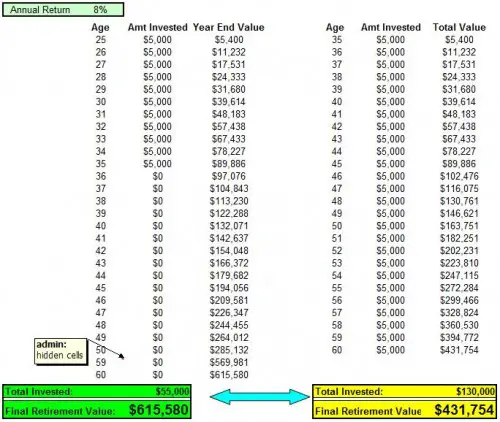

How Much Should I Invest

If you are many years from retirement and struggling with the here and now, you may think a 401 plan isn’t a priority. However, the combination of an employer match and a tax benefit should make it irresistiblethe employer’s match is tax-deferred money invested for you.

When starting out, the achievable goal might be a minimum contribution to your 401 plan. That minimum should be the amount that qualifies you for the entire match from your employer. You also need to contribute the maximum yearly contribution to get the full tax savings.

Example Of Investing In 401k Vs Real Estate

Consider a couple married filing jointly in California, each earning $100,000. In order to compare rental property investment vs 401 we will run two scenarios.

Scenario 1 Max out 401 contribution and let it grow for 30 years.

Scenario 2 Do not contribute to 401. Invest the additional take-home pay in a rental property for 30 years.

| Scenario 1 |

|---|

| $3156 |

The couple invests the annual cash flow in stocks at the same 8% return as scenario 1.

After 30 years, scenario 2 couple has $386,123.56 in stocks and property worth $181,100 .

In retirement, scenario 2 couple has no mortgage after 30 years but they still have operating expenses on a 30-year-old property. The monthly cash flow after the tenants pay down the mortgage is $600.

Investing In Your 401

The variety of investments available in your 401 will depend on who your plan provider is and the choices your plan sponsor makes. Getting to know the different types of investments will help you create a portfolio that best suits your long-term financial needs.

Among the most importantand perhaps intimidatingdecisions you must make when you participate in a 401 plan is how to invest the money you’re contributing to your account. The investment portfolio you choose determines the rate at which your account has the potential to grow, and the income that you’ll be able to withdraw after you retire.

Don’t Miss: Can You Set Up Your Own 401k

Dont Panic When Your 401 Loses Value

Itâs natural to freak out when your 401 loses value. Checking your 401 balance and seeing youâve lost hundreds or thousands of dollars in a few months is never fun.

However, what you donât want to do is panic and make any changes in the moment.

It may seem counterintuitive, but during a stock market crash, the last thing you want to do is take money out of your 401. The reason is that you paid a price for the stocks, mutual funds, and index funds youâre invested in. If they lose value and you sell, you sold your investments for a loss. In fact, the best strategy is to invest even more money into the funds youâre invested in because youâll be paying a discount for the same funds because theyâre lower in value. And because time is on your side, the funds will recover long before youâll need to start taking distributions during retirement.

Understanding The Different Investing Options

The average 401 plan provides about 19 different investment options to choose from. Unless the plan has a default investment option, your contributions could sit in your 401 as cash without being actually invested in anything.

If your contributions are automatically invested in a particular fund, you can always change what your money is invested in. If your 401 plan has an online portal, then you can research different funds and move your money as you please. If not, youâll have to contact your planâs custodian to facilitate moving your money to other investment options.

Your 401 planâs summary plan description will outline the default investment options, the other available investment options, and how to move your money to various funds. Some of the most common funds provided in 401 plans are target-date funds, mutual funds, index funds, and bond funds.

Recommended Reading: How Do 401k Withdrawals Work

Quality Of The Plan Plays A Role

Some of the plans that I have reviewed over the years are simply terrible.

They contain only fixed income funds with low returns, or they have annuities with massive service fees.

It will be very difficult to compound returns in these environments even with the benefits of pre-tax dollars and free money from your employer.

In these extreme cases, it may make perfect sense to invest outside of a 401k.

If you are going to go this route you will need to keep a long-term perspective and have a heavy lean to stocks vs. bonds to overcome the friction of tax.

In fact, this is where it makes the most sense to invest in low-cost index funds with reduced tax exposure. In our buyers guide we have recommendations that will provide specific fund and stock recommendations.

