If You Withdraw The Money When You Retire

For traditional 401s, the money you withdraw is taxable as regular income like income from a job in the year you take it. You can begin withdrawing money from your traditional 401 without penalty when you turn age 59½. The rate at which your distributions are taxed will depend on what federal tax bracket you fall in at the time of your qualified withdrawal.

A few important points:

-

If youve retired, you have to start taking required minimum distributions from your account when you’re 72.

-

If you dont take the required minimum distribution when youre supposed to, the IRS can assess a penalty of 50% of the amount not distributed.

-

You can withdraw more than the minimum.

Use The Still Working Exception

Most people know they are subject to required minimum distributions at age 72, even on a Roth 401. Please note that the RMD age was changed from 70½ to 72 at the end of 2019 through the Setting Every Community Up for Retirement Enhancement Act of 2019. But if you’re still working when you reach that age, these RMDs don’t apply to your 401 with your current employer .

In other words, you can keep the funds in the account, earning away to augment your nest egg and postponing any tax reckoning on them. Keep in mind that the IRS has not clearly defined what amounts to “still working ” probably, though, you would need to be deemed employed throughout the entire calendar year. Tread carefully if you’re cutting back to part-time or considering some other sort of phased retirement scenario.

Also, there are issues with this strategy if you are an owner of a company. If you own more than 5% of the business that sponsors the plan, you’re not eligible for this exemption. Also, consider that the 5% ownership rule means over 5% includes any stake owned by a spouse, children, grandchildren, and parents and may rise to over 5% after age 72. You can see how complicated this strategy can get.

The Benefits Of Working With A Financial Advisor And Tax Professional

Your advisor can help you balance your financial priorities with tax implications by helping you create a plan that meets both your personal and financial goals. Because your Ameriprise financial advisor understands your finances, he or she may also be able to recommend a tax professional for you. Working together, your Ameriprise financial advisor and your tax professional can help structure your investments and retirement distributions for tax efficiency.

Also Check: Can I Buy Bitcoin With My 401k

Tax Charged On 401 Distributions

A withdrawal from a 401 is known as a distribution in âIRS lingoâ. When you take a 401 distribution, the distribution will only be subject to income taxes. For example, if you withdraw $4000, you will only pay income tax on that $4000 in retirement. FICA taxes only apply during your active working years. However, how much you pay as income tax depends on how and when you take a distribution.

When you are 59 ½, you can start taking distributions without paying a penalty tax. For a Roth 401 account, the withdrawals you make are not taxed, since you already paid income taxes when putting money into the account. You can start taking penalty-free and tax-free distributions from a Roth 401 account once you are at least 59 ½.

Once you hit 72 and already retired, you will be required to start taking the required minimum distributions. If you delay in taking the minimum distribution after age 72, IRS will impose a 50% penalty of the amount not distributed.

Have Investment Income We Have You Covered

With TurboTax Live Premier, talk online to real experts on demand for tax advice on everything from stocks, cryptocurrency to rental income.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: How To Rollover A 401k From One Company To Another

What Are Taxes On A 401

When contributing or taking a distribution from a 401, you might ask yourself âwhat are the taxes on my 401s?â. Find out when a tax is charged on 401s.

A 401 is a tax-deferred account, and employees are not required to pay income taxes on their contributions. You will still be required to pay FICA taxes i.e. Social Security and Medicare Taxes. If you make a withdrawal, you will be required to pay income taxes on the withdrawal amount, and a penalty tax if you are below 59 ½.

For most retirement savers, 401 provides a way to reduce income taxes on the paycheck. However, you don’t avoid paying taxes forever. Instead, your tax bill comes when you make a withdrawal, and the 401 tax you pay depends on your age and income level.

