How Does A Roth 401k Affect My Tax Return

Contents

Unlike tax-refundable 401 , donations to Roth 401 have no effect on your taxable income if deducted from your income. This means that you are paying the right amount as you withdraw, so you do not have to pay tax on your withdrawal.

How is Roth 401ks paid? The user-supported Roth 401 program is similar to the traditional system with one main feature. Contributions by employees are not tax deductible but are made in post-tax dollars. Money earned on account, from interest, dividends, or capital gains, is tax-free.

We Ran Through The Similarities And Differences Between Roth 401 Vs Roth Ira

Both are great ways to save for retirement, and each has its pros and cons. If you need help deciding, or just want to talk to someone about getting your finances on the path towards financial freedom, schedule a free discovery call with one of our certified financial planners today.

Bonus: Does your income put you above contribution limits for a Roth IRA? Check out our video on the Backdoor Roth IRA technique.

Should I Roll Over My Traditional 401 To A Roth 401

There isnt a one-size-fits-all answer when it comes to rolling over your retirement savings to a Roth account. If it makes sense for your situation, a Roth conversion is a great way to take advantage of tax-free growth on your accounts.

But keep in mind that rolling over a traditional 401 means paying taxes on it now. And if youre converting a large sum all at once, it could bump you into a higher tax bracket . . . which means a bigger tax bill.

If you can pay cash for the taxes without taking money out of your nest egg and youre still several years away from retirement, it may make sense to roll it over. But whatever you do, do not pull that money out of the investment itself!

Before you roll over accounts, make sure to sit down with an experienced investment professional. Theyll help you understand the tax impact of rolling over your 401 and figure out whether it makes sense for your situation.

Don’t Miss: What To Do With 401k

Vs Roth : How Are They Different

The biggest difference between a traditional 401 and a Roth 401 is how the money you put in is taxed. Taxes are already super confusing , so lets start with a simple definition, and then well dive into the details.

A Roth 401 is a post-tax retirement savings account. That means your contributions have already been taxed before they enter your Roth account.

On the other hand, a traditional 401 is a pretax savings account. When you invest in a traditional 401, your contributions go in before theyre taxed, which makes your taxable income lower.

Roth 401 vs. Traditional 401

|

Contributions |

Contributions are made with after-tax dollars . |

Contributions are made with pretax dollars . |

|

Withdrawals |

The money you put in and its growth are not taxed . However, your employer match is subject to taxes. |

All withdrawals will be taxed at your ordinary income tax rate. Most state income taxes apply too. |

|

Access |

If youve held the account for at least five years, you can start taking money out once you reach age 59 1/2. You or your beneficiaries can also receive distributions due to disability or death. |

You can start receiving distributions at age 59 1/2, no matter how long youve had your 401. You or your beneficiaries can also receive distributions due to disability or death. |

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: When Should You Rollover Your 401k

How A 401 Works

The contributions that you make to your 401 are excluded from your taxable income, which is why this is called a tax-deferred account. So if you earn $40,000 annually and contribute $3,000 to your 401 for the year, the IRS will consider your taxable income to be $37,000 . In some cases, reducing your taxable income could mean less of your income is in a higher tax bracket and save you even more money come tax season.

For the 2022 tax year, you can contribute up to $20,500 to your 401 account. If you are 50 years old or older, some 401 plans will let you add “catch-up contributions” of up to $6,500, allowing for a total of $27,000 in contributions for 2022. Each year, these contribution limits change, so be sure to check the latest IRS publications for updates.

When you invest through your 401 account, your earnings grow tax-free. But once you start withdrawing your 401 account balance, at age 59½ or later, the distributions are taxed as ordinary income. This has benefits if your income is lower in retirement, since you should expect to get taxed at a lower rate. Withdrawing money from your 401 before you’re 59½ years old results in a 20% tax withholding and carries an additional 10% penalty, so it is not advisable.

Why Roth Ira Is Bad

Roth IRAs may seem ideal, but they have their drawbacks, including a lack of direct tax deductions and a low maximum contribution. In the world of retirement accounts, the Roth IRA is the child of choice. Whats not to love about tax-free growth on your retirement savings?

What are the disadvantages of a Roth IRA? One major drawback: Roth IRA contributions are made on an after-tax basis, meaning there is no tax deduction in the year of contribution. Another drawback is that withdrawals of account earnings must not be made before at least five years have elapsed since the first contribution.

Also Check: Can I Convert My 401k To Gold

Who Is Eligible For A Roth 401

If your employer offers it, youre eligible. Unlike a Roth IRA, a Roth 401 has no income limits. Thats a fantastic feature of the Roth option! No matter how much money you earn, you can contribute to a Roth 401.

