Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

Read Also: How To Invest My 401k Money

Example Of The Rule Of 55

For example, suppose you’re 57 years old and are laid off from your job. Now that you don’t have income from work, you may need to dip into your 401 funds. If you were younger than 55, you would have to pay a 10% penalty in order to do that. However, per the Rule of 55, because distributions were made to you after you separated from service with your employer and after the year you reached age 55, you can take penalty-free distributions from your employer-sponsored retirement savings account.

Alternatives To Withdrawing From 401

How can you access cash without withdrawing or borrowing from your 401? If you’re a homeowner with equity, you can consider a cash-out refinance, home equity loan or home equity line of credit . All three of these options typically come with competitive interest rates because the financing is secured by your home.

Permanent life insurance policies with cash value components are another option. In this case, your death benefit serves as collateral for the loan. Once the loan balance is paid off, your death benefit is restored in full.

To avoid the penalties from an early withdrawal, consider how much money you’re really looking for. You may be able to make up some extra cash by refinancing your student loans, particularly if you paid high interest rates when you took out the loan.

Also Check: How To Rollover 401k To Td Ameritrade

Alternatives To A 401 Early Withdrawal

As we mentioned, a 401 early withdrawal can be used in a financial emergency, but it shouldnt be your first choice. The good news is there are plenty of other options available to you.

There are several alternatives to an early withdrawal from retirement, however, most of them mean going into debt, Woodward said. The only difference is your credit will not be used in determining your eligibility for a 401 loan. Your credit will be used for credit cards , HELOCs, personal loans, and any other type of loan.

Your creditworthiness is a major factor when youre borrowing money. Some of the options below may only be available if you have good credit. In other cases, a poor credit score could make the loan cost-prohibitive.

How Does This Affect Your Retirement If Youre A Canadian Living In The Us

If you live in the US and would love to retire in Canada, you can contribute to a 401k plan but then transfer the funds to the Canadian RRSP once you retire and want to get back to Canada. The tax rules will apply here and might have negative results for you.

Thats why you need to ensure you consult a cross-border finance expert to help you with the transfer.

Don’t Miss: How Do I Find My 401k Money

What Is The Difference Between A 401 Loan And A 401 Withdrawal

When you withdraw money from your 401, you have to pay income taxes on the amount you withdraw and you may also have to pay a 10% early withdrawal penalty if you are not at least 59½ years of age. Unlike a 401 loan, you do not have to repay a 401 withdrawal, which can make this type of funding sound good to first-time homebuyers. Remember, though, the money you withdraw will no longer be there for you at retirement.

If your 401 is the only funding source you have, then you might consider buying your home using a 401 loan instead of a 401 withdrawal. Before considering this option, however, remember to check to see if your 401 plan allows for a loan. These often allow you to borrow up to half the value of your vested balance, and repay yourself, with interest. While most 401 loans require repayment within 5 years, for some first-time homebuyers, that period may be extended.

Dont Miss: Can I Move My Ira Into My 401k

Taking Money Out Of A 401 Once You Leave Your Job

If you no longer work for the company that sponsored your 401 plan, first contact your 401 plan administrator or call the number on your 401 plan statement. Ask them how to take money out of the plan.

Since you no longer work there, you cannot borrow your money in the form of a 401 loan or take a hardship withdrawal. You must either take a distribution or roll your 401 over to an IRA.

Any money you take out of your 401 plan will fall into one of the following three categories, each with different tax rules.

Read Also: How Much Will My 401k Be Worth In 20 Years

Also Check: How To Find All My 401k

How To Withdraw Money From Your 401

The 401 has become a staple of retirement planning in the U.S. Millions of Americans contribute to their 401 plans with the goal of having enough money to retire comfortably when the time comes. Whether youve reached retirement age or need to tap your 401 early to pay for an unexpected expense, there are various ways to withdraw money from your employer-sponsored retirement account. A financial advisor can steer you through these decisions and help you manage your retirement savings.

Can You Collect Social Security And A Pension At The Same Time

Can I collect Social Security and a pension? Yes. There is nothing that precludes you from getting both a pension and Social Security benefits. … If your pension is from what Social Security calls covered employment, in which you paid Social Security payroll taxes, it has no effect on your benefits.

