Option : Roll Over The Funds Into An Ira

Most of the time, transferring the money from your old 401 into an IRA is your best option. Thats because an IRA gives you the most control over your investments.

You see, an IRA gives you potentially thousands of mutual funds to choose from. You can pick from the best of the best instead of just a few so-so options. You can work with an investment professional who can walk you through the rollover and help you manage your investments for the long haulno matter where your career takes you.

Did You Make Traditional Contributions Roth Contributions Or Both

When determining what to do with your 401 after retirement, it’s generally wise to withdraw from Roth accounts first and keep traditional 401 contributions untouched as long as possible. Since you generally wouldn’t owe taxes on Roth withdrawals in retirement, this order of liquidation can reduce taxation over your lifetime.

You Will Be Taxed On 401 Distributions

Traditional 401 contributions are often made on a pretax basis, which means they lower your taxable income during your working years.

Because the money wasnât taxed when you contributed it, when you begin taking distributions from your 401, youâll have to pay tax because the IRS treats this money as ordinary income. That means you wonât get to keep everything youâve saved. And if you withdraw too much in a given year, you could push yourself into a higher tax bracket â meaning the government will take a larger portion of your savings.

While you will owe income tax on money that you withdraw from a traditional 401, you will not owe tax on money that you have saved in a Roth 401. If your savings is in a traditional account, itâs possible to do a Roth conversion, where you will owe income tax on the amount you convert in the year that you convert it. With a Roth IRA, you can enjoy tax-free distributions in retirement.

So how does a 401 work in retirement? While it can be rolled to an IRA, ultimately itâs up to you and how you want to use your lifetime of savings to generate the income you need to fund the things youâve been dreaming about for your retirement. An experienced financial advisor who understands the ins and outs of retirement income and tax planning can help.

Are you on track for retirement?

See how much monthly retirement income you may have based on what youâre saving now.

You May Like: Where Does My 401k Go If I Quit My Job

Direct & Indirect Rollover

- Direct rollover: move assets directly into your Thrivent Mutual Funds IRA from your employer plan. You don’t take receipt of the funds, so no federal tax withholding is required. And, the one-rollover-per-year rule does not apply.

- Indirect rollover: take receipt of your retirement assets and deposit them into your IRA within 60 days. Keep in mind 20% tax withholding is mandatory for distributions from employer qualified plans. One-rollover-per-year rule applies to IRAs, but not to qualified employer plans.

PRIVACY & SECURITY Thrivent Distributors, LLC © 2022.

Call us. We’re here to help. Monday through Friday: 7 a.m. to 6 p.m. Central time. When calling, say “mutual funds” for faster service.

Check the background of Thrivent Distributors, LLC on FINRA’s BrokerCheck.

Investing involves risks, including the possible loss of principal. The prospectus and summary prospectus contain more complete information on the investment objectives, risks, charges and expenses of the fund, and other information, which investors should read and consider carefully before investing. Download Thrivent Mutual Funds,Thrivent ETFs and Thrivent Interval Funds prospectuses, and when available summary prospectuses, or call 800-847-4836.

This site is for U.S. investors only.

After You Retire You Have An Important Choice To Make With Your 401 Account Here Are The Options Available Along With The Pros And Cons Of Each So You Can Determine Which Is Best For You

This article was updated on July 6, 2017, and was originally published on June 13, 2015.

If you’re planning to retire soon and have a 401 or similar employer-sponsored retirement plan, then you have an important question to answer: what happens with your retirement nest egg? You could choose to leave your money in the plan, take a lump sum payout or partial withdrawal, buy an annuity, or roll the money over to an IRA. All of these options have their pros and cons, so let’s see if we can figure out which is the best move for you.

Don’t Miss: Who Does Walmart Use For 401k

Rollover To An Annuity

A guaranteed lifetime income annuity, similar to a pension distribution, will provide a steady stream of income that’s guaranteed to last for the rest of your lifeno matter how long you live.1 With an annuity that offers a guaranteed payout, you wont have to worry about the impact a decline in the market will have on your payments.

Put Yourself In The Drivers Seat

Finally, you have the option of rolling over your account into an IRA, which is my favorite option out of the four mentioned here.

With an IRA, youll have the same tax treatment as leaving your money in the 401, but with more flexibility. Specifically, in an IRA you can invest in any stock, bond, or mutual fund you want, and even if you choose to stay in funds like those in your 401, you may be able to find lower-fee options through an IRA.

Its true that an IRA is likely to require a little more effort on your part than simply leaving the money where it is, but in my opinion, the gaining total control of how your retirement nest egg is invested is worth it.

Also Check: Can I Take 401k Money To Buy A House

Periodic Distributions From 401

Instead of cashing out the entire 401, you may choose to receive regular distributions of income from your 401. Usually, you can choose to receive monthly or quarterly distributions, especially if inflation increases your living expenses. If the 401 is your main source of income, you should budget properly so that the distributions are enough to meet your expenses.

