Deferral Limits For 401 Plans

The limit on employee elective deferrals is:

- $22,500 in 2023 , subject to cost-of-living adjustments

Generally, you aggregate all elective deferrals you made to all plans in which you participate to determine if you have exceeded these limits. If a plan participants elective deferrals are more than the annual limit, find out how you can correct this plan mistake.

Withdrawing Funds Between Ages 55 And 59

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan after leaving your job in order to access them penalty-free, but there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure you understand the rules around the age requirement for penalty-free withdrawals. The age 55 rule won’t apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in this case.

The age-55-and-up retirement rule won’t apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59½.

Can I Contribute To My Ira After Retirement

- Traditional IRA

Should you fund your retirement even after you retire? The idea may seem counterintuitive, but for retirees still working part time, continuing to seed an individual retirement account can ensure that they have enough money to enjoy retirement long into the future. Heres what you should know about contributing to an IRA after youre retired.

You May Like: Can I Move My 401k

Investing In A Business

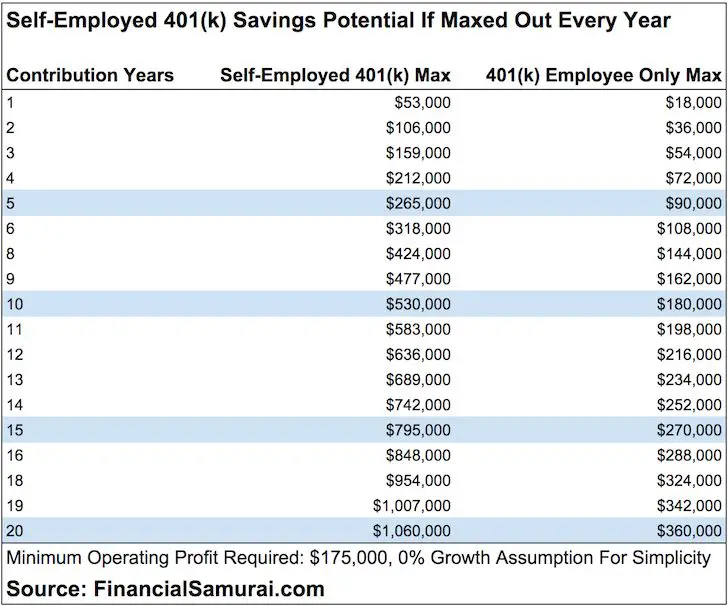

“An employee who has maxed out their 401 might want to consider investing in a business,” says Kirk Chisholm, wealth manager at Innovative Advisory Group in Lexington, Massachusetts. “Many businesses, such as real estate, have generous tax benefits. On top of these tax benefits, business owners can decide what type of retirement plan they want to create. If, for example, they wanted to set up a 401 plan for their company, they would be able to expand their 401 contributions beyond what they may have at their employer.”

Here Are Your Options With Your 401 After You Leave A Job

Image source: www.taxcredits.net via Flickr.

Can you contribute to your 401 after you quit or leave your job? The short answer is “no.” A 401 is designed to make it easier for employers to help their employees save for retirement, and if you are no longer an employee, your former employer has no need to do so.

However, when you leave a job, you have several options for the money you’ve accumulated in your 401, and it’s important to consider all of them to come up with the best plan for you.

Option 1: Leave it aloneEven though you can no longer contribute to your former employer’s plan, you may be able to leave the money that’s already been contributed in the plan. If you have more than $5,000 in your account, the plan’s administrator is required to give you the option to leave your account there. Some other plans have a lower threshold or none at all, so check with your plan administrator if this is an option you may be interest in.

There are some good reasons to consider leaving your 401 where it is. Just to name a few:

- 401 investment funds can have lower fees than mutual funds that ordinary investors can buy .

- If you don’t want the homework involved with researching individual stocks, bonds, and funds, or simply don’t trust yourself to make good investment choices, a 401 is a headache-free way to invest.

- With a 401, you may have access to professional financial planning advice for free.

Read Also: Can You Borrow From Your 401k

Contributions And The Age 705 Rule

The IRS prevents contributions to your traditional IRA once you reach age 70.5 or after. Usually, once you begin to take the RMD for your employer sponsored 401 you cannot contribute any more money to it. If you reach 70.5 and have not yet retired, you and your employer are still allowed to make contributions to your 401 account. However, the mandatory distribution requirement for that particular 401 account is waived.