Also Check: Can You Have A Roth 401k And A Roth Ira

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

Read Also: Can I Open A 401k On My Own

Another Tool In Your Financial Toolbelt

Your SDIRA is yet another tool you have to diversify the way you save and invest. As Ive said in previous articles, land is a great asset to buy and invest in alongside your traditional savings and investments. When it comes to retirement, the same idea applies, and I do practice what I preach. I have a Traditional IRA that is invested in the stock market with basic index funds. I have a self-directed Roth IRA that I use to buy and sell land. I havent abandoned the traditional retirement account and mutual funds, but Im not 100% dependent on it either. I like having more than one option, and I suspect thats going to be the case with most people who read this.

If youve had some experience with real estate or buying land, and its an investment youre comfortable with, an SDIRA is something you should think about. Even if youre on the fence about an SDIRA, you can always reach out to a custodian. Theyre happy to answer your questions, and get you started once youre ready.

Don’t Miss: How To Roll Old 401k Into Ira

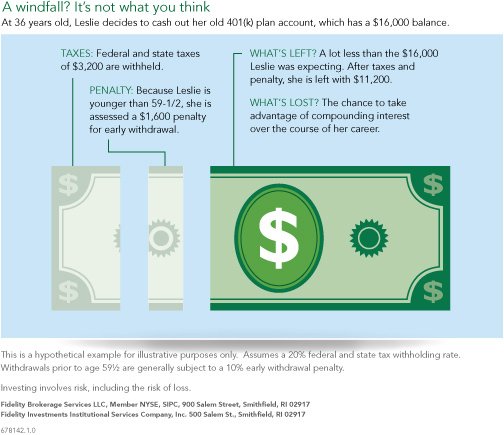

An Early Withdrawal From Your : Understanding The Consequences

OVERVIEW

Cashing out or taking a loan on your 401 are two viable options if you’re in need of funds. But, before you do so, here’s a few things to know about the possible impacts on your taxes of an early withdrawal from your 401.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

