Plan To Replace About 80% Of Income

When you stop working, aim to replace about 80% of pre-retirement earnings from all income sources combined, such as 401s and IRAs, Social Security, and pensions.

You can anticipate spending less, because youll no longer be paying payroll taxes or making 401 contributions. You may also spend less on things like gas and clothing, because youre no longer working. The actual amount youll need in order to replace your working income depends on how frugal or luxurious you want your retirement to be.

What Percentage Of My Income Should I Contribute To My 401

You can use the 401 calculator to get straightforward, dollars-and-cents answers to many important questions about your retirement. When it comes to how much you ought to be saving, however, things arent quite so simple. It depends on your age, how many years you plan to work and, ultimately, on the kind of lifestyle you want to have after you retire.

Some advisors recommend saving 10-15% of your income as a general rule of thumb. If you save that much from the time you first start working in your 20s until you retire, that may be fine. If youre starting your retirement savings later in life, however, you will want to save more than that to try to catch up. While there are few hard and fast rules on exactly how much you should save, here are some general guidelines:

Purpose Of Retirement Mutual Funds

Retirement mutual funds are designed to provide investors with a steady flow of income during their retirement years. If you invest in one of these funds, then you do it to plan for your retirement years. These funds invest in a mix of debt and equity instruments to ensure that you get good returns while at the same time securing a part of your investment. Depending on your requirement, returns can be generated as monthly annuities or as a lump sum.

Don’t Miss: Where Do I Check My 401k

Using This Simple 401 Calculator

Our 401 Growth Calculator is a simple and easy way to estimate the long-term growth of your 401 retirement account by the time you want to retire. Knowing how much your current 401 account may accumulate in the future can help you determine if you should adjust your annual 401 contributions to help reach your retirement goals. After answering a brief series of questions, you will get your results, including your estimated accumulated plan balance at retirement, total out-of-pocket costs, and a summary table and bar graph illustrating your retirement plan accumulation over time.

Retirement Savings By Salary

An alternative option to having a specific dollar amount savings goal by age is to save between 12% to 15% of your annual salary each year starting as early as possible, according to Vanguard.

This percentage may include an employer match. For instance, lets say your employer offers a 5% match on your retirement contributions and you earn $50,000 annually. If you set aside 7% of your income and your employer matches your contribution up to 5%, then you will have saved 12% of your income.

Recommended Reading: Can I Withdraw From My 401k Without Penalty

How Does Titans 401k Calculator Work

Titans 401 calculator gives anyone the ability to project potential returns from a 401 retirement fund, based on your current age, 401 balance, and annual salary how much you plan to contribute each year, plus any employer contributions and the age at which you plan to retire.

A few notes on our inputs:

-

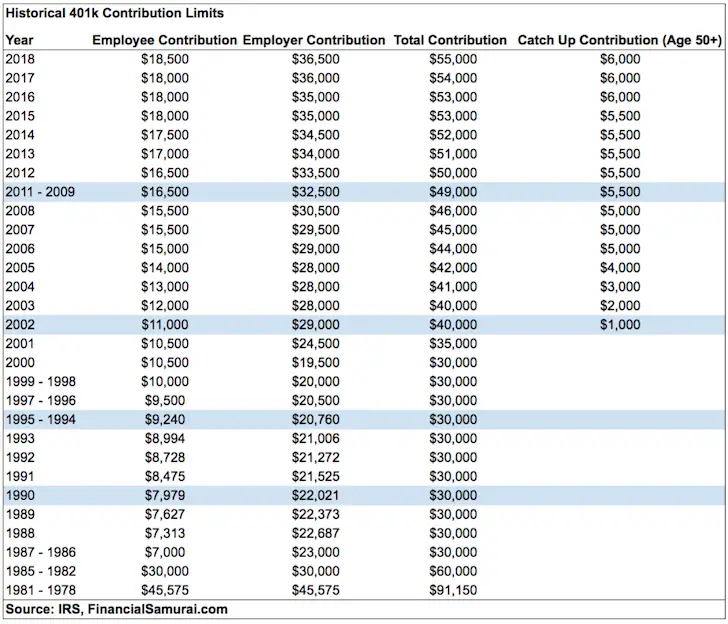

Contribution % of salary: This is the percentage of your salary that you plan to contribute to your 401. Note that our calculator allows increments of 1%, and doesnt apply the IRSscontribution limits, so make sure that the percentage of your salary equals less than $20,500, the 2022 limit for people under age 50. For example, if your salary is $150,000 per year, you can contribute a maximum of 13%.

-

Age you plan to retire: According to the IRS, the minimum retirement age is 59½ this is when you can begin withdrawing from your 401 without penalty. Many people targetage 65 for retirement. Your target retirement age minus your current age is your time horizon.

-

Employer match and limit: Enter this as a percentage of your contributions. For example, if your employer matches 50 cents for every dollar you contribute, enter 50%. Remember, contribution limits arent factored in, so make sure the employer contribution is within the IRSs limit of $61,000 for those under 50 .