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

Also Check: How Do I Invest In My 401k

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

Will You Have Other Sources Of Income

To know how much you’ll need to draw from your 401, you’ll also need to consider other potential sources of income. If you have enough income from other sources, such as part-time work, a spouse’s income, a pension or Social Security benefits, it’s possible you won’t need to draw from your 401 quite yet. In this case, you can keep your money invested in the 401 plan or transfer it to an IRA until you need it.

You May Like: How To Take Money Out Of 401k Early

How Long Can A Company Hold Your 401 Funds When You Withdraw

When you leave a job, you can decide to cash out your 401 money. Generally, when you request a payout, it can take a few days to two weeks to get your funds from your 401 plan. However, depending on the employer and the amount of funds in your account, the waiting period can be longer than two weeks.

Each company has different time frames for making distributions when you request a payout. Check the waiting period of your employerâs 401 plan by checking the summary plan description given by the company. The waiting period starts when you request a payout up to when you receive the cash distribution, or funds are rolled over to an IRA or 401.

Cash Preservation When Working After 70

The rules of the game may change when you hit the milestone age of 72 when you are required to take distributions from your retirement accounts, which makes your taxable income soar. But you can still reap the tax benefits of putting money into a retirement account until you formally and fully retire.

If you find yourself still working at this point in your life, you are probably either trying to seal a crack in your nest egg or you are one of those people who will only be ready to retire when absolutely necessary.

Either way, knowing you have options can make a difference in your bottom line.

Recommended Reading: Can You Move Money From One 401k To Another

How A 401 Works After Retirement

There are 401 plan rules that designate the age you are eligible to get your retirement funds and how theyre distributed. Here are a few facts to keep in mind:

- The IRS lets people who retire after the age of 59½ begin taking money out of their 401.

- You are still eligible to withdraw funds from your plan before you turn 59½, but doing so will result in a 10% early withdrawal penalty in most circumstances.

- Those who are 55 and older but not yet 59½ may avoid the 10% early withdrawal penalty with their retirement plan. This applies if you have money in a 401 from an employer you just left.

- You can receive your retirement plan funds via lump-sum distribution or annuity or installment payments after you turn 59½.

- A lump-sum distribution gives you everything youve earned during your plan at once.

- An annuity or installment plan, on the other hand, allows you to receive incremental payments for a set period.

- You dont need to start taking money from your 401 as soon as you retire. Some people prefer to work past the age of 59½, for example, and forgo plan distributions until later.

Dont Miss: Fidelity 2030 Target Retirement Fund

Here’s How Much That You And Your Employer Can Contribute To Your Account

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

If your employer offers a 401 plan, it can be one of the easiest and most effective ways to save for your retirement. But while a major advantage of 401 plans is that they let you put a portion of your pay automatically into your account, there are limits on how much you may contribute.

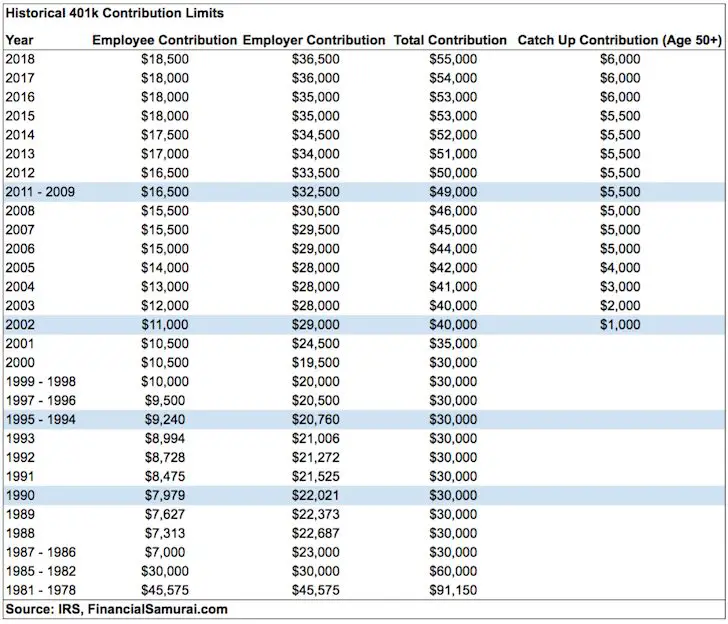

Each year, usually in October or November, the Internal Revenue Service reviews and sometimes adjusts the maximum contribution limits for 401 plans, individual retirement accounts , and other retirement savings vehicles. In October 2022, the IRS made updates for 2023.

