How Do Distributions Work

Some retirement plans have required minimum distributions . This is a withdrawal from the account that you must make, and usually theres a specific amount. This applies to traditional IRAs and both 401 plans. For IRAs, you must take the RMD when you turn 70 1/2. For 401s, you take the RMD when you turn 70 1/2 or when you retire, whichever comes later.

Note that you can take distributions before reaching the age of 70 1/2. Once you turn 59 1/2, you can start to take withdrawals without a penalty fee, if you choose to. If you withdraw funds before reaching 59 1/2 years of age, theres a 10% penalty fee.

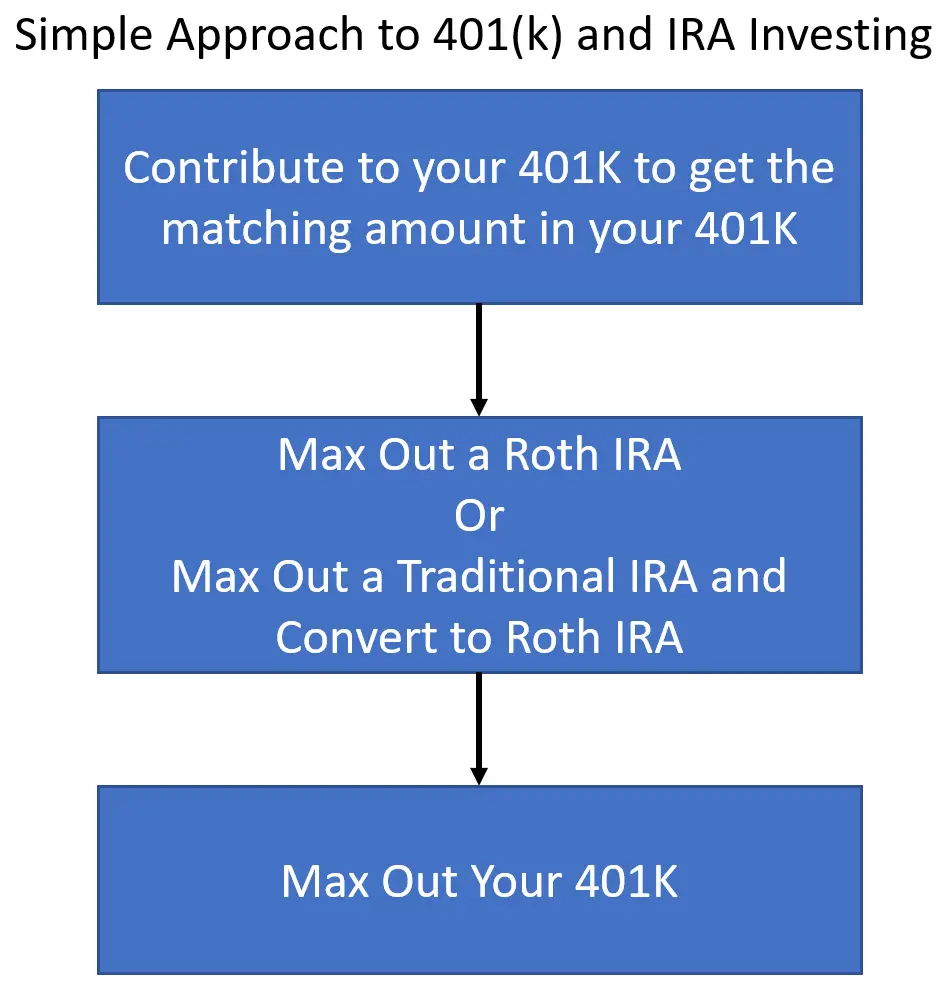

Both IRA and 401 plans are great retirement planning tools. Planning your finances for retirement doesnt have to be hard. And there are simple steps you can take to make your life easier down the road.

To learn more about retirement planning and investing, sign up for our free e-letter below. Its packed with useful insight.

About Amber Deter

Amber Deter has researched and written about initial public offerings over the last few years. After starting her college career studying accounting and business, Amber decided to focus on her love of writing. Now shes able to bring that experience to Investment U readers by providing in-depth research on IPO and investing opportunities.

Why Are You Setting Up A Retirement Plan

For many small-business owners, the answer is that theyre trying to maximize their own retirement savings dollars. If thats the case, contribution limits should weigh heavily in your decision. For high earners especially, the higher contribution limit of the 401 makes it a more attractive choice than a SIMPLE IRA.

