Develop An Investment Thesis And Portfolio Rules

Before allocating funds to bitcoin in a 401 or IRA, investors must determine why they want to make such a unique allocation. Allocating to bitcoin solely because one believes the price may rise may not be the best decision. The investor must decide why bitcoin should have a place in his or her portfolio for example, as a market hedge or as an active allocation to an emerging technology and then must design rules for portfolio management.

Read More: Why Invest in Cryptocurrency?

Find An Ira That Lets You Buy Crypto

The IRS does not allow you to place property in retirement accounts. However, you can buy property with funds from your retirement account and hold it there. Because the Internal Revenue Service considers cryptocurrencies property for tax purposes, you can add them to an IRA if the IRA buys it and holds it.

The most challenging part of placing crypto in your retirement account is finding a company that lets you use the funds from the account for purchases. You’ll need to look for a company that allows you to include crypto in a self-directed IRA, which enables you to control what is in your account.

Some examples of crypto IRA companies you can look at are:

There are many other IRA companies allowing cryptocurrency in accounts. No matter which one you choose, it’s essential to vet them to ensure they are legitimate and regulated. Additionally, you should look out for scams and fraudulent offerings. The Securities and Exchange Commission published an investor alert in 2018 regarding fraudulent activities some companies use to attract investors.

In April 2022, Fidelity Investments introduced its Digital Assets Account, which allows investors to place a percentage of Bitcoin in their 401s.

Everyone Will Be Using Cryptocurrencies To Buy Everything Soon

Not if the U.S. and China have a say in things. Both are diligently working on developing their own digital currencies. Neither country is likely to allow its monetary policy to be hijacked by a random cryptocurrency or two.

Im not going to fight the Fed and China and expect to win. I think the chance of Bitcoin or any other cryptocurrency becoming the new world currency is unlikely.

Oh, and youve heard that everyone is buying cryptocurrencies now, right? According to Bloomberg, 95% of all Bitcoin is held by 2% of all Bitcoin account holders. And, CNBC reports that a total of 13% of all Americans have bought or sold cryptocurrencies.

Don’t Miss: Should I Use My 401k To Start A Business

Irs Thoughts On Cryptocurrencies

The IRS released notice 2014-21 on March 25, 2014. In that notice they state they dont exactly treat cryptocurrencies like currency. Instead, they treat crypto more like property . This sparked a long debate between the Securities and Exchange Commission and the Commodities & Futures Trading Commission . The point of this discussion? To try and determine under whose domain crypto assets fall.

In notice 2014-21, the IRS states, virtual currency is treated as property for U.S. federal tax purposes. Generally, this means any profits made on selling those currencies result in general tax principles that apply to property transactions apply to transactions using virtual currency.

To put it plainly, the IRS will charge capital gains taxes on any profits made by selling crypto assets. This could be either short-term capital gains , or long-term capital gains. Typically, you pay long-term capital gains on investments youve had longer than 12 months. Expect to pay 15-20% for long-term capital gains taxes.

Will You Be Able To Add Crypto To Your 401

Though Fidelity will make it possible to add Bitcoin to 401 accounts, this doesnt mean that every employee whose plan is overseen by the company will be able to do so.

Thats because 401 accounts are ultimately the responsibility of employers, who have a fiduciary responsibility to their employees. At the moment, most analysts predict that most companies wont allow their employers to add Bitcoin at least not right away. Though Bitcoin might be suitable for some employees, its unlikely to be a responsible investment for those close to retirementand because of the way that most employers administer 401 plans, the same investment options must be open to all plan participants.

These concerns have recently been echoed by the Department of Labor. Though the federal agency hasnt gone as far as banning crypto from retirement plans, it issued a compliance assistance document in March 2022 that reminded plan overseersthat is, employers who must act solely in the best interest of participating workersthat they were responsible for choosing prudent options. And it strongly suggested that cryptocurrencies didnt yet appear to meet that bar.

The net effect of these concerns is that most employees wont be able to add Bitcoin to their 401 accounts anytime soon.

