Tax Rules: Withdrawals Deductions & More

If youre building your retirement saving, 401 plans are a great option. These employer-sponsored plans allow you to contribute up to $19,500 in pretax money in 2021 or $20,500 in 2022. Some employers will also match some of your contributions, which means free money for you. Come retirement, though, your withdrawals are subject to income taxes and other rules. Heres what you need to know about how 401 contributions and withdrawals are taxed. For help with all retirement issues, consider working with a financial advisor.

How Does 401 Matching Work

A few different scenarios could occur if your employer offers 401 matching. Some of the matching formulas that your employer may use include:

-

A single-tier formula: The employer pays 50% or 100% of every dollar up to the first X% of your contributions. This is known as partial matching.

-

A multi-tier formula: The employer pays 100% of every dollar up to the first X% of contributions. Then the employer pays 50% on the next Y% of contributions.

-

A dollar cap: Employers match dollar-for-dollar up to a certain amount.

In addition to the above, there are matching scenarios based on things like age, job position or tenure.

You need to make the minimum contributions to get the most of your employer match. Lets say that your employer will match 100% of your contributions up to 6% of your salary. If you elect only to contribute 4% of your annual income, your employer will likely only match up to 4%. To get the most out of your employer match, your minimum annual salary contributions should be the maximum threshold set by your company .

Additionally, you should be mindful of your employers vesting schedule, which defines the period of time it takes for you to have complete control over your employer contributions. This is a tool that employers use to retain employees.

You should also be aware of when your employer contributes to your account. They could pay:

-

Every pay period

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

You May Like: How To See Your 401k Balance

A 401k And An Ira Can Work Together

Contents

The most important difference between a 401k and an IRA is that a 401k has to be set up by an employer, and an IRA is a personal retirement account that anyone can create for themselves. The amount that can be saved on a tax-deferred basis is also much higher with a 401k.

If you want to have a 401k, you will need to work for a company that creates them for its employees. Assuming you have a 401k from your work, you can also set up an IRA, and save even more money that can grow without being taxed.

Withdrawing Funds From Your 401

Funds saved in a 401 are intended to provide you with income in retirement. IRS rules prevent you from withdrawing funds from a 401 without penalty until you reach age 59 ½. With a few exceptions , early withdrawals before this age are subject to a tax penalty of 10% of the amount withdrawn, plus a 20% mandatory income tax withholding of the amount withdrawn from a traditional 401.