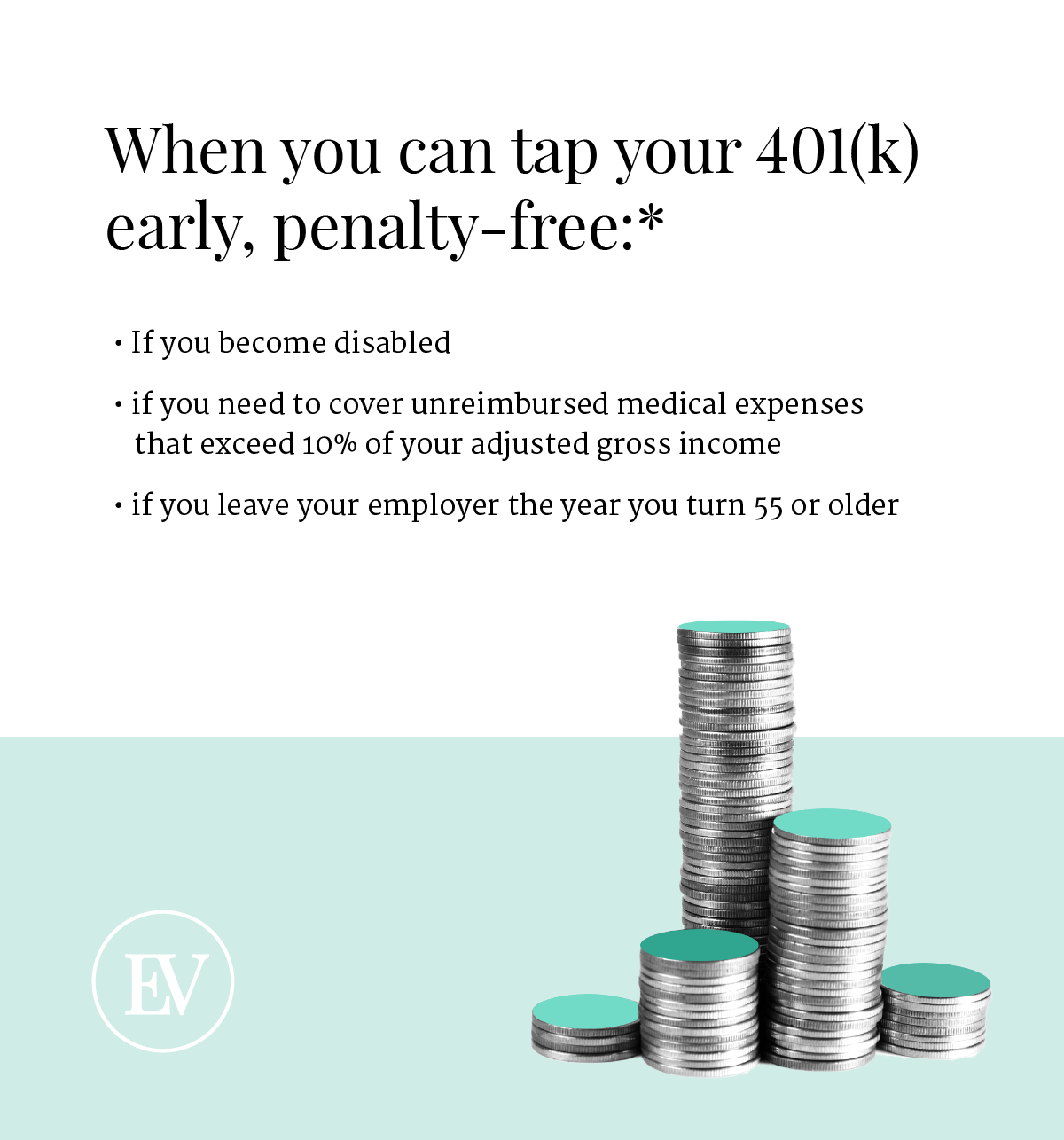

Reasons You Can Withdraw From 401k Without A Penalty Include

Recommended Reading: How To Find Missing 401k Money

Also Check: When Can I Access My 401k

When Does The Rule Not Apply

The Rule of 55 doesn’t apply to any retirement plans from previous employers. Only the 401 you’ve invested in at your current job is eligible. Additionally, the Rule of 55 doesn’t work for individual retirement accounts , including traditional, Roth and rollover accounts. You’ll have to wait until age 59½ to access those assets without penalty.

There’s a way around this, however: You could roll over the funds from your former 401 and IRA plans into your current 401. Note that the process can be complicated, and not all employers accept rollovers. Before initiating a transfer, talk to your human resources representative and consult with a tax advisor to avoid unnecessary headaches. If you are allowed to make the transfer, all the funds in your current 401, including the transferred amount, will be available if you take early distribution using the Rule of 55.

Reasons To Withdraw Penalty

There are a few reasons an account owner may want to withdraw retirement funds from an IRA or 401 account before reaching retirement age. In the following situations, those withdrawals may be free of penalties. Be aware that rules vary by account type.

In general, IRAs permit penalty-free withdrawals in more circumstances than 401s. However, 401s permit loans IRAs do notâmore on that below.

Recommended Reading: Can I Withdraw My 401k If I Leave My Job

Do You Have To Withdraw From 401k At 72 If You Are Still Working

If you are still working for a company when you reach the age for starting RMDs from your company’s 401, generally, you can delay taking the RMDs until you retire. … If you own more than 5% of the business for which you are working, you cannot delay 401 RMDs. You have to start your RMDs at age 72.

Withdrawing When You Retire

After you reach the age of 59 1/2, you may begin taking withdrawals from your 401. If you leave your job in the calendar year when you turn 55 or later, you can also begin taking penalty-free withdrawals from the 401 you had with that current company. If you are a public safety worker, this rule takes effect at the age of 50.

Once you reach 72, you are actually obligated to begin making required minimum distributions or RMDs.