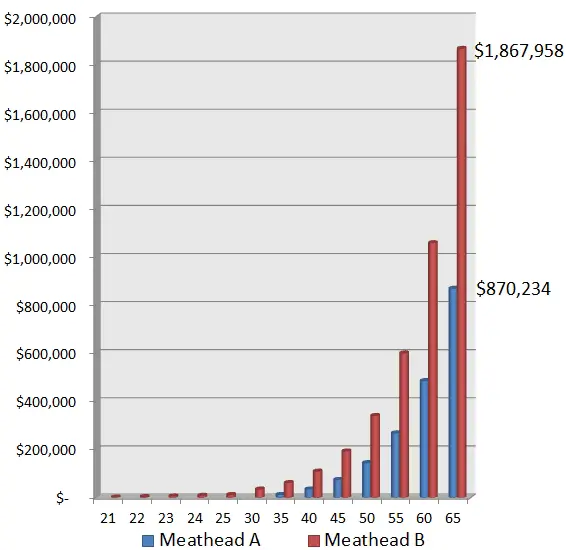

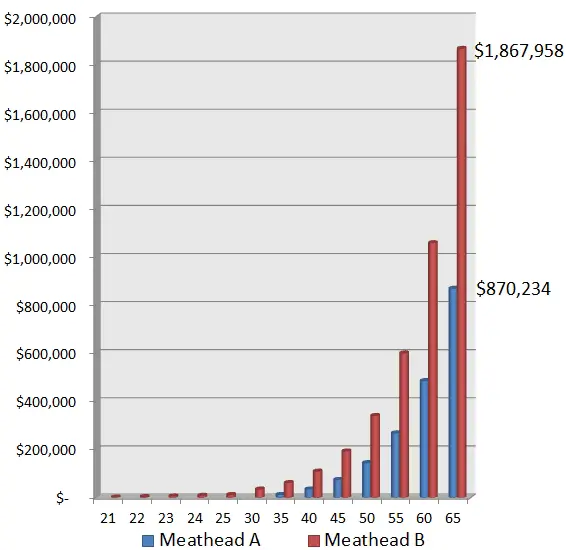

For example, if you have accumulated $1 million in retirement savings, you can choose to receive $3,330 every month, which amounts to approximately $40,000 annually. You can adjust the amount once a year or every few months if your 401 plan allows it. This option allows the remaining savings to continue growing over time as you take periodic distributions.

Be Sure To Understand The Tax Consequences Before Making The Change

If you are considering leaving a job and have a 401 plan, then you need to stay on top of the various rollover options for your workplace retirement account. One of those options is rolling over a traditional 401 into a Roth individual retirement account . This can be a very attractive option, especially if your future earnings will be high enough to knock into the ceiling placed on Roth account contributions by the Internal Revenue Service .

Regardless of the size of your earnings, you need to do the rollover strictly by the rules to avoid an unexpected tax burden. Since you havent paid income taxes on that money in your traditional 401 account, you will owe taxes on the money for the year when you roll it over into a Roth IRA. Read on to see how it works and how you can minimize the tax bite.

Don’t Miss: How Do You Repay A 401k Loan

S To Roll Over 401k To Ira

The process is simple:

Direct Rollover Vs Indirect Rollover: Whats The Difference

Okay, once you decide to roll money from one account to another, you have two options on how to do the transfer: a direct rollover or an indirect rollover. Spoiler alert: You always want to do the direct transfer. Heres why.

With a direct rollover, the money in one retirement accountan old 401 you had in a previous job, for exampleis transferred directly to another retirement account, like an IRA. That way, the owner of the account never touches the money, and you wont have to pay any taxes or penalties on the cash being transferred. Once its done, its done!

Indirect rollovers, on the other hand, are a bit more complicatedand needlessly risky. In an indirect rollover, instead of the money going straight into your new account, the cash goes to you first. Heres the problem with that: You have only 60 days to deposit the funds into a new retirement plan. If not, then youll get hit with taxes and penalties.

See why the direct rollover is the only way to go? Theres just no reason to take a chance on an indirect rollover that leaves you open to heavy taxes and penalties. Thats just dumb with a capital D!

About the author

Ramsey Solutions

Also Check: Can Anyone Have A 401k

Should I Move The Money In My 401 To Bonds

An employer-sponsored 401 plan may be an important part of your financial plan for retirement. Managing those investments wisely means keeping an eye on market movements. When a bear market sets in, you may be tempted to make a flight to safety with bonds or other conservative investments. If youre asking yourself, Should I move my 401 to bonds? consider the potential pros and cons of making such a move. Also, consider talking with a financial advisor about what the wisest move would be for your individual portfolio.

Roll It Into A Traditional Individual Retirement Account

The pros: Because IRAs arent sponsored by employersyou own them directlyyou wont have to worry about making changes to your account should you change jobs again in the future. IRA providers may also offer a wider array of investment options and services than either your old or new employer-sponsored plan.

