Traditional Or Roth Ira

If youre just starting out, you may want to stick to basics: a traditional or Roth IRA. You can put in as much as $6,000 for the 2021 and 2022 tax years . With a traditional IRA, your contributions may be deductible, and the growth is tax-deferred.

If youre not covered by an employer plan, your traditional IRA contributions are deductible, with no income limits. But if you have a spouse covered by a plan, income limits may apply. For more details, check the IRS website.

With a Roth IRA, your contributions are made on an after-tax basis, but your money will grow tax-free, and youll pay no taxes on your distributions as long as you follow the withdrawal rules. Plus, you can take out your own contributions anytime without paying tax.

Roth IRAs do have income limits. Those who are married and filing jointly must have modified adjusted gross incomes below $198,000 for 2021 to make a full contribution.

Which IRA is right for you? A lot depends on your age and current income. Young people, for instance, are likely to have smaller incomes and thus pay less in taxes than they will when they get older.

If you think that your taxes will be higher later than they are today, it makes sense to favor a Roth IRA, says Ed Slott, a CPA and founder of IRAhelp.com.

Conversely, those with higher incomes might want to get the immediate tax deduction with a traditional IRA.

Can I Open A 401 On My Own

A 401 is offered by your employer so you generally cannot open a 401 on your own. If you are self-employed, then you may be able to open a 401 plan for yourself, called a Solo or single-participant 401 plan. You can open a solo 401 on your own with the help of a solo 401 provider. If your business is made up of only you or your spouse, these plans can be a great way to save for your retirement, and they are simple to set up! You can contribute for both yourself as the employee, and as the employer, so your contribution limits are higher than if you work for someone else. Read here for more information on Solo 401 plans.

Need To Open A Roth Ira

My favorite online broker is Ally Invest but you can check out our recap on the best places to open a Roth IRA and the best online stock broker sign-up bonuses. There are many good options out there, but I have had the best overall experience with Ally Invest. No matter which option you choose the most important thing with any investment is to get started.

Read Also: How Can I Roll Over My 401k

Decide Where To Open Your Roth Ira Account

Almost all investment companies offer Roth IRA accounts. If you have an existing traditional IRA, the same company can probably open a Roth IRA for you.

Ask these questions as you decide where to open the account:

- Is there a fee to open or maintain it?

- Does the company provide customer service online or by telephone?

- Does the company offer the types of investments you’re looking for, whether that means exchange-traded funds , target-date funds, actively managed funds, or stocks and bonds?

- How much does it cost to trade? This is especially important if you plan to buy and sell frequently in your account.

The financial institution you open the account with is called a custodian because it takes custody of your money.

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

| Compare the Best Online Brokers |

|---|

| Company |

| $0 for stock/ETF trades, $0 plus $0.65/contract for options trade |

Who Qualifies To Open A 401k Without An Employer

There are only two requirements to open a Solo 401k.

Many sole proprietors, small business owners without employees , independent contractors, and freelancers typically fit this description. The business can be structured as a Limited Liability Company , an LLC partnership, a C-Corp, or an S-Corp. There are really no restrictions other than the business has no full-time employees except for the owner and spouse. Importantly, the business can hire outside contractors as long as they are not W-2 employees. You can also have part-time employees as long as they are less than 1,000 hours a year.

If you already qualify, thatâs excellent! .

You can have a Solo 401k if youre moonlighting or making money from a hobby. If you have a 401k at more than one job, the total employee contribution limits must be within the maximum for the year, but the employer contribution is not limited. Make yourself one of the savvy people with two retirement savings plans.

If you need more information, read on because the ability to open a 401k without an employer

is a core issue affecting multiple facets of your financial future and freedom.

Recommended Reading: How To Convert A 401k To Roth Ira

If I Offer A 401 To My Employees Are There Compliance Regulations I Must Follow Or Can The Retirement Plan Provider Help With These

Certain employers who offer 401 and other retirement plans must abide by the Employee Retirement Income Security Act of 1974, as amended, which helps ensure that plans are operated correctly and participants rights are protected. In addition, a 401 plan must pass non-discrimination tests to prevent the plan from disproportionately favoring highly compensated employees over others. The plan fiduciary is usually responsible for helping comply with these measures.

This information is intended to be used as a starting point in analyzing employer-sponsored 401 plans and is not a comprehensive resource of all requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. For specific details about any 401 they may be considering, employers should consult a financial advisor or tax consultant.

Unless otherwise agreed in writing with a client, ADP, Inc. and its affiliates do not endorse or recommend specific investment companies or products, financial advisors or service providers engage or compensate any financial advisor or firm for the provision of advice offer financial, investment, tax or legal advice or management services or serve in a fiduciary capacity with respect to retirement plans. All ADP companies identified are affiliated companies.

