Covering Your Spouse Under Your Solo 401

The IRS allows one exception to the no-employees rule on the solo 401: your spouse, if he or she earns income from your business.

That could effectively double the amount you can contribute as a family, depending on your income. Your spouse would make elective deferrals as your employee, up to the $19,500 employee contribution limit . As the employer, you can then make the plans profit-sharing contribution for your spouse, of up to 25% of compensation.

How A Health Savings Account Works

HSAs are funded with pretax dollars, and the money within them grows tax-deferred as with an IRA or a 401. While the funds are meant to be withdrawn for out-of-pocket medical costs, they dont have to be, so you can let them accumulate year after year. Once you reach age 65, you can withdraw them for any reason. If its a medical one , its still tax-free. If its a non-medical expense, you are taxed at your current rate.

To open an HSA, you have to be covered by a high-deductible health insurance plan . For 2022, the Internal Revenue Service defines a high deductible as $1,400 per individual and $2,800 per family.

Also, the annual out-of-pocket expenses, including deductibles, co-payments, but not premiums, must not exceed $7,050 for self-only coverage or $14,100 for family coverage for 2022.

The annual contribution limit for 2022 contribution limit is $3,650 for individuals and $7,300 for families. People age 55 and older are allowed a $1,000 catch-up contribution.

Choose A Type Of Plan

Private 401k providers require a written investment plan from each investor that includes the type of plan you wish to start. You have two options: traditional and Roth. Traditional plans entail investing money pre-tax. When the time comes for you to retire, you pay taxes on your money as you make withdrawals. Consider the potential tax rate increases before choosing this option. Instead, also consider your other option. If you open a Roth private 401k, you will invest your funds after-tax. While this could decrease the amount you can afford to invest while you are working, you have more funds to obtain when you retire. Determine which type will benefit you the most when starting a private 401k.

Also Check: Should I Have An Ira And A 401k

How To Start A 401k

Setting up a 401k retirement plan can be quite simple or complicated depending on your approach. Most people choose to outsource at least some portion of the process in other to ease up the burden involved. In particular, they use a template legal document to establish the 401k plan because its a lot cheaper than hiring an attorney to reinvent the wheel for you. Unless your retirement plan is especially tricky or youre trying to get fancy , youll probably use preconfigured programs from 401k vendors. These programs are often called volume submitter or prototype plans.

