Do I Have To Pay Taxes When Rolling Over A 401

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options arenât usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

Your 401 Rollover Options

Dont worry you have choices about what happens once you lose access to your employer-sponsored retirement plan. Your 401 rollover can head in a few different directions:

-

Rollover to a new 401 plan

-

Rollover to an IRA

-

Lump-sum distribution

-

Keep the 401 plan with your former employer

In the event that youre starting a new job and currently have a 401 plan through your employer, you may be able to roll that over directly into your new companys 401 plan. But that isnt always an option.

If youre wondering, Can I rollover my 401k to an IRA? The answer is yes. You always have the option to transfer the funds from your existing 401 plan into an IRA or a Roth IRA.

If you dont want to roll the funds over, you can do a lump sum distribution, meaning you can take your money out of the account. However, a lump sum distribution comes with some drawbacks. Not only will taking the money out instead of rolling it over cause you to lose out on the opportunity to grow your funds, but youll also get hit with a 20% withholding tax if youre under 59 1/2.

While its not a guarantee, many companies actually keep your former 401 with them even after you leave your job. You can speak with your plan sponsor about your options for remaining in the plan.

Read Also: What Is A Safe Harbor 401k Plan

Option : Roll The Money Into Your New Employers Plan

Rolling your money over to your new 401 plan has some benefits. It simplifies your life because your investments will be in one place and youll also have higher contribution limits with a 401 than you would with an IRA. But there are lots of rules and restrictions with rolling money over into your new employers plan, so its usually not your best option. Which brings us to . . .

Net Unrealized Appreciation And Company Stock In A 401

If you have company stock in a 401, it could save you significant money on taxes to transfer those shares into a taxable brokerage account to take advantage of net unrealized appreciation, or NUA. NUA is the difference between what you paid for company stock in a 401 and its value now.

For example, if you paid $20,000 for company stock and its now worth $100,000, the NUA is $80,000.

The benefit of the NUA approach is that it helps you avoid paying ordinary income tax on these distributions of your own companys stock from your retirement account. That can be up to 37 percent, which is now the highest tax bracket, says Landsberg.

Instead, youll enjoy capital gains tax treatment, which even at the highest tax bracket is only 20 percent. High earners, however, will be subject to a bonus 3.8 percent net investment income tax. And an NUA may be subject to a 10 percent early withdrawal tax if you move funds prior to age 59 1/2.

Landsberg says NUA makes the most sense when the difference in tax rates is higher.

Net unrealized appreciation is a very powerful tool, if used correctly, Landsberg says. So you can get creative and potentially have a pretty nice windfall if you use the NUA rules correctly.

Recommended Reading: How Much Does A 401k Cost A Small Business

Background Of The One

Under the basic rollover rule, you don’t have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you can’t make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .

Rollover In Retirement Accounts

With a direct rollover, the retirement plan administrator may pay the plans proceeds directly to another plan or to an IRA. The distribution may be issued as a check made payable to the new account. When receiving a distribution from an IRA through a trustee-to-trustee transfer, the institution holding the IRA may distribute the funds from the IRA to the other IRA or a retirement plan.

In the case of a 60-day rollover, funds from a retirement plan or IRA are paid directly to the investor, who deposits some or all of the funds in another retirement plan or IRA within 60 days.

Taxes are typically not paid when performing a direct rollover or trustee-to-trustee transfer. However, distributions from a 60-day rollover and funds not rolled over are typically taxable.

Another type of retirement account rollover has emerged as a financing alternative for those who are starting a business. When executed properly, a rollover for business startups allows entrepreneurs to invest their retirement savings into a new business venture without incurring taxes, early withdrawal penalties, or loan costs. However, a ROBS transaction can be complicated to execute, so it’s important to work with a competent provider.

Read Also: Can You Use 401k To Pay Taxes

How 401 Rollovers Work

In most cases, you can transfer the funds directly from your old retirement account to your new one. You may even be able to transfer all your investments intact, without liquidating them first. If not, the account administrator can send cash via wire or ACH transfer.

Alternatively, you can cash out all your investments, withdraw the money from your old retirement plan, and deposit it into your IRA or your new employer-sponsored plan. Its called an indirect rollover, and the plan administrator may withhold 20% of your balance for taxes. Youll get it back as a tax refund if you deposit the full amount in your new retirement account.