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

Important Plan Provision Changes: New plan loan provisions are no longer offered in the TD Ameritrade Individual 401 plan. All outstanding plan loans must be paid off by May 31, 2022 to continue to use the TD Ameritrade plan document. Roth 401 deferral contributions in the Individual 401 plan will no longer be accepted as of December 1, 2022.

Also Check: How Do I Get My 401k Money After I Quit

Traditional And Roth 401s

When you participate in a traditional 401 plan, the taxable salary that your employer reports to the IRS is reduced by the amount that you defer to your account. This means income taxes on that money are postponed until you withdraw from your account, usually after you retire.

An increasing number of employers are offering employees a relatively new 401 choicea Roth 401. If you participate in a Roth 401, the amount you defer doesn’t reduce your taxable income or your current income taxes. But when you withdraw after you retire, the amounts you take out are tax-free, provided you’re at least 59½ and your account has been open at least five years.

Both the traditional 401 and Roth 401 offer tax advantages when you defer a portion of your salary into an account in your employers retirement savings plan. Both feature tax-deferred compounding of contributions that are made to the account. Both have no income limits and require minimum distributions after you turn 72 in most cases, and both can be rolled over to an IRA when you retire or leave your job for any reason.

Here is a chart showing the different tax structures for the two 401 options:

Whats more, if your modified adjusted gross income is too large to allow you to qualify for a Roth IRA, a Roth 401 is one way to have access to tax-free withdrawals. There are no income restrictions limiting who can participate. The only requirement is being eligible to participate in your employers plan.

How To Open A 401k Without An Employer

How do you open a 401 account without an employer plan? Many companies donât offer a 401. But there are many alternatives to save for retirement.

The 401 retirement plan is the most common way in which Americans save for retirement. However, according to a study by the US Census Bureau, only 14% of US employers offer a 401 through their company. That still results in over 70% of Americans contributing to a 401 plan. But if you find yourself working for a company that doesn’t offer a 401 plan, you might not know how to open a 401 without an employer plan.

If your company doesnât offer a 401 plan or you are self-employed, youâll need to join a separate financial institution. There youâll be able to open a 401, IRA, or any other retirement plan you choose.

In addition to these alternatives to 401s, you’ll want to rollover your old 401s to these accounts. Consolidating your 401s will help keep your retirement properly managed and accounted for.

Also Check: How To Take Out Money From My 401k

You Expect To Pay Higher Taxes In The Future

Since Roth IRAs use after-tax dollars, youll have to pay taxes upfront on any funds you roll over. However, you wont have to pay taxes on your distributions, which could be extremely beneficial if youre taxed at a higher rate when you reach retirement. Youll pay taxes either way now or later. But with a Roth IRA, you can rest assured your withdrawals will be tax-free.

What Is A 5

The 5-taxable-year period of participation begins on the first day of your taxable year for which you first made designated Roth contributions to the plan. It ends when five consecutive taxable years have passed. If you make a direct rollover from a designated Roth account under another plan, the 5-taxable-year period for the recipient plan begins on the first day of the taxable year that you made designated Roth contributions to the other plan, if earlier.

If you are a re-employed veteran making designated Roth contributions, they are treated as made in the taxable year of qualified military service that you designate as the year to which the contributions relate.

Certain contributions do not start the 5-taxable-year period of participation. For example, a year in which the only contributions consist of excess deferrals will not start the 5-taxable-year period of participation. Further, excess contributions that are distributed to prevent an ADP failure also do not begin the 5-taxable-year period of participation.

Recommended Reading: Can I Borrow Money From My 401k

What Are The Contribution Levels And Limits Of A Solo 401

To take full advantage of contributions to a Solo 401 plan you must understand your limits as an employee and employer, as well as contributions allowed on behalf of a spouse if applicable.

When contributing as the employee, you are allowed up to $19,500 or 100% of compensation in salary deferrals for tax year 2021 and $20,500 or 100% of compensation for tax year 2022. If you are over 50, an additional $6,500 catch-up contribution is allowed bringing the total contribution up to $26,000 for 2021 and $27,000 for 2022. This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a combination of both. Additionally, as the employer, you can make a profit-sharing contribution up to 25% of your compensation from the business up to $58,000 for tax year 2021 and the maximum 2022 solo 401k contribution is $61,000. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401 contribution limit is $57,000 and the maximum 2021 solo 401 contribution is $58,000. If you are age 50 and older and make catch-up contributions, the limit is increased by these catch-ups to $64,500 for 2021 and $67,500 for 2022.

Find Out If Youre Eligible And Ready

First things first. Before you can open a Roth IRA, you have to make sure you meet the income limits to contribute to a Roth IRA.

