tips for combating cyberattacks.

IT experts agree that employees are often the weakest link in the fight against cybercrime. They often make critical mistakes because they lack the knowledge and training to recognize warning signs or avoid improper behavior while working online.

Here’s a list of tips to aid in cyber security training and greatly enhance the security of your business data:

You May Like: How To Find 401k Account

Other Financial Benefits Of A Solo 401

The solo 401 can be an excellent choice for those with a side gig as well, especially if theyre already able to live comfortably on their main salary. With the solo 401 you can go above the usual limits of a 401.

While you may contribute to multiple 401 accounts, your total employee contribution to all types of 401s may not exceed the annual maximum contribution, that is, $20,500 in 2022.

But the solo 401 can be valuable even if you already have a 401 plan and even if youve maxed out that other plan for a given year. Thats because you can still make an employer contribution, allowing you to exceed the smaller employee-only contribution amount. So the solo 401 allows you to save more with the employer contribution, reducing your business taxes.

Another benefit of the solo 401 is that it doesnt prevent you from taking advantage of other retirement plans such as the IRA. You can still contribute up to the annual maximum there. If youre an individual looking to set up a traditional IRA or Roth IRA, then youll want to look at the benefits of those plans.

Like the typical 401 plan, the solo 401 also allows you to take out a loan against your account. loan.)

While I generally encourage clients to avoid that strategy, it can come in handy at times, Conroy says.

Any Additional Retirement Options For Freelancers

Both IRAs and a freelancer 401 both designed to help you save for retirement, but they arent the only options out there.

Your retirement playbook could also include certificates of deposit and savings accounts as well as investing with a robo-advisor and/or trading individual stocks, bonds and ETFs.

For added insights about saving for retirement, consider talking with your salaried friends as well as your network of self-employed professionals to see what theyre up to. Combined with information from your financial advisor, youre on your way to creating a retirement plan that works for you now and that you can refine over time.

Investing involves risk, including the potential loss of money invested. Past performance does not guarantee future results. Neither asset diversification or investment in a continuous or periodic investment plan guarantees a profit or protects against a loss.

Investment products are: NOT FDIC INSURED NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, GOLDMAN SACHS BANK USA SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

You May Like: Do Banks Have 401k Plans

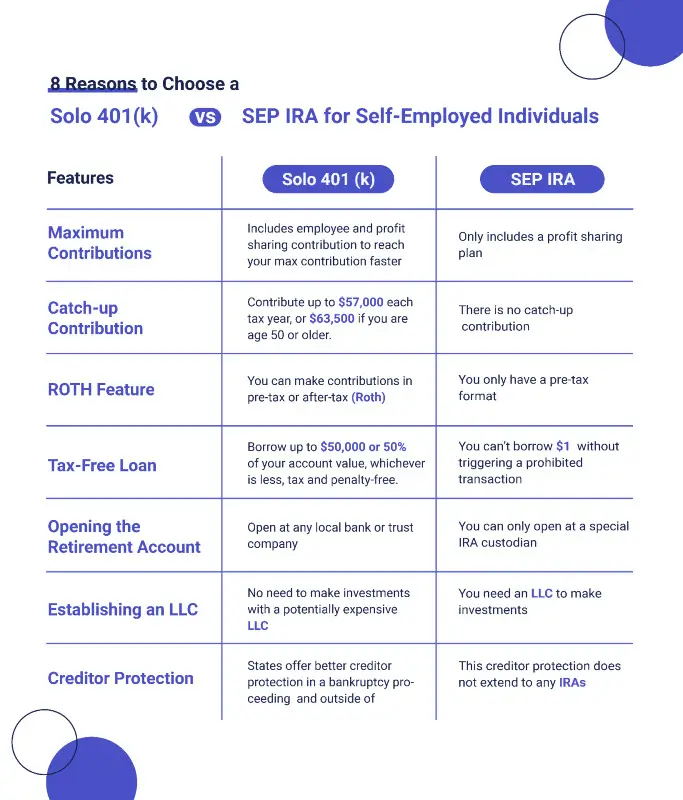

What Are The Benefits Of A Solo 401

Unlike other options, a Solo 401 account holder can choose between a traditional option and a Roth option. The traditional option allows you to deduct the amount you pay in from your income for that year, giving you an immediate tax break. With the Roth option, the income taxes on that money is paid immediately and you owe no taxes when you withdraw the funds.