If you dont have access to a Roth option at work, you can still take advantage of the Roth benefits by working with your investment professional to open a Roth IRA.

Roth 401 To Roth Ira Conversions

The rollover process is straightforward if you have a Roth 401 and youre rolling it over into a Roth IRA. The transferred funds have the same tax basis, composed of after-tax dollars. This is not, to use IRS parlance, a taxable event.

If your 401 is a Roth 401, you can roll it over directly into a Roth IRA without intermediate steps or tax implications. You should check how to handle any employer matching contributions because those will be in a companion regular 401 account and taxes may be due on them. You can establish a Roth IRA for your 401 funds or roll them over into an existing Roth.

Recommended Reading: How To Recover 401k From Old Job

You May Like: How To Get Funds From 401k

How Much Can A 40 Year Old Contribute To A Roth Ira

Key offers For 2021 and 2022, individuals can put away up to $6,000 a year . Roth IRA contributions may be limited by an individuals overall income.

How much can I contribute to my 2022 Roth?

The 2022 changes highlight the contribution limit for employees participating in 401, 403, most 457 plans, and the federal governments Thrift Savings Plan will be increased to $20,500. Contribution limits for traditional and Roth IRAs remain unchanged at $6,000.

How much can a 40 year old contribute to an IRA?

IRA contribution limits are raised every few years to keep up with inflation. For 2021 and 2022, individuals can put away up to $6,000 a year . Roth IRA contributions may be limited by an individuals overall income.

Can I Contribute To A 401k And An Ira

It is a question that comes up frequently when it comes to retirement planning: Can I contribute to a 401k and an IRA? The simple answer is yes, you can. However, there are some caveats when it comes to deducting your IRA contributions if you participate in both types of plans.

Fortunately for your retirement nest egg, you can contribute to both types of retirement accounts. In fact, both workplace and individual retirement accounts represent important building blocks in your retirement savings. Supplementing your workplace retirement account is a great way to boost your retirement savings and put even more of your money to work in tax-advantaged accounts.

An added bonus: IRAs also often offer more investment options than the typical 401k plan. Just as with your traditional 401k, you may contribute pretax dollars to a traditional IRA and then benefit from tax-deferred growth and distributions. As I later cover, be aware that you can only contribute pretax dollars up to certain income levels.

Read Also: How To Make 401k Grow Faster

Read Also: When Do I Have To Draw From My 401k

Can I Contribute To A Roth Ira If I Have A Roth 401

June 30, 2021 by Retirement

Q. Im almost 28, single, and an engineer. I save the max in my 401 at work. My taxable income was less than $90,000. Growing up, my parents started a Roth IRA for me. I have been contributing several thousand dollars a year to that Roth since high school. I now have the option at work to convert my 401 to a Roth. If I do so, because my income will continue to rise and I want tax-free withdrawals, will I be able to contribute to my non-employer Roth account?

Saver

A. Yours is a great question.

Theres a lot of confusion when it comes to determining eligibility for IRA contributions.

Contributions to a Roth IRA are limited by your income, said Deva Panambur, a fee-only planner with Sarsi, LLC in West New York and an adjunct professor of personal finance at Montclair State University.

For 2021, you can contribute the maximum amount of $6,000 into a Roth IRA if your modified adjusted gross income is less than $125,000. Qualified individuals over 50 can contribute $7,000. If your income is between $125,000 and $140,000 you can contribute a lesser amount, he said.

When deciding whether to contribute to a Roth account or a 401 or a traditional IRA, you must compare your current tax rate to your expected tax rate when you withdraw the money from the 401 or IRA, typically at retirement, Panambur said.

Email your questions to [email protected].

