Rolling Over A : What Are Your Options

Lets say youre starting a new job and youre wondering what to do with the money in a 401 you had at an old job. You have four options:

- Option 1: Cash out your 401.

- Option 2: Do nothing and leave the money in your old 401.

- Option 3: Roll over the money into your new employers plan.

- Option 4: Roll over the funds into an IRA.

Well walk you through the pros and cons of each one:

Option : Roll Over The Money Into Your New Employers Plan

Rolling your money over to your new 401 plan has some benefits. It simplifies your investments by putting them in one place. And you also have higher contribution limits with a 401 than you would with an IRAwhich means you can save more!

But there are lots of rules and restrictions for rolling money over into your new employers plan, so its usually not your best bet. Plus, your new 401 plan probably only has a handful of investing options to choose from too. And if youre feeling iffy about those options, why put all your retirement savings there? Which brings us to . . .

You Can Manage All Your Investments In One Place

A recent study found that the youngest baby boomers worked 12 different jobs over the course of their careers.2 Did you hear that? Twelve! Imagine how difficult it is to keep track of a dozen 401s from previous jobs.

The more scattered your retirement accounts are, the harder it is to make good decisions about your investmentsand that can affect your retirement future. Youll be able to manage your retirement funds better by having them all in one place.

Also Check: How Should I Invest My 401k

Transfers To Simple Iras

Previously, a SIMPLE IRA could only accept transfers from another SIMPLE IRA plan. A new law in 2015 now allows a SIMPLE IRA to also accept transfers from traditional and SEP IRAs, as well as from employer-sponsored retirement plans, such as a 401, 403, or 457 plan. However, the following restrictions apply:

- SIMPLE IRAs may not accept rollovers from Roth IRAs or designated Roth accounts of employer-sponsored plans.

- The change applies only to rollovers made after the two-year period beginning on the date the participant first participated in their employers SIMPLE IRA plan.

- The new law only applies to transfers to SIMPLE IRAs made after December 18, 2015, the date of enactment.

- The one-per-year limitation that applies to IRA-to-IRA rollovers also applies to rollovers from a traditional IRA, SIMPLE IRA, or SEP IRA into a SIMPLE IRA.

Keeping Your 401 With A Former Employer

If your ex-employer allows it, you can leave your 401 money where it is. Reasons to do this include good investment options and reasonable fees with your former employers plan. Keep in mind that you may not be able to ask the plan administrator any questions, you may pay higher 401 fees as an ex-employee, and you cant make additional contributions.

Another noteworthy thing to consider is that your former employer could decide to move your old 401 account to another provider. If your balance is between $1,000 and $5,000 and your former employer wants to close your old 401 account, your former employer can, but it is required to transfer the balance to an IRA in your name and notify you in writing. For balances under $1,000, your former employer can send you a check, which you’d need to put in a retirement account within 60 days to avoid taxes and penalties.

Also Check: Should I Have A 401k And A Roth Ira

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

Rollover To A Life Insurance Policy

Technically, you cant roll over your 401 account into an insurance policy however, if you have a life insurance needs, you can withdraw funds from the account and redirect them to pay for a life insurance policy. You can avoid early withdrawal penalties under IRS Rule 72t,2 which allows you to take equal payments from your accounts. However, you must agree to take consistent withdrawals from your account each year for life.

Recommended Reading: What Are The Best 401k Funds To Invest In

Tips For Retirement Investing

- Consider finding a financial advisor to steer you in the right direction in terms of savings and investments. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- When youre starting to plan for retirement, you should consider the tax laws of the state you live in. Some have retirement tax laws that are very friendly for retirees, but others dont. Knowing what the laws apply to your state, or to a state you hope to move to, is key to getting ahead on retirement planning.

Delay Required Mandatory Distributions

Workers with traditional IRAs and 401s both face the same reality when it comes to taking mandatory distributions. The IRS requires that you begin taking distributions by April 1 of the year following your 72nd birthday. However, you may delay taking RMDs from your 401 if youre still working and own less than 5% of the company that sponsors the plan.

