What Is A Solo 401 And Who Is Eligible

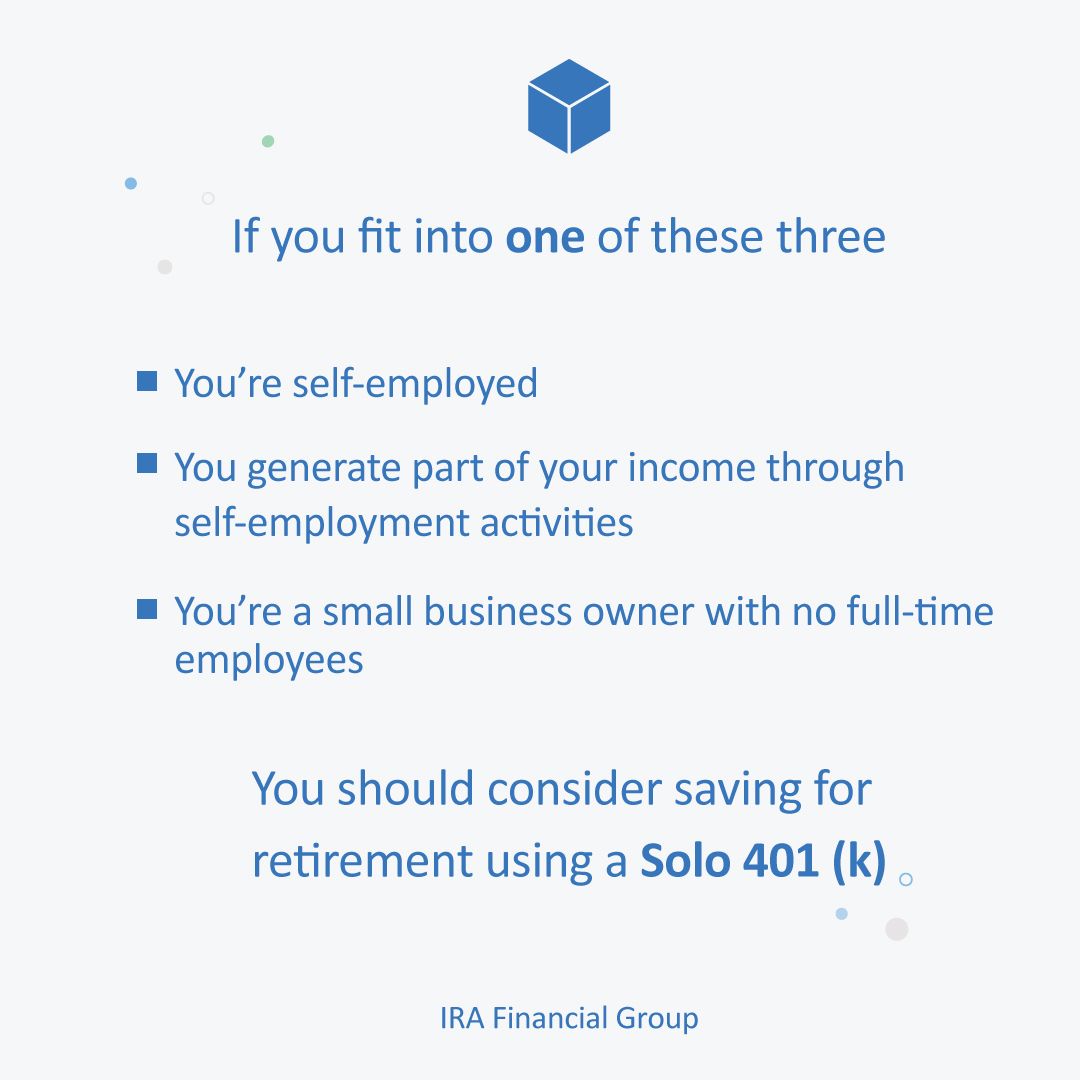

A solo 401 is an individual 401 designed for the self-employed and for business owners with no full-time employees.

A solo 401 is really special because you have the option of putting aside so much money for your future, money expert Clark Howard says. Youre able to take a huge amount of what you earn, if you can afford to, and put it in a solo 401.

| Rules & Limits | |

|---|---|

| No age/income restrictions can’t have qualifying employees | |

| Employee Contribution Limit | |

| $6,500 | |

| Total Contribution Limits | |

| Taxes | Depends on whether your account is traditional, Roth or both |

Although its similar to a traditional 401 retirement account, a solo 401 is unique: You can contribute as an employer and as an employee. It also imposes fewer rules and requires less paperwork than a typical 401 plan.