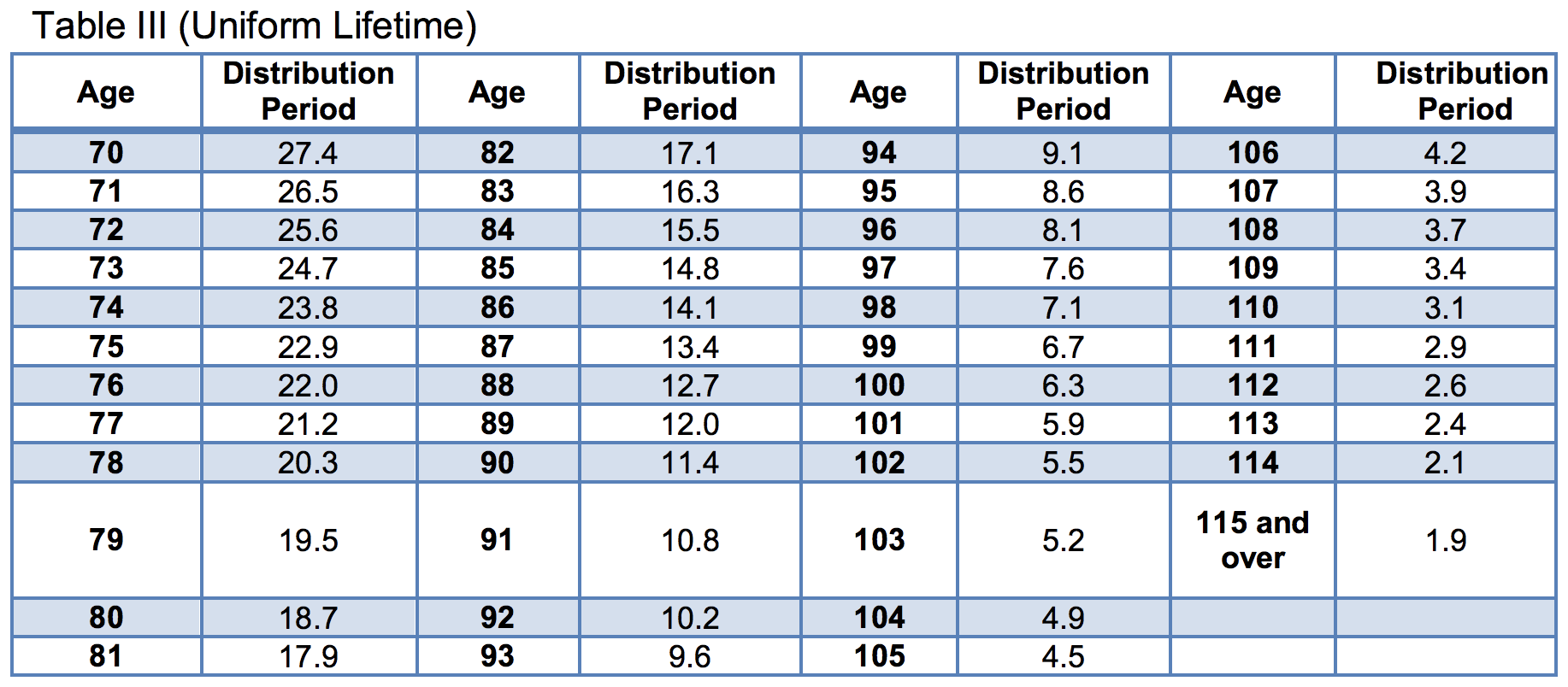

After you turn 59 ½, you can choose to begin taking distributions from your account. You must begin withdrawing funds from your 401 at age 72 , as required minimum distributions .

Don’t Miss: Do I Need A 401k

Tax On Early Distributions

If a distribution is made to you under the plan before you reach age 59½, you may have to pay a 10% additional tax on the distribution. This tax applies to the amount received that you must include in income.

Exceptions. The 10% tax will not apply if distributions before age 59 ½ are made in any of the following circumstances:

- Made to a beneficiary on or after the death of the participant,

- Made because the participant has a qualifying disability,

- Made as part of a series of substantially equal periodic payments beginning after separation from service and made at least annually for the life or life expectancy of the participant or the joint lives or life expectancies of the participant and his or her designated beneficiary. ,

- Made to a participant after separation from service if the separation occurred during or after the calendar year in which the participant reached age 55,

- Made to an alternate payee under a qualified domestic relations order ,

- Made to a participant for medical care up to the amount allowable as a medical expense deduction ,

- Timely made to reduce excess contributions,

- Timely made to reduce excess employee or matching employer contributions,

- Timely made to reduce excess elective deferrals, or

- Made because of an IRS levy on the plan.

- Made on account of certain disasters for which IRS relief has been granted.

Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying taxes on the withdrawal amounts.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas.”Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the traditional 401 owner makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401 plan. The employee is essentially borrowing from themselves. If you take out a 401 loan, please consider that if you leave the job before the loan is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

Recommended Reading: How Often Can I Change My 401k Investments Fidelity

Take An Early Withdrawal

Perhaps youre met with an unplanned expense or an investment opportunity outside of your retirement plan. Whatever the reason for needing the money, withdrawing from your 401 before age 59.5 is an option, but consider it a last resort. Thats because early withdrawals incur a 10% penalty on top of normal income taxes.

While an early withdrawal will cost you an extra 10%, it will also diminish your 401s future returns. Consider the consequences of a 30-year-old withdrawing just $5,000 from his 401. Had the money been left in the account, it alone would have been worth over $33,000 by the time he turns 60. By withdrawing it early, the investor would forfeit the compound interest the money would accumulate in the years that follow.

What Is The 4% Withdrawal Rule

The 4% rule is when you withdraw 4% of your retirement savings in your first year of retirement. In subsequent years, tack on an additional 2% to adjust for inflation.

For example, if you have $1 million saved under this strategy, you would withdraw $40,000 during your first year in retirement. The second year, you would take out $40,800 . The third year, you would withdraw $41,616 , and so on.

Potential advantages: This has been a longstanding retirement withdrawal strategy. Many retirees value this strategy because its simple to follow and gives you a predictable amount of income each year.

Potential disadvantages: Lately, this approach has been criticized for not considering the effects of rising interest rates and market volatility. Indeed, if you retire at the onset of a steep stock market decline, you risk depleting your savings early.

Also Check: How Do I Cancel My 401k With Fidelity

Differences Between Ira And 401k

An Individual Retirement Account refers to the savings account individuals own to secure their financial position post-retirement. On the other hand, 401K is a retirement savings scheme that employers sponsor for their employees as a loyalty reward for their tenure of service.

Together, they form the most significant retirement savings schemes that individuals can opt for to have a financially secure post-retirement life. However, both these options differ in terms of the investment options they offer and the contribution limits. Though most people think they have to choose between these two post-retirement savings options, they can opt to invest in both schemes simultaneously for a financially healthy life after retirement.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:

Can I Leave My Money In My 401 Plan After I Terminate Employment

It depends upon your account balance and the terms of your 401 plan. The IRS allows 401 plans to automatically cash-out small account balances defined as less than $5,000 without the owners consent upon their termination of employment. Under these rules, account balances between $1,000 and $5,000 must be rolled over into a personal IRA for the benefit of the employee. Amounts below $1,000 can be paid out by check.

To find the cash-out limit applicable to your 401 plan, check your plans Summary Plan Description . If your account exceeds this limit, you can postpone distributions until the date you must start taking Required Minimum Distributions.

Recommended Reading: Who Can Contribute To A Solo 401k

Ira Vs 401k Withdrawals Rules

With both 401k plans and IRA plans, you can withdraw money before retirement. But the penalties for doing so are outrageous.

