What’s The Bottom Line About 401s

Ultimately, a 401 plan could be the right method of saving if you want to reach your retirement goals on time and not sweat finances too much. 401 plans are advantageous for many Americans, so consider contributing to one if you haven’t already.

That said, 401 plans are just one of the retirement options you can pursue. IRAs and other retirement plans might be better, depending on your circumstances.

Looking for more info to expand your financial and professional knowledge? Explore Entrepreneur’s Money & Finance articles here.

How To Open A 401k Without An Employer

How do you open a 401 account without an employer plan? Many companies donât offer a 401. But there are many alternatives to save for retirement.

The 401 retirement plan is the most common way in which Americans save for retirement. However, according to a study by the US Census Bureau, only 14% of US employers offer a 401 through their company. That still results in over 70% of Americans contributing to a 401 plan. But if you find yourself working for a company that doesn’t offer a 401 plan, you might not know how to open a 401 without an employer plan.

If your company doesnât offer a 401 plan or you are self-employed, youâll need to join a separate financial institution. There youâll be able to open a 401, IRA, or any other retirement plan you choose.

In addition to these alternatives to 401s, you’ll want to rollover your old 401s to these accounts. Consolidating your 401s will help keep your retirement properly managed and accounted for.

What Is A Qualified Domestic Relations Order

A qualified domestic relations order is a judicial order entered as part of a property division in a divorce or legal separation. Specifically, the QDRO divides retirement and pension plans such as 401, 403, and 457 as well as federal and state civil service plans and IRAs. Further, the QDRO formally recognizes an alternate payees right to receive, or assigns to an alternate payee the right to receive, all or a portion of the benefits payable with respect to a participant under a retirement plan.

Donât Miss: Can I Buy 401k Myself

Also Check: How To Withdraw Money From Nationwide 401k

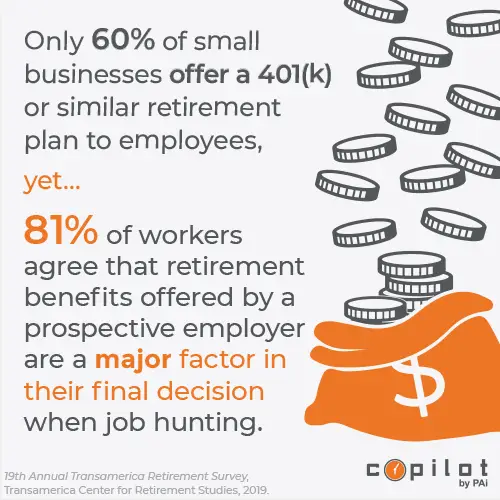

What Are The Benefits Of Offering A 401 To Employees

When it comes to 401 plans, there are often common misconceptions around the time, resources, and costs it takes to establish and set up a plan. Business owners may believe that a 401 plan isn’t right for them, are unclear of the benefits, or believe the administrative responsibilities are too cumbersome. In truth, there are some significant advantages in offering a 401 plan to employees:

- A 401 can help make your business more competitive in attracting and retaining top talent.

- Employers can take advantage of an annual tax credit of up to $5,000 for the first three years of the plan.

- Plan expenses are tax-deductible, along with employer contributions such as an employee match or profit-sharing.

- Advances in payroll integration and recordkeepingmake the implementation and maintenance of offering a retirement plan more affordable than ever.

Stinks Start Your Own Plan

Iâm always inundated with waves of studies that show how little Americans are saving for retirement. And then people I meet start telling me how 401s are simply not up to the task.

I agree with most of the research out there that shows how inadequate 401s are. They are strictly voluntary, loaded with fees and not effective â unless you work for a big company and save as much as you can.

The latest piece of damning evidence on this subject comes from the Economic Policy Institute, a think tank funded by the Labor Movement. Itâs âRetirement Inequality Chartbookâ calls 401s âan accident of history,â that is obscure parts of the U.S. tax code that were never meant to be substitutes for pensions, which were largely abandoned by corporate employers.

Those with high salaries do very well in 401s, the report notes, although everyone else comes up short. Thatâs because the high earners get the lionâs share of tax benefits, causing a widespread inequality among savers.

âRetirement insecurity has worsened for most Americans as retirement wealth has become more unequal,â the EPI report notes. âFor many groups, the typical household has no savings in retirement accounts and balances are low even when focusing only on households with savings.â

Yet this doesnât mean that the helter-skelter retirement system is an outright failure. Retirement savings have increased overall. Itâs just that those in the middle and lower-income groups arenât saving enough.

Also Check: Can You Have More Than One 401k

Contribute Enough To Get Any Employer Match

Even the priciest 401 plan can have some redeeming qualities. Free money via an employer match is one of them. Contributing enough money to get the match is the bare minimum level of participation to shoot for. Beyond that, it depends on the quality of the plan.

A standard employer match is 50% or 100% of your contributions, up to a limit, often 3% to 6% of your salary. Note that matching contributions may be subject to a vesting period, which means that leaving the company before matching contributions are vested means leaving that money behind. Any money you contribute to the plan will always be yours to keep.