Beware that if you fail to deposit the funds within 60 days however, the IRS typically hits you with the 10% early withdrawal penalty.

If you sell your positions and transfer or redeposit cash, make sure you reinvest the money based on your target asset allocation.

Reasons To Roll Your Money Into An Ira

When you have a lot of retirement accounts in a lot of different places, its hard to a) wrap your mind around where you actually stand and b) make sure that everything you own is properly diversified. If you have all your retirement accounts in an IRA, on the other hand, balancing your investments and forecasting whether youre on track to hit your goals, like we do for you at Ellevest is a lot easier.

Another big reason why many people choose to roll an old 401 into an IRA is to have more choice. When you can decide for yourself which company youll open your IRA with , you often have greater control over things like how much you pay in fees and the types of businesses your money is supporting. With a 401, youre stuck with whatever investment provider and investment options your employer picks for you .

Also, if youre trying to make certain special purchases, the government lets you take money out of an IRA before retirement without facing the 10% early withdrawal penalty. These include things like college costs and your first home. Not so with a 401.

Recommended Reading: How Much Income Will Your 401k Provide

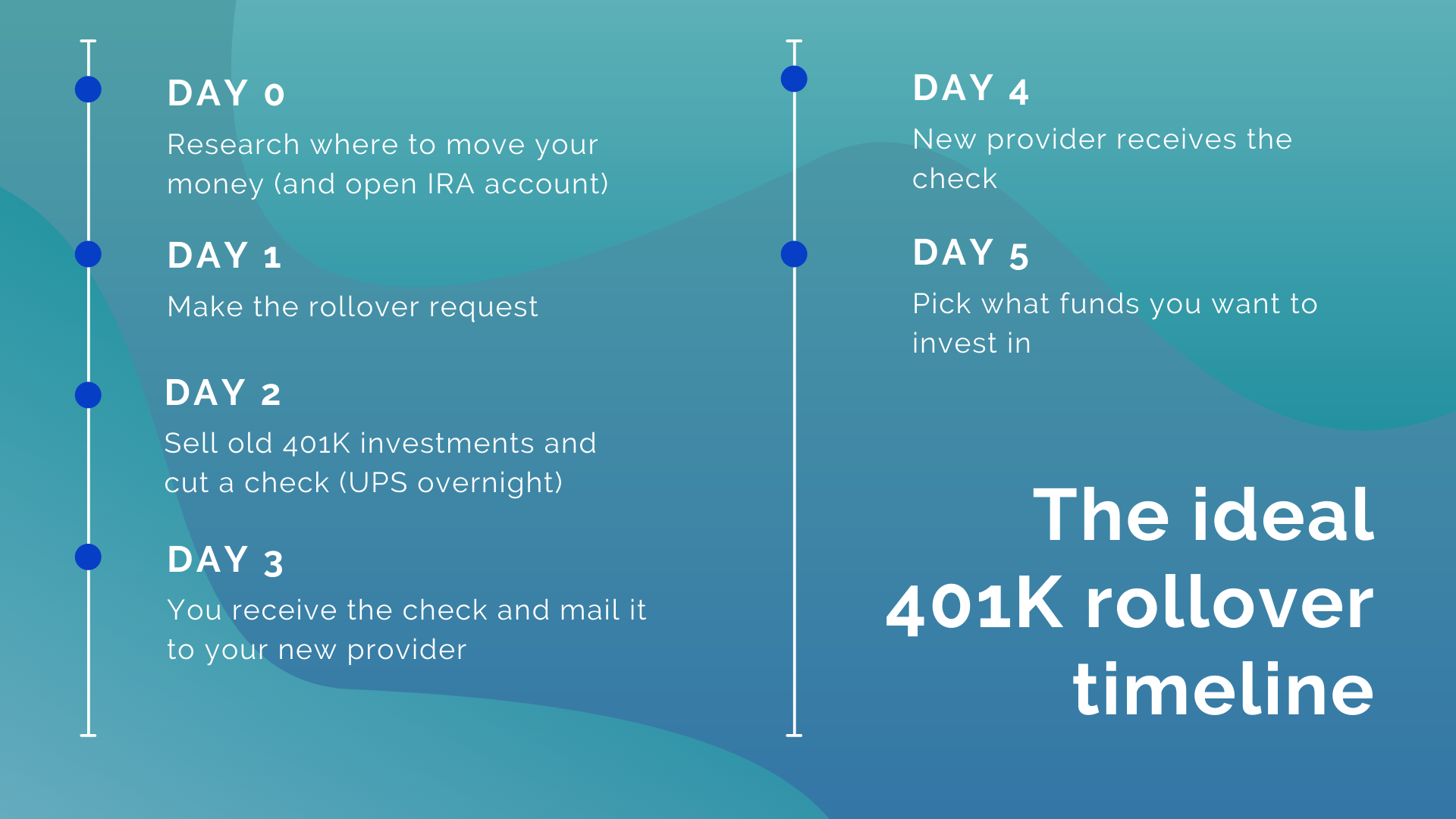

How Long Does It Take To Rollover A 401

There is no one-size-fits-all answer when it comes to rolling over a 401. The amount of time it will take to complete the rollover process will depend on several factors, including the type of 401 you have, the financial institution where your 401 is held, and the financial institution where you want to rollover your 401.

If you have a traditional 401, you will likely be able to complete the rollover process within a few weeks. However, if you have a Roth 401, the rollover process may take a bit longer, as special rules apply to Roth 401s.

Finally, its important to note that you may be subject to taxes and penalties if you do not complete the rollover process within 60 days. Therefore, its essential to work with a financial advisor or tax professional to ensure that you complete the rollover process correctly and promptly.

Rolling Over Your 401 Into An Ira Account Comes With Many Benefits

A Tea Reader: Living Life One Cup at a Time

When you change jobs, you generally have four options for your 401 plan. One of the best options is doing a 401 rollover to an individual retirement account . The other options include cashing it outand pay taxes and a withdrawal penalty, leave it where it isif your ex-employer allows this, or transfer it into your new employer’s 401 planif one exists. For most people, rolling over a 401 for those in the public or nonprofit sector) is the best choice. This article explains why and how to go about it.

