What Are 401 Matching Contributions

An employer-offered 401 matching contribution is when they deposit money in your 401 account that equals the contributions you make, with a limit. Your boss may decide to match your entire contribution or only contribute part depending on the 401 s requirements. Some employers also make non-matching 401 contributions separate from what employees contribute.

Although employer-matching 401 contributions are not required by law, they can be a key employee benefit that helps an organization keep prized talent and construct solid teams.

Many employers offer matching contributions to 401s. The average employer contribution in 2019 was $4,100, slightly more than $1,000 each quarter.

401 plans that vest employer contributions over a set period of years mean that the companys employees must ultimately stay with the organization for a specific timeframe to take ownership of matching funds.

Vesting is a way for employers to keep their best employees by rewarding them. When you finish the vesting schedule, you own all stock options.

Understanding 401 Plan Contribution Limits

The 401 plan and its variations are all long-term savings plans that are designed to help people build their retirement savings. The IRS considers them to be qualified plans, which means they have certain tax benefits for the employee, the employer, or both.

One tax advantage for employees, in most cases, is that their contributions are deducted from gross income. That reduces taxable income and lowers taxes. The other tax advantage is that money from every paycheck goes into an investment account, grows tax-deferred, and builds net worth over the long term.

Some employers choose to match a percentage of their employees contributions. When available, employees should take full advantage of it because it’s effectively a savings bonus. For example, in 2020, the average employer match was about 4.7% of the employees gross salary, according to Fidelity Investments.

Contributions to 401s and other retirement plans are limited by the IRS to prevent highly paid workers from benefiting more than the average worker from the tax advantages they provide.

How To Maximize Your 401 Retirement Savings

A workplace 401 account can be a powerful tool to help build your retirement savings. To maximize your 401 benefits, follow these tips:

1. Set your contribution level to take full advantage of your employers 401 match. If your company matches a certain percentage of your contributions, set your contribution level to take maximum advantage of the match. Otherwise, youre leaving money on the table.

2. Start contributing to your 401 immediately.

3. Take advantage of target-date funds. If youre overwhelmed by the investment options offered by your 401 plan, choose a target-date fund aligned with your anticipated year of retirement. Target date funds are optimized for your retirement timeline, making them great options for beginners or more hands-off investors.

4. Increase your 401 contribution percentage regularly. Each year, increase your 401 contribution rate by at least one additional percentage point. Gradual small increases have a minor impact on your take-home pay and a major impact on your retirement nest egg over time. In addition, if you receive any raises or bonuses, dedicate at least a portion of them to your savings.

You May Like: Can You Buy Gold With Your 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is A Contribution

Every year, you have the opportunity to contribute a certain amount to your 401 and/or IRA accounts that count towards the annual maximum.

For 401s, the annual maximum you can contribute as an employee is $20,500 this amount increases by $6,500 to $27,000 if youre over age 50. These contributions come out of your paycheck before taxes, and youll see it on your pay stub as 401 deferral or 401 contribution.

For Traditional and Roth IRAs, which are opened outside of your employment relationship, the annual maximum for contributions is $6,000, with another $1,000 available to those over age 50 . Traditional and Roth IRAs come with different tax considerations, but the contribution limit for both accounts is the same.

Read Also: Why Choose A Roth Ira Over A 401k

Also Check: Should I Roll My Old 401k Into My New 401k

What Rrsp Prpp Or Sppcontributions Can You Deduct On Your Tax Return

You can claim a deduction for:

- contributions you made to your RRSP, PRPP or SPP

- contributions you made to your spouses or common-law partners RRSP or SPP

- your unused RRSP, PRPP or SPP contributions from a previous year

You cannot claim a deduction for:

- amounts you pay for administration services for an RRSP

- brokerage fees charged to buy and sell within a trusteed RRSP

- the interest you paid on money you borrowed to contribute to an RRSP, PRPP, or SPP