Tax Rules: Withdrawals Deductions & More

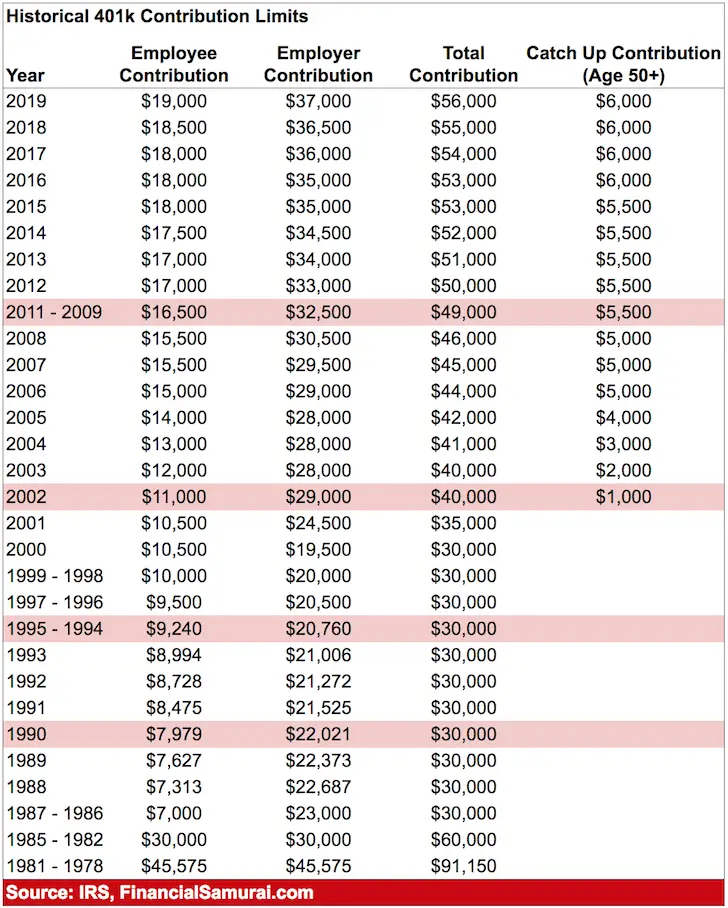

If youre building your retirement saving, 401 plans are a great option. These employer-sponsored plans allow you to contribute up to $19,500 in pretax money in 2021 or $20,500 in 2022. Some employers will also match some of your contributions, which means free money for you. Come retirement, though, your withdrawals are subject to income taxes and other rules. Heres what you need to know about how 401 contributions and withdrawals are taxed. For help with all retirement issues, consider working with a financial advisor.

Don’t Miss: How Do I Find All My 401k Accounts

Asset Allocation Can Have A Big Impact On A Portfolios Ending Balance

Assumes a constant asset allocation, a 75% confidence level, and withdrawals growing by a constant 2.47% over 30 years. Assumes a starting balance of $1 million. Confidence level is defined as the number of times the portfolio ended with a balance greater than zero. See disclosures for additional disclosures on allocations and capital market estimates. The example is hypothetical and provided for illustrative purposes only. It is not intended to represent a specific investment product and the example does not reflect the effects of taxes or fees.

Remember, choosing an appropriate mix of investments may not be just a mathematical decision. Research shows that the pain of losses exceeds the pleasure in gains, and this effect can be magnified in retirement. Picking an allocation youre comfortable with, especially in the event of a bear market, not just the one with the greatest possibility to increase the potential ending asset balance, is important.

Read Also: State Of Connecticut Retirement Division

How Is A 401 Taxed When Inherited Why Is It Different To Regular Inheritance

When a person passes, their 401k becomes part of their taxable estate.

The individual who inherits the account is generally expected to keep receiving distributions, and the distributions generally follow the same tax treatment as would apply to the original account holder.

Distributions from a 401 are taxed as ordinary income, and as such this means that the beneficiary is responsible for reporting these distributions, and paying the necessary income taxes on it.

So, if there were any taxes due on earnings in the account, these still have to be paid.

However, at this point its worth noting that if the beneficiary is a spouse, they are exempt from the 10% early withdrawal penalty, provided that they roll the money over into an inherited Individual Retirement Account .

There may still be a penalty to pay, however, if the money left in the account remains untouched for a period of 10 years after the original owners passing.

Although its worth noting that there can be exceptions to this rule, for example in the case of minors, the disabled, and the chronically ill.

Don’t Miss: Can Anyone Open A 401k

What Is A Good Monthly Retirement Income

Median retirement income for seniors is around $24,000 however, average income can be much higher. On average, seniors earn between $2000 and $6000 per month. Older retirees tend to earn less than younger retirees. It’s recommended that you save enough to replace 70% of your pre-retirement monthly income.

The Case For Not Cashing Out A 401 Early

Keep in mind compound interest only works if you leave the money sitting. When you cash your retirement checks early, youre not only subtracting that sum from your future retirement, but youre also negating potential interest accrued over the years and losing almost 30 percent of your balance to taxes and fees.

It may be tempting to view your 401 as your own personal bank account, but it can be so much more if you have the willpower to let your money work harder for you.

Are you considering taking money out of your 401? Try our 401 calculator to see if this option is right for you.