Read Also: What Is A Simple 401k

Buying Cryptocurrencies With A Solo 401k:

Using your Solo 401k to buy cryptocurrencies is easy! Just follow the simple steps below:

Have questions? Wed love to hear from you. Weve been investing in crypto since 2013 and love finding new alternative investments.

Is A Crypto Ira A Good Idea

There are significant risks involved with investing in crypto. There can be large gains, but there can also be large losses. Crypto might be another way to diversify a portfolio to compensate for downturns in other markets, but the risk of loss is very high in a retirement account with more than a small percentage of crypto in it.

Investing in cryptocurrencies and other Initial Coin Offerings is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein.

Don’t Miss: Can I Buy Individual Stocks In My 401k

Bitcoin In A 401 As A Hedge Or Emerging Store Of Value

Bitcoin is seen by many as a hedge asset. Many bitcoin holders believe that it is wise, similar to an investment in precious metals, to allocate a certain percentage of ones net worth into an asset that is not controlled by a central entity. Bitcoin is an open-source, decentralized network, and many believe it is an emerging store of value. Many people view bitcoin as an insurance-like instrument that will protect their wealth in the event of a systemic failure. An allocation to an asset seen as a store of value and a hedge against governmental or central bank errors represents a responsible and reasonable approach.

Read More: The Link Between Bitcoin and Inflation

Other investors believe bitcoin is an emerging technology that will power the future of many industries. An allocation to bitcoin viewed through the lens of an emerging technology would be similar to an allocation to a growth stock position or a more specific equity strategy. Many 401 plans offer participants the opportunity to invest in broad-based index funds or more specific, actively managed funds that may include large-cap growth or small-cap growth company stocks. Viewing bitcoin as an investment into emerging technology is a responsible way to view the asset.

It is important to note that an allocation to bitcoin represents an alternative allocation and must be done with caution.

What Retirement Savers Can Do Instead

Currently there is no regulatory environment or national policy regarding cryptocurrencies. To minimize your exposure to crypto risk, the only safe way at the moment is to avoid investing your 401 funds in digital assets.

But if you do decide to invest in cryptocurrencies, there are a couple steps you can take to minimize potential damage and still benefit. First, it might be a wise move to keep your retirement funds apart. Defined contribution plans often follow asset allocation guidelines to help you save for your retirement, so make sure to keep your retirement investments aligned with your risk tolerance goals.

If youd like to capture some of the potentially-high returns for crypto investments, try investing through your regular brokerage account. Putting some money into a crypto exchange-traded fund like the Bitcoin Strategy ETF offers investors exposure to Bitcoin without having to buy the digital coin directly.

Another option is to open an account with a cryptocurrency exchange like Coinbase, Kraken or Binance.US. These exchanges allow you to buy currencies like Bitcoin and Ethereum with your debit card, and if you plan on holding the crypto coins for a while, you also have the option of safeguarding your investments in their digital vaults.

Recommended Reading: Can An Individual Open A 401k Account

The Solo 401k: A Unique Retirement Plan For Small Business Owners

This interesting variation of the original 401k plan is sure to grab your attention. Especially if you are a self-employed person with no full-time employees . It can be created in before-tax or after-tax configurations and, best of all, Bitcoin and your 401k get to be best friends for life.

A Solo 401k allows you a maximum annual contribution limit of $18,500. But depending on your age, your business can also make profit sharing contributions into the account. These additional contributions can bring your total up to $55,000 per year. Compare that to a traditional or Roth IRA thats capped at $5,500 per year. Of course, with either style of plan , persons over 50 can enjoy even higher annual contribution limits.

How Can I Buy Cryptocurrency In My Ira Or 401k And What Are The Benefits

First, as a general rule of thumb, IRAs and retirement plans can own anything outside of life insurance, contracts and collectibles.

Cryptocurrency is just one of the many options that you can choose when you have a self-directed IRA. Self-directed IRAs allow you to have the keys in your hand to choose alternative investments like real estate, promissory notes, and even cryptocurrency.