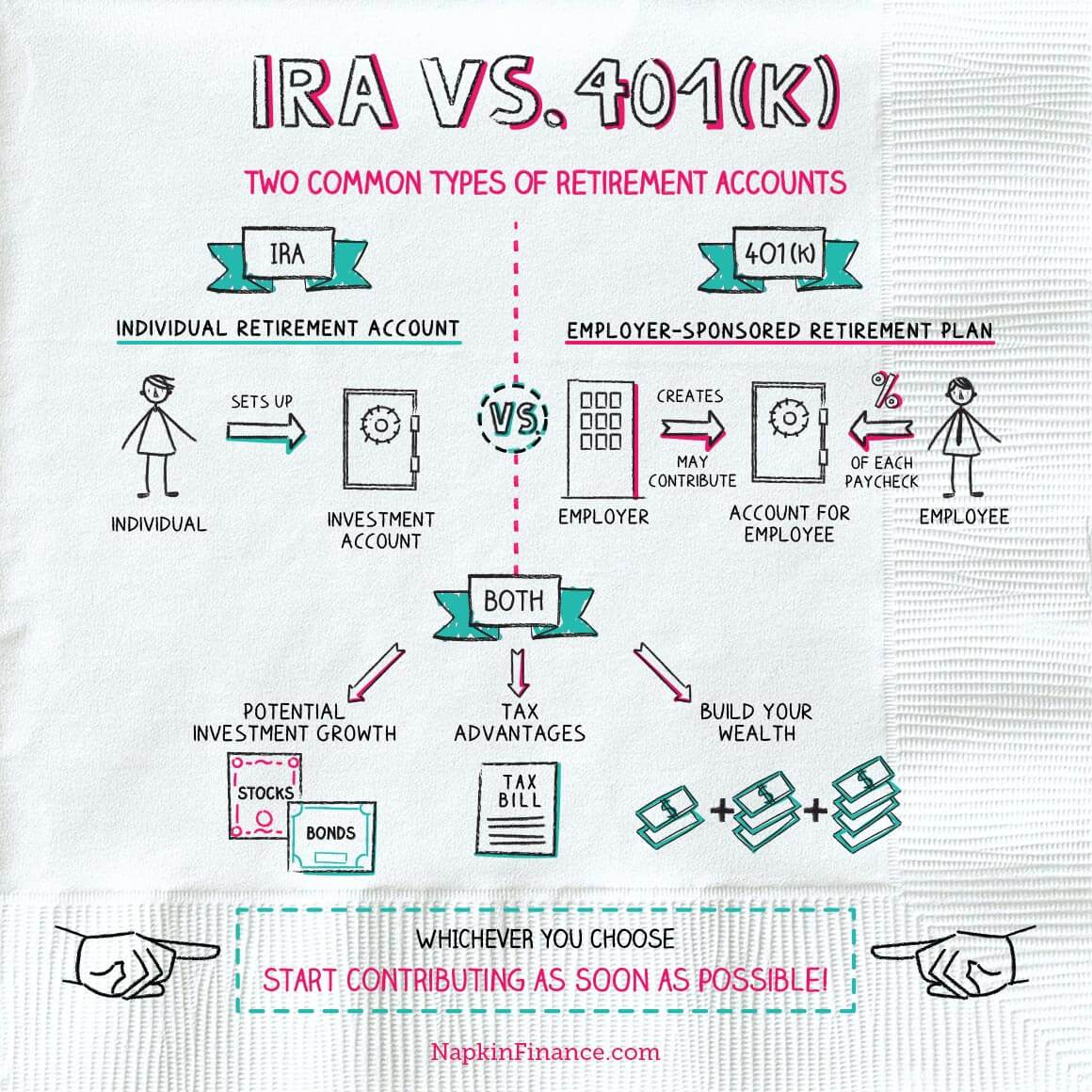

You May Like: What’s The Difference Between An Ira And A 401k Account

What Happens If I Cash Out My 401

If you simply cash out your 401 account, you’ll owe income tax on the money. In addition, you’ll generally owe a 10% early withdrawal penalty if you’re under the age of 59½. It is possible to avoid the penalty, however, if you qualify for one of the exceptions that the IRS lists on its website. Those include using the money for qualified education expenses or up to $10,000 to buy a first home.