- any capital losses within your RRSP

- employer contributions to your PRPP

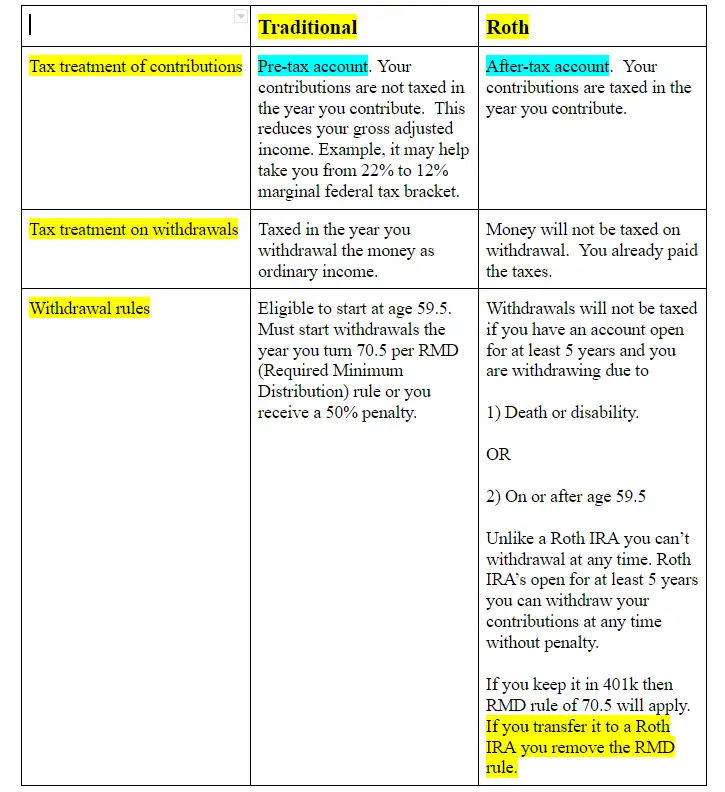

Traditional Vs Roth 401

Some employers offer both a traditional 401 and a Roth 401. With a traditional 401 plan, you can defer paying income tax on the amount you contribute. In other words, if you earn $80,000 a year and contribute the maximum $22,500, your taxable earnings for the 2022 tax year would be $57,500.

With a Roth 401 plan, you dont get an upfront tax break, but when its time to withdraw that money in retirement, you wont owe any tax on it. All your accumulated contributions and earnings come out tax free.

Investing in both types of plans provides you with tax diversification, which can come in handy during retirement.

If you have access to both a Roth and a traditional 401 plan, you can contribute to both, as long as your total contribution to both as an employee doesnt exceed $22,500.

In addition to the Roth and traditional 401, some employers also offer an after-tax plan, allowing you to save up to the total annual limit of $66,000. With this account you can put away money after-tax and it can grow tax-deferred in your 401 account until withdrawal, at which point any withdrawn earnings become taxable.

You May Like: How To Roll Your 401k From Previous Employer

Should You Max Out Employer Matching

If your employer offers a match, you should definitely strive to contribute enough to take advantage of the full match. If you dont, youre leaving free money on the table, says ODonnell. It adds up over time.

Even if you dont want to max out your 401, getting the full employer match helps you save the most and take advantage of all the benefits available to you through your employer. Its therefore a good idea to at least contribute enough to get whatever your company is willing to match.

Its important to start small and start now because you can always increase the amount you save each year. Even a 1% increase will add up, especially if your company matches those contributions. That puts the power of compounding to work for you, adds Winston.

How Do 401 Matches Work

Every 401 plan is different, so youll have to check your employers plan for the details on exactly how yours works. But there are two common types of matches:

Partial matching

Your employer will match part of the money you put in, up to a certain amount. The most common partial match provided by employers is 50% of what you put in, up to 6% of your salary. In other words, your employer matches half of whatever you contribute but no more than 3% of your salary total. To get the maximum amount of match, you have to put in 6%. If you put in more, say 8%, they still only put in 3%, because thats their max.