Titans calculator also includes a few assumptions, but you have the option to edit these fields if you wish.

Want To Learn More About Planning For Retirement

-

Read our guide on saving for retirement to learn tips, tricks, and tools to help you reach your long-term savings goals.

-

Learn more about how long your retirement savings may last in this Learning Center article.

-

Wondering if your savings are on track compared to others your age? Find out in the average retirement savings article.

-

If youâre ready or nearly ready to start withdrawing from your retirement accounts, read understanding the rules for 401 withdrawal after 59 ½.

You May Like: Can I Use My 401k To Purchase A Home

Contribution Effects On Your Paycheck

An employer-sponsored retirement savings account could be one of your best tools for creating a secure retirement. It provides two important advantages:

-

All contributions and earnings are tax-deferred. You only pay taxes on contributions and earnings when the money is withdrawn.

-

Many employers provide matching contributions to your account, which can range from 0% to 100% of your contributions.

Use this calculator to see how increasing your contributions to a 401 can affect your paycheck as well as your retirement savings.

This calculator uses the latest withholding schedules, rules and rates .

How Much To Save For Retirement

Naturally, the next question becomes: how much should a person save for retirement? Simply put, it’s an extremely loaded question with very few definite answers. Similar to the answer to the question of whether to retire or not, it will depend on each person, and factors such as how much income will be needed, entitlement for Social Security retirement benefits, health and life expectancy, personal preferences regarding inheritances, and many other things.

Below are some general guidelines.

Also Check: How Long To Transfer 401k After Leaving A Job

General Pros And Cons Of A 401

Pros

Cons

- Few investment optionsGenerally speaking, 401s have few investment options because they normally originate from employers, they are limited to what is offered through employers’ 401 plans, as compared to a typical, taxable brokerage account.

- High feesCompared to other forms of retirement savings, 401 plans charge higher fees, sometimes as a percentage of funds. This is mainly due to administration costs. Plan participants have little or no control over this, except to choose low-cost index funds or exchange-traded funds to compensate.

- Illiquid 401 funds can only be withdrawn without penalty in rare cases before 59 ½. This includes all contributions and any earnings over time.

- Vesting periodsEmployers may utilize vesting periods, meaning that employer contributions don’t fully belong to employees until after a set point in time. For instance, if an employee were to part ways with their employer and a 401 plan that they were 50% vested in, they can only take half of the value of the assets contributed by their employer.

- Waiting periodsSome employers don’t allow participation in their 401s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law.

How Much Should You Have In 401k To Retire

According to financial experts, you should aim to have six times your annual salary in a 401 account by age 50 and eight times your annual salary by age 60. By age 67, your total 401 balance should be ten times the amount of your current annual salary. So, for example, if youre earning $100,000 per year, you should have $1,000,000 saved.

You May Like: Should I Get A 401k

How Much Income From Social Security Benefits Can You Expect In Retirement

As discussed, life expectancy changes as you age. For instance, male life expectancy at birth is 76 years, but males who actually live until age 76 have a life expectancy of almost 11 years. That means the decision regarding when to claim benefits should be based in part on your life expectancy.

With that in mind, this chart is based on life expectancy at age 62 — the age at which eligibility for Social Security retirement benefits begins. In other words, the chart assumes men across all three age groups will live until age 82, and it assumes women across all three age groups will live until age 85.

Additionally, the chart is based on the average retirement benefit paid to new beneficiaries who started Social Security at age 62 in 2021. Anyone who turned 62 last year would have seen their benefit reduced by 29.17%. I have reversed that reduction to estimate the Social Security income for individuals who claim at FRA.

Similarly, anyone who turned 62 in 2021 would have received a 25.3% delayed retirement credit if they had claimed Social Security retirement benefits at age 70. I have accounted for that credit to estimate the Social Security income for individuals who claim at age 70.

|

Retired Workers |

|---|

What Will Be The Future Value Of Your 401k

Will your 401k savings be enough to secure your financial future?

The last thing you’d want is to reach retirement age realizing that you’re going to need to work for another 20 years.

Proper financial planning results in a secure future, and your 401k can be a key contributor. This simple 401k Calculator will show what role your 401k will play in plotting your path to your golden years.

Don’t Miss: How To Find Your 401k Balance

How To Calculate Using A 401 Contribution Calculator

One needs to follow the below steps to calculate the maturity amount for the 401 Contribution account.

Step #1 Determine the initial balance of the account, if any. Also, a fixed periodical amount will be invested in the 401 Contribution, which would be a maximum of $19,000 per year.

Step #2 Figure out the rate of interest that would be earned on the 401 Contribution.

Step #3 Now, determine the duration left from the current age until retirement.

Step #4 Divide the interest rate by the number of periods the interest or the 401 Contribution income is paid. For example, if the rate paid is 9% and compounds annually, the interest rate would be 9%/1, which is 9.00%.