The other brilliant thing about solo 401 plans is that, at least in theory, they offer a Roth option . Unless youre in a high tax bracket, Clark wants you to contribute your solo 401 funds into a Roth option.

If youre a freelancer, you operate a side hustle or you own your own business, a solo 401 can be a great way to save and invest for retirement. The only requirements are:

- You must make self-employment income.

- You cannot have any qualified employees.

In this case, a qualified employee is someone who has worked for your company for at least one year and has worked at least 1,000 hours per year.

How To Set Up A Solo 401

There are specific steps that must be taken to properly open a solo 401 plan, according to the Internal Revenue Service .

First, you have to adopt a plan in writing, making a written declaration of the type of plan you intend to fund. The choices are the same as those given to an employee opening a 401 plan: you can choose a traditional 401 or a Roth 401. Each has distinct tax benefits.

A solo 401 must be set up by Dec. 31 in the tax year for which you are making contributions.

You can open a solo 401 at most online brokers and traditional brokers or directly through a financial services company. You’ll want to do some research ahead of time to identify the best solo 401 company for you.

You’ll need an employer identification number to get started with the enrollment process. If you don’t have one already, you can apply online directly to the IRS.The rest of the documentation will be provided by the broker or financial services company you choose for the account.

Benefits Of A Solo 401

Solo 401s provide some advantages over other types of retirement accounts available to you. One big advantage is the availability of the Roth option as well as the traditional version. Only the traditional option can be used by those who invest using the SEP IRA, a Keogh plan, or a SIMPLE IRA. The plain-vanilla IRA that is available to all who have earned income is available in Roth or traditional versions but the annual contribution limits are far lower.

One of the main advantages of the solo 401 is that it can accept contributions from both an employee and an employer. That is, if you have a solo 401, you wear both hats and can make contributions in both roles.

Recommended Reading: How Much Can You Put In Your 401k Per Year

Determining Compensation For Self

The starting point for identifying compensation for contribution purposes on behalf of self-employed individuals is to determine the individuals earned income or net earnings from self-employment. Depending on the individuals type of self-employment, an individual will use one of the following forms to determine net earnings for a specific year.

- A partnership generates a Schedule K-1, Partners Share of Income, Deductions, Credits, etc., for each individual partner showing the partners net earnings for the year.

- A sole proprietor must file Schedule C, Profit or Loss From Business, showing the net earnings from the business for the year.

- Farmers file Schedule F, Profit or Loss From Farming, to show net income from farming.

Does A Solo 401 Plan Allow For Roth Contributions

Yes, you can choose to make Roth 401k contributions to your solo plan. Similar to a Roth IRA, you will contribute after-tax dollars and then enjoy tax-free withdrawals at retirement. Just be sure that you specify this designation when completing your opening paperwork. If you need the money early, make sure you know how to take an early withdrawal without a penalty.

Recommended Reading: How To See How Much Is In My 401k

Why Choose Roth Over A Traditional Ira

Like we talked about earlier, since you pay taxes on the money you put in your Roth IRA when you invest it, youll be able to use your savings in retirement tax-free. That means if you contribute the maximum amount each year, you could potentially have a nest egg worth almost $1.5 million after 30 years! Weve got your attention now, right? And you wont have to pay a penny in income taxes when you withdraw that money in retirement.

Its also important to remember that you have no idea what tax rates will be when you reach retirement, especially if you move up in tax brackets throughout your career .

With a Roth IRA, youre paying the current income taxes within your bracket as you contribute. So, when you finally settle down to enjoy that nest egg, you know exactly how much money is yours versus Uncle Sams.

Dont Miss: Can You Use 401k For Investment Property

Adding Your Spouse Under Your Solo 401

You have already learned that one of the biggest qualifications for a solo 401 is the fact that your business can have no other full-time employees. However, there is an exception for spouses. Just as your spouse can receive Social Security spousal benefits, they can also receive benefits from your 401k. If your spouse earns money from the business, then he or she can take advantage of the plan as well. Your spouse would be allowed to make the maximum contribution to the plan, and your business could also contribute up to 25% of the spouseâs salary into the plan. Essentially, this could double your individual contributions into your 401.

Also Check: Can You Contribute To Both 401k And Ira

Solo 401k Contribution Limits

To understand the contribution limits, you need to remember that as a self-employed person, you are both employee and employer.

The total solo 401k contribution limit for 2021 is $57,000 in 2020 and $58,000 in 2021 with an additional $6,500 catch-up contribution if you are 50 or older.

Within that total contribution limit, there are limits for each of your roles

- Employee: As the employee, you can contribute the lesser of 100% of your compensation or up to $19,500 in 2020 and 2021. If youre 50 or older, you can contribute an additional $6,500 as an employee.

