Can You Withdraw From A 401 Without Penalty

For the most part, early 401 distributions are subject to income tax and a 10% penalty on the withdrawn amount. That said, there are a number of exceptions to the 10% additional tax. If, for example, an early distribution is made to cover a medical expense which exceeds a percentage of the borrowers adjusted gross income, the account holder may not be subject to penalty. Other exceptions to the penalties include, but are not limited to:

-

Permanent disability

-

Being called into active military duty

-

Court-ordered withdrawals to pay for a former spouse or defendant

For a full list of the exceptions, please visit the IRSs Exceptions to Tax on Early Distributions page.

Leaving Your Old Job Initiate A 401k Rollover

Quitting? Fired? What about your 401? We explain.

As of May last year, there were an estimated $24.3 million forgotten or left behind 401s, according to a study conducted by Capitalize, totaling to $1.35 trillion in abandoned assets.

Investing made easy.

Life happens in chapters. And sometimes, a new chapter involves getting a new job or losing your current one. There can also be some cliffhangers from the preceding chapter, but one thing to not leave behind is the money you had saved for retirement with that employer through your 401 plan.

Ira Rollover Vs Transfer

Although both rollovers and transfers allow you to move your retirement savings from one financial institution to another, the process for each is different, and each have different rules.

A 401 rollover occurs when you move retirement funds from an employer-sponsored plan to an IRA this is why it’s also called a Rollover IRA. This option is typically chosen when an employee leaves a job and is no longer contributing to the employer-sponsored retirement plan.

A Transfer is when you move your IRA to another IRA at a different institution. In the case of a transfer, funds or assets are sent between institutions, from the previous custodian or trust company to the new one. This is not only the quickest, but also the best method of moving your IRA to a self-directed IRA.

Recommended Reading: Should You Convert 401k To Roth Ira

How Much Can You Take Out Of Your Ira To Buy A Home

Account holders can take out as much money from their IRA as they want to fund a home purchase. However, to discourage premature withdrawals, the IRS will tax any money thats taken out as income in the year it is withdrawn. There is, however, a provision for first-time home buyers. Anyone looking to buy a home who hasnt owned in the last two years may take out up to $10,000 without incurring the 10% penalty which usually accompanies early withdrawals.

Alternatives To Withdrawing Your 401 To Purchase A Home

The penalties associated with taking money out of a 401 are high enough to make someone consider other alternatives. Fortunately, theres more than one way to receive the necessary capital to buy a home. Prospective homebuyers dont have to use a 401 to buy a house instead, they can turn to one of the following sources of capital:

-

Mortgage Programs

Read Also: Can I Move My Ira Into My 401k

Decide Where You Want The Money To Go

If youre making a rollover from your old 401 account to your current one, you know exactly where your money is going. If youre rolling it over to an IRA, however, youll have to set up an IRA at a bank or brokerage if you havent already done so.

Bankrate has reviewed the best places to roll over your 401, including brokerage options for those who want to do it themselves and robo-advisor options for those who want a professional to design a portfolio for them.

Bankrate has comprehensive brokerage reviews that can help you compare key areas at each provider. Youll find information on minimum balance requirements, investment offerings, customer service options and ratings in multiple categories.

If you already have an IRA, you may be able to consolidate your 401 into this IRA, or you can create a new IRA for the money.

How To Roll A 401 Into An Ira

Here’s how to start and finish a 401 to IRA rollover in three steps.

1. Choose which type of IRA account to open

An IRA may offer you more investment options and lower fees than your old 401 had.

2. Open your new IRA account

You generally have two options for where to get an IRA: a robo-advisor or an online broker.

-

If you’re not interested in picking individual investments, a robo-advisor might be a good option. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, usually for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments, and has a reputation for good customer service.

» Ready to get started? Explore our picks for best IRA accounts

3. Ask your 401 plan for a direct rollover

Here are the basic instructions for a direct rollover:

Contact your former employers plan administrator, ask for a direct rollover, complete a few forms, and ask for a check or wire of your account balance to be sent to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include, and where it should be sent.

Read Also: How Much Can I Borrow Against My 401k

Invest With Your Ira Appropriately

Remember there are two goals of rolling over an old 401 into an IRA the first is to consolidate your 401 assets, and the second is to grow those assets by allocating them into investments that will increase in value over time.

