What To Consider Before A Pension Rollover To An Ira

According to the IRS, you can roll over a qualified pension plan to any type of retirement account. But, even if your rollover meets the considerations of being a qualified plan and if you are leaving the company or the company is closing its pension plan, there are other factors you should consider when deciding whether to roll over your pension plan to an IRA.

First, you generally have a wider variety of investment options in an IRA than in a company pension plan. You can choose your own investments, taking into consideration your individual risk tolerance, investment goals and time horizon. Types of investments would include stocks, bonds and mutual funds, but youre not limited to just those.

When do you plan to retire? Under a company pension plan, you can take a distribution from your retirement account at age 55. If you do a pension rollover to an IRA, you will have to wait until you are 59.5 to take a penalty-free distribution. The penalty is 10% if you take a distribution before 59.5. There are exceptions to this rule. If you have qualified education expenses, medical expenses or if you are a first-time homebuyer, you may be able to make a withdrawal without a penalty

You can avoid paying taxes on the rollover if your pension is going to a traditional IRA. You only pay taxes when you make a withdrawal if the withdrawal is going to the traditional IRA. This is different for a Roth IRA. If you set up a Roth IRA, you pay taxes when the pension is rolled over.

Can You Roll An Ira To Your 401

A frequently asked question by some investors is, âCan I roll an IRA into a company 401?â The answer is yesâIRA rollovers to 401s are permissible by the IRS, as long as the employerâs plan allows for it. As shown in the IRS rollover chart, investors are allowed to move money from an IRA into a 401 account. And when done correctly, investors can do this without incurring taxes, since the funds are going from one tax-advantaged retirement account to another.

Similar questions about this type of rollover include SIMPLE IRAs, Roth IRAs, and 401s:

- Can you roll a SIMPLE IRA into a 401? Yes, but investors must have had the SIMPLE IRA for at least two years. The start date for the two-year waiting period is when investors began participating in the SIMPLE IRA.â

- Can you roll a Roth IRA into a 401? No, the IRS doesnât allow this type of rollover because the contributions received different tax treatment. Roth IRA contributions are made with after-tax funds. The earnings are withdrawn tax-free during retirement, so rolling that money into a 401 would forgo the benefits of the Roth IRA in the first place. â

- Can you roll a 401 into an IRA without penalty? Yes, although investors would lose out on features unique to a 401, such as taking out a 401 loan. They would gain more control over fees and investments.

Roll It Over To Your New 401

You may be able to roll your old 401 funds over into your new 401 if your company offers one. But first, you must make sure you’re eligible to contribute to your new 401 and the plan allows rollovers. Some companies require their employees to work for the company for a certain number of months before they’re eligible to participate in the 401. If you can’t contribute right away, you may have to wait to do your rollover.

In addition, some plans don’t allow you to roll over funds from an old 401. If this isn’t a possibility for you, you will either have to leave your savings in your old 401 or transfer it to an IRA, as discussed below.

If you decide to roll your old 401 funds into your new 401, you’ll need to choose between a direct and an indirect rollover. A direct rollover is the best choice for most people. To do this, you provide your old 401 provider with information about where you’d like your funds sent and it handles the transfer for you. You will need to pay a small, one-time fee for this and fill out a form with your old 401 provider.

An indirect 401 rollover is where you cash out your old 401 and then deposit the funds into the new account yourself. This is riskier than a direct rollover because if you fail to deposit the funds in the new account within 60 days, the government considers your withdrawal a distribution. You’ll pay taxes on it, plus a 10% early withdrawal penalty if you’re under 59 1/2.

Read Also: How To Roll Ira Into 401k

Take A Cash Distribution

While withdrawing all of your money may seem like a good idea in the short-term, be sure you understand the consequences before you do. Money withdrawn will be taxable and subject to a mandatory 20% federal withholding rate. You may also face early withdrawal penalties.

- Pros

-

- Having the cash could be helpful if you face an extraordinary financial need.

- Cons

-

- Taxes and penalties for taking a cash distribution may be substantial.

- Withdrawals before age 59½ may be subject to a 10% early withdrawal penalty and will be taxed as ordinary income.

- Your savings will no longer grow tax-deferred.1

- Withdrawing your money may impact whether you have enough money for retirement.

How To Rollover An Ira To 401

Youve opened and contributed to a traditional IRA, invested it, waited several months, and youre now ready to exercise the option to convert it into a Roth IRA. Now, because youve read the blog on how to do a backdoor Roth IRA correctly, you also know that before you do that Roth conversion, you need to move any pre-tax IRAs out of the IRA into a 401 or similar plan. This includes IRAs like a SEP IRA or a rollover IRA. While a reverse rollover may not be common, there are times a IRA to 401 rollover makes sense. In this blog, we will explain the reasons for and against an IRA to a 401 rollover and how you can do it.

