Does Separate Account Refer To The Actual Funding Vehicle Or Does It Refer To Separate Accounting Within The Plan’s Trust

Under IRC Section 402A, the separate account requirement can be satisfied by any means by which an employer can separately and accurately track a participants designated Roth contributions, along with corresponding gains and losses.

Find Out If You Can Contribute And If You Make Too Much Money For A Tax Deduction In 2021 And 2022

Traditional IRAs are tax-advantaged retirement savings accounts. Money invested in a traditional IRA can grow tax-free until you begin making withdrawals as a retiree. Withdrawals are taxed at your ordinary income tax rate.

Many, but not all, Americans can invest in a traditional IRA with pre-tax funds, claiming a deduction for their contribution in the year it is made. However, if either you or your spouse is covered by a workplace retirement plan, there are income limits for making tax-deductible contributions to traditional IRAs. If you exceed the income limits, you will not be eligible to contribute to your account with pre-tax funds, but you can still make nondeductible contributions and benefit from tax-free growth. On a related note, there are limits to your IRA contribution as well.

Here’s what you need to know about traditional IRA income limits in 2021 and 2022.

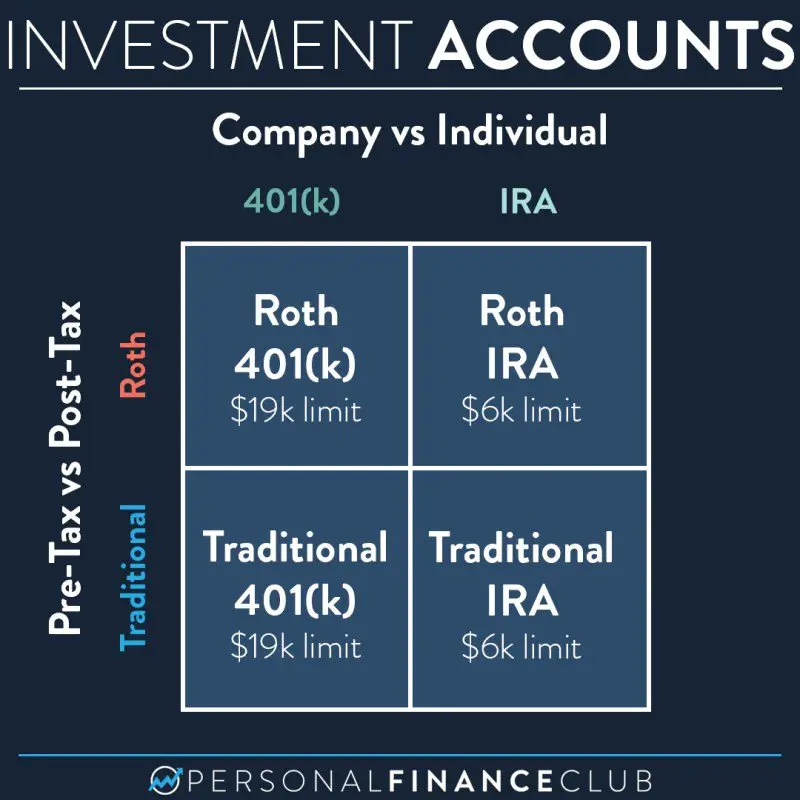

Investing In Both A 401 And A Roth Ira

A 401 is a qualified plan that’s set up by an employer. It lets eligible workers invest a portion of their wages into an account. You make pre-tax contributions to a traditional 401 through deductions from your paychecks.

Roth IRA plans are those that you invest in with after-tax dollars. These are private plans, not offered by employers, so you have to open an account on your own with a banking or financial institution.

If you have a 401 through work, you can still open a Roth IRAas long as you meet the income requirements. And if you have a Roth IRA already, you can still elect to participate in a 401 through your job. What matters is that your accounts are set up properly and that you qualify to participate in the plan you choose.

Read Also: Should I Open A 401k

Do Employees Have Any Recordkeeping Or Reporting Obligations

An employee has no reporting obligation with designated Roth contributions in a plan. However, an employee rolling over a distribution from a designated Roth account to a Roth IRA should keep track of the amount rolled over in accordance with the instructions PDF to Form 8606, Nondeductible IRAsPDF.