Your very last step in executing a rollover is to make sure that second goal is being met and that the funds in your IRA are being appropriately invested. If you chose an automated IRA then this should happen automatically. Thats because as soon as your funds arrive theyll be allocated into a portfolio that was created for you during the sign-up process for your new IRA account. You should still log in and check to make sure thats the case, but usually theres nothing more for you to do.

If you choose a self-directed account then youll have to invest the money yourself. Often the simplest option is to purchase a target-date retirement fund this is an investment vehicle that puts your money into a combination of higher-risk, higher-return stocks and lower-risk, lower-return bonds. The exact mix changes as you age so that you have more stocks when youre younger and less as you get older: because stocks generate higher returns but are more volatile we should own more of them early on when we can withstand their fluctuations in order to achieve their higher long-term returns.

Otherwise you can assemble a portfolio on your own by making trades.

Background Of The One

Under the basic rollover rule, you don’t have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you can’t make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .

You May Like: How Do I Get My Money From 401k

Will Taxes Be Withheld From My Distribution

- IRAs: An IRA distribution paid to you is subject to 10% withholding unless you elect out of withholding or choose to have a different amount withheld. You can avoid withholding taxes if you choose to do a trustee-to-trustee transfer to another IRA.

- Retirement plans: A retirement plan distribution paid to you is subject to mandatory withholding of 20%, even if you intend to roll it over later. Withholding does not apply if you roll over the amount directly to another retirement plan or to an IRA. A distribution sent to you in the form of a check payable to the receiving plan or IRA is not subject to withholding.

Why Choose Irar For Your Self

The answer is clear and simple!

Your account will be serviced by an experienced team of Certified IRA Services Professionals with expertise in self-directed IRAs. Our knowledge and experience in self-directed IRA rules, regulations, and recent trends, will assist you in making smart educated decisions.

Youll also be able to save over 50% compared to fees charged by other industry providers. We believe in maintaining lower fees because were committed to helping you build long-lasting retirement wealth.

At IRAR we see many cases in which IRA owners transfer their existing self-directed IRA to IRAR because theyve grown unhappy with their current provider account fees were too high, poor service, or the provider has gone out of business or changed in management.

Regardless of the reason, we want to help.

You May Like: How To Use Your 401k Money

Rollover To Another 401

If you value the simplicity of having all your retirement funds in one place, are looking to minimize account maintenance fees or want to prepare yourself to take advantage of the Rule of 55, a 401-to-401 rollover can be a good choice. By rolling over an old 401 into a plan with your new employer, you can keep everything in one place. Evaluate investment options carefully, though, to make sure there arenât high fees and that the investments available work for you.

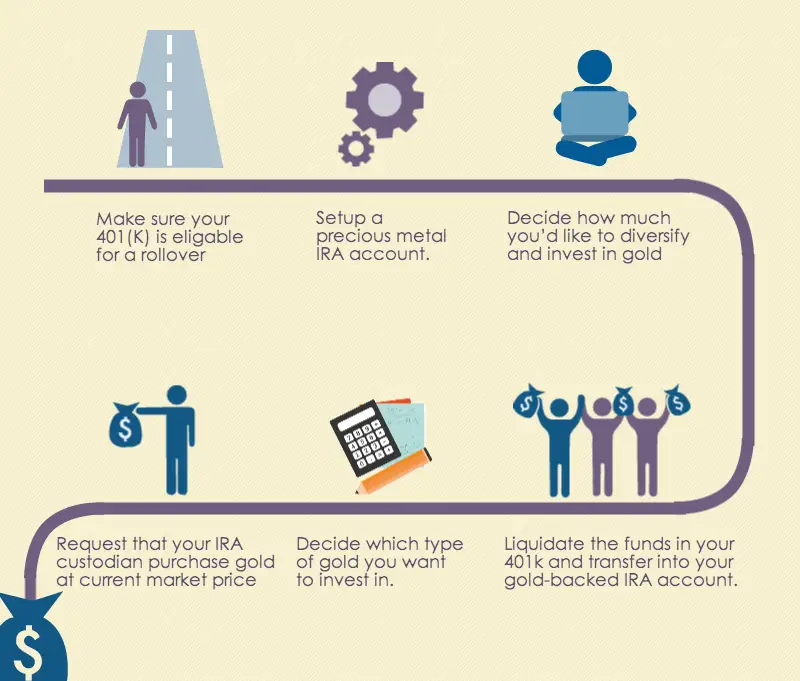

S To Roll Over 401k To Ira

The process is simple:

Also Check: How To Draw Out Your 401k

Roll Over Your 401 To An Ira

This option makes sense if you want to roll over your 401 and you want to avoid a taxable event. If you have an existing IRA, you may be able to consolidate all of your IRAs in one place. And an IRA gives you many investment options, including low-cost mutual funds and ETFs.