» Thinking about the future? Learn about succession planning for your business.

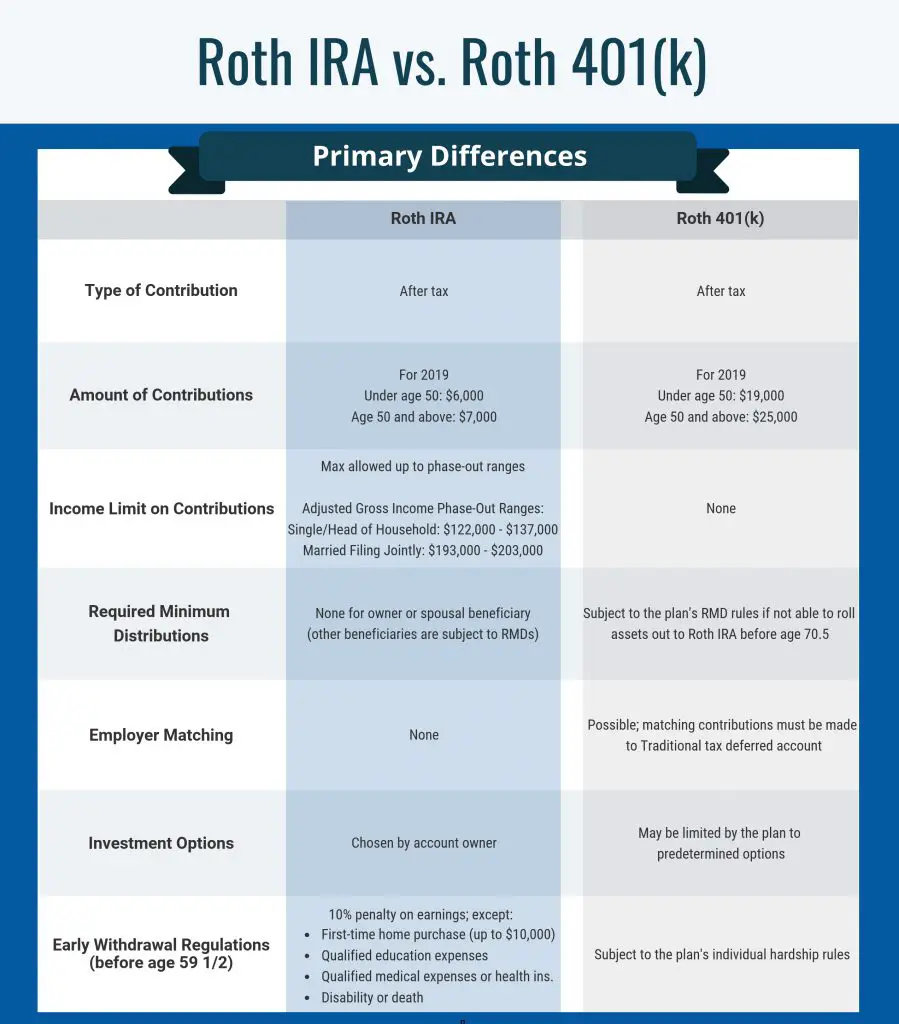

What Are Roth 401 Contribution Limits

For 2022, the 401 contribution limit is $20,500. This contribution limit applies to all of your 401 contributions, whether theyre in a Roth or traditional 401. That means if youre contributing to both, the combined total of your contributions cant exceed that amount. And in case you were wondering, your employers contributions do not count toward the limit.

If youre 50 or older, you can also pitch in an extra $6,500 as a catch-up contributionwhich increases your contribution limit to $27,000.

You May Like: How To Calculate Your 401k Contribution

Ira Overview And Characteristics

IRA stands for individual retirement arrangement, but an IRA is more commonly known as an individual retirement account. There are many different types of IRAs that you can open, including traditional and Roth IRA plans.

Other types of IRAs include simplified employee pension and savings incentive match plan for employees IRAs, which are typically used by self-employed individuals and small businesses. SEPs and SIMPLEs come with their own sets of rules, restrictions, and limits. The information in this section pertains to traditional and Roth IRAs only.

Eligibility. You must have a job and have earned income for the tax year to open an IRA. Earned income is money you make from working, such as your salary, bonuses, tips, and self-employment income. Income from investments, Social Security, unemployment, annuities, and pensions doesnt count. If you want to open a Roth IRA, specific income limits apply.

