When You Can Withdraw Money From A 401

You generally must be at least 59 1/2 to withdraw money from your 401 without owing a 10% penalty. The early-withdrawal penalty doesnt apply, though, if you are age 55 or older in the year you leave your employer.

Your withdrawals will be subject to ordinary income tax. And once you reach age 72, youll be obligated to take required minimum distributions. One exception: If youre still working when you hit that age and you dont own 5% or more of the company youre working for, you dont have to take an RMD from the 401 that you have through that job.

Contribution Limits In 2021 And 2022

For 2022, the 401 limit for employee salary deferrals is $20,500, which is above the 401 2021 limit of $19,500. Employer matches dont count toward this limit and can be quite generous.

However, the total contribution limit, which includes employer contributions , has increased to $61,000 in 2022, up from $58,000 in 2021.

On top of these amounts, workers aged 50 and older can add up to $6,500 more annually as a catch-up contribution.

The 401 contribution limits also apply to other so-called defined contribution plans, including:

- 403 plans, available to education and non-profit workers.

- Most 457 plans used by state and local government employees.

- The federal governments Thrift Savings Plan.

| 401 plan limits | ||

|---|---|---|

| Maximum salary deferral for workers | $19,500 | |

| Catch-up contributions for workers 50 and older | $6,500 | |

| Total contribution limit, plus catch-up contribution | $64,500 | |

| Compensation limit for figuring contributions | $290,000 | |

| Compensation threshold for key employee nondiscrimination testing | $185,000 | |

| Threshold for highly compensated employee nondiscrimination testing | $130,000 | +$5,000 |

Can You Contribute To A Roth And Traditional Ira At The Same Time

You may be able to contribute to both Roth and the traditional IRA, up to the limit set by the IRS, which is a total of $ 6,000 between all IRA accounts in 2021 and 2022. These two types of IRA also have the eligibility requirements you need to meet .

Can I contribute to a Roth IRA and a traditional IRA in the same year?

You can contribute to a traditional IRA and a Roth IRA in the same year. If you are eligible for both types, make sure your combined contribution amount does not exceed the annual limit. You can also contribute to a traditional IRA and 401 in the same year. Contribution limits apply for each account type.

Read Also: Can A Sole Proprietor Have A 401k

You May Like: How Much Can You Put In Your 401k A Year

Tax Deductible Ira Contributions If I Have A Solo 401k Question:

My question: As my wife and I are *not* contributing to our solo401k plan, does that mean that we are not active participants and IRA contributions are tax deductible?

Good question. Yes, you are still considered covered by a retirement plan at work even if you are not making solo 401k contributions.

While you can still contribute to a traditional IRA, your traditional IRA contribution deductions will be reduced if your AGI is a certain amount.

For 2017, if you are covered by a retirement plan, your deduction for contributions to a traditional IRA is reduced if your AGI is:

- More than $99,000 but less than $119,000 for a married couple filing a joint return or a qualifying widow,

- More than $62,000 but less than $72,000 for a single individual or head of household, or

- Less than $10,000 for a married individual filing a separate return.

Dont Miss: How To Make 401k Grow Faster

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

You May Like: Who Can Contribute To A 401k

What If You Can’t Meet Your Employer Match

If you aren’t yet in a position to contribute enough to meet your employer’s match, and thus not enough to reach the desired 15% savings rate, aim to boost your retirement contributions by 1% to 2% each year. If you opt in to do so, some companies will automatically raise your contribution rate annually, so it’s worth making sure you are signed up for what is called an “auto-escalation” feature.

Ivory Johnson, a CFP and founder of Delancey Wealth Management, recommends increasing your contribution rate as you get pay raises until you max out the limit. There is a limit to how much you can contribute annually to your 401. In 2021, the standard annual contribution limit is $19,500 for 401 plans. And those over age 50 can use catch-up contributions to add an extra $6,500 in their 401 account. Employer contributions don’t count towards those specific limits.

Lynch reminds retirement savers to be strategic with the magic number they would like to contribute to their 401 before automatically trying to max it out, however.

