Is An Ira Better Than A 401

February 24, 2022 by admin

Is an IRA Better Than a 401K? That is a question many people asks themselves, so in this article we are going to help you decide what is the best option for you, as it, of course, will depend on your personal situation. Or maybe both are a good chooice for you? Let´s look into it!

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Pros And Cons Of Iras

There are a number of pros and cons to be aware of when considering an IRA. Here are some of the most important ones to keep in mind.

Pros

- Anyone with a source of earned income is eligible.

- Non-earning spouses are also eligible to contribute.

- You have numerous investment opportunities that give you more control over how your savings are invested.

- A Roth IRA provides flexibility, including the ability to withdraw contributions penalty-free.

- Its simple to establish conventional or Roth variants.

- Roth IRAs are excellent for estate planning.

Cons

- They have relatively low ceilings, so if you want to invest more than the maximum allowed, youll need to use other investment vehicles.

- Contributions are not tax-deductible if they exceed a certain threshold.

- They dont provide you with any investment advice, so you have to make those decisions yourself.

- A 401 is an investment vehicle that allows investors to invest in real estate, private equity, hedge funds, commodities, and collectibles. Its not a specific type of fund but rather a general term for any number of different types of investments.

Recommended Reading: How Does A 401k Retirement Plan Work

Which Of These Tax

A 401 and an individual retirement account are both tax-advantaged retirement accounts. While 401s are typically only offered by employers , IRAs can be opened by individuals through any retail brokerage firm.

401s generally allow higher contributions but offer fewer investment options, whereas IRAs have lower contribution limits — and income caps for high earners — but offer the opportunity to invest in almost any stock, bond, or mutual fund.

Should I Keep My Pension Or Roll It Over To An Ira

The benefits of rolling over from a retirement plan to an IRA include a wider variety of investment options, tax avoidance, greater control over your retirement savings, and withdrawal flexibility. The disadvantages of moving to an IRA include lost creditor protection, no loan options, and early withdrawal penalties.

Can a lump-sum retirement amount be rolled into an IRA? Yes! According to IRS Publication 575, if youre faced with a lump sum payment, you can switch to a traditional IRA or 401 and incur no tax or early withdrawal penalty.

Don’t Miss: What Percentage Should I Put In My 401k

Why Is A Roth Ira Better Than A Roth 401

getty

Maybe youre better off saving your money in a Roth IRA as opposed to a Roth 401. Of course, sometimes you simply dont have a choice.

One of the key advantages of a Roth IRA vs. a Roth 401 is that everyone that earns under a certain level of income has access to establish it and fund it annually, says Daniel G. Dolan, Principal at TFB Advisors, LLC in Overland Park, Kansas. Not all employer-sponsored 401 plans offer the Roth option, so having access to the Roth IRA is critical to accumulate after-tax dollars.

Even if your company does offer a Roth option in its 401 plan, you may still prefer the Roth IRA because it features greater flexibility and customization.

One advantage that most often comes to mind is the ability to open your Roth IRA wherever you want, says Derek Amey, Partner and Advisor at StrategicPoint Investment Advisors in Providence. With the Roth 401 youre beholden to your 401 plans investment choices, which may have limited fund options and unfortunately sometimes expensive fund options. With a Roth IRA you can open it where you want to and invest your money any way that you would like, individual stocks, ETFs different mutual funds etc.

Often overlooked is the requirement to defer your salary in the 401 option with every paycheck. Sometimes you wont know how much to contribute or when to make your contribution, . If this is the case, then the Roth IRA may be more to your liking.

Ira Vs : How To Choose

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Read Also: Can I Cash Out My 401k After Leaving My Employer

