Track Down Previous Employer Via The Department Of Labor

If you cant find an old statement, you may still be able to track down contact information for the plan administrator via the plans tax return. Many plans are required to file an annual tax return, Form 5500, with the Internal Revenue Service and the Department of Labor . You can search for these 5500s by the name of your former employer at www.efast.dol.gov. If you can find a Form 5500 for an old plan, it should have contact information on it.

Once you locate contact information for the plan administrator, call them to check on your account. Again, youll need to have your personal information available.

Average 401k Balance At Age 65+ $458563 Median $132101

The most common age to retire in the U.S. is 62, so its not surprising to see the average and median 401k balance figures start to decline after age 65. Once you reach age 65, there are still several considerations for your retirement, even if you are no longer working and accumulating wealth. Some of these include making decisions about Medicare, creating a plan around withdrawing money from your retirement accounts, and evaluating any additional insurance needs.

What Kind Of Investments Are In A 401

401 accounts often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your company match, and then direct any additional retirement savings contributions for the year into an IRA.

Recommended Reading: Can I Take Out Money From 401k To Purchase Home

How To Calculate Using A 401 Contribution Calculator

One needs to follow the below steps to calculate the maturity amount for the 401 Contribution account.

Step #1 Determine the initial balance of the account, if any. Also, a fixed periodical amount will be invested in the 401 Contribution, which would be a maximum of $19,000 per year.

Step #2 Figure out the rate of interest that would be earned on the 401 Contribution.

Step #3 Now, determine the duration left from the current age until retirement.

Step #4 Divide the interest rate by the number of periods the interest or the 401 Contribution income is paid. For example, if the rate paid is 9% and compounds annually, the interest rate would be 9%/1, which is 9.00%.

Step #5 Determine whether the contributions are made at the start or the end of the period.

Step #6 Determine whether an employer is contributing to match the individuals contribution. That figure plus the value in step 1 will be the total contribution in the 401 Contribution account.

Step #7 Use the formula discussed above to calculate the maturity amount of the 401 Contribution, which is made at regular intervals.

Step #8 The resultant figure will be the maturity amount, including the 401 Contribution income plus the amount contributed.

Step #9 There would be tax liability at the time of retirement for the entire amount since the contributions are pre-tax, and deductions are taken for the contributed amount.

How To Find Old 401 Accounts

E. NapoletanoEditorial Note: The content of this article is based on the authors opinions and recommendations alone and is not intended to be a source of investment advice. It may not have not been reviewed, commissioned or otherwise endorsed by any of our network partners or the Investment company.

Billions of dollars are left behind in forgotten 401 plans in the United States. Thats a massive amount of unclaimed property just waiting to be returned to its right fully owners. So if youre looking to find old 401 accounts, youve come to the right place. Well help you track them down in four different ways.

Don’t Miss: Can I Use 401k For Real Estate Investment

Continued Growth Vs Inflation

Remember that your retirement savings accounts dont grind to a halt when you begin retirement. That money still has a chance to grow, even as you withdraw it from your 401 or other accounts after retirement to help pay for your living expenses. But the rate at which it will grow naturally declines as you make withdrawals because youll have less invested. Balancing the withdrawal rate with the growth rate is part of the science of investing for income.

You also need to take inflation into account. This increase in the cost of things we purchase typically comes out to about 2% to 3% a year, and it can significantly affect your retirement moneys purchasing power.

How Can I Take Advantage Of 401 Matching

401 matching is designed to be easy to take advantage of. All you have to do is make contributions to your 401 and youll get extra money from your employer automatically.

If you want to max out the benefit, make sure that youre contributing enough to get the full match that your employer offers. If you get a 50% match, thats like earning a 50% return on investment immediately and with no risk. Youll be hard-pressed to find a better deal elsewhere.

Even if your employers 401 has high fees, it is worth contributing up to the matching limit for the immediate return. Once youve hit the matching limit you can consider whether other savings strategies, such as opening an IRA may be better for you.

If youre concerned about how fees will affect your retirement plans, take a look at Personal Capitals Retirement Fee Analyzer.