Read Also: Can I Rollover A 401k To A 403b

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

How To Report The Rollover On Your Tax Return

- You must report any transaction when you submit your annual tax return for both direct and indirect rollovers.

- Your IRA brokerage will send you a Form 1099-R that will show how much money you took out of your IRA.

- On your 1040 tax return, report the amount on the line labeled IRA Distributions. The Taxable Amount you record should be $0. Select rollover.

Read Also: How To Find Lost 401k

Keeping The Current 401 Plan

If your former employer allows you to keep your funds in its 401 after you leave, this may be a good option, but only in certain situations. The primary one is if your new employer doesn’t offer a 401 or offers one that’s less substantially less advantageous. For example, if the old plan has investment options you cant get through a new plan.

Additional advantages to keeping your 401 with your former employer include:

- Maintaining performance:If your 401 plan account has done well for you, substantially outperforming the markets over time, then stick with a winner. The funds are obviously doing something right.

- Special tax advantages: If you leave your job in or after the year you reach age 55 and think you’ll start withdrawing funds before turning 59½ the withdrawals will be penalty-free.

- Legal protection: In case of bankruptcy or lawsuits, 401s are subject to protection from creditors by federal law. IRAs are less well-shielded it depends on state laws.

You might want to stick to the old plan, too, if you’re self-employed. It’s certainly the path of least resistance. But bear in mind, your investment options with the 401 are more limited than in an IRA, cumbersome as it might be to set one up.

Some things to consider when leaving a 401 at a previous employer:

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 does protect up to $1.25 million in traditional or Roth IRA assets against bankruptcy. But protection against other types of judgments varies.

Tips On Rolling Over Your 401

- Work with a financial advisor to optimize your retirement planning. If youre unsure where to start, SmartAssets financial advisor matching tool can help you find professionals in your area. Get started now.

- Whether youre contemplating a conventional rollover or an in-service transfer, understanding how much youre paying in fees and other charges is an important part of the process. Review your current plans fee disclosure and research the fees associated with funds youre interested in for your IRA.

Also Check: Why Is A 401k Good

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Also Check: Where Can I Find My 401k Statement