How Important Is It To Offer The Roth Option

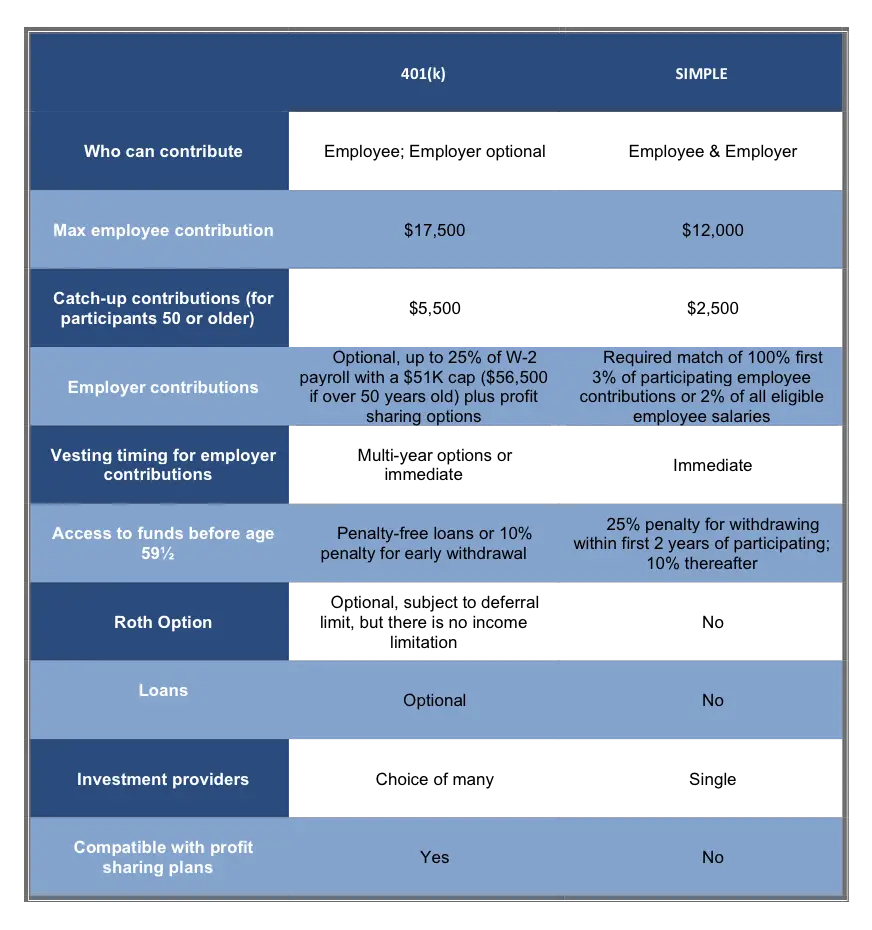

As mentioned earlier, the IRS allows employers to offer a Roth 401. is funded with after-tax contributions in exchange for tax-free distributions in retirement.) There is no Roth version of the SIMPLE IRA. The account is subject to many of the same rules as a traditional IRA: Contributions reduce your taxable income for the year, but distributions in retirement are taxed as ordinary income. That said, the IRS allows participants to save in both a SIMPLE IRA and a Roth IRA at the same time.

Borrowing Money From Your Own 401k Funds

If you have a Roth 401K, and you cannot withdraw any money yet, not even as an early withdrawal, you might be able to borrow money from your 401K account and pay it back later. With a traditional 401K, you do not have this advantage.

Taking out one of these loans is risky because if you end up losing your job, you will have to pay the loan off shortly. Taking out one of these loans is risky. However, it is still an advantage to have this option, as long as you are careful with it.

Recommended Reading: Can You Roll A Traditional 401k Into A Roth Ira

Read Also: What To Roll 401k Into

Is Ira A Good Idea

It’s important to note that IRAs can also be ideal for the 67 percent of people who do have access to a workplace-based plan. If you’re maxing out your contributions there or you simply want another option with more control over your investment, an IRA can present a great way to save even more money for retirement.

What Is An Ira

An IRA is an individual retirement account that allows anyone with earned income to save for retirement on a tax-advantaged basis. Inside an IRA your money can grow tax-free or tax-deferred until you take it out at retirement. This special tax advantage allows your money to compound at a higher rate, letting you accumulate more over time.

The annual contribution limit to an IRA is $6,000 in 2022, though this figure usually rises every few years. Those over age 50 can contribute an additional $1,000 each year.

You can open an IRA at many different financial institutions, including banks and brokers, and you can buy several kinds of assets inside your IRA, including CDs, stocks, bonds, mutual funds, ETFs and more. The best IRA accounts let you invest in potentially high-return assets such as stocks and stock funds.

