How Much Can I Contribute To A 401 And Simple Ira

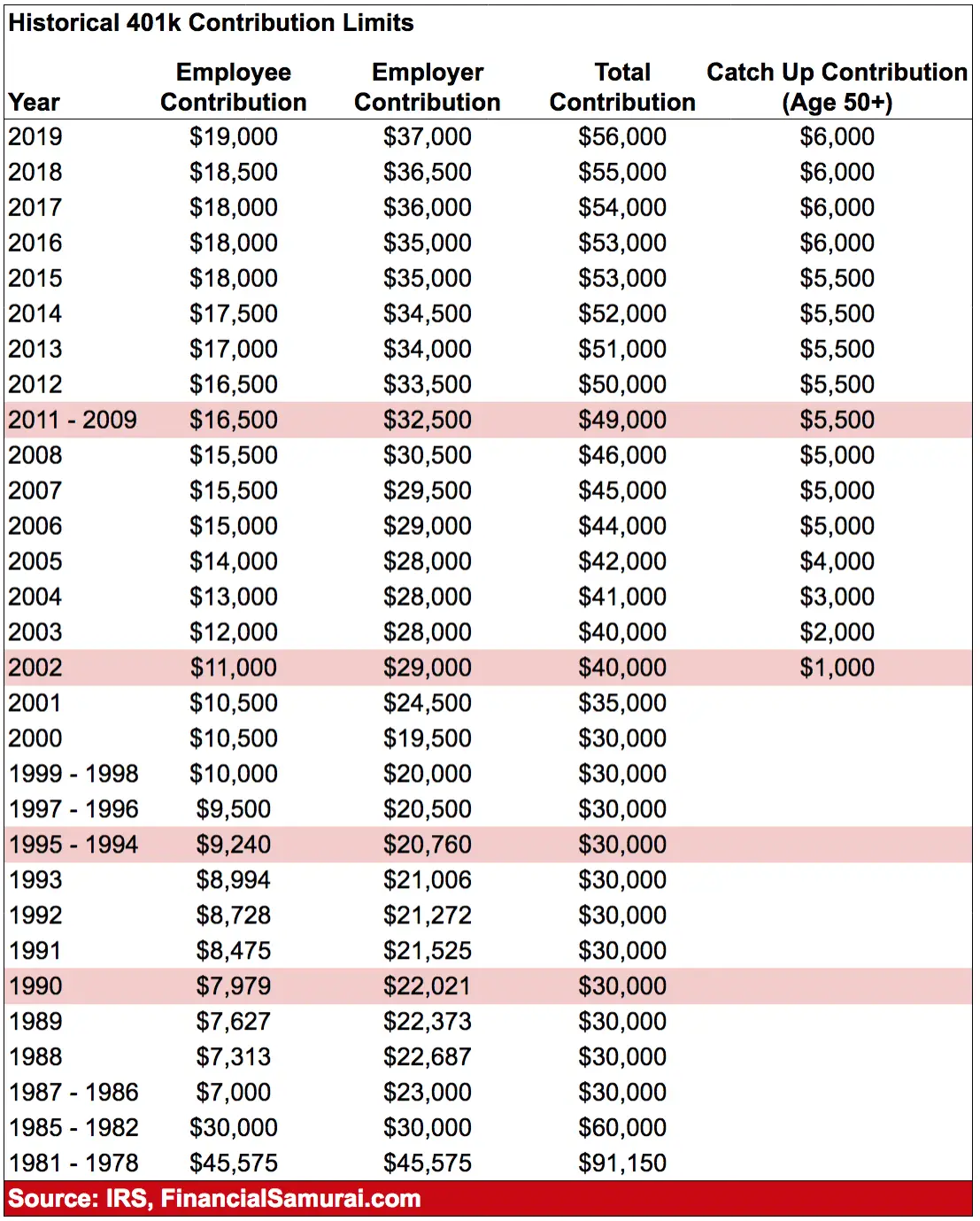

In 2021, the contribution limit for traditional 401 plans is $19,500, with an additional catch-up contribution of $6,500 for plan participants who are age 50 and older.

The contribution limit for SIMPLE IRA plans is $13,500 for 2021. Participants who are age 50 and older may make catch-up contributions up to $3,000, if the plan permits it. If an employee participates in any other employer retirement plan during the year, the total amount of contributions that they can make to all plans is limited to $19,500.

Read Also: Can I Invest My 401k In My Own Business

Solution : Explore All Of Your 401 Rollover Options

When separating from an employer, you have more options than just keeping the old 401 as is or rolling it over to a new 401. From rolling over to a Roth 401 or to a traditional IRA, evaluate all of your available options so that you can consolidate your nest egg on the account most suitable to your retirement saving strategy.

