What Is A 401 Plan

A 401 plan is a retirement savings plan offered by many American employers that has tax advantages for the saver. It is named after a section of the U.S. Internal Revenue Code .

The employee who signs up for a 401 agrees to have a percentage of each paycheck paid directly into an investment account. The employer may match part or all of that contribution. The employee gets to choose among a number of investment options, usually mutual funds.

Wells Fargo 401k Match

New employers are eligible to get Wells Fargoâs match after completing one year of service.

Once they’ve met this requirement, Wells Fargo will match their 401 contributions dollar-for-dollar up to 6% of their eligible compensation every quarter. Also, employees may benefit from a discretionary profit-sharing contribution to their retirement account depending on the company’s financial performance.

Wells Fargo employees get 100% vesting on the matched contributions regardless of their years of service.

Think About How Much You’ll Need In Retirement

Contributing the maximum to your 401 requires a lot of money especially as an ongoing, year-after-year commitment. It may or may not be enough to fund your retirement, or it could be even more than you need. Your 401 contribution amount should be guided by your retirement savings goal.

How much money you’ll need in retirement depends on when you plan to retire, how much of your current income youd like to replace and how much you want to rely on Social Security.

Most experts recommend saving 10% to 15% of your income, but our suggestion is to get a more detailed goal from a retirement calculator.

If you need to start at a lower contribution and work your way up, that’s fine. Aim to contribute at least enough to grab the match, then bump up the percent you contribute by 1% or 2% each year.

You May Like: How Much Can I Rollover From 401k To Roth Ira

Northrop Grumman 401k Match

Northrop Grumman provides automatic enrollment of new employees in its savings plan.

Employees can contribute 1% to 75% of their eligible pay to their 401 plan, and receive 4% to 7% matching depending on the date when they were hired. Employees hired before April 1, 2016, get up to a 4% match of their eligible compensation. Employees hired after April 1, 2016, are eligible for 401 matching up to 7%.

Employees must complete three years of service to be 100% vested in the matching contributions.

How Much Can You Contribute To A 401

The most you can contribute to a 401 is $20,500 in 2022 . Employer contributions are on top of that limit. These limits are set by the IRS and subject to adjustment each year.

That limit dictates how much you can contribute, but it doesnt tell you how much you should contribute. To figure that out, consider the following.

You May Like: How To Know If You Have A 401k

Start Earning More For A Better Financial Future

The answer to How much should I have in my 401k? is an important one but its not the only way to ensure your financial future.

We are going to let you in on a little secret. It is one that has helped thousands of people live their Rich Life:

Theres a limit to how much you can save, but theres no limit to how much money you can earn.

Bonus:

Many people dont understand this and because of that, theyre content with contributing very little to their retirement accounts. When they actually retire, theyre surprised when their nest egg is a lot smaller than they thought and they have to get a job as a Walmart greeter to pay for their condo.

If you realize that your earning potential is LIMITLESS, you can truly get started working toward living a Rich Life today.

We recommend three ways to start earning more money:

1. Negotiate a salary raise. 99% of people are content with not asking for a salary raise. So if you are willing to negotiate, that puts you in the 1% and showcases to your boss that youre a Top Performer willing to work hard for more money.

2. Start a side hustle. One of my favorite money-making tactics is starting your own side hustle. We all have skills. Why not leverage those skills to start earning more money in your free time?

We want to help you get started on one of these tactics today: Starting a side hustle.

Thats why we want to offer you my Ultimate Guide to Making Money.

Stuff like:

Read Also: Should I Transfer 401k From Previous Employer

Annual Limits For An Employers 401 Match

The 2021 annual limit on employee elective deferralsthe maximum you can contribute to your 401 from your own salaryis $19,500. The 2022 elective deferral limit is $20,500. The 2021 annual limit for an employers 401 match plus elective deferrals is 100% of your annual compensation or $58,000, whichever is less. In 2022, this total rises to $61,000 or 100% of your compensation, whichever is less.

Considering that surveys suggest many Americans dont have enough money saved for retirement, meeting or exceeding the amount needed to gain your employers full 401 matching contribution should be a key plank in your retirement savings strategy.