How To Roll Over A Pension Into An Ira

Private sector employers that once offered workers traditional pensions, typically defined benefit plans, have been encouraging people to roll over their pensions into tax-advantaged plans like individual retirement accounts and 401s. If youre considering such a move, its important to understand your options, the pros and cons of each option and the tax-related rules about such a move. Before you do anything, though, consider working with a financial advisor who can help you make the best choices.

During the 1980s, 60% of private-sector companies offered their workers traditional pension plans, which were usually defined benefit plans. As the years have passed and employees stopped staying with the same company for life, the defined benefit plan is going the way of the dinosaur. Today, only 4% of private companies offer defined benefit plans.

As private-sector companies have discontinued their traditional pension plans, they have encouraged workers to launch a pension rollover to an IRA. Some have replaced the defined benefit plan with a 401, a defined contribution plan. They have encouraged their workers to either roll over their pension money to the new 401 or initiate a pension rollover to an IRA.

Recommended Reading: How To Convert 401k To Annuity

Rollover To A Roth Ira

Rollovers are a great time to alter the tax treatment offered by your retirement account, such as rolling your 401 funds over into a Roth IRA. Its a beneficial choice for many retirement savers, but it may be especially appealing for people with high incomes who may not be able to otherwise save in a Roth IRA.

This type of rollover can also help you avoid required minimum distributions that come even with a Roth 401.

However, there will most likely be tax consequences. Because traditional 401 contributions are made with pre-tax dollars, you will owe income taxes on the funds you convert to a Roth IRA, which holds after-tax contributions.

How Much Money Do I Need To Open A Vanguard Ira

At Vanguard, you can open an account with a $0 balance. But there are a few minimums to keep in mind as you begin to invest.

- Vanguard ETFs: You only need enough money to cover the price of 1 share, which can generally range from $50 to a few hundred dollars.

- Vanguard mutual funds: Some Vanguard mutual funds have a $1,000 minimum . Most of our other Vanguard mutual funds have a $3,000 minimum.

You May Like: Can You Rollover A 401k To Another 401 K

Option : Move The Money To Your New Employer’s 401 Plan

Moving money to your new employers 401 may be an option, depending on whether your current employer has a 401 plan and the terms of the plan. Like your former employer’s plan, many factors ultimately depend on the terms of your plan, but you should keep the following mind:

- Ability to add money: You’ll generally be able to add money to your new employer’s plan as long as you meet the plan’s requirements. This option also allows you to consolidate your retirement accounts, which may make it easier to monitor your investments and simplify your account information at tax time.

- Investment choices: 401 plans typically have a more limited number of investment options compared to an IRA, but they may include investments you can’t get through an IRA.

- Available services: Some plans may offer educational materials, planning tools, telephone help lines and workshops. Your plan may or may not provide access to a financial advisor.

- Fees and expenses: 401 fees and expenses often include administrative fees, investment-related expenses and distribution fees. These fees and expenses may be lower than the fees and expenses of an IRA.

- Penalty-free distributions: Generally, you can take money from your plan without tax penalties at age 55, if you leave your employer in the calendar year you turn 55 or older.

- Required minimum distributions: Generally, you must take minimum distributions from your plan beginning at age 72, unless you are still working at the company.

Reasons To Avoid A 401 Rollover

There are some cases when it doesnât make sense to roll your 401 into another account:

⢠IRAs are less protected. If you end up declaring bankruptcy later, a 401 offers more protection from creditors than an IRA.

⢠Higher fees. Depending on the situation you could end up with higher fees when you roll an old 401 into a new 401. Check the fees associated with the new account before you move your money.