401 matching is like getting more money from your employer for free. Taking full advantage of this benefit can make a huge difference in the size of your nest egg and the security of your retirement.

You can run your own numbers on InvestmentZens 401 calculator to see how 401 matching can help your retirement.

Also Check: How To Borrow Money From 401k Fidelity

You May Like: When Can I Start Drawing From My 401k

Increase Your Deferral Rate

Taking advantage of a company match helps you capture valuable contributions from your employer, but it may not be enough. Many 401 providers recommend saving at least 10% annually over the course of your career.3 But, the average 401 contribution is closer to 6%.4

If you arent able to save 10% to 15% of your pay at the beginning of your career, aim to gradually increase your deferral rate over time. One smart tactic is to boost your 401 deferral rate every time you get a raise or bonus. This enables you to save more without reducing your take-home pay.

Another way to consider for enhancing your savings rate is to increase your deferral rate by 1 percentage point every year. Some companies offer an automatic escalation feature that will periodically increase your savings rate with a simple click of a box other companies require you to manually make this change.

A good time to review your contribution amount is at the beginning of the year when youre looking carefully at other benefits elections, such as medical and dental insurance, since the amount you put towards these benefits will have an impact on your paycheck. Another good time to revisit your contribution amount is when you receive additional compensation, whether through a raise, promotion or bonus.

Read Also: Where Can I Start A 401k

How To Access My 401k Online

Although youll have set up your 401K through your employer, your funds will be managed through a custodian or brokerage firm, for example, the likes of Charles Schwab or Vanguard. You should be able to log into your 401K account online through the website of the broker your 401K is with.

If you cant remember your login details, youll need to contact your 401K provider to get your password reset, or failing that you may be able to check your balance over the phone.

If youre not sure which custodian your 401K is set up with, speak to your human resources department at work. They wont be able to tell you your 401K balance, but theyll be able to direct you to the relevant 401K broker.

Recommended Reading: How To Find Old Employer 401k

Don’t Miss: Should I Use 401k To Pay Off Mortgage After Retirement

Check Every Corner Of Your 401

Once you gain access to your account online or review your statement, check how your money is invested.

Most 401 administrators automatically invest your money into a target-date fund. Target date funds are portfolios of various mutual funds and investments tailored to your estimated retirement date. Using your age, the percentage mix of these investments changes to match your risk tolerance as you near retirement.

If you don’t want to hold your money in a target-date fund, you have the option to change investments.

However, if your plan hasn’t automatically allocated your money, it may be waiting to be invested. In this case, your money will be sitting in your account, not growing in a glorified savings account.

Itâs a rare occurrence, but checking your 401 balance will help catch any funds not adequately invested.

Locate Where Your 401s Are

Before you can check how much is in your 401 account, you need to know where your 401s are.

The first place to look is the company with whom you’re currently working. Many companies have implemented auto-enrollment into their 401 plans, ensuring that most of their employees contribute to their retirement. Otherwise, participation may drop because they simply forgot or didn’t know it was available.

Contact your human resources department to get information on if you’re contributing to their 401 and your account information.

Additionally, if you’ve changed jobs a few times in your career, you may have old 401 outstanding in different places. Locating old 401s can be a tricky process as it requires much coordination and hunting down various entities and contacts.

If you’re unsure if you have outstanding 401s with old companies, we can help. Beagle will find any old 401s you have, identify any hidden fees, and provide options to consolidate into one, easy-to-manage account. Sign-up only takes a couple of minutes and Beagle will help you find all your 401 accounts!

Even misplacing one 401 from a previous employer could cost you thousands in potential retirement funds.

You May Like: How Should I Set Up My 401k

Whats The Perfect Way To Withdraw Funds

The perfect way to withdraw the money needed to fund your retirement is a unique solution for you.

Remember to take RMDs if youre required to.

After that, there are plenty of options you can mix and match based on the types of accounts you hold.

Keep in mind:

Youll need the money to fund your entire retirement.

Dont use up all of your tax advantages in the beginning unless thats what makes the most financial sense for you.