Step #5 Determine whether the contributions are made at the start or the end of the period.

Step #6 Determine whether an employer is contributing to match the individuals contribution. That figure plus the value in step 1 will be the total contribution in the 401 Contribution account.

Step #7 Use the formula discussed above to calculate the maturity amount of the 401 Contribution, which is made at regular intervals.

Step #8 The resultant figure will be the maturity amount, including the 401 Contribution income plus the amount contributed.

Step #9 There would be tax liability at the time of retirement for the entire amount since the contributions are pre-tax, and deductions are taken for the contributed amount.

How Much Do I Need To Save To Retire

A good rule of thumb is that your retirement income should equal about 80% of your pre-retirement income, says Steve Sexton, financial consultant and CEO of Sexton Advisory Group, a retirement-planning company.

For example, if you make $150,000 per year, you should aim to have at least $120,000 per year in retirement to live comfortably in your golden years, says Sexton.

But some retirees may choose to live a more frugal or a more lavish lifestyle in retirement. Depending on which route you want to take, the factors that may increase or decrease your savings goal include:

Social security benefits. Beginning at age 62, you can begin receiving partial Social Security benefits in the form of a monthly payment. This amount is reduced by a percentage of your payment the percentage amount is based on the year you were born.

For instance, someone born in 1950 who elects an early benefit would have their payment reduced by 25%. On the other hand, someone born in 1970 would have their benefit reduced by 30%.

Once you reach your full retirement age, you can begin receiving your full Social Security benefit. If you delay your benefit until reaching this age, you may also get delayed retirement credits, which increase the amount you receive. Your monthly payment may reduce how much money you need to withdraw from your retirement savings.

Also Check: When Can I Withdraw Money From 401k

Not A Math Whiz No Worries

You can find out how much your 401k will grow without the help of a financial wizard. Simply provide the required inputs variables and quickly calculator what your 401k will grow to in the future.

Play around with the actuals and the extras to model various what if scenarios to reach your financial goals. This Simple 401k Calculator can be your best tool for creating a secure retirement. The following step-by-step procedure will show you how

Calculating the compound interest growth and future value of your monthly contributions is as simple as entering your beginning balance, the combined contributions , an estimate of your return on investment, and the number of years until retirement.

Related: 5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

How Much Do I Need To Retire

How much you need to retire depends on how much you plan to spend in retirement. How much will you want to shell out on travel? What about saving for medical expenses? These considerations and more make planning your retirement paycheck difficult for many people, especially when theyre decades from retirement.

Don’t Miss: How To Borrow From Your 401k

The Concept Of Retirement Corpus

To support the lifestyle after retirement, one must ensure that sufficient retirement income must be yielding . Retirement income will come from the retirement corpus .

The challenge is to build a big-enough retirement fund. How to do it? Earn more, spend less, save high, and use the saving to build retirement fund. Following are the 4 steps worth remembering:

Want More Here Is Some Of Our Most Popular Retirement Planning Content

Disclaimer: The content, calculators, and tools on NewRetirement.com are for informational and educational purposes only and are not investment advice. They apply financial concepts in a general manner and include hypotheticals based on information you provide. For retirement planning, you should consider other assets, income, and investments such as equity in a home or savings accounts in addition to your retirement savings in an IRA or qualified plan such as a 401. Among other things, NewRetirement provides you with a way to estimate your future retirement income needs and assess the impact of different scenarios on retirement income. NewRetirement Planner and PlannerPlus are tools that individuals can use on their own behalf to help think through their future plans, but should not be acted upon as a complete financial plan. We strongly recommend that you seek the advice of a financial services professional who has a fiduciary relationship with you before making any type of investment or significant financial decision. NewRetirement strives to keep its information and tools accurate and up to date. The information presented is based on objective analysis, but it may not be the same that you find on a particular financial institution, service provider or specific products site. All content, tools, financial products, calculations, estimates, forecasts, comparison shopping products and services are presented without warranty.

Don’t Miss: How Can You Get A 401k

Taxable Investment Portfolio Is Key

The only thing you can count on is after-tax money youve invested or saved. This is why after maxing out your 401k, its good to open up an after-tax brokerage account. Consistently contribute a percentage of your paycheck each mont into your taxable investment portfolio.

Your goal should be to then build as many passive income streams as possible. The more passive income streams and active income streams you have, the more financially free you will be.

Challenge yourself to raise your after-tax and 401k contribution savings percent to possibly 50%. It wont be easy. But if you practice raising your savings rate by 1% a month until it hurts, youll find it easier than you think.

A straightforward way to maximum savings is to make your 401k maximum contribution automatic. Save every other paycheck for the rest of your working life.

Max out your 401k and save over 50% of your after-tax income for at least 10 years in a row. If you do, you will be financially free to do whatever you want!

Read Also: How To View Your 401k