For more details, read:

Contributing To Both A Traditional And A Roth 401

If their employer offers both types of 401 plans, employees can split their contributions, putting some money into a traditional 401 and some into a Roth 401.

However, their total contribution to the two types of accounts can’t exceed the limit for one account .

Employer contributions can only go into a traditional 401 account where they will be subject to tax upon withdrawal, not into a Roth.

Recommended Reading: How Does 401k Match Work

There Are Several Avenues That You May Pursue To Save For Retirement And Some Come With Tax Benefits But What Are The Rules For Investing In More Than One

The federal government in an effort to encourage Americans to build up a nest egg for retirement gives tax benefits for squirreling away funds to be used in your golden years. Two of the most commonly known are 401 retirement plans and an Individual Retirement Account .

Both investment vehicles come in two forms, traditional and Roth. The former is tax deductible but there are limits on the amount you can put into one or several each year. The money and any gains are taxed as income once you start withdrawing, usually after retirement. But can you have both an IRA and a 401 plan?

Is It Better To Have One Ira Or Multiple

Having multiple IRAs can help you fine-tune your tax strategy and gain access to more investment choices and increased account insurance. … Investment diversification: Having IRAs at multiple financial firms can give you exposure to different types of investments and even different investing strategies.

Read Also: Can You Have A Roth Ira And A 401k

When Should I Use Roth 401k Vs Traditional

The difference between a traditional and a Roth 401 is due to when you pay taxes. Although Roth accounts are generally recommended for younger savers, Roth 401 may also allow older savers to benefit from tax-free distributions.

Is it better to do a Roth 401k or traditional?

The biggest advantage of a Roth 401 is this: because you have already paid tax on your contributions, retirement payments are tax-free. Conversely, if you have a traditional 401 , you will have to pay tax on the amount withdrawn based on your current retirement tax rate.

Does Roth 401k reduce take home pay?

If you have a Roth 401 option, your deposits will directly affect your home delivery fee, as deposits are made in after-tax dollars. The biggest advantage of a Roth 401 is that the income is not taxable. This can save a lot of taxes after retirement.

What Is A Health Reimbursement Account And Who Can Own One

November 22, 2022Edward A. Zurndorfer, Certified Financial Planner

A recent column discussed Health Savings Accounts . There are several requirements for a federal employee to contribute to an HSA, including being enrolled in a High Deductible Health Plan . The Federal Employees Health Benefits program offers several health plans that meet the IRS definition of an HDHP.

But there are employees who, while they are enrolled in an HDHP, they do not fulfill some or all or the other requirements to contribute to an HSA. In that case, the FEHB program will provide these employees with a Health Reimbursement Account .

This column discusses what an HRA is and how federal employees who have access to an HRA can utilize it.

An HRA is an employer-funded tax-sheltered account that is used to reimburse allowable medical expenses incurred by the HRA participant and eligible family members. Federal employees enrolled in an HDHP in the FEHB program who are not eligible to contribute to an HSA will be enrolled in an HRA. There is no additional paperwork needed by the employee for enrollment into the HRA.

Also Check: Does 401k Limit Include Match

Losing Track Of Your 401 Plans

When you leave an employer, its your responsibility to keep your employer updated with your current mailing address or email. When a plan administrator loses track of a participant, she may transfer the search costs and applicable penalty fees to the participant. Across the 401 industry, there is no standard on what constitutes a good faith effort to locate a participant. So, some plans may give up the search sooner than others.

Additionally, you should be every few months, and this becomes much more difficult to remember to do if you have multiple accounts to keep track of.

Pro: Diverse Investment Options

If you want to invest your retirement money in diverse retirement options, you can maintain two or more 401 accounts. Previous employerâs 401 accounts will maintain their investment profile even if you no longer contribute to the account.

When you open a new 401, you can choose investment options that help you create a diversified investment portfolio.

Don’t Miss: What Is The Maximum I Can Contribute To My 401k

With A Financial Professional

A financial professional can take care of a lot of the legwork for you, like helping you track down your accounts and completing the necessary paperwork to move them. He or she can also help you choose investments. You may also want to discuss the tax impact of consolidating the retirement accounts with your tax advisor prior to proceeding.

Rules For Having Multiple 401 Accounts

While having more than one 401 account is acceptable, there are a few rules of thumb you should keep in mind. Knowing these will help you make informed decisions about your retirement accounts and ensure youre maximizing your earnings.

Heres what you need to know about having multiple retirement accounts.