Recommended Reading: How To Withdraw My 401k From Fidelity

What Is The Biggest Advantage To Investing In A 401 K Instead Of A Traditional Ira

401s generally allow higher contributions but offer fewer investment options, while IRAs have lower contribution limits and income limits for high earners but offer the ability to invest in nearly any stock, bond, or mutual fund.

What tax advantages do the 401 K and traditional IRA share?

The traditional individual retirement account and 401 offer the benefit of tax-deferred retirement savings. Depending on your tax situation, you may also be able to receive a tax deduction for the amount you contribute to a 401 and IRA each tax year.

What is the advantage of a 401 K over an IRA?

401s Offer Higher Contribution Limits The employer-sponsored plan allows you to add a lot more to your retirement savings than an IRA. For 2021, a 401 plan allows you to contribute up to $19,500. Participants 50 and older can add an additional $6,500 for a total of $26,000.

When An Ira Is Better

An IRA could be better than a 401 if youre looking for more flexibility in your retirement planning.

Unlike a 401, with an IRA the investment world is at your fingertips, says Taylor J Kovar, Certified Financial Planner and CEO of Kovar Wealth Management. Stocks, bonds, mutual funds, and real estate are all available while with a 401, you are limited to just the funds the plan allows you to invest in.

Another reason why an IRA could be a better option is if you currently have low tax rates but anticipate higher tax rates during retirement. By contributing to a Roth IRA, youll pay your taxes upfront so your growth and withdrawals during retirement are tax-free.

Not all employers offer a 401 plan, so an IRA is one of the best alternatives to help you save for retirement on your own.

| Pros |

You May Like: How To Qualify For 401k

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Past performance is no guarantee of future results.

Investing involves risk, including risk of loss.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Roth Ira Vs : Which Is Better

Both Roth IRAs and 401s can be beneficial, but which is better for you?

In a perfect world, you could max out the contributions to both accounts and reap all the benefits. However, both may not be available or you may have limited funds to invest. When the latter is the case, here’s what to consider.

- Contribution matching: Does your employer offer 401 contribution matching? If so, you’ll typically want to take full advantage of the free money on the table.

- Current and future income: If you expect to be in a higher tax bracket in retirement, a Roth IRA can be more advantageous. If your tax bracket is higher now, the 401 can be better.

- Early withdrawals: You can withdraw contributions from a Roth IRA penalty-free after five years no matter your age. 401 plans don’t allow penalty-free early withdrawals of any sort. They may offer loans backed by your savings though.

- Contribution limits: With a 401, you can contribute more than three times what you can to a Roth IRA.

- Income limits: 401s have no income limits while high-income earners are restricted from direct Roth IRAs contributions.

- Required distributions: A 401 requires you to begin taking distributions at age 72, a Roth IRA doesn’t. If you want to pass a Roth IRA on to a beneficiary, you can do so without ever taking distributions from it.

- Automatic payroll deduction: 401 plans offer the perk of automatic payroll deductions while Roth IRAs don’t.

- Fees: 401 plan fees tend to be higher than those for Roth IRAs.

You May Like: How Do You Take Money From Your 401k

Is It Better To Have A 401k Or Ira Or Both

âIf given the option to invest in either one, a key benefit of a 401 is that most employers will offer an employer match on employee contributions. If you have the income that will allow you to spend $19,500 on your 401 and $6,000 on your IRA, then you absolutely must invest in both.

Is it better to have a 401k or IRA?

401s Offer Higher Contribution Limits In this category, the 401 is simply objectively better. The employer-sponsored plan allows you to add a lot more to your retirement savings than an IRA. For 2021, a 401 plan allows you to contribute up to $19,500. In contrast, an IRA limits contributions to $6,000 for 2021.

Why Is 401k Not Good

Theres more than a few reasons that I think 401s are a bad idea, including that you give up control of your money, have extremely limited investment options, cant access your funds until youre 59.5 or older, are not paid income distributions on your investments, and dont benefit from them during the most

Dont Miss: How To Manage 401k Investments

Recommended Reading: How To See How Much Is In Your 401k

History Of Ira And 401 Plans

In 1978, the United States Congress amended the Internal Revenue Code to add section 401. Work on developing the first plans began in 1979. Originally intended for executives, section 401 plans proved popular with workers at all levels because it had higher yearly contribution limits than the Individual Retirement Account it usually came with a company match, and provided greater flexibility in some ways than the IRA, often providing loans and, if applicable, offered the employer’s stock as an investment choice. Several major corporations amended existing defined contribution plans immediately following the publication of IRS proposed regulations in 1981.