Contributing To Your 401

You can contribute a portion of your earnings to a 401 account tax-free each pay period, subject to annual limits set by the Internal Revenue Service . Some employers even offer matching programs, where they contribute an equal amount to help grow your fund. It’s clear to see how it makes sense to put in as much as possible and maximize your 401.

But there may be reasons to hold back. Your financial situation should play a role in how much you decide to put in an employer-sponsored retirement plan. So should the specifics of the plan. Consider whether your company’s 401 is high in quality with solid growth rates and company matching. Make sure your own money base is solid, ensuring that you can afford to put some of your earnings away.

Maxing out your contributions probably isn’t your best choice if you’re struggling to pay bills each month, still working on other aspects of your finances, or if your 401 options aren’t great.

Read Also: What Is A 401k And How Does It Work

Can You Lose Money In An Ira

Understanding IRAs An IRA is a type of tax-advantaged investment account that may help individuals plan and save for retirement. IRAs permit a wide range of investments, butas with any volatile investmentindividuals might lose money in an IRA, if their investments are dinged by market highs and lows.

Employer Matching Contributions To A 401

Many employers provide a matching contribution for some or all of an employees 401 contribution, incentivizing employees to participate in the plan. Matching contributions are considered to be traditional 401 deposits, even if the employee contributes to a Roth 401.

For example, some employers may match 50 percent of an employees contributions up to 8 percent of their salary each year. If the employee contributed 8 percent, the employer would add another 4 percent, and the employee would effectively enjoy a total of 12 percent saved. But if the employee contributed 10 percent, the employer would still add a maximum of 4 percent.

Employers offer different matching amounts, and some employers may offer no match at all.

Many employers require matching contributions to vest over time. For example, if the employer requires three years of vesting, employees must remain with the company for at least three years before any matching funds become fully theirs. However, once the employee has surpassed the vesting period, any subsequent matching funds immediately become theirs.

Matching funds may partially vest, depending on the employees length of service. For example, with a three-year vesting schedule, an employee who stays two full years may be able to keep two-thirds of any matching funds. But the rules depend on the details in the employers plan.

Don’t Miss: How To Take A Loan Against Your 401k

How Much Money Should Be In My 401k At Age 30

If you are earning $50,000 by age 30, you should have $50,000 banked for retirement. By age 40, you should have three times your annual salary. By age 50, six times your salary by age 60, eight times and by age 67, 10 times. 8 If you reach 67 years old and are earning $75,000 per year, you should have $750,000 saved.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Should I Get A 401k

Should I Invest In Real Estate Vs 401k: How To Actually Compare

A reader wrote to me recently asking, What is a better investment than a 401k? After a few emails back and forth, I realized that he was trying to decide if it is better to invest in property or mutual funds. Depending on what corner of the personal finance world you land in, there is always a fierce debate between investing in 401 or rental property. The die-hard real estate investors would tout the benefits of rental real estate. In contrast, the stock enthusiasts would prefer the 401. Before deciding if it is better to invest in 401 or rental property, let us evaluate the pros and cons.

About 401 Investing In Down Markets

You might naturally feel nervous about continuing to invest while share prices are falling. There are two protective measures investors take during bear markets. They are:

You may already be taking these actions in your 401. If you’re younger than 50, you shouldn’t be withdrawing money for at least five years, or possibly 10. And your investment menu may not even offer speculative fund options.

Still, it’s smart to check in on your investment selections. Make sure most of your contribution is allocated to a large-cap or S& P 500 index fund.

Also Check: Can You Transfer A 401k Into An Ira

What Are The Right Stocks To Outperform A 401k

Depending on the time horizon described in our considerations above it will put us on a couple different paths.

When the need for funds is near-term, we should leave the funds in the most conservative fixed return funds where our primary objective is capital preservation.

When we have a longer time horizon but will need the funds prior to our 59 and ½ birthday, well want to shift to low cost index funds but will want to shift the portfolio heavily towards stocks/equities.

Going longer-term, we will want to push for more aggressive risk/return because we have a longer time period for the risk premium of stocks to be realized.

However, as a default rule stick to low cost index funds and turn your focus to increasing contributions by reducing your living expenses.

Seniors who are interested in investing in dividend funds should also read best dividend mutual funds for retirement.