What Is The Best Retirement Plan For A Self

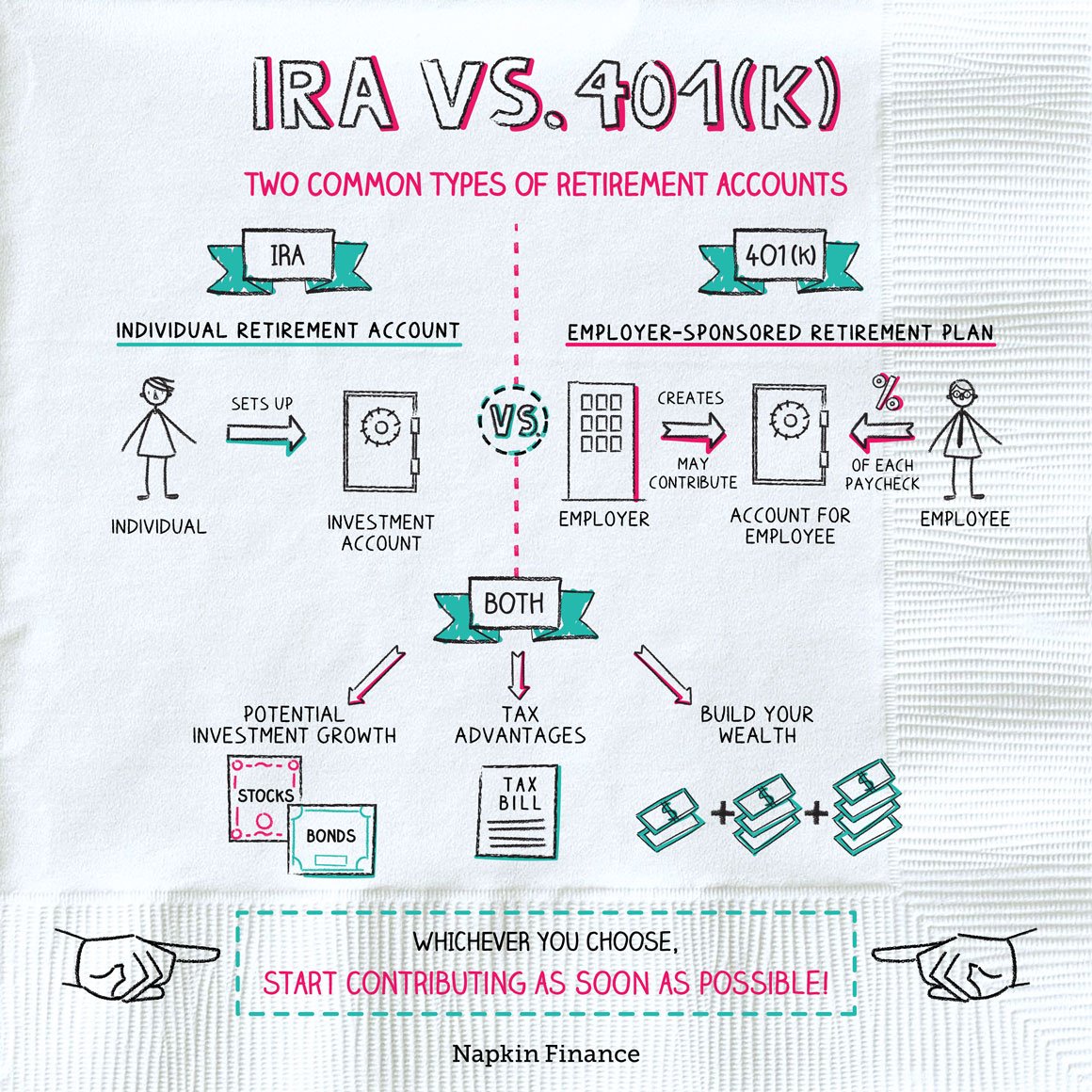

Allec says that, for most businesses, the solo 401 is the best option. Many small businesses can contribute more to a solo 401 than, say, a SEP at the same income level. With an IRA, you can contribute only $6,000 or $7,000 in 2022. With a SEP IRA, you cant contribute as both employer and employee, only as an employer.

There are several other types of retirement plans besides self-employed 401s. These include the following:

Summary: The solo 401 is the best retirement plan for a self-employed person, but traditional IRAs, Roth IRAs, SEP IRAs and SIMPLE IRAs remain options.

Recommended Reading: How Does 401k Transfer Work

How To Start A Private 401k Plan Without An Employer

Many investors have trouble opening a 401k for their retirement because they are not familiar with private 401k plans. As an investor struggling to open a 401k, you are worried that you will not have the necessary finances for retirement. Fortunately, you can open a 401k in a non-traditional way. The private 401k functions similarly to traditional plans that many employers offer employees. You can invest in your future even when the traditional route is out of reach. There are also safe investments for seniors that retired investors can benefit from. If you are not yet retired and want to save for retirement, continue reading to learn how to start a private 401k plan.

Whats So Great About 401 Accounts

A 401 is a popular type of employer-sponsored retirement plan thats available to all employees 21 or older who have completed at least one year of service with the employer, usually defined as 1,000 work hours in a plan year. Some employers enable new employees to join right away, even if they havent met this criterion yet.

In 2021 youre allowed to contribute up to $19,500 to a 401 or up to $26,000 if youre 50 or older. These limits are much higher than what you find with IRAs, and they enable you to set aside a fairly large sum annually.

Most 401s are tax deferred, so your contributions reduce your taxable income each year. You must pay taxes on your distributions in retirement, but you may be in a lower tax bracket by then, in which case you would save money. Some employers also offer Roth 401s. You pay taxes on contributions to these accounts now, but youll get tax-free withdrawals in retirement.

Some employers also match a portion of their employees 401 contributions, which can make the task of saving for retirement a little easier. Each company has its own rules about matching, so consult with your HR department to learn how yours works.

Read Also: How To Collect My 401k Money

Also Check: What Is 401k Plan Mean

Most Important Pieces Of A 401k Plan

The plan document is a legal document that contains the rules and regulations that govern the 401k retirement plan. It contains the general rules governing the 401k plan, specific terms and it also serves as a roadmap for any question that come up when administering the plan. This document is usually lengthy. Typically, a summarized version of the document is distributed to employees when they enroll in the plan.

The adoption agreement is a document that you have to make use of in order to setup your 401k retirement plan. The adoption agreement allows you to customize the plan so that it fits your goals and your organization. In a lot of cases, it will help you to tick some checkboxes: do you want to allow loans yes or no? Is there a match? What kind? Which vesting schedule do you want to use? The plan document is more or less a boilerplate required language for any plan, but the adoption agreement makes it your own plan.

The trust is a legal entity, and is sometimes called the plan. Using a plan document and adoption agreement often create the trust for you. Due to the fact that all trust need to have a trustee, you will have to decide who will serve as a trustee for your plan. In most cases, it is the business owner, president, or somebody in a similar role. If you are your own boss, you will most likely serve as the trustee of your 401k plan.