What About Roth Iras

Can you have a Roth IRA and a 401? Roth IRAs allow you to make contributions using after-tax dollars. This means you dont get the benefit of deducting the amount you contribute from your current years taxes. The upside of Roth accounts, though, is that you can make qualified withdrawals in retirement tax-free.

You might choose to contribute to a Roth IRA and a 401 if you anticipate being in a higher tax bracket when you retire, because of the tax-free benefit. But theres a catch: Your ability to contribute to a Roth IRA is based on your income. So how much you earn not necessarily your enrollment in a retirement plan at work could be a deciding factor in answering the question, can you have a Roth IRA and 401 at the same time.

For 2022, you can make a full contribution to a Roth IRA if:

You file single or head of household, or youre legally separated, and have a modified adjusted gross income of less than $129,000

Youre married and file jointly, or are a qualifying widow, and your MAGI is less than $204,000

Similar to traditional IRA contributions, the amount you can contribute is reduced as your income increases until it phases out altogether.

Don’t Miss: How Do I Cash Out My 401k Early

Can You Contribute To A Roth Ira And A 401

Many, if not most, retirement investors can contribute to both a Roth IRA and a 401 at the same time.

You can and should have both a Roth IRA and a 401, says Gregory W. Lawrence, a certified financial planner and founder of retirement planning firm Lawrence Legacy Group. Future tax rates are heading higher, possibly much higher, so maxing out both a Roth IRA and a 401 will give you more net after-tax dollars in retirement.

If your employer offers a 401 plan, you can choose to contribute to either a traditional 401 account or a Roth 401 account . The difference is when you pay income taxes: Upon making withdrawals in retirement with the former, or when youre making contributions in the present with the former.

Meanwhile, contributions to a Roth IRA are always made after you pay income taxesand qualified withdrawals in retirement are always tax-free. Heres the catch: You can only contribute to a Roth IRA if your annual income is below certain thresholds:

Ira Eligibility And Contribution Limits

The contribution limits for both traditional and Roth IRAs are $6,000 per year, plus a $1,000 catch-up contribution for those 50 and older, for both tax years 2020 and 2021. You can split your contributions between the two types, but your total contribution is still limited to $6,000 or $7,000. Traditional and Roth IRAs also have some different rules regarding your contributions

Don’t Miss: Can I Take A Loan Out Of My 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Taxes With 401k Or Traditional Iras

No matter the type of retirement account you choose to open, there will likely be associated tax questions. At H& R Block, were here to help. With many ways to file your taxes with H& R Block, you can opt for in-office or virtual tax preparation, keeping all tax laws related to retirement savings accounts in mind, we can make sure youre producing an accurate tax return that maximizes allowable tax deductions.

Not in need of tax preparation at the moment? Read more about taxes on retirement income, pensions and annuities.

Related Topics

Finding your taxable income is an important part of filing taxes. Learn how to calculate your taxable income with help from the experts at H& R Block.

Read Also: Can I Roll My Roth 401k Into A Roth Ira

What Are The Differences Between Traditional And Roth Retirement Accounts

Heres a primer on the differences between traditional and Roth retirement accounts. With any traditional account or traditional IRA), you make pre-tax contributions, giving you a nice tax deduction in the year you make them. You skip paying income tax on the funds you invest and their earnings until you make withdrawals in retirement.

However, if you tap a traditional account before age 59.5, you must pay a 10% penalty, plus income tax, on the untaxed portion. Therefore you should only put money into a traditional retirement account that you wont need to spend until retirement.

When you use a Roth account or Roth IRA), you can only make after-tax contributions, which dont offer any tax benefit in the current year. However, the terrific upside of a Roth is that withdrawals of both contributions and investment earnings are tax-free in retirement if youve had the account for at least five years.

You may have significant account growth in a Roth, and it never gets taxed, which could give you massive savings. You can even withdraw your original contributions before retirement without owing taxes or a 10% early withdrawal penalty. That gives you flexibility not offered by any other type of retirement plan.

So, the main difference between a traditional and Roth account is how and when you pay taxes. A traditional retirement account helps cut your current income tax bill on contributions. And a Roth allows you to avoid future income tax on contributions and earnings.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How To Search For Unclaimed 401k

Ira Benefits And Drawbacks

The investment choices for IRA accounts are vast. Unlike a 401 plan, where you’re likely to be limited to a single provider, you can buy stocks, bonds, mutual funds, ETFs, and other investments for your IRA at any provider you choose. That can make finding a low-cost, solid-performing option easy.