You can also fund an IRA for your spouse if youre married and file your taxes jointly, even if they have little or no earned income.

2022 IRA contribution limit. With IRAs, the IRS limits how much you can contribute in any given tax year. For 2022, the IRA contribution limit is $6,000 if youre under age 50. If youre age 50 or over, youre allowed an additional $1,000 catch-up contribution, for a total of $7,000.

Matching contributions. Because an IRA is not an employer-sponsored plan, there are no matching contributions you open and fund the account yourself.

Ira Vs 401 Defined Contribution Plan

Most retirement plans are defined contribution plans. This means you contribute a certain amount each month, quarter or year. The payout you receive during retirement is based on the market value of the account. IRAs and 401s are most commonly defined contribution plans. Also, they both offer tax-advantaged retirement savings. However, there are a few key differences between these types of plans. The good news is that you dont have to choose one over the other. If your finances allow, you can and should, if possible contribute to both a 401 and an IRA.

You May Like: Can I Get Money From My 401k

At What Age Does A Roth Ira Make Sense

A Roth IRA makes sense at any ageearly or even late in your careerso consider your retirement savings options and, if appropriate for your income and financial goals, open one as soon as possible. Think about whether you want to pay taxes when you’re no longer working and may need all the income you can get.

Ira Vs Roth Ira Vs 401k: Investment Options

IRAs of both types allow you to invest in individual stocks, stock indexes, mutual funds, bonds and other assets. In other words, your options are virtually limitless with an IRA, including using a robo-advisor to create an investment portfolio. As a result, you can fine-tune your IRA to reflect your time horizon and risk tolerance. You can also invest in funds with low fees to minimize costs.

On the flip side, 401s present employees with limited options. 401 plans usually have several portfolios available fitting different preferences, such as balanced, aggressive, or target-date funds which prioritize less risk the closer you get to retirement.

Recommended Reading: Can I Rollover My Roth 401k To A Roth Ira

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Retirement Accounts Are Essential For Planning For The Future

In addition to having retirement accounts, having a high savings ratewhich is essentially how much money you save each month compared to your gross incomecan also be highly beneficial.

Retirement accounts are essential for financial success and so that you can have a solid amount of money saved up when you retire. With a better understanding of an IRA vs. 401k, you can move onto Chapter 7, where well cover the differences between a 401 vs. 403b.

This is for informational purposes only and should not be construed as legal, investment, credit repair, debt management, or tax advice. You should seek the assistance of a professional for tax and investment advice.

Third-party links are provided as a convenience and for informational purposes only. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

Save more, spend smarter, and make your money go further

Don’t Miss: Can I Switch My 401k To A Roth Ira

Retirement Planning: Roth Ira Vs Traditional Ira Vs 401

Along with building your financial independence comes the responsibility of retirement planning. For many, guaranteed pension plans are not an option and Social Security isnt enough. Its up to you to decide what amount of money you can save now in order to provide a living well into your golden years. Heres a look at the three most popular savings accounts: Roth IRA, IRA, and a 401.

What Is Roth Ira

A Roth IRA is a retirement account that allows you to make contributions from post-tax earnings, meaning that qualified contributions are NOT eligible to be deducted from your taxable income. The biggest benefit of a Roth IRA is that earnings can be withdrawn tax-free once you turn 59 ½ years old or for other qualified expenses.

You May Like: Can I Take Money Out Of My Fidelity 401k

More Details On Ira Contributions

With Roth and traditional IRA contributions, limits are imposed per taxpayer, not per account. That means an individual may not contribute $6,000 to a Roth IRA and an additional $6,000 to a traditional IRA in 2021. Instead, one may contribute a total of $6,000 split across the different IRAs, say $4,000 to a Roth IRA, and the remaining $2,000 to a traditional IRA.

Spousal IRAs are regular IRAs that married couples who file jointly may participate in.

Married couples can also contribute the same amounts to a spousal IRA for a non-working spouse, as long as one spouse earns enough income to cover both contributions.

Ira Vs Roth Ira Vs 401k: Distributions

The federal government mandates that if you have a traditional IRA, you must take required minimum distributions by age 70.5. Of course, you can take distributions without penalty after age 59.5. Conversely, because the government has already taxed the money inside, Roth IRA funds have no distribution requirements.

