Does California Tax Retirement Income

As outlined in the example above, retirement account income even if it isn’t withdrawn early is considered taxable income in California, including withdrawals from a 401, IRA and pension . Social Security benefits aren’t taxed. Given that California tax rates are among the highest in the nation, along with the state’s high cost of living, saving for retirement as soon as possible is strongly recommended for Californians.

- 401: Contributions are tax-deductible and withdrawals are taxed, in addition to any other taxable income.

- Traditional IRA: Contributions are tax-deductible, earnings grow tax-free and withdrawals are subject to income tax.

- Roth IRA: Contributions are not tax-deductible, and qualified withdrawals are tax- and penalty-free .

- Pensions and annuities: Per the IRS, the taxable part of a pension or annuity is generally subject to federal income tax withholding. You may be able to choose not to have income tax withheld from your pension or annuity payments , or specify how much tax is withheld.

Think About Switching Jobs

You may be willing to do without benefits when you start working if your goal is to gain experience, or because you really believe in a company. Some start-ups might not have retirement plans in the first few years but might plan to offer them later. You may want to think about switching jobs to a more established company to make the most out of your savings if you’ve been where you are for years with no change in benefits.

Pick A Plan And Start Saving

Time is one of the most important factors when it comes to building up your retirement fund. While you’re young, time is on your side. Don’t let the absence of a workplace retirement plan like a 401 stand in your way. There are plenty of other retirement savings optionspick a plan and start saving and investing.

You May Like: Can You Leave Money In 401k At Your Old Job

Cares Act 401 Early Withdrawals

The CARES Act contains a provision allowing those who are under age 59 ½ to take a distribution from their retirement plan while working, waiving the 10% penalty that would normally be associated with this type of distribution.

The distributions are still subject to income taxes, but these taxes can be spread over a three-year period. You can re-contribute some or all of the money taken via this route over a three-year period and avoid some or all of these taxes.

These distributions require that you document that COVID-19 has impacted you or a family member. This means that you or a family member has contracted the virus or that you or a family member has been financially impacted by COVID-19 in ways that might include a job loss or reduced income. For a 401 plan, the ability to take these distributions is not automatic, your employer needs to adopt this as a provision of the plan.

