Is It Worth Having A 401 Plan

Generally speaking, 401 plans are a great way for employees to save for retirement. They make it easy to save because the money is automatically deducted. They have tax advantages for the saver. And, some employers match the contributions made by the employees.

All else being equal, employees have more to gain from participating in a 401 plan if their employer offers a contribution match.

Withdrawing Money Early From Your 401

The method and process of withdrawing money from your 401 will depend on your employer, and which type of withdrawal you choose. As noted above, the decision to remove funds early from a retirement plan should not be made lightly, as it can come with financial penalties attached. However, should you wish to proceed, the process is as follows.

Step 1: Check with your human resources department to see if the option to withdraw funds early is available. Not every employer allows you to cash in a 401 before retirement. If they do, be sure to check the fine print contained in plan documents to determine what type of withdrawals are available, and which you are eligible for.

Step 2: Contact your 401 plan provider and request that they send you the information and paperwork needed to cash out your plan, which should be promptly completed. Select providers may be able to facilitate these requests online or via phone as well.

Step 3: Obtain any necessary signatures from plan administrators or HR representatives at your former employer affirming that you have filed the necessary paperwork, executed the option to cash in your 401 early, and are authorized to proceed with doing so. Note that depending on the size of the company, this may take some time, and you may need to follow up directly with corporate representatives or plan administrators at regular intervals.

Inaction Can Be Costly

If you have left money behind, it would behoove you to track it down. The average balance in forgotten accounts is $55,400. Over a lifetime, says Capitalize, failure to reclaim these assets could cost individuals as much as $700,000 in retirement savings, an estimate based on data from the U.S. Department of Labor, the Census Bureau, 401 record-keepers, IRAs and the Center for Retirement Research at Boston College.

Forgetting about old 401s, and how much money is in them, is very common, says Kashif Ahmed, a CFP at American Private Wealth in Bedford, Massachusetts. Recently, we uncovered one for a client that had more than triple what she thought it had. Youve worked for this money, so its important to locate it and keep building it, says Tess Zigo, a CFP at Emerge Wealth Strategies in Palm Harbor, Florida. I’ve seen many young folks believe it or not who have old accounts sitting in money market funds not earning a dime.

Recommended Reading: How Much Should I Pay Into My 401k

Deferral Limits For 401 Plans

The limit on employee elective deferrals is:

- $20,500 in 2022 , subject to cost-of-living adjustments

Generally, you aggregate all elective deferrals you made to all plans in which you participate to determine if you have exceeded these limits. If a plan participants elective deferrals are more than the annual limit, find out how you can correct this plan mistake.

Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. Its a free service, and it only requires your Social Security number.

Read Also: Can I Invest My 401k In Real Estate

Leaving Before You Are Fully Vested

When you leave a job, you might not be able to keep all of the money in your 401. This is because some 401s have vesting schedules. Vesting occurs when you become fully entitled to the money in your account.

Before you leave a job, be sure to check the vesting schedule for your 401. That way, youll know how much money youre entitled to keep.

Where Can I Find Out About My Pension Benefits

The Pension Rights Center The Pension Rights Center maintains an online clearing-house called Pension Help America . The Pension Help site walks you through a step-by-step process for getting information about your retirement benefits, including referrals to legal professionals. Or, you can e-mail PRC through their website at

Can you find out if you have lost your retirement benefits?

You may have funded pensions or 401 accounts that you dont even know exist. Heres how to track down these accounts. If youve worked for more than one employer in your lifetime, you may have lost or forgotten retirement benefits just waiting for you to track them down.

Also Check: How Can I Invest My 401k

I Still Have A 401k From My Last Job What Do I Do About That

As you move ahead from job to job, dont make the mistake of leaving a trail of old savings accounts behind you. Put your hard-earned savings to work for you by looking at all the options. If youve left a job and a 401k, here are the options available to you for those funds.

- Leave your balance

- Rollover to new 401 plan.

- Rollover to an IRA.

- Cash out your 401.

How Long Do You Have To Move Your 401 After Leaving Your Job

Theres no time limit on how long you can keep your 401 after leaving your job. You can leave it in your former employers plan, roll it into an IRA, or cash it out. Each option has different rules and consequences, so its important to understand your choices before making a decision.

