How Long Will My Ira Last

Again, the answer to this question depends on several factors, including how much you have saved and how much you plan to withdraw each year. However, if you are careful with your withdrawals and invest wisely, your IRA could last for many years. An annuity guarantees your life income, no matter how long you live or the markets perform.

When Will Your Money Run Out

In the next three examples, let’s assume the following:

- You’ll withdraw $3,000 every month

- Your federal marginal tax bracket is 25%

- The annual rate of return on your savings is 8%

- You may increase your withdrawal amount by 4% per year

How to Stretch Your Nest Egg

Impact Of Inflation On Retirement Savings

Inflation is the general increase in prices and a fall in the purchasing power of money over time. The average inflation rate in the United States for the past 30 years has been around 2.6% per year, which means that the purchasing power of one dollar now is not only less than one dollar 30 years ago but less than 50 cents! Inflation is one of the reasons why people tend to underestimate how much they need to save for retirement.

Although inflation does have an impact on retirement savings, it is unpredictable and mostly out of a persons control. As a result, people generally do not center their retirement planning or investments around inflation and instead focus mainly on achieving as large and steady a total return on investment as possible. For people interested in mitigating inflation, there are investments in the U.S. that are specifically designed to counter inflation called Treasury Inflation-Protected Securities and similar investments in other countries that go by different names. Also, gold and other commodities are traditionally favored as protection against inflation, as are dividend-paying stocks as opposed to short-term bonds.

Our Retirement Calculator can help by considering inflation in several calculations. Please visit the Inflation Calculator for more information about inflation or to do calculations involving inflation.

Also Check: How To Find Old Employer 401k

Recommended Reading: Can You Roll Over 401k To Roth Ira

Can I Retire With 3 Million Dollars

A person can retire with $3,000,000 saved. At age 60, a person can retire on 3 million dollars generating $183,000 a year for the rest of their life starting immediately. At age 65, a person can retire on 3 million dollars generating $201,900 a year for the rest of their life starting immediately. At age 70, a person can retire on 3 million dollars generating $220,500 a year for the rest of their life starting immediately.

What Is The Bucket Approach

One final strategy to think about is the bucket approach, which separates your savings into three different buckets to help cover your immediate, short-term and long-term expenses. For example, your first bucket might contain six months of living expenses in an emergency savings account. Your second bucket could set aside three or four years’ worth of living expenses, possibly split between a savings account and a bank certificate of deposit . Your third bucket could contain longer-term investments. Over time you periodically move money from your long-term bucket into your short-term bucket. The goal of the bucket strategy is to help reduce your exposure to investment risk by giving you time to ride out fluctuations in the market over a few years. You may not have to cash in your investments when the market is down with access to the reserves you have in your short-term bucket.

Recommended Reading: Can You Use Money From 401k To Buy A House

Retirement Savings: How Long Will My Money Last And How To Stretch It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Figuring out how many years your retirement savings will last isnt an exact science. There are many variables at play investment returns, inflation, unforeseen expenses and all of them can dramatically affect the longevity of your savings.

But theres still value in coming up with an estimate. The simplest way to do this is to weigh your total savings, plus investment returns over time, against your annual expenses.

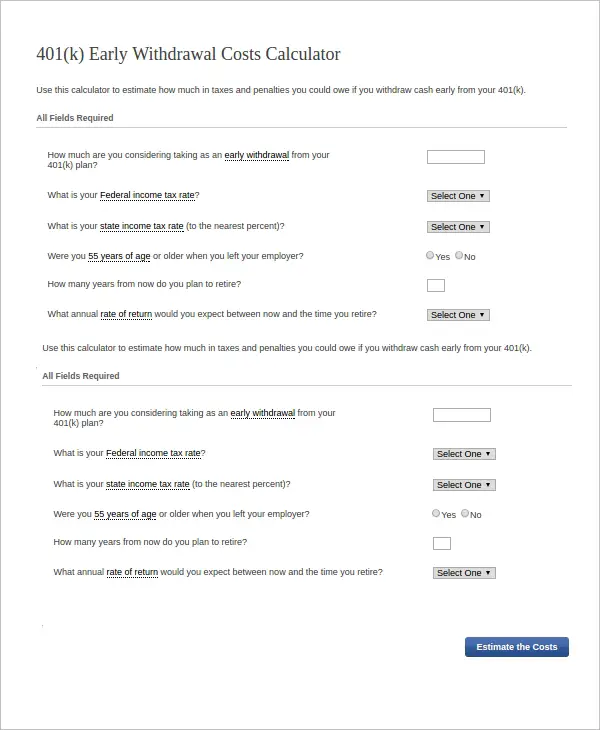

Try our calculator to get your estimate:

What 4% Makes It Safe And How Does That Translate To Life

Well, if you average taking out $20,000 a year or $1,667 a month from your $500,000 and the market returns average 5.5% in 30 years youll have $1,000,000 left. Now, thats pretty safe.