401 distributions have distinct rules. You can begin withdrawing from your 401 when one of the following occurs:

- You retire or change employers.

- You pass away or become disabled.

- You reach age 59.5.

- You qualify for early withdrawals because of hardship.

- Your employer terminates the 401 plan.

You can decide not to withdraw money from your 401 for a while in retirement. But, like IRAs, the government imposes a required minimum distribution upon reaching age 72 .

Don’t Miss: What Is The Minimum 401k Distribution

Ira Vs : Whats The Difference

Morsa Images / Getty Images

An IRA and a 401 are two common types of retirement accounts that offer tax advantages when you invest. The key difference between the two is that an IRA is a type of retirement account that you open, fund, and invest on your own, while a 401 is a retirement account you open through your employer.

If you want to know more about the differences between an IRA and a 401, youre in the right place. Learn more about how each type of retirement account works, who can contribute, and which one makes sense for you.

Types Of Retirement Accounts: Iras And 401s

We can help. By learning about your options, you can choose the type of savings account thats right for your life, now and in the future.

Lets start with the two most common ways to saveIndividual Retirement Accounts and 401 accounts. Well break down the similarities and differences between traditional 401s and traditional IRAs, then share details around Roth IRAs and Roth 401s, giving you a basic understanding of each.

Also Check: Can I Use My 401k To Purchase A House

Stick With The 401k If

In addition to lower costs, many 401 plans offer stable-value funds. This is a low-risk option you cant get outside of an employer-sponsored plan. With recent yields averaging about 1.8%, stable-value funds provide an attractive alternative to money market funds. And unlike bond funds, they wont get hammered if interest rates rise. There are other good reasons to leave your money behind:

Can I Have A Roth 401 And A Roth Ira At The Same Time

Yes, as long as you meet all income limits and restrictions, you can contribute to both Roth types at the same time. The contribution limit for each is different: $20,500 for a Roth 401 and $6,000 for a Roth IRA in 2022. Both account types have catch-up contributions for people over age 50: an additional $6,500 for a Roth 401, and an additional $1,000 for a Roth IRA in 2022.

Read Also: Can You Rollover A 401k While Still Employed

Can I Take A Loan From My Roth Ira

Technically, no. There is no provision for borrowing against your Roth individual retirement account , only for taking qualified or non-qualified distributions. However, if you initiate a Roth IRA rollover, you have 60 days to use that money at 0% interest before depositing it in your new accountessentially, a short-term loan.

How Much To Invest In A 401k And A Roth Ira Difference

As expected, the 401 portfolio is growing significantly faster than the Roth IRA. This is because you do not have to pay taxes upfront and you can invest more. At age 60, the price of the 401k drops to $1,829,768. Roth IRA drops to $1,427,647.

Can you take money out of a roth iraWhat is the Roth IRA 5-year rule? Five year rule for withdrawals. The Roth IRAs five-year rule for withdrawing capital gains requires that you hold your account for a minimum of five years before using that income without penalty. It is important to note that this rule applies specifically to investment income.How do you withdraw from a Roth IRA?Withdrawal of Roth Contributions. Withdrawing from a Roth IRA

Don’t Miss: Can You Roll 401k Into 403b

Can You Lose Money In An Ira

Yes. IRA money held by a brokerage or investment firm is usually invested in securities such as mutual funds or stocks, which fluctuate in value. Note that an IRA is no more or less likely to decline in value than any other investment account. The owner of an IRA faces the same market risks as the account holder of a 401.