“Situations can arise where you may need to prioritize your cash savings in your emergency fund or save for a different reason, such as for a down payment on property or a vehicle,” she adds. “$19,500 isn’t a small chunk of change.”

Keep in mind that although you don’t pay income taxes on the money you set aside in a 401, you’ll have to pay taxes later on when you eventually withdraw the funds in your nonworking years.

How Much Should I Have In My 401 By Age 60

For 55- to 64-year-olds with a 401, the average retirement savings is a little more than $408,000, according to the Federal Reserve.

One factor to consider here is how long you plan to be out of the workforce. If you plan to retire early, youâll have to factor in additional health care costs as you wonât be eligible for Medicare until age 65. Meanwhile, the minimum age to begin collecting Social Security is 62, but the longer you can wait, the higher your payment will be. Youâll also need to factor in expenses and the lifestyle you want to live in retirement.

You May Like: What Can You Do With Your 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Much Should I Contribute To My 401

Planning for retirement is a complex process that starts with an easy first step: saving money. A commitment to regular savings, as early as possible, will launch your retirement planning in the right direction.

As you get closer to retirement, you may want to be more purposeful about your savings. How much should I contribute to my 401? is one of the most common questions that financial services folks hear.

Figuring out how much to put in your 401 depends on your overall goals and financial situation, so it will vary for each person. The amount you can save is also determined by the Internal Revenue Service , because there are limits on how much money can be put aside.

Read Also: Can You Transfer 401k To Roth Ira

Don’t Miss: Can A Small Business Set Up A 401k

Irs Lifts 401 Contribution Limits For 2020

The IRS has nudged up the basic employee contribution limit for 2020 to 401 accounts to $19,500. And it boosted the catch-up contribution for the first time in five years.

If you are 50 or older, you can kick in as much as an additional $6,500.

The combined limit would be $26,000.

The limits apply to regular 401 accounts and to Roth-style accounts, if your plan permits them.

Donât Miss: Can You Use Your 401k To Buy Real Estate

What Happens If I Exceed The Roth 401 Limit

If your 401 contributions exceed the annual limit, you risk being taxed twice on your excess contributions. Its advisable to contact your HR, payroll department, or plan administrator as soon as you notice an overcontribution. If you inform them before the tax-filing deadline, you may be able to fix the issue in time.

Read Also: Who Can Open A 401k

If You Start At Age :

With a 4% rate of return: $843.24 per month

- Annual salary needed if you save 10% of your income: $101,189

- Annual salary needed if you save 15% of your income: $67,459

With a 6% rate of return: $499.64 per month

- Annual salary needed if you save 10% of your income: $59,957

- Annual salary needed if you save 15% of your income: $39,971

With an 8% rate of return: $284.55 per month

- Annual salary needed if you save 10% of your income: $34,146

- Annual salary needed if you save 15% of your income: $22,764

Roth 401 Vs Traditional 401

Although the contribution limits are the same for traditional 401 plans and their Roth counterparts, a designated Roth 401 account is technically a separate account within your traditional 401 that allows for the contribution of after-tax dollars. The elected amount is deducted from your paycheck after income, Social Security, and other applicable taxes are assessed. The contribution doesnt garner you a tax break in the year you make it.

The big advantage of a Roth 401 is that no income tax is due on these funds or their earnings when theyre withdrawn after you retire. A traditional 401 works in the opposite way. That is, savers make their contributions on a pretax basis and pay income tax on the amounts withdrawn when they retire. Neither of these 401 accounts imposes income limitations for participation.

When available, savers may use a combination of the Roth 401 and the traditional 401 to plan for retirement. Splitting your retirement contributions between both kinds of 401s, if you have the option, can help you ease your tax burden in retirement.

Dont Miss: How To Find A Deceased Persons 401k

Also Check: Can I Move My 401k To Gold

How Much Should You Contribute To Your 401 Rule Of Thumb

As a rule of thumb, experts advise that you to save between 10% and 20% of your gross salary toward retirement. That could be in a 401 or in another kind of retirement account. No matter where you save it, you want to save as much for retirement as you can while still living comfortably.