Read Also: How Does 401k Work When You Quit

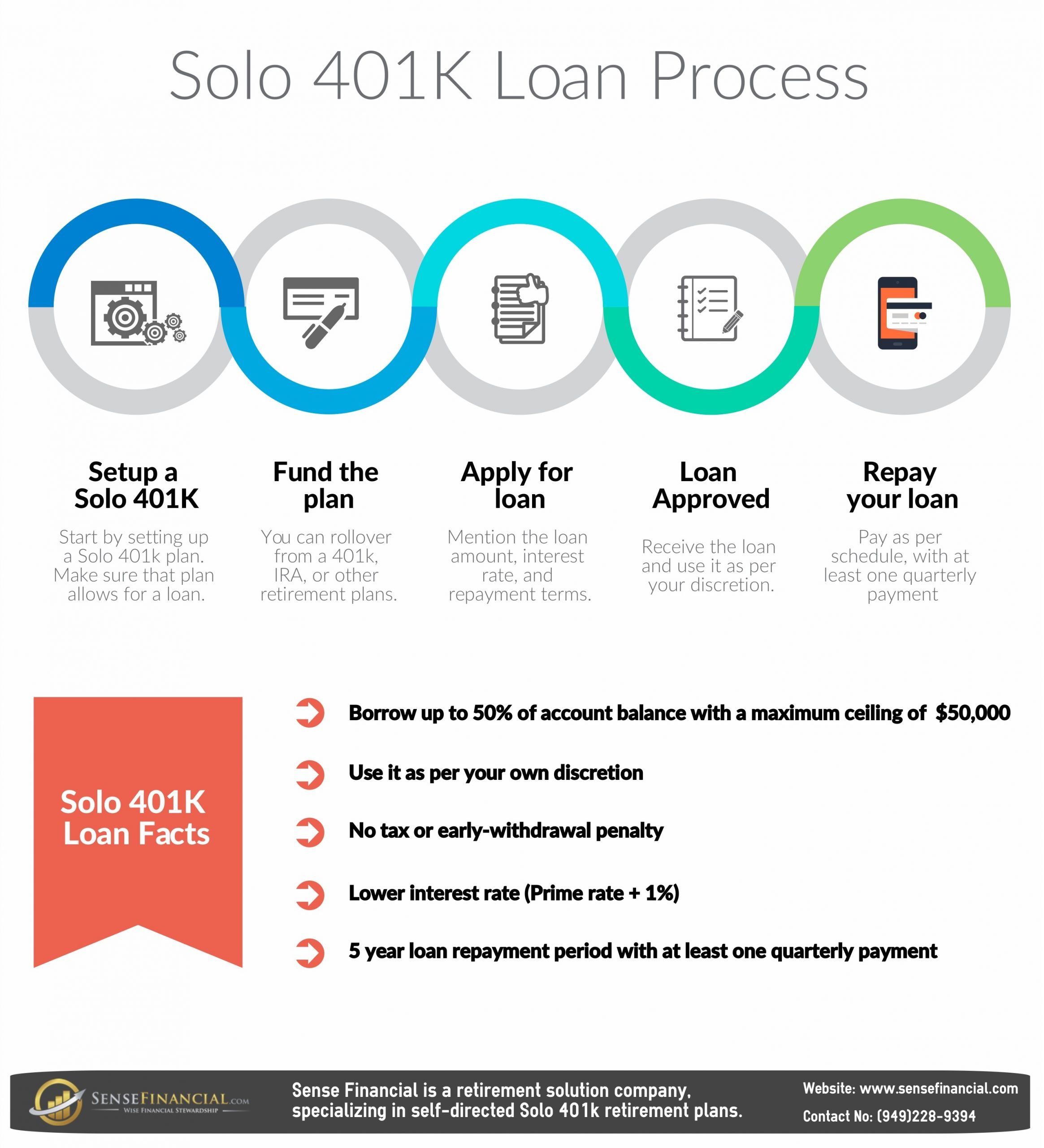

How To Open A Solo 401

You can open a solo 401 at most online brokers, though youll need an Employer Identification Number. The broker will provide a plan adoption agreement for you to complete, as well as an account application. Once youve done that, you can set up contributions. Youll have access to many of the investments offered by your broker, including mutual funds, index funds, exchange-traded funds, individual stocks and bonds.

If you want to make a contribution for this year, you must establish the plan by Dec. 31 and make your employee contribution by the end of the calendar year. You can typically make employer profit-sharing contributions until your tax-filing deadline for the tax year.

Note that once the plan gets rocking, it may require some additional paperwork the IRS requires an annual report on Form 5500-SF if your 401 plan has $250,000 or more in assets at the end of a given year.

If you need help managing the funds in your solo 401, you might want to engage an online planning service. Companies such as Facet Wealth and Personal Capital offer low-cost access to human advisors and provide holistic guidance on your finances, including how to invest your 401.

Recommended Reading: How To Get The Money From Your 401k

What Is A Solo 401

A solo 401, or individual 401, is a 401 plan that is set up for an individual self-employed person. Its also known as a one-participant 401. In order to qualify to set up a solo 401 plan, you must be self-employed, and you must be the sole employee of your business. Once you start hiring employees, youll have to offer them access to your 401 plan if theyre eligible.

Contribution limits for individual 401 plans are similar to those for employer-sponsored 401 plans. Your employee contributions are limited to $19,000 in 2019, or $25,000 if youre over the age of 50. Your business may also contribute up to 25% of your compensation, up to a total combined employer/employee contribution of $56,000 Contribution limits generally increase each year, and the new limits for the following tax year are normally published in early November.

As with any financial investment, though, youll want to consult a financial adviser and a tax adviser to make sure that your contributions are consistent with IRS guidelines and that youre doing everything by the book.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Read Also: How Does 401k Match Work

When 401 Plans Without A Match Are Worthwhile

The employer matching contribution that is part of many 401 plans is an attractive benefit. In some cases, it is equivalent to your employer guaranteeing a 100% return on your investment. However, its not the only advantage that 401 plans have to offer.