A primary reason for the explosion of 401 plans is that such plans are cheaper for employers to maintain than a pension because, instead of required pension contributions, they only have to pay plan administration and support costs if they elect not to match employee contributions or make profit sharing contributions. In addition, some or all of the plan administration costs can be passed on to plan participants. In years with strong profits employers can make matching or profit sharing contributions, and reduce or eliminate them in poor years. Thus, unlike the IRA, 401 creates a predictable cost for employers, while the cost of defined benefit plans can vary unpredictably every year.

Contribution And Income Limits

With both Roth and Traditional IRAs, you can contribute up to $6,000 annually for 2021. If youre over the age of 50, you qualify to make extra or catch-up contributions up to $1,000 each year. Anyone can open a traditional IRA and contribute funds.

In order to contribute to a Roth IRA, your modified gross income must be less than $125,000 if youre single and $198,000 if youre married and file taxes jointly. These income limits are subject to change each year.

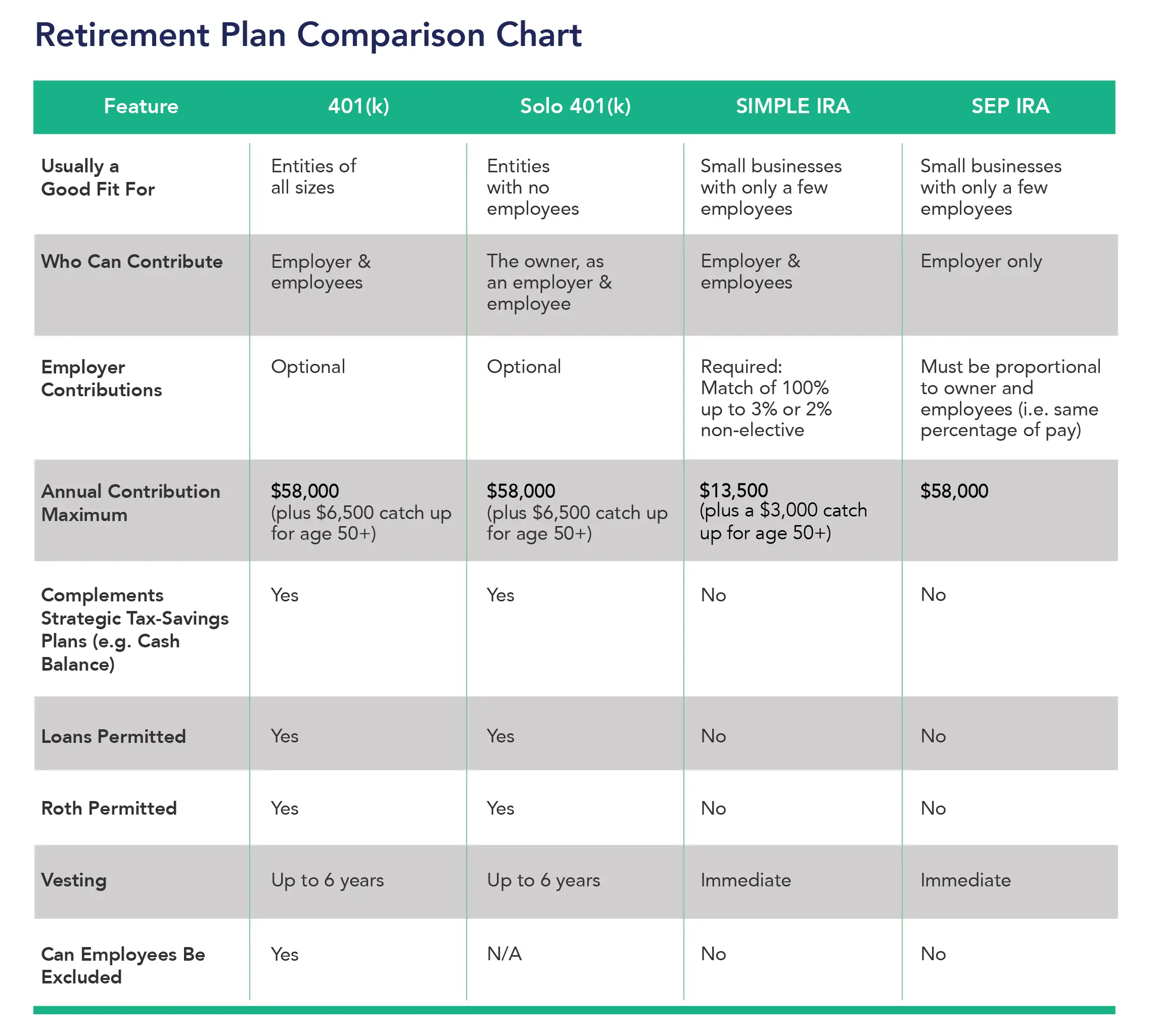

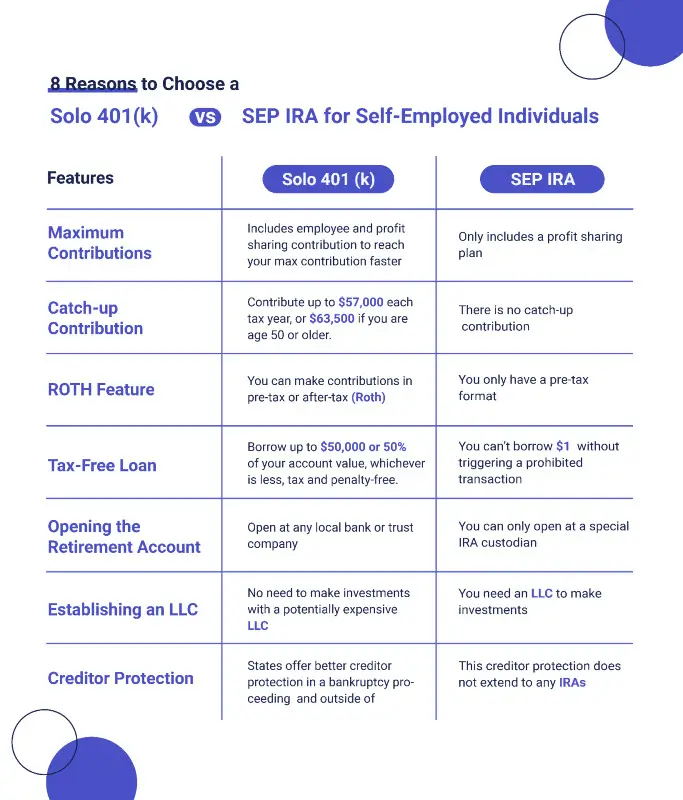

With a SEP IRA, you can contribute up to $58,000 or 25% of your income each year.

Dont Miss: How To Open A 401k Account

Don’t Miss: Who Is The Fiduciary Of A 401k Plan

Is 403b Better Than Ira