If your company retirement plan offers a suitable array of low-cost investment choices and has low administrative fees, maxing out contributions in a 401 makes sense. It also ensures you get the most value out of the perks of tax-free investment growth and, depending on the type of account or the Roth version), either upfront or back-end tax savings.

What Are The Maintenance Costs For Setting Up A 401

Once you establish a 401, your business will have ongoing costs in the form of administrative fees and any matching contributions. Fees generally fall into three categories: day-to-day operations, investment fees, and individual service fees.

There are also potentially fees or penalties associated with being non-compliant with regular 401 benchmarking, which you’ll want to avoid at all costs. A few examples of 401 penalties include:

- Non-compliance with ERISA for failing to meet certain filing and notification requirements

- Failing to file Form 5500 with the IRS each year

- Not providing 402 notices to plan participants who are seeking distributions from their retirement plan accounts

One way to avoid fines and penalties is working alongside a knowledgeable retirement services provider that can help ensure compliance when it comes to retirement plan forms, deadlines, and notifications.

Also Check: What Is The Difference In A 401k And An Ira

Can I Open A 401 On My Own

A 401 is offered by your employer so you generally cannot open a 401 on your own. If you are self-employed, then you may be able to open a 401 plan for yourself, called a Solo or single-participant 401 plan. You can open a solo 401 on your own with the help of a solo 401 provider. If your business is made up of only you or your spouse, these plans can be a great way to save for your retirement, and they are simple to set up! You can contribute for both yourself as the employee, and as the employer, so your contribution limits are higher than if you work for someone else. Read here for more information on Solo 401 plans.

Irc 401 Plans Establishing A 401 Plan

When you establish a 401 plan you must take certain basic actions. For instance, one of your decisions will be whether to set up the plan yourself or consult a professional or financial institution – such as a bank, mutual fund provider, or insurance company – to help you establish and maintain the plan.

Also Check: How Does 401k Work In Divorce

What Are The Benefits Of A 401 Plan Compared To Other Retirement Options

When compared to other retirement options , the benefits of a 401 retirement plan include a broad range of advantages for both employers and employees. Along with a vesting schedule to incentivize retention, both business owners and staff can benefit from:

Tax-advantaged retirement saving: With a 401, employees can save upfront with pre-tax dollars while they are working. By the time they need their savings to fund their retirement, they will likely be in a lower tax bracket, which can generate long-term tax savings.

Employer match: Matching contributions are among the top benefits of 401 plans for employees. Employers can either match a percentage of employee contributions up to a set portion of total salary, or contribute up to a certain dollar amount, regardless of employee salary.

Defrayed 401 plan startup costs: Eligible employers may be able to claim a tax credit of up to $5,000 for the first three years to pay for associated costs of starting a qualified plan such as a 401 for employees. Claiming the credit requires completing Internal Revenue Service Form 8881, Credit for Small Employer Pension Plan Startup Costs.

Is A 401 Right For Everyone

No. 401 plans might be unavailable for freelancers or those who own businesses. In such cases, you might be better off with an IRA or individual retirement account.

IRAs allow you to invest in mutual funds, exchange-traded funds or ETFs and other investment products that firms usually manage. Similar to 401s, IRAs require you to contribute a certain amount into your account each month or year, and they have certain limits.

For instance, 2022’s traditional IRAcontribution limit was $6,000 annually. Unlike a 401, no one matches your contributions, so you are entirely responsible for funding your retirement account.

On the plus side, you’re also in control of where your investments go. You can tweak your IRA to target fast growth, slow growth, or something in between.

You can also pursue a Roth IRA, similar to a Roth 401: you pay taxes on your contributions immediately but don’t have to pay taxes on withdrawals later.

Related: 4 Ways to Save for Retirement Without a 401

Also Check: How To Pull Money Out Of 401k Without Penalty

How To Start A Private 401k Plan Without A Traditional Employer

Many investors have trouble opening a 401k for their retirement because they are not familiar with private 401k plans. As an investor struggling to open a 401k, you are worried that you will not have the necessary finances for retirement. Fortunately, you can open a 401k in a non-traditional way. The private 401k functions similarly to traditional plans that many employers offer employees. You can invest in your future even when the traditional route is out of reach. There are also safe investments for seniors that retired investors can benefit from. If you are not yet retired and want to save for retirement, continue reading to learn how to start a private 401k plan.

How Much Should An Employer Contribute To The Plan

The amount you as an employer decide to contribute is entirely up to you. As you make this decision, consider the tax savings you can receive for making employer contributions. Employer matches are tax-deductible on federal corporate income tax returns, and some administrative fees associated with managing a 401 plan are tax-deductible as well.

You can match as much as you want as long as it stays within the IRS limitations, which combine both employer and employee contributions. According to the IRS, this combined total is the lesser of 100 percent of an employee’s compensation or $61,000 for 2022, not including “catch-up” elective deferrals of $6,500 for employees age 50 or older.