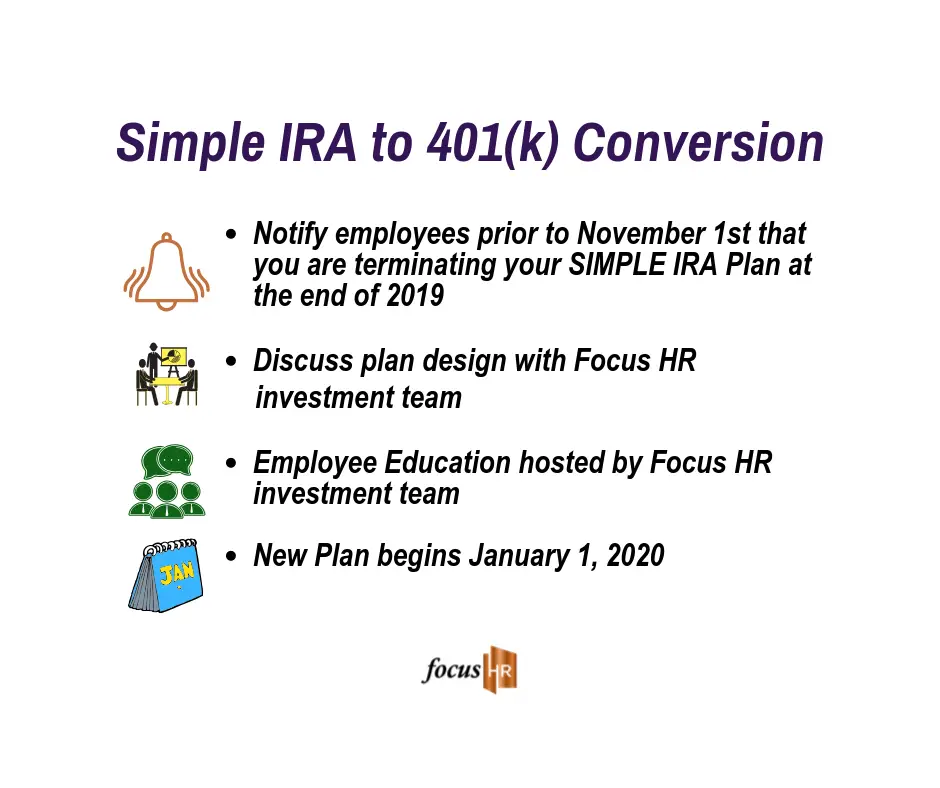

Will You Need To Adjust Employer Contributions

Although a nice perk to attract potential employees, employer contributions are not required of companies that offer 401 plans. You also have the freedom to set vesting terms, which allows you to require employees remain employed by you for a set time before taking ownership of your contributions to their accounts. Employer contributions to employee SIMPLE IRA accounts are mandatory, though you can choose between two matching arrangements dictated by the IRS. Contributions to a SIMPLE IRA are immediately 100% vested.

» Ready to open a SIMPLE, traditional or Roth IRA? See the top-rated IRA account providers

Don’t Miss: How To Convert Your 401k To A Roth Ira

Tips For Iras And 401s

- Having a plan for retirement entails more than contributing to an investment account. Your lifestyle in retirement, healthcare costs, and more are vital to preparing for retirement. A financial advisor can help you create a fully-fledged financial plan that includes short-term and long-term goals. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- While 401s have more inherent structure, you can modify your allocations in most plans to a certain degree. If youre confused after reviewing your 401 options, you might want to speak to a financial advisor about your 401

Limited Investment Options With Often

With a Roth 401, your investment options are limited to those offered by the plan administrator. In many cases, these boil down to a few basic mutual funds . Youre also stuck with the expense ratiosoften somewhat highin 401 plan funds, and, of course, the plan administrators get their cut each year.

You May Like: Can I Borrow Against 401k

Roth Ira Vs : Which Is Better For You

10 Minute Read | September 27, 2021

The Roth IRA and 401 are like cousins: They come from the same family of retirement investment accounts, so they have a lot in common. But look close enough, and youll see how different they are!

Once you understand how they work, you can choose the plan that will help you maximize your savings. And thats not just fancy investing talk. Your choice today could result in thousandsif not millionsof dollars down the road! You need to understand your options so you can be 100% prepared for retirement.

So, what are the major differences between a Roth IRA vs. a 401? And even more importantly: How do you know which one is better for you?

First, lets discuss the main features of each account.

You May Like: How To Recover 401k From Old Job

Roth Ira Vs : An Overview

Both Roth IRAs and 401s are popular tax-advantaged retirement savings accounts that allow your savings to grow tax free. However, they differ where tax treatment, investment options, and employer contributions are concerned.

Contributions to a 401 are made pre-tax, meaning they are deposited before your income taxes are deducted from your paycheck. The amounts are tax deductible, thereby reducing your taxable income. However, in retirement, withdrawals are taxed at your then-current income tax rate.

Conversely, there is no tax deduction for contributions to a Roth IRA. However, the contributions and earnings can be withdrawn tax free when in retirement.

In a perfect scenario, investors would use both accounts to put aside funds that can then grow tax deferred for years. However, before deciding on such a move, there are several rules, income limits, and contribution limits that investors should be aware of.

You May Like: How To Create Your Own 401k