You could, of course, choose to take a little more as the portfolio grew but youd probably want to seriously consider how long you expect to live and if you want to leave behind a legacy amount of money for an estate, family, or charity.

Now, assuming a straight 5.5% return usually shows great outcomes and this calculator isnt sophisticated enough to reveal what happens when you are withdrawing a less safe amount but the market takes a dive in the early years of retirement. It can be grisly. Thats why the 4% rule is so safe. Theres never been a market where you couldnt recover, historically speaking.

You May Like: Should I Combine 401k Accounts

Factors That Affect 401k Savings

How long your 401k will last naturally depends on how much you’ve saved and any investment returns.

It’ll also vary depending on your monthly spending, other sources of income, the rate of return on your outstanding balance and tax rates.

Depending on the impact of inflation, you may also feel that the value of your money drops, meaning you’ll need more to pay for the same thing.

Fidelity recommends savers not to withdraw more than 4%-5% each year from their retirement savings.

Based on that recommendation, you can calculate how much you’ll need depending on what you spend each month.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: How To Get A 401k Loan From Vanguard

Making The Most Out Of Your Savings

Thinking about large retirement funds may sound overwhelming. But dont feel discouraged. Big savings start small. And often, we have to address basic habits to boost our funds. While people think its about cutting expenses, the goal mostly involves prioritizing the right costs.

To help you build retirement savings, here are simple things you can start practicing today:

Arrange Automatic Money Transfers Once you receive your salary, a portion of your money goes directly to your savings account. If your employer doesnt have this set up, you can easily arrange it with your bank. Automated transfers ensure you never touch your savings or retirement contributions on pay days. Youll have dedicated savings while you only spend the money allocated for your monthly budget.

Prioritize Paying Large Debts Do you have high-interest credit card debt? Make sure to dedicate a substantial portion of your salary to reduce debts. The longer you take to pay them off, the more it will eat away at your savings. This is how compounding interest can work against you more interest accrues as your debt increases. Eliminating high-interest debt will free up your cash flow, allowing you to save more towards your retirement funds.

Ultimate Retirement Calculator Terms And Definitions:

- Retirement age: Age at which a person is required to step down. Usually referred to as mandatory retirement age. Can also be used to describe a standard age where most people retire such as age 65 in the United States.

- Retirement benefits: A monthly payment and other benefits such as health care for a person who has reached retirement age.

- Pension: An arrangement to pay a person a regular income when they are no longer earning by actually working

- Government pension: An arrangement of support given by some government to its senior citizens.

- Life expectancy: The average period that a person is expected to live.

- Desired annual retirement income: The amount that a retired person wishes to have as household income

- Desired estate: The amount of estate a retired person wishes to leave to his loved ones

Also Check: How Much To Put In 401k

How Long Will My Money Last With Systematic Withdrawals

You have worked hard to accumulate your savings. Use this calculator to determine how long those funds will last given regular withdrawals.

This information may help you analyze your financial needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

Dont Forget About Inflation

If youre planning to have certain amounts of money many years in the future you absolutely must think about inflation. The value of money in modern economies degrades over time. The central banks in Western countries typically target 2% inflation each year. That means your whole dollar loses two cents of value each year.

This can have a dramatic impact over years. You should be sure to set your target income and savings goals with inflation in mind. Its also important to consider when you look at subjects below like income floors, withdrawal strategies, and asset allocation. Assets you can invest in like real estate or stocks typically dont fall in value as would cash.

Read Also: What Reasons Can You Withdraw From 401k Without Penalty

What Is A 401k

A 401k allows you to dedicate a percentage of your pre-tax salary to a retirement account.

Employers can also choose to match some or all of the contributions, but this isn’t required so it’s not guaranteed.

There are two basic types of 401ks – traditional and Roth – with the main difference being how they’re taxed.

In a traditional 401k, employee contributions reduce their income taxes for the year they are made, but they’ll pay tax when they withdraw cash.