Both of these accounts allow for tax-deductible contributions and tax-free growth for employees with eligible income. A 403 which is only available to employees of certain organizations has higher annual contribution limits, while an IRA can offer a variety of options for tax and investment purposes.

Ira Vs : Whats The Difference

Morsa Images / Getty Images

An IRA and a 401 are two common types of retirement accounts that offer tax advantages when you invest. The key difference between the two is that an IRA is a type of retirement account that you open, fund, and invest on your own, while a 401 is a retirement account you open through your employer.

If you want to know more about the differences between an IRA and a 401, youre in the right place. Learn more about how each type of retirement account works, who can contribute, and which one makes sense for you.

Don’t Miss: What Happens To 401k When You Change Jobs

What Are The Pros And Cons Of An Ira Account

| Pros |

|---|

| Adjusted Gross Income Restriction |

What is the downside of a IRA?

A major drawback of Roth IRA contributions is done with after-tax money, meaning there are no tax deductions in the year of the contribution. Another drawback is that no withdrawals should be made until five years have passed since the first deposit.

Is putting money in an IRA a good idea?

Individual retirement accounts offer investors a fantastic opportunity to save on taxes. Pay your future self by investing in an IRA, and you can cut your income taxes too. However, savvy retirement investors know an even better strategy for minimizing their taxes: use a Roth IRA.