With a traditional 401, your contributions to the plan are tax deductible and the accounts earnings over the years will be tax deferred. You wont owe taxes on any of that money until you withdraw it, usually in retirement. If you contribute to a Roth 401, you wont receive any up-front tax deduction, but all of your withdrawals will be tax free if you meet certain rules.

These tax benefits are the same for every standard 401 plan, whether your employer makes a matching contribution or not. If you are going to be in a lower income tax bracket in retirement than you are now, as is often the case, then putting your money in a 401 could save you thousands of dollars a year in taxes.

Of course, there are other ways of saving for retirement besides a 401. A traditional individual retirement account works much like a traditional 401 when it comes to taxation, and it might offer you a broader range of options for investing your money. .)

Even if your employer matches your 401 contributions, that money doesnt belong to you until it has vested according to the rules of your plan.

Thats The Power Of Peppermint

What is a PEP?

Pooled Employer Plans allow small business owners to pool retirement resources with other employers and make retirement plans lessexpensive and easier to manage.

Does my business qualify?

Companies of any size can join a Pooled Employer Plan AND employers starting a new plan may be eligible for SECURE Act tax credits of up to$15,000 over three years.*

Why should I sign up with peppermint?

With peppermint as your plan sponsor, you can give your employees the retirement plan options they want without the cost, risk, and administrative burden of a traditional 401k. Improve employee satisfaction, retention, and recruitment while helping your team save for the future.

Also Check: How To Set Up 401k For Small Business

Substantially Equal Periodic Payments

Substantially equal periodic payments are another option for withdrawing funds without paying the early distribution penalty if the funds are in an IRA rather than a company-sponsored 401 account.

SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

SEPP withdrawals are not the best idea if your financial need is short term. When starting SEPP payments, you must continue for a minimum of five years or until you reach age 59½, whichever comes later. Otherwise, the 10% early penalty still applies, and you will owe interest on the deferred penalties from prior tax years.

There is an exception to this rule for taxpayers who die or become permanently disabled.

SEPP must be calculated using one of three methods approved by the IRS: fixed amortization, fixed annuitization, or required minimum distribution . Each method will calculate different withdrawal amounts, so choose the one that is best for your financial needs.

What Is Automatic Enrollment

Automatic enrollment is a retirement plan provision that automatically deducts funds from an employees wages to defer into their 401 account. Employers set the default election in the plan document, but employees can choose to opt out of plan participation at any time.

Employers may qualify for a tax credit of $500 each year for three consecutive years when adding an automatic enrollment feature to their new 401 plan.

Read Also: How Do 401k Distributions Work

What About A Traditional Ira

If your income is too high to contribute to a Roth IRA, you can go with a traditional IRA. Like a Roth IRA, you can contribute up to $6,000 a year$7,000 if youre 50 or olderand you and your spouse can both have an account.4

Thats where the similarities end. Unlike a Roth IRA, there are no annual income limits. But youre required to begin withdrawing once you turn 72, and even though contributions to a traditional IRA are tax-deductible, youll have to pay taxes on the money you take from it in retirement.5

Still with us? Now, lets look at some other options you can explore if youre self-employed.

Also Check: How Much Do You Get From 401k

How To Open A 401 Without An Employer

Young professionals hear all the time that they need to start investing in their retirement plan now, so they can have a comfortable nest egg by the time they are ready to retire. One of the most popular retirement plans that many professionals invest in is a 401. However, this option is only available through an employer, so you might be wondering how you can open one if you are self-employed or if your current employer does not offer a 401 plan.

Dont worry. You have options.

Self employed business owner? Start a solo 401

Do you own a business and not have any employees who work for you? You are probably eligible for a solo 401. Setting up a solo 401 is advantageous for people who are self-employed business owners because you can contribute up to the annual maximum as well as up to 20% of your net earnings or 25% of compensation as a business owner.

As of 2020, solo 401 account holders can contribute up to $19,500 . This means you have an opportunity to contribute a lot into your retirement funds if you have enough financial security to make the maximum contributions for yourself as the account beneficiary and the matching contributions as your own employer.

Remember, a solo 401 is only applicable if you have no employees in your small business other than yourself. If you have employees, you can explore other 401 options that can benefit you and your employees.