- Employer: In the employer role, you can contribute an additional profit-sharing contribution of up to 25% of what youre compensated for up to the total contribution limit of $57,000 for 2020 and $58,000 for 2021.

When you calculate your contribution percentage as the employer, the max amount of compensation you can use for 2020 is $285,000 and its $290,000 for 2020. Like other retirement plans, you can expect solo 401k contribution limits to make regular cost-of-living adjustments.

To help you understand how the contribution limits work, let me give you an example.

Youre a blogger who earned $85,000 from your blog in 2020. As the employee, you contribute $19,500 which is the max employee contribution.

Then as the employer, you contribute an additional $21,250. That amount is figured as 25% of your total compensation. $85,000 x 25% = $21,250

The Drawbacks For The Self

While often the best choice if you qualify, there are a few things that make an individual Roth 401 slightly less than perfect:

- Establishing an individual Roth 401 plan can be a lot of initial paperwork.

- An individual Roth 401, unlike a Roth IRA, requires mandatory distributions once you reach age 72. However, you might be able to roll over your Individual Roth 401 assets to your Roth IRA once youre no longer employed, effectively getting around this rule.

- Not all brokerage houses offer individual Roth 401 products.

- You cant change your mind about Roth 401 contributions, rolling them over to your traditional 401 and taking the tax deduction later. Once its done its done. Its a better deal in the long run, anyway.

Anyone who can take advantage of these tax shelters probably should. At the very minimum, it warrants a meeting with your qualified tax adviser to seriously discuss the topic. The consequences in terms of real-world dollars and cents are profound.

Read Also: Can I Transfer My 401k To My Spouse

You May Like: How To Find Out If Deceased Had 401k

Drawbacks To A Solo 401

A solo 401 may not be right for small businesses that plan to expand and hire employees in the near-term, since doing so would likely result in plan ineligibility. In addition, calculating profit-sharing contributions for sole proprietorships and partnerships tends to be complex because it requires modified net profits. The formula for this calculation is available in IRS Publication 560.

Advantages Of Solo 401 Plans

Solo 401 plans have several features that make them stand out from other types of self-employed retirement plans, like Simplified Employee Pension plans or SIMPLE IRAs.

First is the ability to contribute a higher percentage of ones income to the plan. While all workers, regardless of the type of employer retirement plan, are generally limited to a total of $61,000 in combined employee and employer contributions the amount of income an individual must earn to be able to reach that maximum contribution limit changes based on the type of plan.

For example, SEP contributions are capped at 20% of the participants net self-employment income. This is effectively the same as the employer portion of the solo 401 plan contribution, but the additional employee portion allowed by the solo 401 plan which can be 100% of compensation up to $20,500 means that solo 401 plan participants can contribute a much higher percentage of their income if they dont earn enough to max out the employee portion alone.

Specifically, in order to contribute the maximum of $61,000 to their plan, a SEP participant must earn $321,000 in self-employment income whereas a solo 401 plan participant need only earn $217,000 to contribute that amount using standard employee and employer contributions, or just $67,000 when using nondeductible contributions, as shown below.

Nerd Note:

You May Like: Why Move 401k To Ira

Exceptions For Solo 401 Early Distribution Penalties

The IRS may waive the 10% penalty for early withdrawals in certain circumstances. Youll still owe taxes on any contributions or earnings that havent been taxed. The exceptions include:

- Medical expenses that exceed 10% of your adjusted gross income

- Permanent disability

- Certain military service

- A Qualified Domestic Retirement Order issued as part of a divorce or court-approved separation

In the case of a distribution paid to an ex-spouse under a QDRO, the 401 owner owes no income tax and the recipient can defer taxes by rolling the distribution into an IRA.

Unlike an IRA or SEP IRA, a Solo 401 doesnt allow penalty-free withdrawals for higher education expenses or first-time homebuyers.

What Is A Solo 401 Plan And How Does It Work

A solo 401 plan, also called a one-participant 401 or a solo K, offers self-employed people an efficient way to save for retirement. There are no age or income restrictions, but participants must be business owners with no employees .

The solo K has very high and flexible contribution limits, typically allowing more contributions than SEPs, traditional IRAs and Roth IRAs or SIMPLEs, says Joe Conroy, CFP and founder of Harford Retirement Planners in Bel Air, Maryland.

One key difference between the solo 401 and other self-employed retirement plans is that employees can contribute all of their salary up to the annual maximum contribution. Theyre not limited to 25 percent of their salary, as in some other plans. This feature can allow them to minimize taxes, though this contribution doesnt help them avoid the self-employment tax.