Heads-up that you might see this written in a lot of different ways. 50 cents on the dollar up to 6%, 50% on the first 6%, 3% on 6% you get the picture. All various ways to describe a partial match.

Dollar-for-dollar matching

With a dollar-for-dollar match , your employer puts in the same amount of money you do again up to a certain amount. An example might be dollar-for-dollar up to 4% of your salary. In this case, if you put in 4%, they put in 4% if you put in 2%, they put in 2%. If you put in 6%, they still only put in 4%, because thats their max.

Don’t Miss: How To Put Money In 401k

Alternatives To An Employer 401 Match

Deferred annuities can offer premium bonuses on contributions that mimic an employers 401 match with no annual limits.

For example, an annuity may offer up to an 11% bonus on all contributions for the first seven years of the annuity. The 11 percent premium bonus mimics the employers match, and the employee has no annual contribution limits.

Unlike a 401, employees can open a deferred annuity without an employer.

What Are The Tax Benefits To The Employer For Offering A 401 Matching Plan

Employers can use the contributions to employee 401 accounts as tax deductions on their federal corporate income tax returns. These contributions may also be exempt from state and payroll taxes. As a result, the employer keeps their employees happy, sees reduced turnover and benefits financially with tax deductions.

Recommended Reading: Can You Take Out Your 401k

Do Employer Contributions Affect 401k Limits

When contributing to a 401 plan, you must watch out for the IRS contribution limits. Find out how employer contributions affect the 401 limit.

A 401 is an employer-sponsored plan that allows employees to contribute part of their paycheck for retirement. The employee must decide how much to contribute, but it should not exceed the IRS contribution limit. These contributions are deducted automatically from your paycheck and deposited to your 401 account. If the employer offers a match, you should collect the free money to max out your 401 contributions.

The employer contribution does not affect your 401 contribution limit. However, the IRS places a cap on the total employee and employer contributions made to a 401 in a specific year. For 2021, the total contributions to a 401 should not exceed $58,000, or $64,500 if you are above age 50.

Matching Contributions: How Much And When

The specific terms of 401 plans vary widely. Other than the necessity to adhere to certain required contribution limits and withdrawal regulations dictated by the Employee Retirement Income Security Act , the sponsoring employer determines the specific terms of each 401 plan.

Your employer may elect to use a very generous matching formula or choose not to match employee contributions at all. Some 401 plans offer far more generous matches than others. Whatever the match is, it amounts to free money added to your retirement savings, so it is best to take advantage of it, if offered.

Refer to the terms of your plan to verify if and when your employer makes matching contributions. Not all employer contributions to employee 401 plans are the result of matching. Employers may elect to make regular deferrals to employee plans regardless of employee contributions, though this is not particularly common.

Also Check: Should I Transfer 401k From Previous Employer

More Details On Ira Contributions

With Roth and traditional IRA contributions, limits are imposed per taxpayer, not per account. That means an individual may not contribute $6,000 to a Roth IRA and an additional $6,000 to a traditional IRA in 2021. Instead, one may contribute a total of $6,000 split across the different IRAs, say $4,000 to a Roth IRA, and the remaining $2,000 to a traditional IRA.

Spousal IRAs are regular IRAs that married couples who file jointly may participate in.

Married couples can also contribute the same amounts to a spousal IRA for a non-working spouse, as long as one spouse earns enough income to cover both contributions.

Read Also: How To Get Your Money Out Of 401k

How To Maximize 401 Retirement Savings

Employees who utilize a workplace-sponsored retirement plan, such as a 401, are already on a path toward long-term saving for retirement. If an employer offers a contribution match on top of those elective deferrals, however, failing to take full advantage of this match can mean leaving money on the table.

Employees can consider adjusting their monthly 401 plan deferrals to maximize their annual contributions, which may ensure they receive the full match offered by their workplace.

Don’t Miss: How To Check My 401k Account

Traditional Vs Roth 401 Deferrals

Most 401 plans sponsored by an employer offer both traditional and Roth deferral options. These accounts differ in how the account owner pays taxesalthough contribution limits are the same.