Also consider factors such as the positive impact a matching contribution can have on employee morale and worker retention strategies. Given the steep costs of hiring and training new employees, an employer match offers the opportunity to truly invest in your workforce. These considerations may help guide your decisions about how much to contribute to the 401 plan.

Read Also: What Is 401k Vs Ira

It Makes Sense To Invest On Your Own If You Can

Saving for retirement can feel like a daunting task, especially without the help of an employer-sponsored plan.

But it’s worth it to start investing in a retirement account as soon as you can, even if it’s just small amounts of money.

That’s because compound interest over time will help that money grow by a lot more than if you saved it in a checking or savings account.

“You’re getting interest on top of interest,” Zigo said.”So not only are you getting interest on your money but you’re also getting interest on the interest your money is earning.”

Contribute To An Ira And Solo 401k Plan

QUESTION 1: Can I make both solo 401k and Traditional IRA contributions for the same year?

ANSWER: Yes you can contribute to both your solo 401k plan and your IRA in the same year. However, the IRA contributions may not be fully tax deductible since you are also contributing to a solo 401k plan. It comes down to your modified AGI which means you may be able to deduct some of your IRA contribution. for the AGI chart.

Recommended Reading: What Happens To My 401k If I Retire Early

When You Can’t Open A 401 Without An Employer

To be eligible for most retirement accounts, you need to have earned income during that year. If you don’t have an employer and received only unemployment income for the year, you won’t be eligible to contribute to many of these retirement account options.

The one exception to this is the Roth IRA. If you have a significant amount of savings, you can contribute up to the limits set by the IRS.

However, if you are employed, and your employer doesn’t offer a retirement plan, you can still participate in the Traditional and Roth IRAs.

What Are The Benefits Of A Solo 401

Unlike other options, a Solo 401 account holder can choose between a traditional option and a Roth option. The traditional option allows you to deduct the amount you pay in from your income for that year, giving you an immediate tax break. With the Roth option, the income taxes on that money is paid immediately and you owe no taxes when you withdraw the funds.

The Solo 401 has far higher annual contribution limits than a plain-vanilla IRA, although that is also true for the SEP IRA and the Keogh plan.

The Solo 401 allows you to take loans from your account before you retire. This is not an option with many other retirement plans.

Finally, the Solo 401 is relatively straightforward in terms of paperwork, as it is designed for one-person shops, not corporations.

Read Also: Can I Open A 401k If I Am Self Employed

How To Start A 401 For My Business: 4 Steps

Once youve decided that a 401 plan is the right option for your business, its time to get it set up. There are a lot of details that go into starting and managing a 401 plan, but to get started there are four main steps youll need to take:

1. Find a Plan Provider

You can administer a 401 plan yourself, but its much easier to outsource this task to a plan provider. There are a lot of administrative tasks that can be handled by a plan provider who has more experience.

But youll want to take your time to find the right plan provider. When shopping around for a plan provider youll want to consider a few things:

Once youve picked a plan provider, youll need to spend time documenting your decision. You have a fiduciary responsibility to your employees to select and maintain the best provider on their behalf.

Even after youve hired the provider, youll need to monitor your selection to make sure its still the best choice. You should:

- Regularly review their performance

- Review updates to their contract and policies and procedures

- Follow up on participant complaints

2. Decide on Your Employer Contribution

One way you can entice employees to save in the 401 plan you set up is to offer employer contributions. With an employer contribution, youre depositing money into your employees retirement accounts. Employer contributions are a valuable benefit for employees.

With a traditional 401 plan, you have options for offering your contribution.

3. Create Your Vesting Schedule

Supplement Your Savings Outside Of A 401

The IRS is so keen on individuals saving for retirement that its willing to allow workers to save in multiple types of tax-favored accounts at once. Combining the powers of a 401 and an IRA can really supersize an individuals tax savings and future financial freedom.

The ability to contribute to a Roth or traditional IRA is not just beneficial for workers stuck with a subpar 401. IRAs offer a lot more flexibility and control for all investors in terms of investment choices , access to portfolio building and investment management tools, and control over account fees.

Recommended Reading: How Do I Know How Much Is In My 401k

Lack Of Liquidity And Transparency

Some non-traditional investments lack transparency and liquidity, which may restrict investors from easily buying and selling their positions. This can be a rude awakening to those accustomed to the ease of dealing with traditional stocks and bonds.

The downside of managing your own 401, beyond the additional fees, is you potentially becoming your own worst enemy, says Mark Hebner, founder and president of Index Fund Advisors, Inc., in Irvine, Calif., and author of “Index Funds: The 12-Step Recovery Program for Active Investors.

Many investors who do not work with a professional wealth advisor often allow short-term market movements to dictate their long-term investment strategy,” Hebner adds. “This approach can potentially cause disastrous long-term effects during very turbulent times.

Investors in self-directed plans should be sure to diversify their stock holdings, to build downside risk protection into their portfolios.