What Is A Roth 401

Some 401s allow you to make Roth contributions. A Roth 401 contribution has a different tax structure than your standard 401 deposit. While the traditional 401 contribution is tax-deductible up front and taxable when you withdraw funds, the Roth contribution is the opposite. You get no tax deduction for a Roth contribution, but your withdrawals in retirement are tax-free.

Also Check: What Is The Deadline For Setting Up A 401k Plan

Option : Leave It Where It Is

You dont have to move the money out of your old 401 if you dont want to. You wont ever lose the funds provided you dont lose track of your old account again. But this option is usually the least desirable.

For one, its more difficult to manage your retirement savings when theyre spread out over many accounts. You also get stuck paying whatever your old 401s fees were, and these can be higher than what youd pay if you moved your money to an individual retirement account, for example.

But if you like your plans investment options and the fees arent too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you dont forget.

How Much Should I Have In My 401k Based On My Age

There are a few different schools of thought on how much a person should have saved in their 401k based on their age.

Every financial expert has a different opinion. When deciding what the right number is for you, I think one thing to keep in mind is that its better to have more saved than less.

Creating a potential post-retirement budget as a guideline will help you determine how much money youll spend after youre retired.

In an ideal world, you will be completely debt free by the time you retire and have minimal housing and other expenses.

Youll want to be prepare for these costs:

A persons income and expenses can make a difference when it comes to how much they should have saved at each interval age, but here are some general guidelines.

Use these guidelines in conjunction with your projected post-retirement budget to find out if you should have more or less saved by the time you retire than what is suggest ed here.

Do you have a 401k from an old employer that you need to rollover? Check out Capitalize which is free and will help take out the hassle of rolling over your 401k!

Don’t Miss: How To Check For 401k

Traditional Ira Vs Roth Ira

Like traditional 401 distributions, withdrawals from a traditional IRA are subject to your normal income tax rate in the year when you take the distribution.

Withdrawals from Roth IRAs, on the other hand, are completely tax free if they are taken after you reach age 59½ and see out a five-year holding period. However, if you decide to roll over the assets in a traditional 401 to a Roth IRA, you will owe income tax on the full amount of the rolloverwith Roth IRAs, you pay taxes up front.

Traditional IRAs are subject to the same RMD regulations as 401s and other employer-sponsored retirement plans. However, there is no RMD requirement for a Roth IRA, which can be a significant advantage during retirement.

Why You Need To Save For Retirement

Once upon a time, employees worked for the same company for their entire careers. When they retired, the company then provided them with a defined benefit pension plan for the rest of their lives.

In 1960, pension plans covered 23 million people or about half of the private sector workforce. Sixty years later, only about 4% of the working population is covered by a defined benefit pension plan. In short, youre probably on your own when it comes to retirement savings.

Today, you are responsible for your own retirement fund. That means you need to spend your working years contributing to a retirement savings account, such as a 401 or an individual retirement account .