-

In a pretax 401 account, deferral contributions are made to the plan before taxes are withheld and you are subject to income tax when funds are withdrawn.

-

In a Roth account, deferral contributions are made to the plan after taxes are withheld. Your Roth contributions are always tax-free and earnings may be tax-free if you meet certain requirements.

In other words, for Roth contributions, the money for your retirement comes out of your paycheck after you pay income taxes on those funds, not before. However, you enjoy a deferred tax benefit because you can withdraw the money in retirement without paying income tax .

Think about when your tax burden will likely peak to determine whether a traditional or Roth 401 account is most appropriate for your needs. If you have not been working for very long, you will probably be in a higher tax bracket when you retire and may want to consider investing in a Roth 401 account.

Extension Apply To Both Contribution Types Question:

Self-directed 401k contributions deadlines are based on the type of entity sponsoring the solo 401k so you are correct. Please see the following.

- If the entity type is a Sole Proprietorship, the annual solo 401k contribution deadline is April 15, or October 15 if tax return extension is timely filed.

- If the entity type is an LLC taxed as an S-Corporation , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an LLC taxed as a Partnership , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is a Partnership , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an S-Corporation , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an C-Corporation , the annual solo 401k contribution deadline is April 15, or September 15 if tax return extension is timely filed.

Don’t Miss: Can You Have A Traditional Ira And 401k

What Happens If You Contribute Too Much To Your 401

If your 401 contributions exceed the limits above, you may end up being taxed twice on your excess contributions: once as part of your taxable income for the year that you contribute and a second time when you withdraw from your plan. Earnings still grow tax-deferred until you withdraw them.

If you realize you contributed too much to your 401, notify your HR department or payroll department and plan administrator right away. During a normal year, you have until your tax filing deadlineusually April 15to fix the problem and get the money paid back to you.

Excess deferrals to a 401 plan will have to be withdrawn and returned to you. Your human resources or payroll department will have to adjust your W-2 to include the excess deferrals as part of your taxable income. If the excess deferrals had any earnings, you will receive another tax form that you must file the following tax year.

Access to thousands of financial advisors.

Expertise ranging from retirement to estate planning.

Match with a pre-screened financial advisor that is right for you.

Answer 20 questions and get matched today.

Connect with your match for a free, no-obligation call.

Employee And Employer Combined

Regardless of whether contributions to your 401 come from you and/or from employer matching, all deferrals are subject to an annual contribution limit dictated by the Internal Revenue Service . For 2022, the total contribution amount allowed for all 401 accounts held by the same employee is $61,000, or 100% of compensation, whichever is less. For 2023, this limit rises to $66,000.

You May Like: Where To Put Your 401k Money When You Retire

How To Maximize Your 401 Match

U.S. News & World Report 02/11/2020

Many companies offer a 401 match to employees who save for retirement, but its not always easy to qualify for the match and take it with you when you leave the job. There might be waiting periods before you are eligible for a 401 match and vesting schedules that prevent you from keeping the match if you dont stay at that job for a specific period of time.

How Does 401 Matching Work?

Some companies contribute to a 401 plan on behalf of employees regardless of whether the worker saves in the plan, while other firms offer to make a contribution to the 401 plan only if the employee also saves some of his or her own money in the plan. The exact amount of a 401 match varies by employer, but it is often 50 cents or $1 for each dollar the employee contributes. There is also often a cap on the amount the employer will match, such as 6% of pay. A 401 match does not count against the employees 401 contribution limit for tax deduction purposes, but it is subject to a different IRS annual limit.

Heres how to take advantage of 401 matching contributions:

Find a job with a good 401 match.

Set up automatic 401 withholding.

Watch out for 401 waiting periods.

Follow the 401 match rules.

Dont stick with the 401 default contribution.

Pay attention to the 401 vesting schedule.

Find a Job With a Good 401 Match

Set Up Automatic 401 Withholding

Watch Out for 401 Waiting Periods

Follow the 401 Match Rules

919308.1.0