Read Also: Why Cant I Take A Loan From My 401k

Overall Limit On Contributions

Total annual contributions to all of your accounts in plans maintained by one employer are limited. The limit applies to the total of:

- elective deferrals

The annual additions paid to a participants account cannot exceed the lesser of:

However, an employers deduction for contributions to a defined contribution plan cannot be more than 25% of the compensation paid during the year to eligible employees participating in the plan .

There are separate, smaller limits for SIMPLE 401 plans.

Example 1: In 2020, Greg, 46, is employed by an employer with a 401 plan, and he also works as an independent contractor for an unrelated business and sets up a solo 401. Greg contributes the maximum amount to his employers 401 plan for 2020, $19,500. He would also like to contribute the maximum amount to his solo 401 plan. He is not able to make further elective deferrals to his solo 401 plan because he has already contributed his personal maximum, $19,500. He would also like to contribute the maximum amount to his solo 401 plan.

Roll Your Balance Over Into A Roth Ira

From a tax standpoint, this would be the same as a rollover to a Roth 401, as described above.

The key difference is that you would be responsible for finding your own investment options, rather than choosing from the menu of a 401 plan. If you are fully retiring, this may be a good option for managing your savings through your retirement years.

You May Like: Can You Transfer 401k To Another 401 K

Why The 401k Is A Bad Investment

Theres more than a few reasons that I think 401s are a bad idea, including that you give up control of your money, have extremely limited investment options, cant access your funds until youre 59.5 or older, are not paid income distributions on your investments, and dont benefit from them during the most

How much money should you have in your 401K by 55?

Assumptions vs. Reality: The Actual 401k Balance by Age

| AGE | |

|---|---|

| $216,720 | $64,548 |

What are some reasons why you or your friends might continue to work past the age of retirement?

Financial Reasons to Work

- Your Savings Arent Substantial. Saving for retirement can be difficult, and many people simply have nothing set aside.

- You Want to Delay Receivng Social Security.

- You Need Health Insurance.

- Your Investments Have Lost Value.

- You May Be Able to Receive Your Pension While Still Working.

Can you still contribute to a 401k After retirement?

If you want to keep contributing to your retirement savings but cannot contribute to your 401 after retiring from your job at that company, you can elect to roll over your account into an IRA. Previously, you could contribute to a Roth IRA indefinitely, but could not contribute to a traditional IRA after age 70½.

You Have Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into either your new employers plan or an individual retirement account . You can also take out some or all of the money, but that could mean serious tax consequences. Make sure to understand the particulars of the options available to you before deciding which route to take.

You May Like: How To Cash Out 401k With Fidelity

What Is A Withdrawal Buckets Strategy

With the buckets strategy, you withdraw assets from three buckets, or separate types of accounts holding your assets.

Under this strategy, the first bucket holds some percentage of your savings in cash: often three-to-five years of living expenses. The second holds mostly fixed income securities. The third bucket contains your remaining investments in equities. As you use the cash from the first bucket, you replenish it with earnings from the second and third buckets.

Potential advantages: This approach allows your savings to continue to grow over time. Through constant review of your funding, you also benefit from a sense of control over your assets.

Potential disadvantages: This approach is more time-consuming.

How Much Money Do I Need To Open A Vanguard Ira

At Vanguard, you can open an account with a $0 balance. But there are a few minimums to keep in mind as you begin to invest.

- Vanguard ETFs: You only need enough money to cover the price of 1 share, which can generally range from $50 to a few hundred dollars.

- Vanguard mutual funds: Some Vanguard mutual funds have a $1,000 minimum . Most of our other Vanguard mutual funds have a $3,000 minimum.

Read Also: How Do I See How Much Is In My 401k

Example: Taking Rmds From A Roth 401

An individual who could take a look at this strategy is someone who is older than 72, self-employed, and making contributions to a Roth 401. In this case, if they alter their savings strategy by contributing to a pretax 401 and converting an outside IRA, then they might be able to reduce their state income tax burden and avoid having to take RMDs from their Roth 401, which is an after-tax account.

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Recommended Reading: What Happens To Unclaimed 401k Money