Also Check: How To Draw From 401k

Can You Have More Than One 401 Account

Yes, you can, but having multiple 401 plans floating around isnt a good idea and should be avoided. Over the 1994-2014 period, 25 million 401 holders separated from an employer and left at least one account behind and several millions of those holders left two or more 401s behind. A combination of limited portability of old 401 funds into new 401 plans, potential for forced-transfer into an IRA account, and automatic enrollment into new 401 plans sets the stage for more and more Americans owning multiple 401 plans throughout their careers.

What You Need To Know About The 401k Rules From The Irs

Here we go again about taxes. Why? Thats because the 401K is an IRS tax exception designed to promote retirement savings. If you mess up your tax-deferred 401K contributions, be prepared for the IRS to come knocking.

Per the IRS, there are two 401K contribution limits:

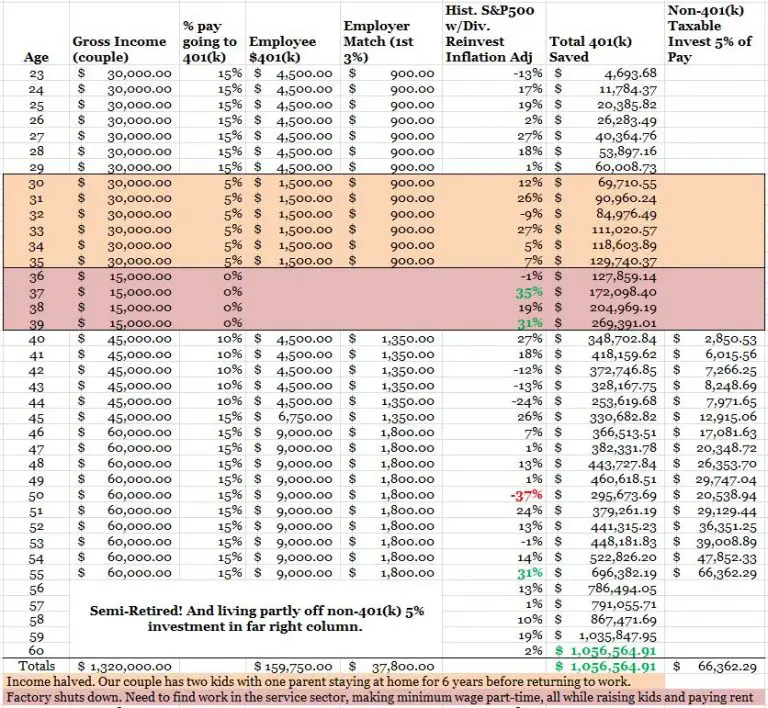

Bottom line: if youve 1099s or reportable business income, then you can contribute 20% of your net profit to a solo 401K, up to the combined limit of $58,000for 2021.

Now lets do some quick math. If youve got a net profit of $290,000, then as your own boss you can contribute $58,000 to your solo 401K on the employer portion. But wait, you ask, what about my W2 job where my employer contributed a match to my 401K. Ah-ha! Keep reading. Rule #2 will explain why over contributing by each employer is allowed.

Read Also: Can I Start A 401k Without A Job

Why Have You Set The Default Life Expectancy Of The Calculator To 95 Years

For starters, people are living longer. Even though the average life expectancy in Canada is 82 years, many people live past this. Itâs better to have more money tucked away for retirement than to run out of savings. Extra savings can always be passed down to your beneficiaries. You can change the default life expectancy if you think youâll live a longer or shorter life.

Read Also: Can You Have Your Own 401k

Working With Your Financial And Tax Professionals

A 401 plan can become the cornerstone of a personal retirement savings program, providing the foundation for future financial security. Consult your financial and tax professionals to help you determine how your employerâs 401 and other savings and investment plans could help make your financial future more secure.

Important NoteEquitable believes that education is a key step toward addressing your financial goals, and weâve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matter addressed and you should seek advice based on your particular circumstances from an independent advisor.

Whatâs the next step for you?

A financial professional can help you decide. Letâs talk.

Recommended Reading: Who Do I Contact To Cash Out My 401k

Can I Have An Ira And A 401k

The quick answer is yes, you can have both a 401 and an individual retirement account at the same time. These plans share similarities in that they offer the opportunity for tax-deferred savings .

Can you lose money in an IRA?

An IRA is a type of tax-advantaged investment account that may help individuals plan and save for retirement. IRAs permit a wide range of investments, butas with any volatile investmentindividuals might lose money in an IRA, if their investments are dinged by market highs and lows.