Read Also: Can You Pull From Your 401k To Buy A House

Frequently Asked Questions About Annuity Rollovers

A financial advisor can help determine which type of annuity is best suited for you and whether you should purchase any specific riders to modify the contract to meet your needs.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once youve been matched, consult for free with no obligation.

Keeping Your Current 401 Plan

First off: Whatever you do, dont take the cash out. This means cashing out your 401 and depositing that amount into your checking account and using it toward other expenses. This is a bad idea. If you do, youll get hit with a penalty from the IRS, and the money will count as income that increases your federal taxes for the year. Although it may be tempting, try other options instead.

One of the easiest things you can do instead is simply leave your current 401 balance where it is, even though you wont be able to make any additional contributions.

This option might be right for someone who is happy with the fees and performance of their current 401 plan and who doesnt have another retirement account to move the balance to.

But this option may not be the best because in a decade or two, you may have a handful of 401 plans sitting with previous employers, making them easy to lose track of and difficult to manage.

Also, not every employer allows you to keep your 401 open after you leave. Some might have a minimum balance requirement or require that you rehome your retirement funds into a new account with the same investment manager.

Also Check: Can You Get Your 401k If You Quit Your Job

Should I Keep My 401k With My Old Employer

Leave It With Your Former EmployerIf you have more than $5,000 invested in your 401, most plans allow you to leave it where it is after you separate from your employer. 2 If you have a substantial amount saved and like your plan portfolio, then leaving your 401 with a previous employer may be a good idea.

Millions Of 529 Accounts Hold Billions In Savings

There were nearly 15 million 529 accounts at the end of last year, holding a total $480 billion, according to the Investment Company Institute. Thats an average of about $30,600 per account.

529 plans carry tax advantages for college savers. Namely, investment earnings on account contributions grow tax-free and arent taxable if used for qualifying education expenses like tuition, fees, books, and room and board.

However, that investment growth is generally subject to income tax and a 10% tax penalty if used for an ineligible expense.

This is where rollovers to a Roth IRA can benefit savers with stranded 529 money. A transfer would skirt income tax and penalties investments would keep growing tax-free in a Roth account, and future retirement withdrawals would also be tax-free.

Don’t Miss: How To Transfer Your 401k From One Company To Another

Rollover To A Roth Ira

Rollovers are a great time to alter the tax treatment offered by your retirement account, such as rolling your 401 funds over into a Roth IRA. Its a beneficial choice for many retirement savers, but it may be especially appealing for people with high incomes who may not be able to otherwise save in a Roth IRA.

This type of rollover can also help you avoid required minimum distributions that come even with a Roth 401.

However, there will most likely be tax consequences. Because traditional 401 contributions are made with pre-tax dollars, you will owe income taxes on the funds you convert to a Roth IRA, which holds after-tax contributions.

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. Itâs also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, itâs a good way to save money, stay organized and make your money work harder.

Also Check: Can You Transfer Money From 401k To Roth Ira

Can You Roll Over An Ira Into A 401

Most of the time, rollovers involve moving an old 401 into an IRA of your choice. While not as common, its also possible in some cases to roll an existing IRA into a 401 plan.

Here, well review some of the common instances where this might make sense, and offer guidance on how to make the move if you decide its right for you.

How To Start Saving For Retirement

One of the best ways to start saving for retirement is to make sure youre enrolled in your employers 401 plan. You can decide what percentage of each paycheck youd like to defer into this account and some companies will even match all or a portion of what you contribute so you grow your balance even faster. Pay extra close attention to the terms required for matching, though, as some employers have a minimum percentage amount that is required. For example, if your employer matches contributions of at least 3%, youll need to contribute at least 3% of each paycheck to your 401 in order to receive the match.

401 accounts also come with annual maximum contribution limits that change slightly each year for 2022, youre allowed to contribute up to $20,500. Keep in mind, however, that it can be very difficult to max out your account. If youre not able to hit the $20,500 mark, make sure youre at least contributing enough to receive your employers match.

Another way to make sure youre growing your retirement savings is to contribute to a Roth IRA, a powerful tool you can use when it comes to saving for retirement since you can contribute after-tax money that gets invested and grows over time. When you withdraw the money at retirement anytime after age 59 1/2 you wont have to worry about paying any taxes on it either.

Terms apply.