No Interest No Collateral No Credit Score

401 business financing is an ideal method if you dont want to go into debt, dont qualify for a loan, or just dont have the cash on hand to start or purchase a business. Unlike other types of funding methods, your credit score, past experience, or on hand collateral play no role in eligibility. Instead, the main factors are the type of retirement account or IRA) and the amount of money you have in it .

Also Check: How Young Can You Start A 401k

Bankruptcy & Creditor Protection For Solo 401k Plan

QUESTION 4: I am trying to better understand the protections of the solo 401k. I believe it qualifies for unlimited bankruptcy protection, but does it also have unlimited lawsuit protection under ERISA ?

ANSWER:

- Bankruptcy: Solo 401K plans have creditor protection under the federal bankruptcy rules.

- As far as protection from non bankruptcy creditors, the protection falls at the state level. While solo 401K plans are not covered by the federal creditor protection rules of ERISA, they are generally protected under most state laws subject to certain carve outs .

Aim To Save At Least 10% Of Your Income Each Year Automatically

An all too common mistake new investors make is that they focus on what to invest in, rather than how much to invest, says Rapplean.

âYounger investors get really hung up on the investment choices, when the focus really should be on your savings rate,â says Rapplean. Academic research suggests someone in their 20s needs to aim to save at least 10%â15% is even betterâto land at retirement in solid shape. If you get a later start, you will want to aim to save even more.

If you canât reach that threshold right now, donât get disheartened. Many people canât itâs equally important to get any amount of money you can into the market to start benefiting from compounding returns. Even small sums can become small fortunes over decades.

Recommended Reading: How Do I Put My 401k Into An Ira

The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

Savings Incentive Match Plan For Employees

You can put all your net earnings from self-employment in the plan: up to $14,000 in 2022 , plus an additional $3,000 if you’re 50 or older , plus either a 2% fixed contribution or a 3% matching contribution.

Establish the plan:

Recommended Reading: Is An Ira Better Than A 401k

Solo 401 Contribution Limits

The total solo 401 contribution limit is up to $58,000 in 2021 and $61,000 in 2022. There is a catch-up contribution of an extra $6,500 for those 50 or older.

To understand solo 401 contribution rules, you want to think of yourself as two people: an employer and an employee . Within that overall $58,000 contribution limit in 2021 and $61,000 in 2022, your contributions are subject to additional limits in each role:

-

As the employee, you can contribute up to $19,500 in 2021 and $20,500 in 2022, or 100% of compensation, whichever is less. Those 50 or older get to contribute an additional $6,500 here.

-

As the employer, you can make an additional profit-sharing contribution of up to 25% of your compensation or net self-employment income, which is your net profit less half your self-employment tax and the plan contributions you made for yourself. The limit on compensation that can be used to factor your contribution is $290,000 in 2021 and $305,000 in 2022.

Keep in mind that if youre side-gigging, employee 401 limits apply by person, rather than by plan. That means if youre also participating in a 401 at your day job, the limit applies to contributions across all plans, not each individual plan.

Fully Legal And Irs Compliant

In 1974, Congress enacted the Employee Retirement Income Security Act to shift the burden of building retirement assets from the employer to the employee. ERISA, when paired with specific sections of the Internal Revenue Code, makes it legal to tap into your eligible retirement accounts without an early withdrawal fee or a tax penalty.

Don’t Miss: When Can I Sign Up For 401k

Invest In A Business Startup

The thrill of funding the next big thing makes investing in a startup exciting, however, it also includes a high degree of risk. Crowdfunding or focused investment platforms are a few ways that startups reach out to both potential investors and future customers.

Key benefits: Low investment threshold, rapid growth could lead to a corporate buyout and a large financial gain.

Drawbacks: High failure rates, may take a long time for the investment to pay off and/or to liquidate the investment.

Managing Your Retirement Funds

It’s important to start saving for retirement as soon as you begin earning income, even if you can’t afford to save that much at the beginning. The sooner you begin, the more you’ll accumulate, thanks to the miracle of compounding.

As your savings build, you may want to get the help of a financial advisor to determine the best way to apportion your funds. Some companies even offer free or low-cost retirement planning advice to clients. Robo-advisors such as Betterment and Wealthfront provide automated planning and portfolio building as a low-cost alternative to human financial advisors.

Recommended Reading: How To Withdraw Money From My Fidelity 401k

You Have More Choices And Potential But Greater Risks Of Messing Up

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Participants in 401 plans might feel restricted by the narrow slate of mutual fund offerings available to them. And within individual funds, investors have zero control to choose the underlying stocks, which are selected by the mutual fund managers, who regularly underperform the market.

Fortunately, many company’s offer self-directed or brokerage window functions that give investors the option to seize the reigns over their own financial destinies by managing their 401 plans for themselves. But there are both pros and cons to taking the do-it-yourself route.