Mistake #: Buying Too Much Of Your Companys Stock

If your employer’s stock shares are an investment choice in your 401, you may want to consider keeping your allocation to no more than 10 percent. Youre not being disloyal even the mightiest of companies think Enron and WorldCom can falter. With your salary already tied to your companys fortunes, you dont want a sizable part of your retirement savings to be similarly dependent.

You May Like: How To Do A Direct 401k Rollover

Employee Contributions To A 401

Employee contributions to a 401 plan are limited to $20,500 in 2022. Employees can have the money seamlessly deducted from their paychecks and deposited into their accounts, making it easy for employees to participate in the plan and not feel as if theyre missing the money.

If theyve opted to purchase mutual funds as part of their plan, the money will be automatically invested in those funds, according to the investment plan.

What Are The Pros And Cons Of An Ira

The IRA offers a similar variety of pros and cons. Here are the most important:

Pros of an IRA

- Available to anyone with earned income

- Non-earning spouses can contribute, too

- Wide array of investment options

- Easy to set up traditional or Roth versions

- A Roth IRA is great for estate planning

- A Roth IRA offers flexibility, including penalty-free withdrawals of contributions

Cons of an IRA

- Deductibility of contributions is limited due to income

- No investment advice

You May Like: How To Switch 401k To Ira

Can I Invest In Real Estate With My 401k

I am sure some of my astute readers must be wondering if there is a way to get the best of both worlds. If you are thinking, can I buy real estate with 401 money, the answer is yes, but it is complicated.

You can use your 401 to buy real estate. But there are some limitations to using this approach.

Cut Back On Budget And Redirect To Savings

David Peters, founder and owner of Peters Tax Preparation & Consulting in Richmond, Va., has been telling business owners to take a hard look at their budget, paying close attention to where they are spending their money and searching for ways to cut. For instance, they might be able to work at home and save on gas or cut unneeded luxury items. “A smart move would be to cut some of the current expenses so you can continue to save for the long-term goals,” he said.

Recommended Reading: Does A Solo 401k Need An Ein

Approaching Your Employer With Better 401 Options

These are the primary reasons for why you should invest in a Roth IRA:

- mutual funds with stocks

- money market funds

- guaranteed investments accounts or bank accounts/notes

All of these have distinct return profiles, with equities typically being the highest earners and both bonds and money market funds considered to be a good choice. CDs or savings accounts with guaranteed interest are the lowest yielding investments, however they are usually quite secure.

It is possible that you will not have access to all of these alternatives when picking a plan, and the management choices available to you may be less than optimal. If you have better options, please do not hesitate to contact your human resources department. Employers simply want to make their workers happy and are glad to let you do the job on your own time, especially if it can save them money as well.

Recruiting Fellow Employees to Help

It is possible that a large number of individuals requesting the same modifications to your companyâs financial planning may be required to make anything happen. It is often a smart idea to write out a letter with your own plan of action plainly described. You can then talk to other employees and get them to sign a petition after that. The letter should be polite yet businesslike, as well as succinctly stating goals and ways to achieve them.

Are Retirement Savers Actually Changing Course

To answer this question, we looked at the behavior of 401 participants during the first half of 2022 from T. Rowe Prices recordkeeping data. Using collective and anonymized data, we analyzed their exchange activity and changes in their deferral rates during this volatile period.

In general, 401 participants have been staying the course. Based on our research, over 95% of 401 participants have not made any investment exchanges during the first half of 2022. But underlying that, there are some noticeable trends.

Apart from exchanges, 401 participants can also change their deferral rates in response to market conditions, but other factors may also be at work. For most of the first half of 2022, average deferral rates stayed relatively stable. More recently, though, the average has trended downward, suggesting that cutting back on contributions is one way workers may be coping with inflation at fourdecade highs. If high inflation persists and the downward trend in deferral rates is prolonged, then it could become problematic because retirement savings might fall.

Average Deferral Rate Has Remained Stable

Weekly average deferral rate during the first and second quarter of 2022

As of July 1, 2022.401 participants of plans with approximate assets> $25m. during the first half of 2022 from T. Rowe Prices record-keeping data.Source: T. Rowe Price.

Read Also: How To Open 401k For Individuals

At What Age Should You Start An Ira

Prime Working Years This is when people typically start thinking about opening an IRA and with good reason. You’re in your prime earning years, so you likely have the money to tackle this goal. At this stage of your life, it’s generally a good idea to start saving as much as possible for retirement.