Read Also: How Do I Open A 401k Account

Why Not Include Cryptos In Your Plan

The problem with cryptos and other digital assets is the lack of regulation and policies regarding their existence and use. Investing in such assets can expose your retirement funds to significant risks, and betting your future retirement on unregulated assets could easily end in disaster.

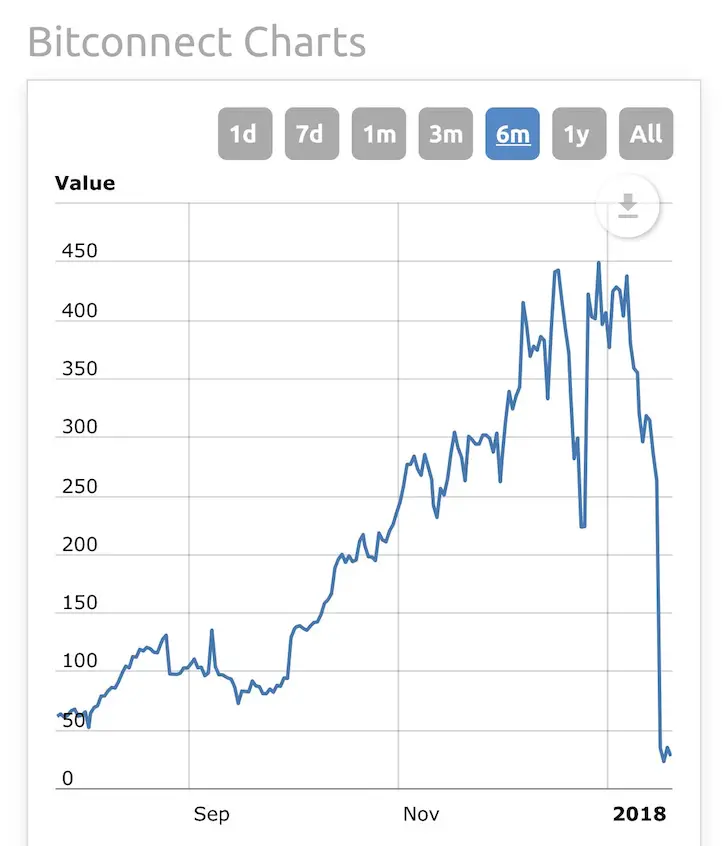

For example, the DOL warns that cryptocurrencies are subject to extreme price volatility. At this stage in their development, cryptos often experience speculation and valuation issues, which lead to wild price swings. Extreme volatility can be devastating to retirement savings and highly problematic for retirees who depend on these monies for daily living.

Another issue with offering cryptos in a retirement plan is the difficulty in evaluating them as an asset. Even experts have trouble separating real cryptocurrency value from speculative hype, and retirement savers may interpret including a crypto option in a 401 menu as an endorsement by the plan manager. Currently none of the proposed models for valuing cryptocurrencies meet the same rigorous accounting standards that are used for equities or debt analysis, so oftentimes a cryptos value is up in the air.

Digital assets like cryptocurrencies are not held like traditional investments either. Instead, cryptos are often held in digital computer wallets and may be exposed to hacking and theft. Ever hear of the Welshman who threw away his hard drive holding $500 million in Bitcoin? Thats yet another problem.

Which Path Is Right For You

The truth is, it depends! If you plan to trade crypto in short time windows and feel comfortable dealing with opening an institutional level exchange account, as well as overcoming the tech hurdles of a hardware wallet, the self-custody path may be right for you.

If you plan to buy and hold crypto for a longer period of time, and dont want to worry about losing your assets to the threat of hacking or theft, the custodial account may be right for you.

Contact a Nabers Group team member if you have any questions and well be happy to discuss your options with you!

Recommended Reading: How Often Can I Change My 401k Contribution Fidelity

Why The Best Crisis Management Comes Before The Crisis

For most small businesses, hiring a registered financial adviser to select, monitor and advise on plan investments is the surest way to protect against any potential ERISA violations and monetary risks. This is why almost all ERISA employer-sponsored 401 plans require their plan participants to select their investments from the bucket of investments selected by the registered financial adviser. These investments are typically always publicly traded mutual funds and/or exchange-traded funds. One of the reasons employers get sued because of a retirement plan is “inappropriate investment choices.”