You May Like: How Do You Find Out Your 401k

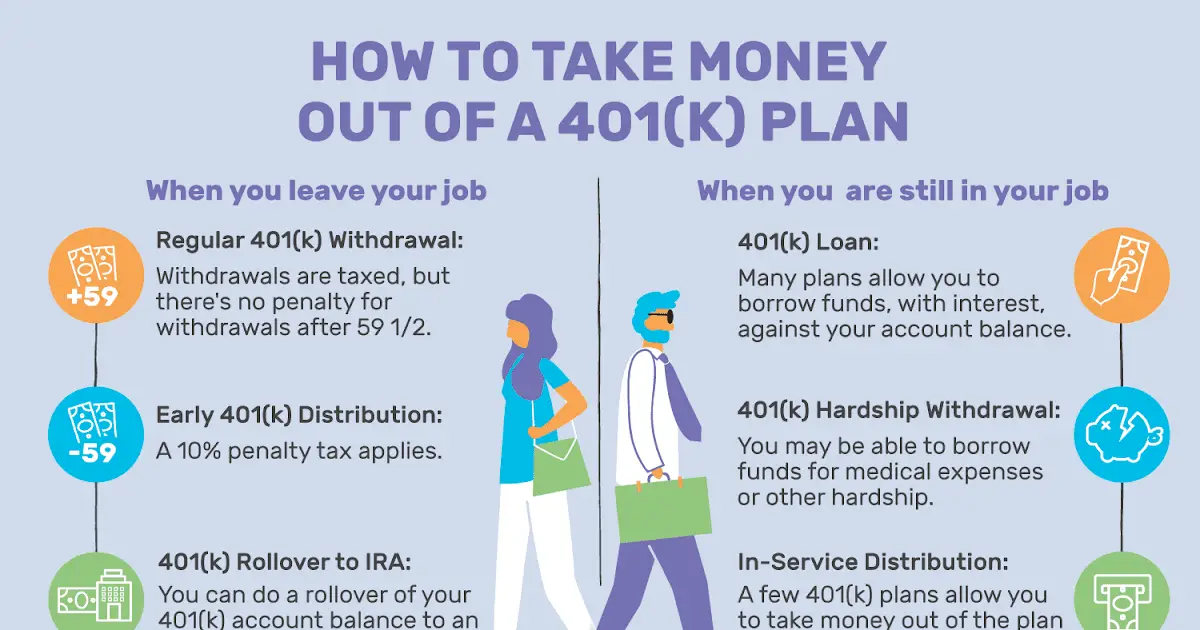

Provisions For Changing Jobs

Most 401 plans permit the employee who terminates employment the options of receiving the 401 balance in a lump sum or to receive periodic payments or to roll over the proceeds to an IRA or other employer-sponsored retirement plan. Additionally, some 401 plans permit the terminated employee to retain their 401 balance in their former employer’s plan. Amounts that are retained in a former employer’s 401 plan or transferred to another employer’s plan or IRA postpone the taxation until amounts are subsequently distributed from the plan or IRA the money was rolled into.

When receiving funds from a 401 with the intention to roll the amount to an IRA:

- The rollover must be completed in 60 days.

- Employers must withhold 20% of the proceeds as a withholding tax. It is up to the participant to make up this 20%, or it will be treated as a distribution. The money withheld will be used as a credit against any income tax liability.

- Neither the 60-day rule nor the 20% withholding apply to amounts directly transferred to an IRA or other qualified plan.

Other Ways To Reduce Taxable Income

Just what you’ll pay in federal income taxes is based on your taxable income. You decrease the amount of tax you pay when you reduce your taxable income.

You can use a few other financial planning strategies to reduce your taxable income. One common strategy is to set aside funds to pay for health-related expenses in a health savings account or a flexible spending account . You might also consider paying for child care expenses with a dependent care FSA and saving in a deductible IRA.

You May Like: What Is The Max For 401k

How Much Will I Lose Cashing Out My 401 Early

Consider this concrete example. Lets say your plan allows early distributions, so you decide to take $10,000 out of your 401. Youre taxed at a federal rate of 22% and a state rate of 8%, so youll end up paying $2,500 in federal tax and withholding, plus $800 to the state. That means that you will be paying a hefty $4,300 from your retirement savings to receive $5,700.

Worse yet, assuming the average 8% year-over-year returns, leaving that $10,000 in the account could make you $68,485 over the next 25 years.

How much will you pay for 401? Get an instant quote.