Its important to say that this is just a general rule. The actual amount you should save depends on your individual situation. For example, if you are 50 years old and dont have any retirement savings, you should save more than 20% of your gross annual salary. If youre 30 years old and already have $100,000 in retirement savings, you could probably decrease your contributions for a bit in order to pay off a mortgage or loan. Its difficult to create a one-size-fits-all plan, because everyone is in a different place with his or her finances.

Saving 10% to 20% of your salary every year might sound like a lot. Luckily, you dont have to do it all at once. You can spread your contributions out throughout the year and you can contribute more or less some years. You also dont have to save all that money through your 401. Lets take a step back and talk about other factors you should consider when you think about how much to contribute to your 401.

Also Check: Should I Rollover My 401k When I Retire

Saving In An Ira After You Max Out Your 401 Or 403

First, make sure you’re really on track to max out your 401 or other workplace plan contribution limit. For 401 or similar workplace retirement plans, you can contribute up to $19,500 in 2020 . Plus, if you’re age 50 or older in 2020, the retirement catch-up contribution is $6,500 , allowing you to contribute up to $26,000 .

If you have maxed out your 401 or 403, next look into an individual retirement account . Wherever you are in life, an IRA can help complement your workplace plan. The pretax savings guidelines for IRAs look pretty straightforward at first glance:

- If you’re younger than age 50, you may sock away up to $6,000 pretax in an IRA if you meet certain IRS guidelines.

- If you’re 50 or older, the IRS lets you contribute an additional $1,000, totaling $7,000, to an IRA.1

It’s a good idea to see if you are eligible for a Roth IRA, which has income limits. If you are eligible, you make contributions with after-tax dollarsbut retirement withdrawals in many cases are tax-free.

Recommended Reading: What Percent Should You Put In 401k

Contribute To Solo 401k And Day

Your wifes ability to contribute to a solo 401 depends on the self employment income that she receives from the partnership. Specifically, in order to determine how much she could contribute to the solo 401 she would take the amount reported on line 14 of her K-1 and reduce it by one half of the self-employment tax. Of that number, she could contribute for 2021: up to $26,000 as an employee contribution plan sponsored by her daytime employer) and a profit-sharing contribution to the solo 401 equal to 20% of that same number provided that her overall contribution to the solo 401 cannot exceed $64,500 for 2021. For 2022, the overall limit is $67,500.

Also Check: How Much Will My 401k Be Worth In 20 Years

Think About How Much Youll Need In Retirement

Contributing the maximum to your 401 requires a lot of money especially as an ongoing, year-after-year commitment. It may or may not be enough to fund your retirement, or it could be even more than you need. Your 401 contribution amount should be guided by your retirement savings goal.

How much money youll need in retirement depends on when you plan to retire, how much of your current income youd like to replace and how much you want to rely on Social Security.

Most experts recommend saving 10% to 15% of your income, but our suggestion is to get a more detailed goal from a retirement calculator.

If you need to start at a lower contribution and work your way up, thats fine. Aim to contribute at least enough to grab the match, then bump up the percent you contribute by 1% or 2% each year.