If you leave your 401 in your former employers plan, youll still be able to access your account and make changes to your investment choices. However, you may have limited options for withdrawing your money and may be subject to higher fees.

Rolling your 401 into an IRA gives you more control over your account and typically lower fees. Youll also be able to access your money more easily. However, youll need to roll over the account within 60 days to avoid paying taxes and penalties.

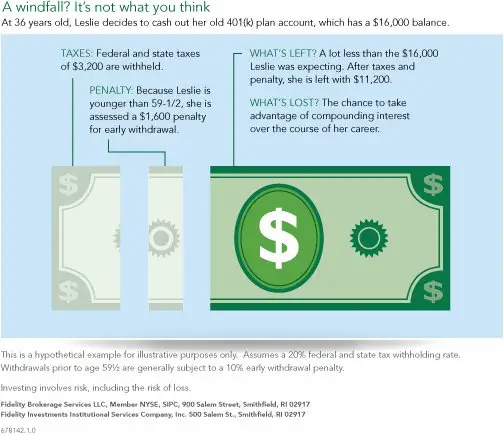

Cashing out your 401 should be a last resort. Youll have to pay taxes on the money you withdraw, and you may also be hit with a 10% early withdrawal penalty if youre under age 59 1/2. Cashing out will leave you without the tax-deferred savings to help you reach your retirement goals.

Don’t Miss: What Happens When You Rollover A 401k

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

Government And Military Pension Resource

Depending on your role in the military, some pensions are available to both veterans and their survivors. Be sure to refer to the U.S. Department of Veterans Affairs website for more information.

- Department of Veteran Affairs: If you or your deceased spouse is a veteran, you can find information on your pension at the VAs pension website.

- State government websites: If you were an employee of your state or local government, be sure to check your states government website to search for information regarding your pension.

Read Also: Can You Use 401k To Buy Investment Property

Are There Other 401 Options

Withdrawal is not the only way to access 401 funds for a down payment.

Your benefits provider may also offer 401 loan options. If available, this option not only helps you avoid the early withdrawal penalty fee, but also paying income tax on your withdrawal.

401 loans let you borrow up to 50% of your vested account balance Taking out this type of loan puts your 401 account on hold for the duration of the loan you wont be able to make additional contributions until the money is paid back.

But how can you calculate whether the 401 loan is a smart financial decision? As with any lending scenario, the price you pay to borrow the money has a big impact on determining whether the loan is worth it. You can typically expect a 1%-2% spike above the prime rate for these types of loans. Another factor to consider has to do with your employment. If youre unable to pay back the loan on time or before leaving/losing your job, you may be subject to the same financial penalties that come with a withdrawal.

You Can Also Borrow From Your 401 But There Are Downsides

According to Quicken Loans, you can often borrow from your 401generally up to 50 percent of your vested account balance or $50,000, whichever amount is lessalthough the company advises checking with your employer or HR department to determine whether your 401 plan even allows loans.

The company also notes that youll have an allotted time for repaying the loan, which is usually within five years. Youll pay interest on the loan, which is often 2 points over the prime rate. The loan might impact your debt-to-income ratio and make it harder to get a mortgage.

However, there are upsides. Quicken Loans said, Besides allowing you to make a purchase you might otherwise not be able to make, borrowing from your 401 is basically borrowing from yourself, rather than another lender. That means that you might not be losing as much money on interest payments as you would if you got the funds via another means.

Read Also: Do You Get Your 401k When You Quit

You May Like: How To Invest In A 401k Plan

What Happens To My 401k If The Economy Collapses

One of the major concerns during an economic collapse is what will happen to retirement savings, like 401s. After all, the stock market is often one of the first places to feel an economic downturns effects. So, what would happen to 401s if the economy collapsed?

In the short term, you would likely see a sharp decline in the value of your account. However, in the longer term, the economic collapse would likely cause many firms to file bankruptcy in which case your 401 shares would essentially become worthless.

Of course, this is just one possible scenario and its impossible to say for sure what would happen to 401s in an economic collapse. However, its important to be aware of the risks so that you can make informed decisions about your retirement savings.

What To Do When You Find Your Old 401 Plan

If find your lost 401, congratulations! However, its not time to celebrate by blowing it all on a fancy vacation or a shopping spree. You invested that money to build a retirement nest egg and thats exactly where those funds should stay.