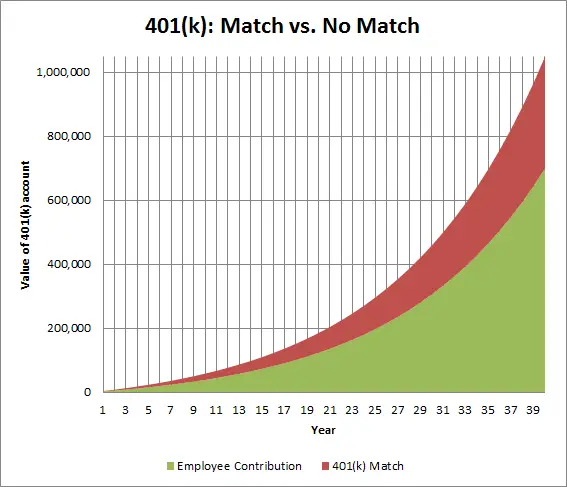

Taking into account the power of compounding and a 6% annual rate of return, contributing enough to receive the full employer match could possibly be the difference between retiring at 60 versus 65, said Young.

Use Fidelitys 401 match calculator to find out how matching contributions can impact your retirement savings.

Read Also: How Much Tax On 401k After Retirement

Matching Contributions: How Much And When

The specific terms of 401 plans vary widely. Other than the necessity to adhere to certain required contribution limits and withdrawal regulations dictated by the Employee Retirement Income Security Act , the sponsoring employer determines the specific terms of each 401 plan.

Your employer may elect to use a very generous matching formula or choose not to match employee contributions at all. Some 401 plans offer far more generous matches than others. Whatever the match is, it amounts to free money added to your retirement savings, so it is best not to leave it on the table.

Refer to the terms of your plan to verify if and when your employer makes matching contributions. Not all employer contributions to employee 401 plans are the result of matching. Employers may elect to make regular deferrals to employee plans regardless of employee contributions, though this is not particularly common.

Matching Contributions For A Roth 401

If you choose to save money in a Roth 401, matching contributions must be allocated to a separate traditional 401 account. This is because IRS rules require you to pay regular income tax on employer contributions when they are withdrawnand Roth 401 withdrawals arent taxed in all but a few cases.

Remember, with a traditional 401 account, your contributions are made pre-tax, and you pay regular income tax on withdrawals. And with a Roth 401 account, your contributions are made using after-tax dollars, and qualified withdrawals are generally tax free.

Also Check: How Do I Find Out What My 401k Balance Is

Whats This Whole Employer Match Vesting Thing

A lot of employers use a vesting schedule for their 401 matches. Its a way to help them hedge their bets on you as an employee by reducing the amount of money theyd lose if you were to leave the company. Its also meant to give you a shiny incentive to stay.

A vesting schedule determines how much of your employers matching contributions you actually own, based on how long youve worked there. For example, if your employer contributions vest gradually over four years, then 25% of your employer contributions belongs to you after youve been there one year, 50% belongs to you after two years, 75% belongs to you after three years, and theyre all yours once you hit your fourth work anniversary.

Theres another type of vesting schedule, called cliff vesting. This ones more of an all-or-nothing scenario. With a four-year cliff, 0% of the contributions are yours until you hit your fourth workiversary, then 100% of them are all yours, all at once.

All the contributions made after your vesting schedule ends are usually fully vested right away. Oh, and dont worry: 100% of the money you put in yourself is always fully vested.

How Does The Employer Match Work

Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution: a percentage of the employees own contribution and a percentage of the employees salary. Employers might match 25%, 50%, or even 100% of an employees contribution up to a set percentage of the employees salary.

Some companies may match contributions dollar for dollar, while others match at a smaller percentage. Other employers may set a hard dollar-based cap instead of limiting match contributions to a percentage of the employees total salary. Total employer contributions cannot exceed 25% of eligible employees annual salary or compensation.

No matter what your companys match program is, its important to strategize. Retirement experts regularly encourage employees to contribute enough to reach the maximum possible employer contribution, or at least as much as they can comfortably contribute. This ensures employees arent leaving money on the table, especially since its part of their total compensation.