Also Check: How Do You Take Money Out Of 401k

How To Rollover An Employer 401k To The Solo 401k

Have funds at a current or previous employer 401k? Learn how you can rollover those funds to your Solo 401k and get them into your control. If you are an independent thinker, the Solo 401k is probably the best retirement account for you. Its definitely the best retirement plan for the self-employed and freelancers. Saving for retirement doesnt involve a one-size-fits-all plan. Since every situation is unique, its important to look for the retirement account that best lines up with your job situation and future goals. The Solo 401k offers the most flexibility and highest contributions allowed under the tax laws. That makes it the right choice for the person wanting full control of their future and especially control of their retirement future.

There are several ways to open and/or fund your Solo 401k. A rollover from an employer 401k is among the fastest and easiest. When you rollover funds from a current or previous employer to your Solo 401k, its important that it be done correctly to avoid taxes and penalties. If the rollover is done wrong, you can trigger an accidental distribution . To assure all of the forms are filled out correctly, we provide an easy-to-use rollover request generator that creates a customized rollover to transfer funds from another existing account into your Solo 401k.

How Often Can I Roll Over My Ira

Investors often ask how many times you can roll over an IRA. For this, the magic number to keep in mind is one. IRA rollovers can be completed once in a 12-month rolling period, not a calendar year, regardless of the IRA account type. Even if you hold multiple retirement accounts, you are only eligible to make one rollover per the 12-month regulation period set by the IRS. Violating these terms can result in a taxable distribution and a 10 percent penalty if the individual is under the age of 59 ½.

When it comes to where to rollover an IRA, investors have several options. Many investors choose to roll over a Roth IRA or other account into another low-risk investment and savings option such as a self-directed IRA. This process varies depending on the investment type and comes with a variety of tax implications depending on whether money is changing from pre-tax to post-tax standing.

Also Check: What Can You Do With Your 401k

Recommended Reading: What Happens To My 401k If I Get Fired

Invest Your Newly Deposited Funds

You’ll have to choose investments in your new IRA so your money can grow. Make sure to maintain an appropriate asset allocation given your age, and consider your risk tolerance.

Finally, when your new IRA has been opened, be sure to read up on common IRA mistakes to avoid, such as forgetting required minimum distributions, not designating beneficiaries, and trading too often in the account.

Should You Choose A Simple Ira

If your employer offers a SIMPLE IRA and youâre eligible for the plan, itâs a good idea to participate, especially if the employer provides matching contributions. Matching contributions are free money, and with a SIMPLE IRA that money is immediately yours as soon as it hits your account.

If youâre an employer with 100 or fewer employees and want to provide an employee retirement benefit, a SIMPLE IRA can be a solid choice that allows you to attract high-quality workers without some of the paperwork and hassle that can come with a 401. However, itâs important to review your options and consider whether it makes sense for you. Remember that youâll likely have to provide some amount of employer contribution as long as you have a SIMPLE IRA retirement plan.

Also Check: How To Check For 401k

You May Like: Can I Transfer Part Of My 401k To An Ira

Rollovers Of Retirement Plan And Ira Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

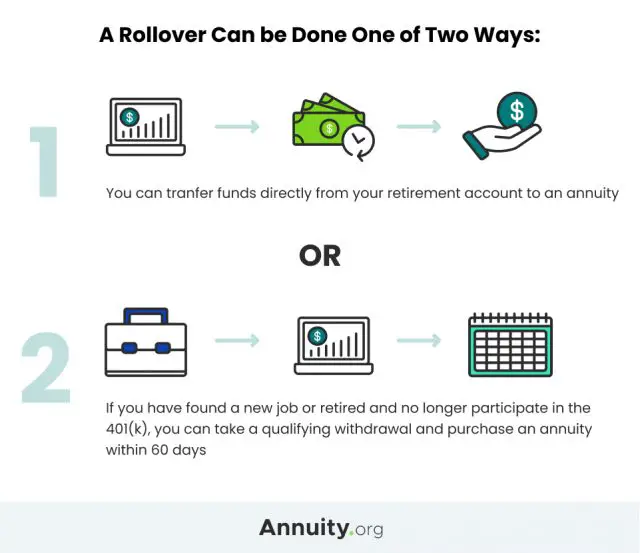

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

The Rollover ChartPDF summarizes allowable rollover transactions.

You Want To Relax Early

Proponents of the FIRE movement invest aggressively so they can become work-optional in their 50s or even earlier.

If thats your plan, youll want at least a portion of your investments to be in an account thats more accessible than a 401, which you cannot tap without penalty before the age of 59 ½. A strategy known as a Roth conversion ladder involves converting 401 funds into a Roth IRA over a period of years.

Its a bit complex, says Hernandez. Theres a small number of people that it could make sense for. Its important to understand the tax impact.

Recommended Reading: What Is The Best 401k Match