Cant start a solo 401? Invest in alternative retirement options

Read Also: Can You Take Money From 401k Without Penalty

Taking Rmd From Roth And Pretax Solo 401k Funds Question:

With respect to taking the RMD from the solo 401k plan, the standard practice is to take a separate RMD amount from each account . In that case, two separate calculations would need to be performedone on each source . If the plan allows you to do so, however, the amount of the distribution may be aggregated across account balances meaning that the total required minimum distribution amount can be satisfied in any combination between the two accounts. Please note that our Solo 401k plan would allow for this approach to satisfy the RMD requirement. A scenario where this approach may be preferable would be one where the requirements to make a qualified Roth distribution have not been satisfied .

Recommended Reading: How To Invest In A 401k Plan

What Are The Maintenance Costs For Setting Up A 401

Once you establish a 401, your business will have ongoing costs in the form of administrative fees and any matching contributions. Fees generally fall into three categories: day-to-day operations, investment fees, and individual service fees.

There are also potentially fees or penalties associated with being non-compliant with regular 401 benchmarking, which youll want to avoid at all costs. A few examples of 401 penalties include:

- Non-compliance with ERISA for failing to meet certain filing and notification requirements

- Failing to file Form 5500 with the IRS each year

- Not providing 402 notices to plan participants who are seeking distributions from their retirement plan accounts

One way to avoid fines and penalties is working alongside a knowledgeable retirement services provider that can help ensure compliance when it comes to retirement plan forms, deadlines, and notifications.

Dont Miss: Can You Move Money From One 401k To Another

Don’t Miss: How Do I Know I Have A 401k

Invest In A Business Startup

The thrill of funding the next big thing makes investing in a startup exciting, however, it also includes a high degree of risk. Crowdfunding or focused investment platforms are a few ways that startups reach out to both potential investors and future customers.

Key benefits: Low investment threshold, rapid growth could lead to a corporate buyout and a large financial gain.

Drawbacks: High failure rates, may take a long time for the investment to pay off and/or to liquidate the investment.

What’s So Great About 401 Accounts

A 401 is a popular type of employer-sponsored retirement plan that’s available to all employees 21 or older who have completed at least one year of service with the employer, usually defined as 1,000 work hours in a plan year. Some employers enable new employees to join right away, even if they haven’t met this criterion yet.

In 2021 you’re allowed to contribute up to $19,500 to a 401 or up to $26,000 if you’re 50 or older. In 2020, those amounts rise to $20,500 and $27,000. These limits are much higher than what you find with IRAs, and they enable you to set aside a fairly large sum annually.

Most 401s are tax deferred, so your contributions reduce your taxable income each year. You must pay taxes on your distributions in retirement, but you may be in a lower tax bracket by then, in which case you would save money. Some employers also offer Roth 401s. You pay taxes on contributions to these accounts now, but you’ll get tax-free withdrawals in retirement.

Some employers also match a portion of their employees’ 401 contributions, which can make the task of saving for retirement a little easier. Each company has its own rules about matching, so consult with your HR department to learn how yours works.

Also Check: What Is An Ira Account Vs 401k

How Do Employers Choose The Best Mutual Funds To Offer Employees

Managing investments is sometimes beyond the expertise of employers. Thats why many of them outsource the process of selecting, diversifying and monitoring plan investments to an investment advisor. Professional assistance helps ensure that the investment options are in the best interest of the plan and its participants.

This article is intended to be used as a starting point in analyzing 401k and is not a comprehensive resource of requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. ADP, Inc. and its affiliates do not offer investment, tax or legal advice to individuals. Nothing contained in this communication is intended to be, nor should be construed as, particularized advice or a recommendation or suggestion that you take or not take a particular action.

Unless otherwise agreed in writing with a client, ADP, Inc. and its affiliates do not endorse or recommend specific investment companies or products, financial advisors or service providers engage or compensate any financial advisor or firm for the provision of advice offer financial, investment, tax or legal advice or management services or serve in a fiduciary capacity with respect to retirement plans. All ADP companies identified are affiliated companies.

ADPRS-20220422-3172