The Solo 401 has far higher annual contribution limits than a plain-vanilla IRA, although that is also true for the SEP IRA and the Keogh plan.

The Solo 401 allows you to take loans from your account before you retire. This is not an option with many other retirement plans.

Finally, the Solo 401 is relatively straightforward in terms of paperwork, as it is designed for one-person shops, not corporations.

Can You Have Employees And Open A Single

You cant have any full-time employees, but you can contract with freelancers or employ part-time employees who dont work more than 1,000 hours per year for your business. Note that not all individual 401 plans allow for part-time employees, so be sure to check with your provider before hiring employees.

Recommended Reading: Can I Rollover 401k To Roth Ira While Still Employed

Offer Incentives To Cover Busy Periods

Many employers offer incentives or premium pay to employees who agree to work during high-demand times. Offering a small bonus or higher hourly rate during a busy period may incentivize employees to hold off on using their paid time off until a less busy time comes up.

It may be worth asking your employees what type of non-traditional benefits they would value. Also, consider whether coverage is essential during certain parts of the calendar year and whether incentives can help relieve critical staffing challenges during those times.

Advantages Of Solo 401 Plans

Solo 401 plans have several features that make them stand out from other types of self-employed retirement plans, like Simplified Employee Pension plans or SIMPLE IRAs.

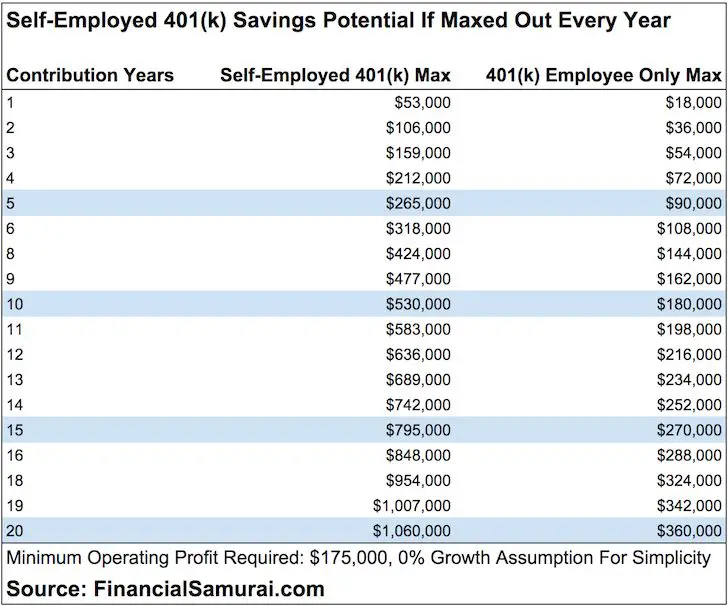

First is the ability to contribute a higher percentage of ones income to the plan. While all workers, regardless of the type of employer retirement plan, are generally limited to a total of $61,000 in combined employee and employer contributions the amount of income an individual must earn to be able to reach that maximum contribution limit changes based on the type of plan.

For example, SEP contributions are capped at 20% of the participants net self-employment income. This is effectively the same as the employer portion of the solo 401 plan contribution, but the additional employee portion allowed by the solo 401 plan which can be 100% of compensation up to $20,500 means that solo 401 plan participants can contribute a much higher percentage of their income if they dont earn enough to max out the employee portion alone.

Specifically, in order to contribute the maximum of $61,000 to their plan, a SEP participant must earn $321,000 in self-employment income whereas a solo 401 plan participant need only earn $217,000 to contribute that amount using standard employee and employer contributions, or just $67,000 when using nondeductible contributions, as shown below.

Nerd Note:

You May Like: Where To Open A 401k Account

Can You Contribute A Lump Sum To A Self

According to Bergman, a self-employed individual can usually make an employee deferral lump-sum contribution to a plan so long as they have sufficient earned income. However, in the case of a W-2 owner/employee, the employee deferral contribution should not be more than the income earned for that income period. In the case of employer profit-sharing contributions, those can be made by the employer in a lump sum.