The Irs Charges A 10% Penalty On Early 401 Withdrawals

Generally speaking, the only penalty assessed on early withdrawals from a 401 retirement plan is the 10% additional tax levied by the IRS. This tax is in place to encourage long-term participation in employer-sponsored retirement savings schemes. Learn more about how to calculate your specific penalty for early withdrawal below.

Recommended Reading: What Should I Contribute To My 401k

Solo 401 Contribution Limits For 2022

With a Solo 401, small business owners can contribute as both employees and employers. Maximizing your Solo 401 can lead to substantial tax savings. As a Los Angeles financial planner, many of my highest-earning clients save 50 cents on the dollar for their 401 contributions . Would you rather write a check to the IRS or your financial future?

For 2022, the maximum contribution to a regular 401 is $20,500. As a business owner, you can potentially take that up to $61,000 . Thanks to the additional catch-up contributions, that number increases by $6,500 if you are 50 or older. This brings the total Solo 401 contribution limit for 2022 up to a whopping $67,500 for some business owners.

Taxes On Pension Income

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs, 401s, 403s and similar retirement plans, and tax-deferred annuitiesin the year you take the money. The taxes that are due reduce the amount you have left to spend.

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money. In either case, your employer will withhold taxes as the payments are made, so at least some of what’s due will have been prepaid. If you transfer a lump sum directly to an IRA, taxes will be deferred until you start withdrawing funds.

Smart Tip: Taxes on Pension Income Vary by StateIts a good idea to check the different state tax rules on pension income. Some states do not tax pension payments while others doand that can influence people to consider moving when they retire. States cant tax pension money you earned within their borders if youve moved your legal residence to another state. For instance, if you worked in Minnesota, but now live in Florida, which has no state income tax, you dont owe any Minnesota income tax on the pension you receive from your former employer.

Also Check: How To Get Money Out Of My 401k

Cash Out And Federal Tax

The money that you cash out from your 401 plan counts as taxable income on your federal income taxes for the year you take the lump sum distribution. This can lead to you being bumped into a higher income tax bracket and paying more in taxes than if you had spaced out your distributions over a longer period of time. For example, if you are single in 2018 and you have more than $38,701 but less than $82,500 of taxable income, you would fall in the 22 percent tax bracket. However, if your income was $80,000 and you cashed out $50,000 from your 401 plan, you would fall in the 24 percent tax bracket.

It Depends On Whether Your Funds Are In A Traditional Or Roth 401

A Tea Reader: Living Life One Cup at a Time

When you withdraw funds from your 401or “take distributions,” in IRS lingoyou begin to enjoy the income from this retirement mainstay and face its tax consequences. For most people, and with most 401s, distributions are taxed as ordinary income. However, the tax burden youll incur varies by the type of account you have: traditional or Roth 401, and by how and when you withdraw funds from it.

Read Also: Can You Rollover A 401k While Still Employed

Roth 401s Reduce Taxes Later

Like tax-deferred 401s, earnings grow tax-free in a Roth 401. However, the Roth 401 earnings aren’t taxable if you keep them in the account until you’re 59 1/2 and you’ve had the account for five years.

Unlike a tax-deferred 401, contributions to a Roth 401 do not reduce your taxable income now when they are subtracted from your paycheck. Contributions to a Roth 401 are after-tax contributions. You are paying taxes as you contribute, so you wont have to pay taxes on the funds or their earnings when you withdraw the money.

- Savers who believe their income and tax rate during retirement will be lower than while working usually opt for a traditional 401.

- Those who predict they will have more income and have a higher tax rate when they retire often prefer the Roth 401.

Among other things, the tax savings you get with a Roth 401 depends partially on the difference between your tax rate while employed and your future tax rate during retirement. When your retirement tax rate is higher than your tax rate throughout your working years, you benefit tax-wise with a Roth 401 plan.

- Taxpayers often have the option of funding both a Roth 401 and a tax-deferred 401.

- The IRS adjusts the maximum contribution amount to account for cost-of-living and announces the annual limits for each type of 401 at least a year in advance.

- Traditionally, the IRS has provided an additional contribution option for savers age 50 and older to enable them to prepare for their pending retirement – $6,500 in 2021.

Traditional And Roth 401 Plans

Individuals who want to save for retirement may have the option to invest in a 401 or Roth 401 plan. Both plans are named for the section of the U.S. income tax code that created them. Both plans offer tax advantages, either now or in the future.

With a traditional 401, you defer income taxes on contributions and earnings. With a Roth 401, your contributions are made after taxes and the tax benefit comes later: your earnings may be withdrawn tax-free in retirement.

Read Also: Should I Take A 401k Loan To Pay Off Debt