Don’t Miss: Can I Withdraw Money From My 401k

Is It A Good Idea To Take Early Withdrawals From Your 401

There are few advantages to taking an early withdrawal from a 401 plan. If you take withdrawals before age 59½, you will face an additional 10% penalty in addition to any taxes you owe. However, some employers allow hardship withdrawals for sudden financial needs, such as medical costs, funeral costs, or buying a home. This can help you skip the early withdrawal penalty but you will still have to pay taxes on the withdrawal.

Employer Matching Contribution Formulas

Most often, employers match employee contributions up to a percentage of annual income. This limit may be imposed in one of a few different ways. Your employer may elect to match 100% of your contributions up to a percentage of your total compensation or to match a percentage of contributions up to the limit. Though the total limit on employer contributions remains the same, the latter scenario requires you to contribute more to your plan to receive the maximum possible match.

Some employers may match up to a certain dollar amount, limiting their liability to highly compensated employees regardless of income. For example, an employer may elect to match only the first $5,000 of your employee contributions.

The IRS requires that all 401 plans take a nondiscrimination test annually to ensure that highly compensated employees dont benefit more from tax-deferred contributions.

“Your employer could match 100% or even a dollar amount based upon some formula, but this can get expensive and normally owners want their employees to take some ownership of their retirement while still providing an incentive,” says Dan Stewart, CFA®, president, Revere Asset Management Inc., in Dallas, TX.

Recommended Reading: Can I Roll Over 401k Into Ira

Taxes And Employer 401 Matching Contributions

You dont have to pay any income taxes on employer 401 matching contributions until you start making withdrawals.

Gross income includes wages, salaries, bonuses, tips, sick pay and vacation pay. Your own 401 contributions are pre-tax, but still count as part of your gross pay. However, your employers matching contributions do not count as income, said Joshua Zimmelman, president of Westwood Tax & Consulting.

Your employers matching contribution grows tax-deferred in a traditional 401, boosting your compounding returns over the years. You dont have to pay any taxes on the employer match until you start making withdrawals, said Zimmelman. Traditional 401 withdrawals are taxed as ordinary income at whatever tax bracket youre in when you make those withdrawals..

Traditional 401 Vs Roth 401

When 401 plans became available in 1978, companies and their employees had just one choice: the traditional 401. Then in 2006, Roth 401s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.

While Roth 401s were a little slow to catch on, many employers now offer them. So the first decision employees often have to make is between a Roth and a traditional .

As a general rule, employees who expect to be in a lower after they retire might want to opt for a traditional 401 and take advantage of the immediate tax break.

On the other hand, employees who expect to be in a higher bracket after retiring might opt for the Roth so that they can avoid taxes on their savings later. Also importantespecially if the Roth has years to growis that there is no tax on withdrawals, which means that all the money the contributions earn over decades of being in the account is tax-free.

As a practical matter, the Roth reduces your immediate spending power more than a traditional 401 plan. That matters if your budget is tight.

Since no one can predict what tax rates will be decades from now, neither type of 401 is a sure thing. For that reason, many financial advisors suggest that people hedge their bets, putting some of their money into each.

Recommended Reading: Why Roll 401k Into Ira

What Percentage Of Companies Match 401k Contributions

The 401 match for all employers fluctuated between 3% and close to 5% for the past decade, as confirmed by data from sources, such as the U.S. Labor Department. They are the Bureau of Labor Statistics and Fidelity International. In addition to 87% of employers setting aside retirement plan contributions according to Fidelitys 2020 Facts & Insights report.

If You Want To Get The Most Out Of Your Employer Match You Have To Understand The Factors That Influence It

A 401 match is a flashy perk employers dangle in front of prospective employees, but its actual value varies quite a bit: anywhere from nothing to tens of thousands of dollars.

To find out how much you’ll get, you have to weigh several factors, which I outline below. Once you understand these basics, you can leverage this information to secure an even larger company match.

Image source: Getty Images.

Read Also: Should I Transfer 401k From Previous Employer

How A 401 Works

The 401 is a special investment account designed to help working individuals save for retirement. The plan dates back to 1978 when Congress passed the Revenue Act. Working individuals were given an opportunity to avoid paying taxes on deferred compensation, such as bonuses or stock options.