Also Check: How To Check My 401k Plan

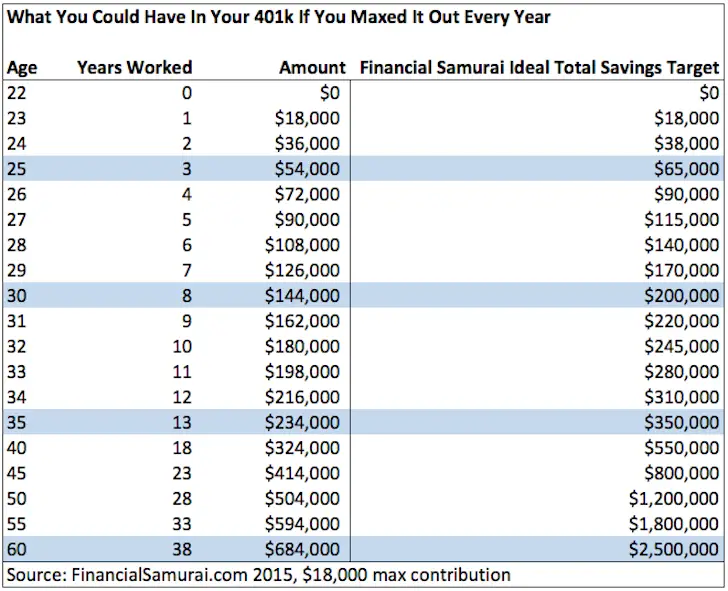

Financial Samurai 401k Savings By Age Guide

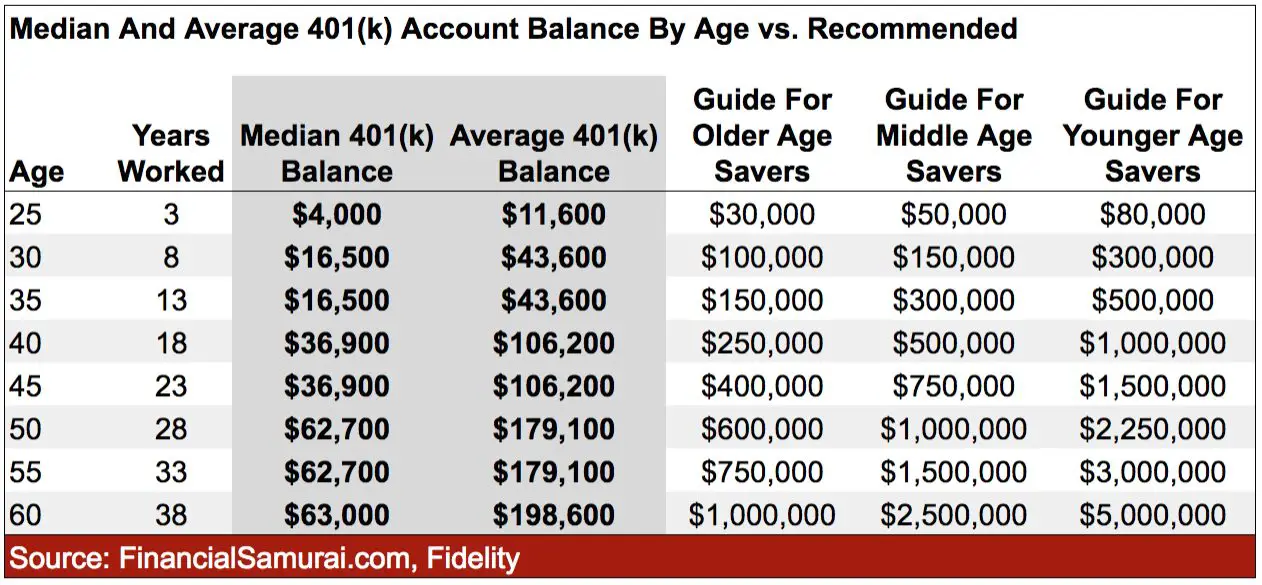

From the results, we can see that even after 38 years of consistent saving, youll only have around $1,000,000 to $5,000,000 in your 401k in a realistic cycle of bull and bear markets. In other words, I believe everybody should become 401k millionaires by 60.

If youre just starting your 401 savings journey, you could get lucky and achieve the high end column with consistent 8%+ annual growth and company profit sharing after 38 years. After all, the maximum 401 contributions will be much higher over the next 38 years than the previous 38 years.

But its most likely that most people reading this article should follow the middle-to-low end columns as a 401 savings guide. The median age in America is roughly 36. Meanwhile, the median age of a Financial Samurai reader is closer to 38.

Making Your Retirement Savings Last

One of the most important keys to making your retirement savings last is to set a budget in retirement. You need to strictly stick to your budget since you are living on a fixed amount of money during retirement.

If you find your your savings are not sufficient to support your current budget then here are some additional strategies to stretch your retirement savings.

Need more help in figuring out how much money youll need in retirement, and how to build that wealth to achieve retirement? Our course shows you how to lay the foundation and framework for financial independence so you can start living according to your values.

Read Also: How Much Do You Get From 401k

You May Like: How To Open A 401k With An Employer