With an IRA, any money withdrawn before the age of 59 1/2 is subject to a 10% penalty, plus federal, state and local taxes on that amount. However, there are exceptions.

The 10% penalty wont apply if you use the money to pay for medical expenses, to buy a house for the first time, and to pay for higher education for yourself, spouse, child, or grandchild.

The same withdrawal rules apply for 401k accounts. Like an IRA,youll get hit with a 10% penalty if you make withdrawals from your 401k before age 59 1/2. Like an IRA, there are some exceptions to withdraw money from a 401k without a penalty.

The exceptions are that if you experience financial hardship, such as:

- Paying for medical expenses

- Paying for a funeral or a primary residence.

- You become totally disabled.

- You are recently divorced and you have a court order to give money to your ex-spouse or child.

However, showing financial hardship can be hard to prove. You really have to show that you cant get the money from a bank or from any other sources.

The rules regarding withdrawals from your 401k and IRA can be complex. So, always consult with a tax or financial advisor for more information.

The 401 Withdrawal Rules For People Between 55 And 59

Most of the time, anyone who withdraws from their 401 before they reach 59 ½ will have to pay a 10% penalty as well as their regular income tax. However, you can withdraw your savings without a penalty at age 55 in some circumstances. You cannot be a current employee of the company that runs the 401, and you must have left that employer during or after the calendar year in which you turned 55. Many people call this the Rule of 55.

If youre between 55 and 59 ½ years old and you are considering a 401k withdrawal from an old employer, you should keep a few things in mind. For starters, doesnt matter why your employment stopped. Whether you quit, you were fired, or you were laid off, you can qualify for a penalty-free withdrawal. However, you need to meet the age requirement and your employment must end in the calendar year you turn 55 or later.

These rules for early 401 withdrawal only apply to assets in 401 plans maintained by former employers. The rules dont apply if youre still working for your employer. For example, an employee of Washington and Sons usually wont be able to make a penalty-free withdrawal before they turn 59 ½. However, the same employee can make a withdrawal from a former employers 401 account and avoid the penalty when he or she turns 55.

You May Like: When You Retire Is Your 401k Taxed

The 401 Withdrawal Rules For People Older Than 59

Most 401s offer employer contributions. You can get extra money for your retirement, and you can keep this benefit after you change jobs as long as you meet any vesting requirements. Thats an important advantage that an IRA doesnt have. Stashing pre-tax cash in your 401 also allows it to grow tax-free until you take it out. Theres no limit for the number of withdrawals you can make. After you become 59 ½ years old, you can take your money out without needing to pay an early withdrawal penalty.

You can choose a traditional or a Roth 401 plan. Traditional 401s offer tax-deferred savings, but youll still have to pay taxes when you take the money out. For example, if you withdraw $15,000 from your 401 plan, youll have an additional $15,000 in taxable income that year. With a Roth 401, your contributions come from post-tax dollars. As long as youve had the account for five years, Roth 401 withdrawals are tax-free.

Do Rmd Rules Apply To Roth Iras Roth 401 And Roth 403 Plans

- RMD rules do not apply to the original Roth IRA owner. RMD rules do apply to beneficiaries who settle to an inherited Roth IRA. Spouse beneficiaries can move the assets to their own Roth IRA instead of an inherited Roth IRA to avoid RMDs.

- Roth accounts in 401 and 403 plans are subject to RMD requirements, so you may want to roll your plan to a Roth IRA to avoid the distribution requirements. Before doing so, be sure to consider all the relevant issues when moving money from an employer plan to an IRA.

Don’t Miss: Can I Invest My Own 401k

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Do You Pay Tax On 401 Contributions

A 401 is a tax-deferred account. That means you do not pay income taxes when you contribute money. Instead, your employer withholds your contribution from your paycheck before the money can be subjected to income tax. As you choose investments within your 401 and as those investments grow, you also do not need to pay income taxes on the growth. Instead, you defer paying those taxes until you withdraw the money.

Keep in mind that while you do not have to pay income taxes on money you contribute to a 401, you still pay FICA taxes, which go toward Social Security and Medicare. That means that the FICA taxes are still calculated based on the full paycheck amount, including your 401 contribution.

Read Also: Can You Open Up Your Own 401k

Traditional 401 Vs Roth 401

When 401 plans became available in 1978, companies and their employees had just one choice: the traditional 401. Then in 2006, Roth 401s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.

While Roth 401s were a little slow to catch on, many employers now offer them. So the first decision employees often have to make is between a Roth and a traditional .

As a general rule, employees who expect to be in a lower after they retire might want to opt for a traditional 401 and take advantage of the immediate tax break.

On the other hand, employees who expect to be in a higher bracket after retiring might opt for the Roth so that they can avoid taxes on their savings later. Also importantespecially if the Roth has years to growis that there is no tax on withdrawals, which means that all the money the contributions earn over decades of being in the account is tax-free.

As a practical matter, the Roth reduces your immediate spending power more than a traditional 401 plan. That matters if your budget is tight.

Since no one can predict what tax rates will be decades from now, neither type of 401 is a sure thing. For that reason, many financial advisors suggest that people hedge their bets, putting some of their money into each.