⢠Limited investment choices. A new employerâs 401 might have more limited investment choices. If thatâs the case, you might want to stick with your existing 401 because the assets work better for your situation.

⢠A 401 gives you access to the rule of 55. With a 401, you might be able to begin taking withdrawals from your account penalty-free before age 59 ½ if you leave your employer after age 55. While IRAs donât have this feature, you may be able to emulate it by taking subsequently equal periodic payments from your IRA.

Read Also: How Do I Transfer 401k To Ira

Fund Your New Traditional Ira Account

To complete this step, youll need to work closely with the administrator of your old 401 account. Alternately, your employers HR department might also be able to assist you.

You must make a written request to have your balance transferred to the new IRA account you created in step 2. There may be either paper-based or online forms designated for such transfer requests. Youll need to fill them out and provide necessary account identification details, both for the existing and the new rollover account.

Typically, youll have the following options to fund your new account:

Transfer Funds From Your Old Qrp

Contact the plan administrator of the QRP you are rolling , and request a direct rollover distribution payable to Wells Fargo. Make sure to:

- Ask to roll over the funds directly to Wells Fargo for benefit of your name.

- Reference both your name and the account number of the new IRA you set up or your existing IRA.

They will either send the funds directly to Wells Fargo, or you will receive a check in the mail made payable to your IRA to deposit into your Wells Fargo IRA.

Don’t Miss: How Does A Solo 401k Plan Work

Do I Have To Pay Taxes When Rolling Over A 401

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

How To Roll Over A 401 To A Traditional Ira

If you decide to roll over your 401, carefully consider the tax impact of your actions. If you choose to roll it over into a traditional IRA, there is no immediate tax impact 100% of your 401 balance transfers tax-free into your traditional IRA account. A 401-to-Roth IRA rollover, however, will trigger an immediate tax liability.

When rolling over your 401 balance into an IRA, there may be a 20% withholding tax applied to that balance. And that will mean only 80% of your balance moves to your new IRA account. Moving less than 100% of your 401 means youll be subject to tax and may have to pay a 10% penalty on the 20% shortfall unless you make up for the shortfall using non-IRA or other non-pension funds. Here’s how to ensure a stress-free rollover of your 401 into a traditional IRA:

Read Also: Can I Invest In My Own 401k

Begin The Rollover Process

Youll have to fill out paperwork to conduct your rollover, and it may require some back-and-forth conversations with your providers. You have several options to actually move the money from the old provider to the new one, but your best option is a direct rollover.

In a direct rollover, the funds are sent straight from your 401 into your new account without you touching the funds. Its important that you specify a direct rollover so that you dont have the check made payable to you. You could trigger a mandatory 20 percent withholding for taxes, and the IRS charges a 10 percent bonus penalty on withdrawals made before age 59 1/2.

Decide What Kind Of Account You Want

Your first decision is what kind of account youre rolling over your money to, and that decision depends a lot on the options available to you and whether you want to invest yourself.

When youre thinking about a rollover, you have two big options: move it to your current 401 or move it into an IRA. As youre trying to decide, ask yourself the following questions:

- Do you want to invest the money yourself or would you rather have someone do it for you? If you want to do it yourself, an IRA may be a good option. But even if you want someone to do it for you, you may want to check out an IRA at a robo-advisor, which can design a portfolio for your needs. But do-it-for-me investors may also prefer to make a rollover into your current employers 401 plan.

- Does your old 401 have low-cost investment options with potentially attractive returns, and does your current 401 offer similar or better options? If youre thinking about a rollover to your current 401 plan, youll want to ensure its a better fit than your old plan. If its not, then a rollover into an IRA could make a lot of sense, since youll be able to invest in anything that trades in the market. Otherwise, maybe it makes sense to keep your old 401.

- Does your current 401 plan offer access to financial planners to help you invest? If so, it could make sense to roll your old 401 into your new 401. If you move money to an IRA, youll have to manage it completely and pick investments or hire someone to do so.

Also Check: When I Leave A Job What Happens To My 401k