Other Sources Of Retirement Income

Home Equity and Real Estate

For some people in certain scenarios, preexisting mortgages and ownership of real estate can be liquidated for disposable income during retirement through a reverse mortgage. A reverse mortgage is just as it is aptly named â a reversing of a mortgage where at the end , ownership of the house is transferred to whoever bought the reverse mortgage. In other words, retirees are paid to live in their homes until a fixed point in the future, where ownership of the home is finally transferred.

Annuities

A common way to receive income in retirement is through the use of an annuity, which is a fixed sum of periodic cash flows typically distributed for the rest of an annuitant’s life. There are two types of annuities: immediate and deferred. Immediate annuities are upfront premiums paid which release payments from the principal starting as early as the next month. Deferred annuities are annuities with two phases. The first phase is the accumulation or deferral phase, during which a person contributes money to the account . The second phase is the distribution, or annuitization phase, during which a person will receive periodic payments until death. For more information, it may be worth checking out our Annuity Calculator or Annuity Payout Calculator to determine whether annuities could be a viable option for your retirement.

Passive Income

Inheritance

Read Also: How To Start A 401k For My Small Business

How Long Do You Need The Money To Last

For those entering retirement, we can pick a conservative number for life expectancy. After all, we want our money to last at least as long as we will. If you are also planning for a spouse that you expect to outlive you then you should use the more conservative number.

90 years is a pretty conservative number if youre under 70. If youre older than that you may want to consider 100. If youre curious how we arrived at that number you can check out the actuarial tables from the Social Security Administration Office of the Chief Actuary.

Your current age subtracted from 90 is the time you need your money to last. The best assumption is that you will want to have a very similar income to the income you have in your last few years before retirement. That means you need to save enough money to cover that income for the years you expect to live. You may have some Social Security or pension coverage that provide for part of the income you need. You can use our savings and retirement calculators to determine what effort you have left to devote to savings.

Choosing a conservative age beyond our life expectancy and a comfortable income level gives us a buffer or a margin of safety in case we live longer than expected, have higher expenses, or unexpected circumstances we want to meet.

What Are The Tax Implications Of A Windfall

First, generally speaking life insurance proceeds excluding interest is not considered income in the US.

Similarly, inheritances are not considered taxable in the US in most circumstances. We like this article from Intuit about managing for inheritance tax implications.

If you win something like a raffle or lottery then normal income tax considerations apply and it may be worth consulting a tax attorney.

Also Check: How Much Can An Employer Contribute To A 401k

Why Is 4% Considered A Safe Withdrawal Rate

This rule specifies that based on historical market results, its safe to withdraw 4% of your total retirement savings every year without risk of depleting the funds as long as you keep it invested in the market. This would have worked even in the Great Depression.

Our calculators generally use 4% as the rule of thumb for how much retirement income a given amount of retirement savings will generate. You might want to have a lower rate for a more conservative projection . More likely, you may tinker with a higher rate depending on how many retirement years you are looking to fund.

Those choices also depend on whether you want to leave behind money or spend what youve accumulated on the way out. If youre already 90, you probably dont need to project 35 years of retirement ahead. If youre 60 you may well want 30-35 years or more depending on health, history, and other factors.

It is possible that you can combine some fixed income like social security or a spouses pension to your withdrawal considerations.

Play around with our retirement calculator to get a sense of how much savings generates how much income with different withdrawal assumptions.

At What Age Do Most Americans Retire

65 is the common retirement age most people aim for. But according to the U.S. Census Bureaus American Community Survey in 2019, the average retirement age varied for different states.

- In Washington, D.C., people retired at an average age of 67.

- In Hawaii, South Dakota, and Massachusetts, people retired at an average age of 66.

- Those living in West Virginia and Alaska retired at an average age of 61.

Retiring a bit early, say the age of 61, is an option for those who have saved enough funds. And for residents of West Virginia and other similar states, the general low cost of living may help you reach your retirement goals earlier.

Meanwhile, residents in the following states had an average retirement age of 65:

While others try to retire at 65 or earlier, many Americans, particularly Gen Xers and baby boomers, plan to work through retirement. Based on a 2019 article by Business Insider, some of these people simply want to work even if they dont need the money, up until the age of 72. And because retiring early has its disadvantages, it makes sense for some people to keep working especially if theyre still in good health.

How Long People Live

Don’t Miss: How Do I Find My 401k Contributions