Is This Really All Freelancers Should Be Saving For Retirement

The 10% to 15% guideline can be a good starting point and provide some structure. But how much you may need to save for retirement depends on a variety of things such as your current age. To see how much you may want to save overall, plug in some numbers in .

Good to know: If you dont already have a budget in place, you could create one and see how saving for retirement fits in to it. New to budgeting? Weve got you covered with some to try.

Also Check: Does Mcdonald’s Offer 401k

Should I Buy Stocks In Roth Ira

Given the tax characteristics of the two types of IRAs, it is generally better to hold investments with the greatest growth potential, typically stocks, in Roth, while assets with more moderate returns, usually bonds, in traditional IRAs.

How many shares should I have in my Roth IRA? As a general rule, however, most investors hold 15 to 20 stocks at the very least in their portfolios.

Should I Choose A Traditional Or Roth Solo 401

For many investors, deciding between a traditional or Roth solo 401 comes down to whether you believe youre in a lower tax bracket today than you will be in retirement. If you think you are paying lower taxes now, you might choose a Roth solo 401. If you anticipate being in a lower tax bracket in retirement, a traditional solo 401 may be a better bet.

Theres another wrinkle with a Roth solo 401 account: You can only contribute up to $20,500 in 2022 and $22,500 in 2023, plus catch-up contributions if youre 50 or older. If youre able to save more than this amount, you will need to contribute the extra into a traditional solo 401 account. You can make both employer and employee contributions to a solo 401, but your employer contributions cannot be saved in a Roth account.

Recommended Reading: How To Get Money From 401k Early

Can You Take The Hsa Contribution Tax Deduction When Self

Self-employed people are eligible for the HSA contribution deduction. Heres how to figure out whether its worth it and a few situations you might find yourself in.

Content provided for general information. Talk to your advisor to confirm the details for your specific situation before taking action. I may receive a referral fee if you choose to use linked products or services.

Determining Compensation For Self

The starting point for identifying compensation for contribution purposes on behalf of self-employed individuals is to determine the individuals earned income or net earnings from self-employment. Depending on the individuals type of self-employment, an individual will use one of the following forms to determine net earnings for a specific year.

- A partnership generates a Schedule K-1, Partners Share of Income, Deductions, Credits, etc., for each individual partner showing the partners net earnings for the year.

- A sole proprietor must file Schedule C, Profit or Loss From Business, showing the net earnings from the business for the year.

- Farmers file Schedule F, Profit or Loss From Farming, to show net income from farming.

Also Check: Should I Convert My 401k To A Roth Ira

Businesses With Virtual And Digital Services Will Continue To Be In Demand

Not only were many people sequestered at home for long periods of time during 2020 and 2021, but offices, stores, gymnasiums, restaurants, and entertainment venues found they were required to either halt or dramatically reduce in-person service, with many only recently opening back up to normal capacity. As a result, demand for technology and virtual offerings soared. Businesses that were in particularly high demand included:

Post A Calendar For Everyone To See

In a public area of the workplace or online, post an easy-to-understand calendar reflecting time off that has already been submitted and granted.

An up-to-date calendar can help alleviate any possible frustration from employees asking for time off on days already booked by others. It also helps identify when it may be necessary to recruit and hire additional seasonal help.

Recommended Reading: What Happens To My Roth 401k When I Quit

Provide Fee Disclosure Information

Your self-employed 401 should not be subject to Title 1 of ERISA because it does not cover employees beyond the owners of the business sponsoring the plan . However, you if operate a money purchase or profit sharing plan with common law employees you should be aware of the to keep up to date on fee disclosure regulations for plan sponsors and plan participants.

How The Solo 401 Works

Solo 401s are a retirement savings option for small businesses whose only eligible participants in the plan are the business owners . It can be a smart way for someone who is a sole proprietor or an independent contractor to set aside a decent-sized nest egg for retirement.

Not content with the federal acronym, various financial institutions have their own names for the solo 401 plan. The independent 401 is one of the most generic. Other examples include:

- One-Participant k

- Self-Employed 401

If you are not sure which name your financial service provider uses, ask about the 401 plan for small business owners. The IRS provides a handy primer on such plans.

Don’t Miss: Can You Transfer Your 401k Into Ira Without Getting Penalized