First You Need To Understand Contribution Limits

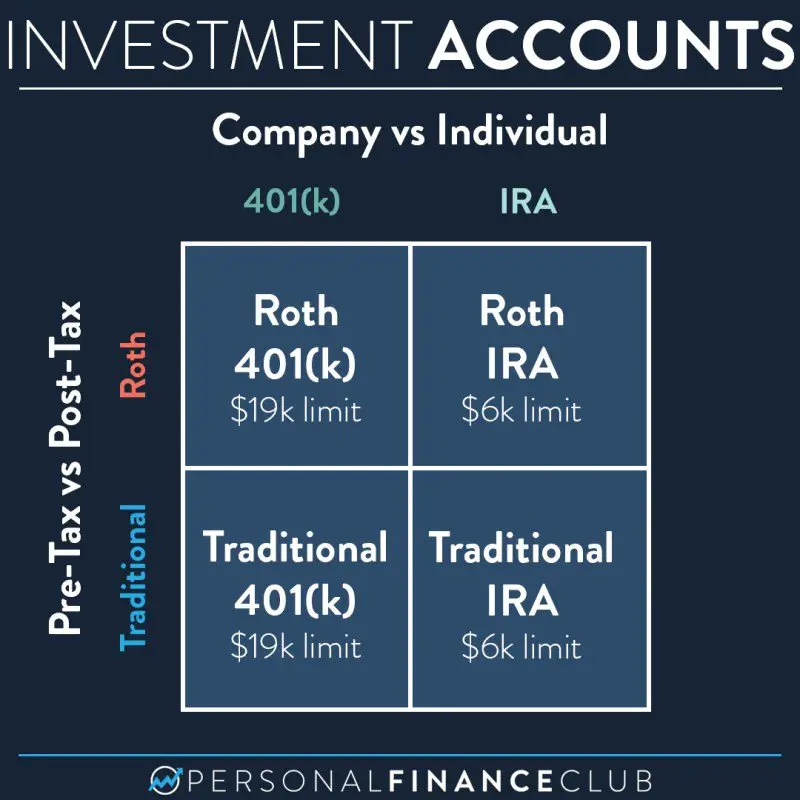

Before we get into how to contribute to multiple 401s and IRAs, we need to understand the limitations.

The IRS sets limits to how much you can contribute to your retirement accounts. 401s have different contribution limits than IRAs.

The contribution limit for any 401 account is $19,500. This limit is for total contributions, whether to just one account or split between a 401 and Roth 401. If you are 50 and older, you can contribute an additional $6,500 as a catch-up bonus.

Additionally, if you receive an employer match, the total contribution for a 401 canât exceed $58,000, or $64,500 if you’re 50 and older.

For IRAs, the IRS limits annual contributions to $6,000 for each account. Individuals 50 and older can contribute an additional $1,000.

Recommended Reading: What’s The Most I Can Contribute To My 401k

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

Can You Have A Roth Ira And A Roth 401

It is possible to have both a Roth IRA and a Roth 401 at the same time. However, keep in mind that a Roth 401 must be offered by your employer in order to participate. Meanwhile, anyone with earned income can open an IRA, given the stated income limits.

If you dont have enough money to max out contributions to both accounts, experts recommend maxing out the Roth 401 first to receive the benefit of a full employer match.

Read Also: Where To Put My 401k Rollover

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Much Can I Contribute To My 401k And Roth Ira In 2021

| Designated Roth 401 | |

|---|---|

| Maximum Choice Contribution | Aggregate* employee elective contributions are limited to $20,500 in 2022 $19,500 in 2021 . |

How much can I contribute to both a 401k and Roth IRA?

You can contribute up to $19,500 in 2020 for a 401 plan. If you are 50 years or older, the maximum annual contribution jumps to $26,000. You can also contribute up to $6,000 to a Roth IRA in 2020. That jumps to $7,000 if youre 50 or older.

Can I contribute to both Roth 401k and Roth IRA?

It is possible to have a Roth IRA and a Roth 401 at the same time. However, keep in mind that a Roth 401 must be offered by your employer to participate. Meanwhile, anyone with earned income can open an IRA, subject to stated income limits.

Also Check: How Do You Find Out About Your 401k

Pick An Ira Provider For Your 401 Rollover

When moving your money, you need to figure out which brokerage will provide you with the services, investment offerings and fees you need. If youre a hands-on investor who wants to buy assets beyond stocks, bonds, ETFs or mutual funds, you need to look for a custodian that will allow you to open a self-directed IRA. On the other hand, if youre more hands-off, it might make sense to choose a robo-advisor or a brokerage that offers target date funds.

Which Is Better For Taxes A Roth Ira Or 401

Weve talked briefly about the different tax implications of a 401 and Roth IRA, but lets dive a bit further into them here. As we mentioned, a 401 and a Roth IRA have different tax advantages.

In most cases, 401 contributions are made pre-tax, meaning they reduce your taxable income and, therefore, your tax burden in the current year. The money grows tax-deferred while its in your account, and youll pay taxes on your 401 withdrawals at your ordinary income tax rate at retirement.

A Roth IRA, on the other hand, allows you to make your contributions after taxes. While theres no tax advantage in the current year, your money grows tax-free in the account and you can withdraw both your contributions and earnings tax-free during retirement.

So which tax advantage is better? Traditional 401 contributions are generally more beneficial for taxpayers with a high income today who expect to have a lower income during retirement. In other words, you can get a tax break today if your tax rate is high, and then defer those taxes until youre in a lower tax rate. And vice versa.

A Roth IRA is better for taxpayers who expect to be in a higher tax bracket during retirement. You can pay the taxes today while your tax rate is lower, and then enjoy tax-free withdrawals while your tax rate is higher during retirement.

Read Also: How To Find If You Have A 401k