In other respects, the solo 401 operates like any other 401 plan, whether its a traditional 401 or a Roth 401. If you set up your solo 401 to take tax-deductible contributions, it will operate like a traditional 401, allowing you to contribute pre-tax money and get a break on this years taxes. On the other hand, if you opt for a Roth, youll make after-tax contributions, but will benefit from the tax-free withdrawals in retirement.

If you think tax rates will be higher in the future, like I do, then a Roth can be a very valuable account to reduce your future tax burden in retirement, Conroy says.

Read Also: How Can I Pull Money Out Of My 401k

Do You Qualify For A Self

LAST REVIEWED Oct 29 20208 MIN READ

Are you a self-employed professional planning for your retirement? A self-employed 401 is an excellent plan to build out your retirement nest egg. Whether you are a freelancer, shop owner, or small business owner without employees, a solo 401 retirement plan can help you live your dream life when you retire. Here well discuss an overview of a self-employed 401, setting one up, how to withdraw from the account and other vital information.

Should I Choose A Traditional Or Roth Solo 401

For many investors, deciding between a traditional or Roth solo 401 comes down to whether you believe youre in a lower tax bracket today than you will be in retirement. If you think you are paying lower taxes now, you might choose a Roth solo 401. If you anticipate being in a lower tax bracket in retirement, a traditional solo 401 may be a better bet.

Theres another wrinkle with a Roth solo 401 account: You can only contribute up to $20,500 in 2022 and $22,500 in 2023, plus catch-up contributions if youre 50 or older. If youre able to save more than this amount, you will need to contribute the extra into a traditional solo 401 account. You can make both employer and employee contributions to a solo 401, but your employer contributions cannot be saved in a Roth account.

You May Like: How Can I Find My Old 401k

What Else Do Small Business Owners Need To Know About 401 Plans

Small business owners who offer retirement savings plans may be able to take advantage of tax incentives. Matching employee contributions, for instance, is generally tax deductible as a business expense. For the first three years of the plan, employers may also be eligible for tax credits up to 50% of the start-up and administration costs or $5,000 , as well as a $500 automatic enrollment credit per year.

The 6 Best Solo 401 Companies Of 2022

- Best for Account Features: E*TRADE

- Best for Mutual Funds: Vanguard

- Best for Real Estate: Rocket Dollar

Get $100 when you open a new, eligible Fidelity account with $50 or more. Use code FIDELITY100. Limited time offer. Terms apply. Offer Disclosure.

Fidelitys self-employed 401 plan is our best overall pick due to a combination of very low fees, a wide range of investment choices, and the companys emphasis on retirement savings.

-

No regular account fees and no commissions for stock or ETF trades

-

10,000+ no-transaction-fee mutual funds including four Fidelity funds with no fund expenses

-

Retirement resources including calculators, apps, and education resources to help you improve your retirement savings and investment strategy

-

Some active traders may want more powerful active trading tools

-

No electronic deposit for contributions

Fidelity self-employed 401 accounts are a great choice for fee-conscious investors, earning our top overall pick. The Fidelity solo 401 charges no opening or closing costs and no annual maintenance fees. Customers can invest in stocks, ETFs, and over 3,400 mutual funds with no trading commissions. That means many small business owners could use this account without ever paying any fees to Fidelity. If you need help to place orders, however, the $32.95 broker-assisted trade fee may be an impediment.

Read our full Fidelity review.

Don’t Miss: How Long Does It Take To Rollover 401k To Ira

Getting Your Solo 401 Started

Once you have established the type of plan you want, you will need to create a trust that will hold the funds until you need them or you reach retirement age. You can select an investment firm, online brokerage, or insurance company to administer the plan for you.

You also need to establish a record-keeping system, so that your investments are accounted for properly.

How Does A Self

The solo 401 is like the classic 401. You contribute into the account from your pre-tax income, and you can invest the savings without paying taxes. However, you will pay taxes on withdrawals when you retire. A self-employed 401 allows your spouse to contribute in the same plan.

A major difference between an individual 401, a standard 401, and other personal 401 options is that you can make more contributions. If you qualify for a self-employed 401, the higher contribution restrictions, and easy administration of the account, makes it an ideal choice for retirement savings.

You May Like: Can An Individual Open A 401k

Do I Need A 401kk Solo Plan

A solo 401 is an excellent way to save for retirement if you’re a small business owner. If you hire employees at some time during your business’s lifetime, you’ll have to adjust the plan to include them equally or create criteria to define benefit-eligible employees and create retirement plans for them.