However, the amount of money you can contribute to an IRA is much lower than with 401s. For 2021 and 2022, the maximum allowable contribution to a traditional or Roth IRA is $6,000 a year, or $7,000 if you are age 50 or older. If you have both types of IRAs, the limit applies to all of your IRAs combined.

An added attraction of traditional IRAs is the potential tax-deductibility of your contributions. But, the deduction is only allowed if you meet the modified adjusted gross income requirements. Also, it is subject to phase out if you have a workplace retirement plan and make above a certain amount.

For single taxpayers covered by a workplace retirement plan, the phase-out range in 2022 is $68,000 to $78,000, up from $66,000 to $76,000 in 2021. For married couples filing jointly, if the spouse making the IRA contribution is covered by a workplace retirement plan, the phase-out range is $109,000 to $129,000 in 2022, up from $105,000 to $125,000 in 2021.

Having earned income is a requirement for contributing to an IRA, but a spousal IRA lets a working spouse contribute to an IRA for their nonworking spouse, making it possible for the couple to double their retirement savings.

If My Only Participation In A Retirement Plan Is Through Non

You can contribute to a traditional IRA regardless of whether or not you are an active participant in a plan. However, when determining whether you can deduct a contribution to a traditional IRA, the active participant rules under IRC Section 219 apply. You are an active participant if you make designated Roth contributions to a designated Roth account. As such, your ability to deduct contributions made to a traditional IRA depends on your modified adjusted gross income.

Read Also: How To Take A Loan From My 401k

Is A Distribution From My Designated Roth Account For Reasons Beyond My Control A Qualified Distribution Even Though It Doesn’t Meet The Criteria For A Qualified Distribution

No, if you have not held the account for more than 5 years or if the distribution is not made after death, disability, or age 59 ½, then the distribution is not a qualified distribution. However, you could roll the distribution over into a designated Roth account in another plan or into your Roth IRA. A transfer to another designated Roth account must be made through a direct rollover.

When Must I Be Able To Elect To Make Designated Roth Contributions

You must have an effective opportunity to make an election to make designated Roth contributions at least once during each plan year. The plan must state the rules governing the frequency of the elections. These rules must apply in the same manner to both pre-tax elective contributions and designated Roth contributions. You must make a valid designated Roth election, under your plans rules, before you can place any money in a designated Roth account.

Read Also: How To Invest Your 401k In Real Estate

No Matter How You File Block Has Your Back

Can I Contribute To Both A 401 And Ira

When it comes to building retirement savings, its easy to feel confused about where you can save, and how much. One of the most frequent questions we encounter is, Can I contribute to both a 401 and IRA?

The answer is yes. In fact, this is the most ideal situation for individuals as it allows you to take advantage of the various tax benefits of both retirement accounts. However, while you can always contribute to both accounts, your eligibility to receive the tax benefits of these plans depends on your income. If you exceed income limits by the IRS, you may not be able to take full advantage of the tax benefits of both.

To better understand this, its important to first examine how each investment vehicle works. For a quick refresher, we outlined the basics below.

Recommended Reading: What Investments Should I Have In My 401k

Can I Roll Over Distributions From A Designated Roth Account To Another Employer’s Designated Roth Account Or Into A Roth Ira

Yes. However, because a distribution from a designated Roth account consists of both pre-tax money and basis , it must be rolled over into a designated Roth account in another plan through a direct rollover. If the distribution is made directly to you and then rolled over within 60 days, the basis portion cannot be rolled over to another designated Roth account, but can be rolled over into a Roth IRA.

If only a portion of the distribution is rolled over, the rolled over portion is treated as consisting first of the amount of the distribution that is includible in gross income. Alternatively, you may roll over the taxable portion of the distribution to another plans designated Roth account within 60 days of receipt. However, your period of participation under the distributing plan is not carried over to the recipient plan for purposes of measuring the 5-taxable-year period under the recipient plan.

The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. See FAQs: Waivers of the 60-Day Rollover Requirement.

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options aren’t usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

Read Also: Are Employer 401k Contributions Taxable