In 2022, as long as your adjusted gross income is less than $129,000 for single filers and $204,000 for married couples filing jointly, you can contribute the maximum amount to a Roth IRA.1

Remember when we said your Roth IRA has a specific place in your wealth-building plan? Heres the deal: Eligibility for an IRA isnt all you should keep in mind. You also need to make sure saving for retirement fits into your budget. That means youll need to be halfway through the Baby Steps. Baby Step 1 is saving a $1,000 starter emergency fund. Baby Step 2 is getting out of debt using the debt snowball method. Baby Step 3 is saving three to six months of expenses for a fully funded emergency fund.

And then you get to Baby Step 4investing 15% of your household income for retirement. When youre trying to figure out where to invest for retirement first, remember: Match beats Roth beats Traditional. This means you should invest in your 401 up to your match , then max out your Roth IRA. If you havent reached 15% at that point, go back and invest in your 401. And if you have a Roth 401 at work, great! You can invest your entire 15% there.

Working through the Baby Stepsand getting out of debtis the quickest right way to build wealth. So if you havent paid off all your debt or saved up an emergency fund, stop investing for now. No exceptions!

You May Like: How Do I Rollover My 401k Into An Ira

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Roth Solo 401k Benefits

The Roth Solo 401k is the best retirement plan for self-employed and small business owners. With the potential increase of federal and state income tax rates, the ability to generate tax-free returns from your IRA investments is the last surviving legal tax shelter.

With this plan, you can make almost any type of investment tax-free. This includes real estate, tax liens, precious metals and more. You can also continue to make traditional investments, like stocks, bonds and mutual funds. When you reach age 59 1/2, youll have the ability to live off your Roth 401 assets without having to pay tax.

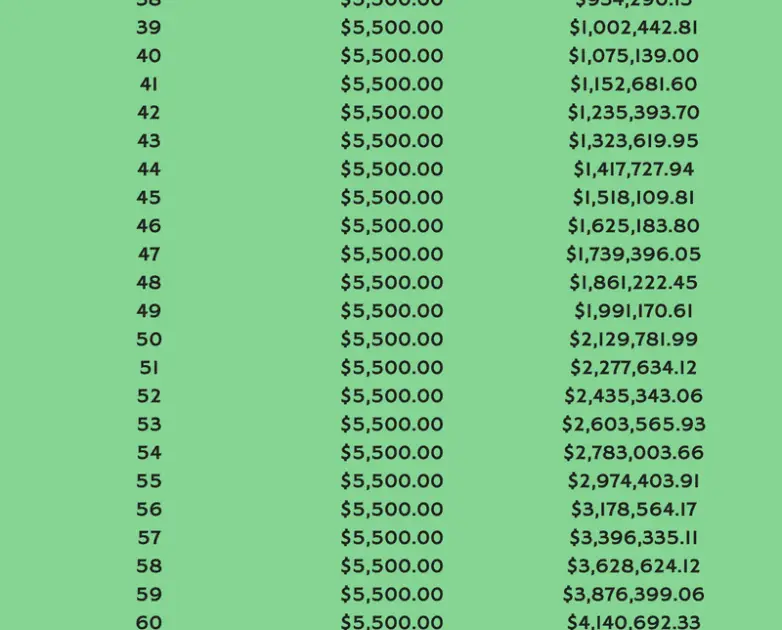

Look at the Roth Solo 401k this way: if you start contributions in your 40s and generate a modest rate of return, you may have over $1 million tax-free when you retire. With a Solo Roth 401, you have options. A Solo Roth 401 has the following benefits:

- Solo 401 benefits

Learn about the Roth Solo 401 retirement plan

Recommended Reading: When Can I Take 401k

Workers Of All Ages Can Benefit From Stashing Away After

If your employer offers a Roth option in your 401, it’s a great idea to invest in it, or at least consider investing a portion of your 401 contribution in the Roth. Contributions to a Roth 401 won’t reduce your tax bill now. While pretax salary goes into a regular 401, after-tax money funds the Roth. But as with Roth IRAs, withdrawals from Roth 401s are tax- and penalty-free as long as you’ve had the account for five years and are at least 59½ when you take the money out.

Because there are no income limits on Roth 401 contributions, these accounts provide a way for high earners to invest in a Roth without converting a traditional IRA. In 2021, you can contribute up to $19,500 to a Roth 401, a traditional 401 or a combination of the two. Workers 50 or older can contribute up to $26,000 annually.

If you get matching funds from your employer, they go into a traditional pretax 401 account. However, a proposal in the Securing a Strong Retirement Act, which has been nicknamed the SECURE Act 2.0, would allow workers to have employer matching contributions invested in a Roth 401. The House Ways and Means Committee has approved the bill, though it still needs to be voted on by both chambers of Congress.