Also Check: How To Transfer Tsp To 401k

There Are Contribution Limits For 401s

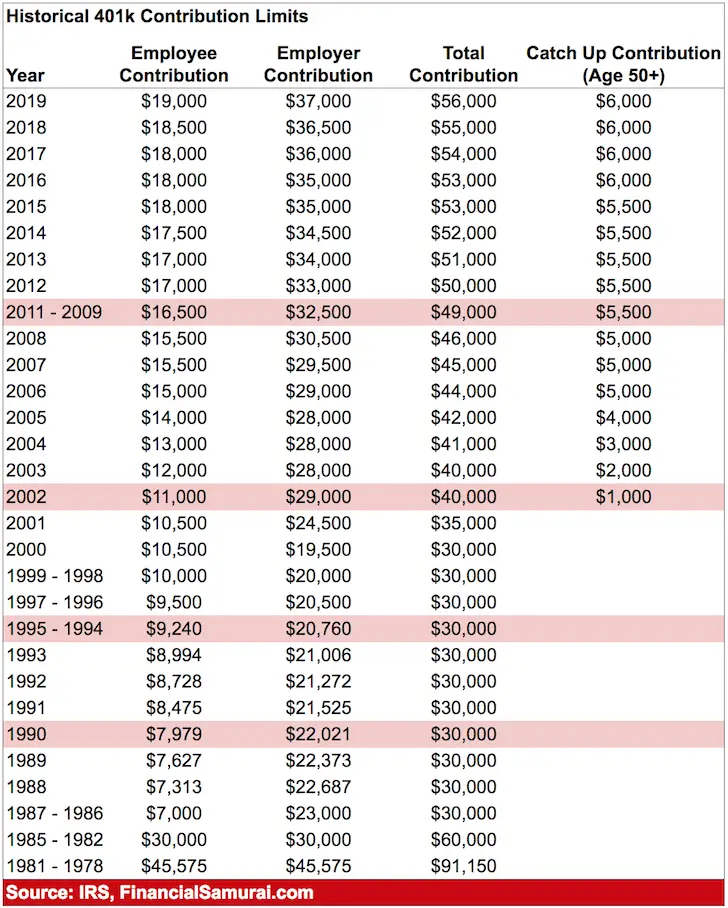

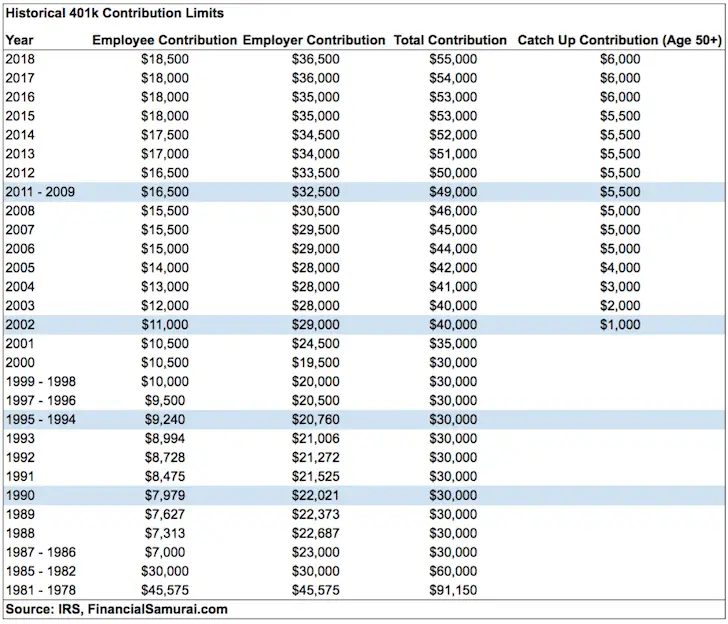

The IRS sets an annual limit on how much money you can set aside in a 401. That limit can change because it is adjusted for inflation. For 2021, you can put away $19,500. Those 50 or older by year-end can contribute an extra $6,500. Check out the Financial Industry Regulatory Authoritys 401 Save the Max Calculator, which will tell you how much you need to save each pay period to max out your annual contribution to your 401. If you cannot afford to contribute the maximum, try to contribute at least enough to take full advantage of an employer match .

Average 401k Balance At Age 22

The average 401k balance at ages 22-24 is actually pretty impressive, and indicates that young people using the Personal Capital Dashboard are taking their retirement savings seriously. When youre in your early 20s, if youve paid down any high-interest debt, endeavor to save as much as you can into your 401k. The earlier you start, the better. As you can see from the potential savings chart , compounding interest is no joke.

You May Like: Does Max Contribution To 401k Include Employer Match

Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

Matches And Roth 401s

A growing number of employers offer a Roth 401 option, where employees make contributions with after-tax moneyand neither the contributions nor any earnings they generate are taxed down the road when the money is withdrawn. While employers can match Roth-directed contributions, IRS rules require that all matched funds reside in a pre-tax account, just like employer-contributed matching funds in a traditional 401 account.

As a consequence, the matching funds your employer contributes to your Roth 401 will be taxed as ordinary income when you withdraw them. If you contribute to both a Roth and a traditional 401, the match is applied first to the traditional 401 amount and then, if necessary, to any Roth-directed funds.

Recommended Reading: Should I Move 401k To Ira

Also Check: What Happens To My 401k After I Leave My Job