So, holding alternative assets in a 401 plan, though legal, is not common because of the ERISA trustee fiduciary risks. However, it is possible your employer could allow you to invest in Bitcoin with your 401 funds. The advantage of using retirement funds to buy cryptocurrency is that all gains are tax-advantaged. So long as your 401 plan documents permit alternative assets and the plan trustee will allow the investment, you will generally be permitted to buy cryptocurrency in your 401 plan.

For example, my company, which establishes and administers self-directed retirement plans, allows its employees to buy Bitcoin with their 401 plan funds due to employee interest. As a plan fiduciary, my liability risks do increase however, we require each interested employee to sign various disclosure forms and only use a small percentage of their funds for Bitcoin investing.

Know The Risks

Make Sure That Youre Eligible

The general rule of thumb is that you established your 401 as a full-time employee from a previous employer, or you are more than 59.5 years old. Other eligibility requirements can vary, depending on the type of retirement plan you have, such as a Traditional or Roth IRA, 403, 457, and Thrift Savings Plan .

Please note the rules dictating eligibility to move a 401 to an IRA arent always crystal clear and can vary from person to person. If you are confused or unsure of your own eligibility, please contact BitIRA today for a complimentary consultation.

We have a team of IRA Specialists, who are well-versed in the rules of 401-to-Bitcoin IRA rollovers. If you make a bitcoin investment for your SDIRA, they can assist you with the entire transfer process to make it quick and easy. However, please note that there is no obligation for you to take any action after your consultation.

Here are the three steps to take to convert your 401 savings into bitcoin:

You May Like: How To Buy 401k Plan

Tax Implications Of 401k Roll Over:

Be careful if your old employer insists on sending you a check. There is a very serious potential pitfall here. And the best way to avoid it is to ask them to send it directly to your account custodian. Do not have the check sent directly to you. This can raise a whole range of unwanted taxation problems. Basically, if the check is sent directly to you the IRS will view this as taxable income and you could be charged a lot of tax. It has to go straight to your account custodian. Technically, there is a 60-day window for you to transfer this check to your trustee before the IRS are on your back. But why take this chance. Things happen and unexpected things happen in life. Just have them send it directly to your account holder and never receive it in person in the first place.

How We Determined The Winners

We researched numerous bitcoin IRAs to find the best options for cryptocurrency selection, fees, security, features, and more.

On the fee side of things, we paid closed attention to account minimums and account setup fees/advisory fees. We also considered customer service availability when narrowing down platforms.

Don’t Miss: How To Close 401k After Leaving Job

Ask Yourself These Questions Before Deciding If Bitcoin Is Right For Your 401

If youre still interested in buying cryptocurrency, however, ask yourself a few questions to see whether it makes sense for you and your situation. Simpson offers three questions that he thinks the general public should be asking before they jump into the crypto market.

- Why am I thinking of putting my money in this? Is it just because it is what the media is telling me everyone else is doing, says Simpson. You would think that as recently as the Bernie Madoff case was, people would be leerier of get rich quick schemes. We all hear about the people who made millions on cryptocurrencies. What we dont hear about are the thousands of other people who went broke.

- Do I have the risk tolerance to invest in this? Weve all seen the wild swings in value that cryptocurrency goes through, sometimes daily, he says. Can you, as an investor, really stomach watching your account value go up by 50 percent this week and down 50 percent next?

- Do I understand what Im investing in? Most people do not have any idea how cryptocurrency works, how its valued and who uses it, says Simpson. Take some advice from Warren Buffett, dont ever invest in something that you dont understand.

Even beyond these questions, you should consider how crypto fits into your retirement portfolio. The vast majority of Americans should steer clear of risky investments and stick to proven methods of generating wealth, says Chris Barnes, chief commercial officer, Escalent, a human insights company.