To invest your old 401, you can do whats known as a rollover to avoid early withdrawal penalties. You can roll over the funds into an individual retirement account or into another retirement plan, such as your current employers 401.

In both cases, you can avoid withholding taxes if you roll over the funds directly via the plan administrator. If a distribution is made directly to you, you have 60 days to deposit it into your new retirement account in order to avoid taxes and penalties.

Recommended Reading: How To Get My 401k Money Without Quitting

If My Company Closes What Happens To My 401

When a company shuts down, it raises questions for employees about what will happen to their 401 accounts. The good news is that defined-contribution plans, including 401s, are protected under federal law. If your company shuts down, goes bankrupt, terminates your plan, or merges it with another plan, the money youve saved for retirement doesnt just disappear. You may, however, have to do a little homework to track it down.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: How To Use My 401k To Start A Business

Don’t Miss: What Should I Do With My Old Company 401k

Keep Things In Perspective

When it comes to your 401k, its important to keep things in perspective. Yes, it can be disheartening to see the value of your account going down, but its important to remember that this is just a short-term blip. The stock market is notoriously volatile, and there will always be ups and downs.

If you panicked and sold off all of your assets every time the market took a dip, you would never make any money. So, try to take a long-term view of your 401k and ride out the inevitable ups and downs.

How Does Your Money Grow In A 401k

The other way for your 401k to grow is through dividends or cash payments of a companies profits. In short, whenever a company makes a profit, it can choose to reinvest them in the company or pay them out to investors. Usually, it is a combination of the two.

How to invest in your 401k wisely?

but the risk is actually in holding cash.

You May Like: Can I Move My 401k To An Ira

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

Search Databases For Unclaimed Assets

If you still cant find information on your lost 401 plans, you can also try searching one of the publicly available databases for unclaimed assets. The National Registry of Unclaimed Retirement Benefits is a good place to start. By entering your Social Security number, you can quickly see if there are any unclaimed retirement funds that belong to you. The money may still be held in the employers plan, or the company may have opened a special IRA account in your name to hold the funds.

You can also search using the National Association of Unclaimed Property Administrators site, which will help you track down unclaimed money you may be owed, not limited to retirement assets. Be sure to check in each state you have lived or worked. The site processes tens of millions of requests each year and has helped return more than $3 billion in unclaimed assets annually.

Recommended Reading: What Is The Best Fund To Invest In 401k

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

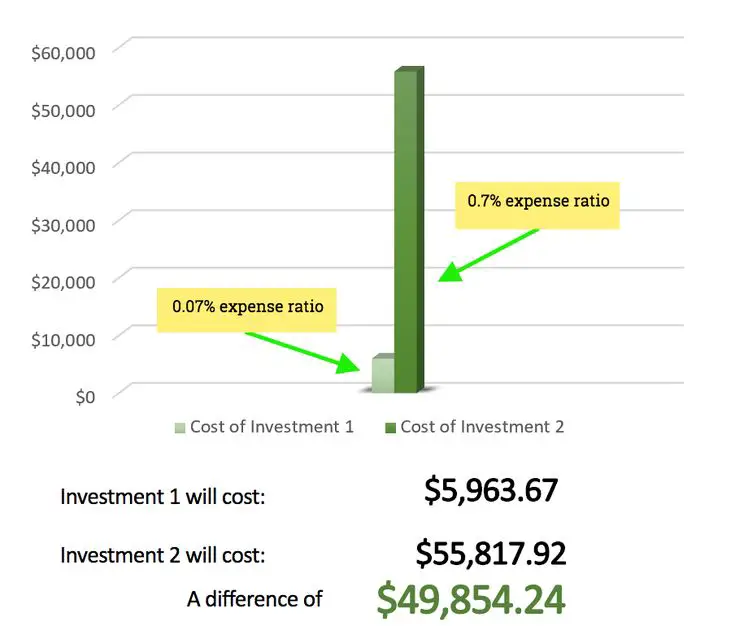

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

Is It Worth Having A 401k

While 401 plans are a valuable part of retirement planning for most U.S. workers, theyre not perfect. The value of 401 plans is based on the concept of dollar-cost averaging, but thats not always a reliable theory. Many 401 plans are expensive because of high administrative and record-keeping costs.

What do you do if you have no 401k?

Key Takeaways

Also Check: Can I Roll Part Of My 401k To An Ira