What To Do If Your Job Doesnt Offer A 401

A lot of people use 401s to invest for retirement, which is why you hear so much about them. But actually, more than one-third of working adults dont have access to a 401 at their job including many part-time workers, self-employed people, and people whose employers just dont offer them.

If youre in that situation, your employer might offer a different kind of retirement plan, like a payroll deduction IRA or a SIMPLE IRA. But if not, no sweat you arent out of luck. Here are some other types of accounts you can use to build up that nest egg for Future You instead.

Dont Miss: How To Tell If You Have A 401k

Read Also: How To Do A Hardship Withdrawal 401k

What Are The Most Common Mistakes People Make With Self

Overcontributing, in Allecs opinion, is the largest mistake. When you discover youve put too much money into your plan, call your provider right away. They can help you withdraw the overcontributed amount so you wont have to pay taxes on it.

Another common error is breaking one of the prohibited transaction rules. For example, your plan buys a house in Florida and rents it out as an investment. If you want to take a family trip to Disney World, you cant stay in that house. Once youve invested in alternative assets and break the rules, you will be subjected to taxes and penalties. Always make sure your provider goes over the rules with you when you open your individual 401.

The last mistake many people make is not getting their solo 401 set up by the end of the year.

What Are The Maintenance Costs For Setting Up A 401

Once you establish a 401, your business will have ongoing costs in the form of administrative fees and any matching contributions. Fees generally fall into three categories: day-to-day operations, investment fees, and individual service fees.

There are also potentially fees or penalties associated with being non-compliant with regular 401 benchmarking, which you’ll want to avoid at all costs. A few examples of 401 penalties include:

- Non-compliance with ERISA for failing to meet certain filing and notification requirements

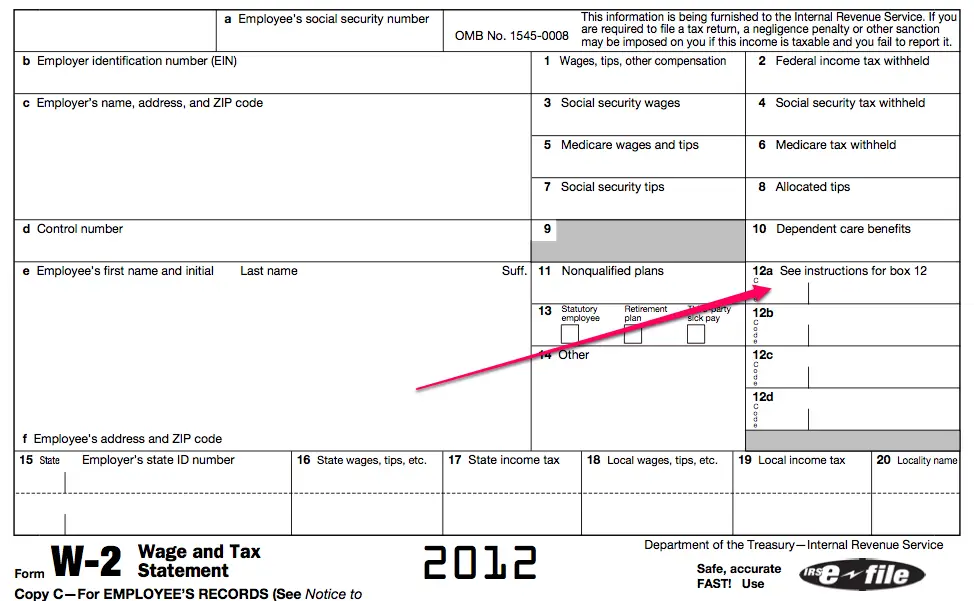

- Failing to file Form 5500 with the IRS each year

- Not providing 402 notices to plan participants who are seeking distributions from their retirement plan accounts

One way to avoid fines and penalties is working alongside a knowledgeable retirement services provider that can help ensure compliance when it comes to retirement plan forms, deadlines, and notifications.

Don’t Miss: How Does 401k Show On Paycheck

According To 401k Statistics 58% Of 401k Participants See Themselves As Savers

Interestingly, the remaining 42% of 401k plan participants think of themselves as investors. Whats more, 72% believe its more important to save now so you could have a comfortable retirement. These attitudes show a changing dynamic towards savings. Hopefully, it will prompt more Americans to choose a retirement plan as soon as possible.

Also Check: How Do I Set Up A Solo 401k Plan

What Else Do Small Business Owners Need To Know About 401 Plans

Small business owners who offer retirement savings plans may be able to take advantage of tax incentives. Matching employee contributions, for instance, is generally tax deductible as a business expense. For the first three years of the plan, employers may also be eligible for tax credits up to 50% of the start-up and administration costs or $5,000 , as well as a $500 automatic enrollment credit per year.

Recommended Reading: Will 401k Limits Increase In 2021