The cons: Once you roll your funds into an IRA, they may no longer be eligible for a future rollover into a 401 plan, and RMDs apply at age 72, regardless of whether youre employed. Also, youll need to specify how the funds in your traditional IRA are to be invested. Until you do so, the money will remain in cash or a cash equivalent, such as a money market account, rather than invested.

Also Check: Can I Buy A Business With My 401k

Keeping Your 401 With A Former Employer

If your ex-employer allows it, you can leave your 401 money where it is. Reasons to do this include good investment options and reasonable fees with your former employers plan. Keep in mind that you may not be able to ask the plan administrator any questions, you may pay higher 401 fees as an ex-employee, and you cant make additional contributions.

Another noteworthy thing to consider is that your former employer could decide to move your old 401 account to another provider. If your balance is between $1,000 and $5,000 and your former employer wants to close your old 401 account, your former employer can, but it is required to transfer the balance to an IRA in your name and notify you in writing. For balances under $1,000, your former employer can send you a check, which you’d need to put in a retirement account within 60 days to avoid taxes and penalties.

What Is A Systematic Withdrawal Plan

In a systematic withdrawal plan, you only withdraw the income created by the underlying investments in your portfolio. Because your principal remains intact, this is designed to prevent you from running out of money and may afford you the potential to grow your investments over time, while still providing retirement income. However, the amount of income you receive in any given year will vary, since it depends on market performance. Theres also the risk that the amount youre able to withdraw wont keep pace with inflation.

Potential advantages: This approach only touches the income not your principal so your portfolio maintains the potential to grow.

Potential disadvantages: You wont withdraw the same amount of money every year, and you might get outpaced by inflation.

For illustrative purposes only.

Read Also: Invest 15 Of Income For Retirement

Recommended Reading: When Can You Start Drawing From Your 401k

Guaranteed Income For Life May Not Be As Good As It Seems

One fairly popular option is to use the money to purchase an annuity, which basically means you’ll receive a steady stream of income for the rest of your life in exchange for a large payment now.

Obviously, the upside to this is that you’ll have a steady “paycheck” for as long as you live, and there is zero chance that you will outlive your money. There are several options when choosing annuities, including options that guarantee payments to your spouse or heirs if you die before a certain time. Here’s a primer on annuities to help you get started if you want more information.

The major downside to an annuity is inflation. In other words, the payments you receive from the annuity will be worth less and less as time goes on. For example, if you buy an annuity that pays you $2,000 a month and the inflation rate averages 2%, those checks will have just $1,336 in purchasing power 20 years from now. You can find annuities with payments that increase over time, but this will cut down your initial income significantly.

Taxes Owed On A Traditional 401

If you have a 401, your contributions are funded with pre-tax dollars and are not taxed. However, in the future, you will pay ordinary income taxes on a 401 withdrawal once you start taking the money out.

Such an example underlines the importance of paying close attention to when and how you withdraw money from your 401.

Dont Miss: How To Move Your 401k To A Roth Ira

Don’t Miss: Is 401k Divided In Divorce

Rolling Over A : What Are Your Options

Lets say youre starting a new job and youre wondering what to do with the money in a 401 you had at an old job. You have four options:

- Option 1: Cash out your 401.

- Option 2: Do nothing and leave the money in your old 401.

- Option 3: Roll over the money into your new employers plan.

- Option 4: Roll over the funds into an IRA.

Well walk you through the pros and cons of each one:

Option : Roll The Money Into Your New Employers Plan

Rolling your money over to your new 401 plan has some benefits. It simplifies your life because your investments will be in one place and youll also have higher contribution limits with a 401 than you would with an IRA. But there are lots of rules and restrictions with rolling money over into your new employers plan, so its usually not your best option. Which brings us to . . .

You May Like: What Should I Do With My Old Company 401k

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options aren’t usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

Using Retirement Savings To Fund An Annuity

Say youre interested in using your retirement funds to buy an annuity. Should you withdraw the funds from your retirement account, pay the taxes and then buy the annuity? Or can you just roll over the funds directly into the annuity, continuing to avoid taxes until you receive the income stream payments?

In most cases, the Internal Revenue Service allows qualified funds to be transferred into, or out of, qualified annuities.

Direct rollovers occur when qualified funds move from one trustee to another trustee without touching the owner. Under these circumstances, direct transfers are tax-free. Direct transfers are commonly done by mailing or wiring funds directly to the new plan provider, but on some occasions the old plan provider may mail the check directly to you, payable to the new plan provider. This still counts as a tax-free direct transfer.

Indirect rollovers, however, are more complicated and have significant tax consequences if not executed correctly. Indirect rollovers occur when the participant takes constructive receipt of the funds. In order to remain tax-free, the funds must be rolled over within 60 days of distribution. Otherwise, the distribution is income taxable and may also be subject to the penalty for withdrawing funds prior to age 59½.

The advice here is simple: whenever possible use direct transfers.

You May Like: Is There A Limit On Employer 401k Match