The plan didn’t gain traction until 1981. That’s when the Internal Revenue Service came up with rules to allow taxpayers to set aside payroll deductions to their 401 plans. Approximately 4.8 million people had access to a 401 plan in the private sector in 1983.

But how does the plan work? As noted above, you can elect to have a percentage set aside from every paycheck into a designated investment account. You can choose how much of your contribution goes to which investments within that accountusually mutual funds. Some employers match employee contributions up to a certain percentage, which sweetens the pot.

Like other investment accounts, 401s come in two different options:

- Traditional 401s: These accounts use pretax dollars for contributions. This reduces your taxable income and, therefore, your annual tax liability. You can claim the amounts you invest as a tax deduction on your annual tax return. You are, however, liable for taxes on any withdrawals you make.

- Roth 401s: These accounts require contributions to be made using after-tax dollars, which means there is no immediate tax benefit. But any withdrawals you make end up being tax-free.

What Is A 401k Match

A 401K plan is a retirement account provided by an employer. As the employee, you can choose to contribute part of your salary to the 401K plan. A 401K match is the amount your employer will also contribute to your account above and beyond what you contribute.

For example, an employer can offer to match up to 3% of your salary to your 401K plan so long as you contribute 3% as well.

Read Also: Can I Make My Own 401k

What Is A Dollar

With a dollar-for-dollar 401 match, an employers contribution equals 100% of an employees contribution, and the employers total contribution is capped as a percentage of the employees salary.

We commonly see employers offer a 3%, dollar-for-dollar match, said Taylor. They match 100% of your contributions up to 3% of your salary.

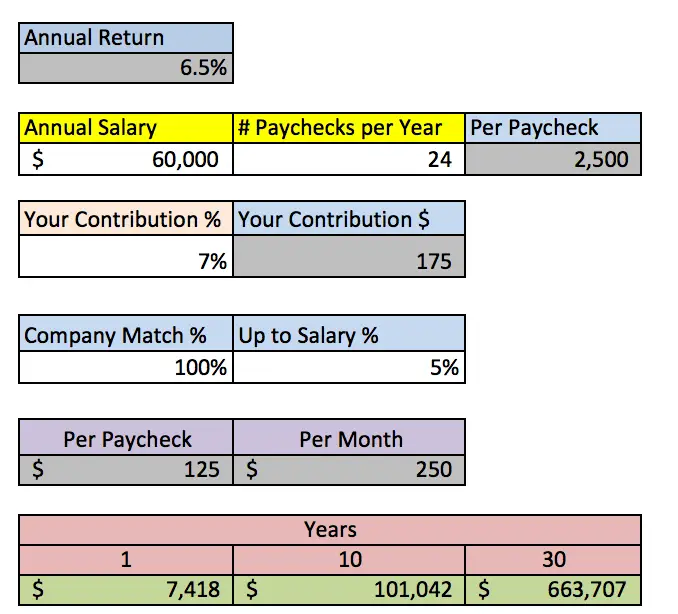

Imagine you earn $60,000 a year and contribute $1,800 annually to your 401or 3% of your income. If your employer offers a dollar-for-dollar match up to 3% of your salary, they would add an amount equal to 100% of your 401 contributions, raising your total annual contributions to $3,600.

Vesting And Employer 401 Contributions

Some 401 plans include a vesting schedule for employer contributions. With vesting, you must wait for a period of time before taking ownership of the 401 contributions made by your employer.

Note that most 401 plans let you start contributing to your account as soon as you join the company. Contributions that you make to your 401 account are always considered fully vestedthey are always 100% owned by you. Extended vesting periods only cover employer contributions.

According to Vanguard, 40% of 401 participants were in plans with immediate vesting of employer matching contributions. Smaller plans, meaning plans with fewer participants, used longer vesting schedules, with employees only becoming fully vested after five or six years.

If you have a 401 and your employer matches your contributions, be sure to ask about the vesting schedule. If your plan has a vesting schedule, you dont own your employers contributions to your 401 until you are fully vested. If you take a new job before that point, you could lose some or even all of your employers 401 contributions.

Don’t Miss: How To Calculate Employee 401k Match