You May Like: How To Pull Money From A 401k

You May Like: Will Walmart Cash A 401k Check

What Is The Tax Penalty For Withdrawing Money From A 401

It depends on when you make the withdrawal. If you are age 59 1/2 or older, then there is no tax penalty. However, if you make a withdrawal before reaching this age, you will be charged an extra 10% penalty on top of your regular income taxes that you pay on the funds. In some cases, you might be able to take a withdrawal without being required to pay the penalty. Some situations include hardship withdrawals, unreimbursed medical expenses, education related expenses, qualified reservists, and death. This is not an exhaustive list, and you should contact your financial planner to discuss your specific situation to see if you can qualify for a penalty-free withdrawal.

Can I Borrow From My 401k If I No Longer Work For The Company

401k Plan Loans An Overview. There are opportunity costs. If you quit working or change employers, the loan must be paid back. If you can t repay the loan, it is considered defaulted, and you will be taxed on the outstanding balance, including an early withdrawal penalty if you are not at least age 59 ½.

Dont Miss: What Happens To Your 401k If You Leave Your Job

Don’t Miss: How To Invest My 401k Money

Hardships Early Withdrawals And Loans

Generally, a retirement plan can distribute benefits only when certain events occur. Your summary plan description should clearly state when a distribution can be made. The plan document and summary description must also state whether the plan allows hardship distributions, early withdrawals or loans from your plan account.

Domestic & International Tax Law & Estate Planning

AtCastro & Co., we offer a broad range of services to individuals in need of international taxation planning and estate planning. The hallmark of our firm remains the same as it was when we first opened our doors: to provide sophisticated, high-quality international tax planning and results-oriented billing practices to our valued clients. This commitment has allowed us to achieve success in the past, and we continue to excel.

Speak with an international tax attorney for individuals from our team today to learn more about our services by calling us at orcontacting us online.

You May Like: Can I Rollover My 401k To A Brokerage Account

When Should You Make A 401 Early Withdrawal

Considering the 10% penalty, financial planners often advise taking an early withdrawal from your 401 as a last resort. Since penalty-free withdrawals are available for a number of financial hardships and situations, plan participants who take an early withdrawal with a penalty are often in serious financial straits.

Ive seen people take withdrawals for a number of reasons, Stiger says. Everything from a childs tuition to a spouses burial expenses the hope is that distributions are used for larger, more unexpected expenses like medical emergencies, keeping a home out of foreclosure or eviction, and in a down period, putting food on the table.

Ultimately, taking an early withdrawal can make sense if you are able to take advantage of a penalty-free exception, use the Rule of 55 or the SEPP exemption, or take advantage of a topical change in rules, such as the Covid-related changes offered in 2020 as part of the CARES Act.

It might make sense to exhaust other options firstcheck out these 10 ways to get cash nowbefore turning to your tax-deferred retirement account for an early withdrawal. And remember: Contributions to a Roth IRA can always be withdrawn without penalty if youre truly in a bind.

K Vs Rrsp: What Are They How Do They Differ

Do you know the difference between a 401k vs RRSP? If not, dont worry many people dont either!

In this article, well break down the differences between these two retirement savings options.

The average American worker has a 401k retirement savings plan through their employer, while the average Canadian worker has a Registered Retirement Savings Plan .

There are some key differences between the two types of plans that can affect how much money you have in retirement.

Heres a look at the American 401k vs the Canadian RRSP.

Don’t Miss: How To Invest 401k With Fidelity

What Happens To My 401k If I Quit My Job

If you leave a job, you have the right to move the money from your 401k account to an IRA without paying any income taxes on it. If you decide to roll over your money to an IRA, you can use any financial institution you choose you are not required to keep the money with the company that was holding your 401.

Penalties For Withdrawing Money From Your 401 Early

A 401 plan can play a key role in your retirement income, especially if you resist the urge to withdraw from it early . However, you may need a lump sum of cash at some point in your life such as to cover a medical emergency or the down payment on a house.

While an early 401 withdrawal can help in those situations, it often comes with a hefty cost. Make sure you know the consequences first.

Its never too early to start planning for retirement. Get started today by creating a free online dashboard to track your progress.

If youre still considering withdrawing from your 401 early, heres what you should know about the penalty tax.

Also Check: Where Is My 401k Account Number