There are plenty of mutual fund companies and brokerages that offer no-load mutual funds and commission-free ETFs, says Greg McBride, CFA, Bankrate chief financial analyst.

You also want to just make sure that youre satisfying any account minimums so that you dont get dinged for an account maintenance fee for having a low balance, McBride says. Index funds will have the lowest expense ratios. So theres a way that you can really cut out a lot of the unnecessary fees.

Check with your IRA institution first to ensure that it will accept the kind of rollover that you would like to make.

The letter of the law says it is OK . But in practice, your 401 plan may not allow it, says Michael Landsberg, CPA/PFS, principal at wealth management firm Homrich Berg.

Decide Where You Want Your Money To Go

You have a few destination options to choose from when you roll over a 401.

Use a rollover IRA: The most commonly used is a rollover IRA. This is simply a traditional IRA except it houses funds rolled over from another retirement account like a 401.

Investors typically roll over funds into like accounts — a traditional 401 into a traditional IRA and a Roth 401 into a Roth IRA. You may also roll over funds from a traditional account into a Roth account, but you’ll owe taxes at your current income tax rate on the amount converted. If you expect a year of low income, perhaps from an extended gap between jobs, then this conversion may be advantageous.

Transfer to a new 401: The other option is to roll over funds from an old 401 into your new employer’s 401 plan. This keeps all of your retirement investments consolidated so that they’re easier to manage. For high-income earners, another reason to transfer to a new 401 may be to keep the backdoor Roth IRA option available by sidestepping the IRA aggregation rule. As long as the fees are reasonable for the current 401 plan, this isn’t a bad option.

Don’t Miss: When Can You Take Money Out Of 401k Without Penalty

How To Roll Over Your 401 To An Ira

There are many reasons why you may have decided to make a 401-to-IRA rollover. You may have left your job for a position at a new company, you may have been laid off or you may have decided to take your career in a new direction. Regardless, if youve been contributing diligently to your employer-sponsored retirement plan for a number of years, you could have a decent stash of cash in your account. If you want help managing your retirement accounts after your rollover, consider working with a financial advisor.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Recommended Reading: Is 401k Enough For Retirement

How To Pick An Ira To Roll Over To

The most important question you need to ask is whether you want to start a traditional IRA or a Roth IRA. Traditional IRAs work much like traditional 401 plans. You contribute money before you pay taxes. The 2023 maximum contribution limit for traditional and Roth IRAs is $7,500.

With a traditional IRA, the money you contribute is deducted from your taxable income for the year. When you reach retirement, the money is taxable as you withdraw it. A Roth IRA, however, works differently. You contribute money post-taxes. The money is then not taxable when you withdraw it in retirement. If you think you might want to keep contributing to your new IRA after the rollover is complete, its important to decide which type of IRA you want.

Its also important to consider the tax implications. If you have a traditional 401 plan, that means you didnt pay taxes on the money when you contributed it to your account. If you want to move that money into a Roth IRA, youll have to pay taxes on it. You can roll over from a traditional 401 into a traditional IRA tax-free. Same goes for a Roth 401-to-Roth IRA rollover. You cant roll a Roth 401 into a traditional IRA.

Begin The Rollover Process

Youll have to fill out paperwork to conduct your rollover, and it may require some back-and-forth conversations with your providers. You have several options to actually move the money from the old provider to the new one, but your best option is a direct rollover.

In a direct rollover, the funds are sent straight from your 401 into your new account without you touching the funds. Its important that you specify a direct rollover so that you dont have the check made payable to you. You could trigger a mandatory 20 percent withholding for taxes, and the IRS charges a 10 percent bonus penalty on withdrawals made before age 59 1/2.

Don’t Miss: What Happens With 401k When You Quit

Rollovers Of Retirement Plan And Ira Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

The Rollover ChartPDF summarizes allowable rollover transactions.