Can A 16 Year Old Open A Roth Ira

Anyone can bet on a Roth IRA, regardless of age. This includes babies, teenagers and grandparents. Contributors must have income for the year in which the deposit is made.

Who is not allowed to open a Roth IRA? If your adjusted gross income is greater than $ 196,000 for married performers or $ 133,000 for single performers, you will not be able to make a Roth contribution.

You May Like: Can I Buy A Business With My 401k

Percent Employer Contributions Limit

If you own your own business, you are limited to putting in 20 percent of net earnings from self-employment into a 401 account. This does include the employee contribution to the retirement account.

Net earnings exclude the amount used for S-Corp distributions since its not considered earned income.

How Do 401 Accounts Work

A 401 account is an employer-sponsored retirement plan that they offer to their employees. Using a 401, employees can contribute some of their wages to start setting money aside for retirement. These accounts are tax-advantaged and tax-sheltered, making them an essential part of anyoneâs retirement plan.

To help get employees to contribute to their 401 accounts and start saving for retirement, many employers offer a 401 match. This match is typically a percentage of your wages that the employer will match your 401 contributions on. They will then add the extra money straight to the account. So since a 401 match is basically free money, itâs important to use the 401 to your advantage and to understand how they work.

Read Also: How To Find 401k From Previous Employer

Leave Your 401 With The Old Employer

In many cases, employers will permit a departing employee to keep a 401 account in their old plan indefinitely, though the employee can’t make any further contributions to it. This generally applies to accounts worth at least $5,000. In the case of smaller accounts, the employer may give the employee no choice but to move the money elsewhere.

Leaving 401 money where it is can make sense if the old employer’s plan is well managed and you are satisfied with the investment choices it offers. The danger is that employees who change jobs over the course of their careers can leave a trail of old 401 plans and may forget about one or more of them. Their heirs might also be unaware of the existence of the accounts.

Unseen Benefit #: Double Disability And Life Insurance

God forbid if something were to happen to you. But if it were, then your loved ones are doubly protected. For example, just looking at your life insurance, which is usually 2x your salary. Now that youre two salaries, thats in effect a free double life insurance coverage. Lets say your salary in Job 1 is $180K and in Job 2 is $220K. Now youve got a $800K life insurance, free!

You May Like: Can You Use Your 401k As Collateral For A Loan

Unseen Benefit #: Potentially Double Leave Of Absence Sick Days Covid Leave

If COVID didnt convince you that 2 or even 3x is wise, then imagine an essential worker getting sick and having to tough it out without benefits. If you 2x in tech, youre tremendously privileged. Lets take a moment and thank those who support our lives by tipping more, using more words of appreciation, and helping those with less to get to where the Overemployed is at.

Having a baby? No worries. Depending on where you live, you may be able to take double maternity or paternity leave, like in Michigan.

Got a case of the Monday and just dont want to work? Take a double sick day off.

Caught COVID, take two weeks off from both employers. No questions asked.

Oh, got one of those wellness days off? If youre lucky, maybe both of your employers have the same day off.

What Is The Main Benefit Of A 401

A 401 plan lets you reduce your tax burden while saving for retirement. Not only are the gains tax-free but it’s also hassle-free since contributions are automatically subtracted from your paycheck. In addition, many employers will match part of their employee’s 401 contributions, effectively giving them a free boost to their retirement savings.

Also Check: How To Transfer 401k From Fidelity To Vanguard

What Happens If I Have 2 Ira Accounts

Contents

There is no limit to the number of traditional individual retirement accounts or IRAs. However, if you set up multiple IRAs, you wont be able to deposit more than the deposit limit on all of your accounts each year.

Is having two IRA accounts bad? There is no limit to the number of individual retirement accounts .

Combining 401 Accounts: How To Get Started

- Gather your most recent 401 and IRA statements. To transfer these accounts, you need statements that are less than 90 days old.

- Collect online rollover or transfer forms and contact information from your brokerage company or previous employer.

- Be sure to have your 401 accounts rolled over directly to Schwab. If you dont, you may have to pay taxes you could have avoided.

Read Also: What Percent Should You Put In 401k

How Does A 401 Earn Money

Your contributions to your 401 account are invested according to the choices you make from the selection your employer offers. As noted above, these options typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as you get closer to retirement.

How much money you contribute each year, whether or not your company matches your contribution, how your contributions are invested and the annual rate of return on those investments, and the number of years you have until retirement all contribute to how quickly and how much your money will grow. And provided you don’t remove funds from your account, you don’t have to pay taxes on investment gains, interest, or dividends until you withdraw money from the account after retirement , in which case you don’t have to pay taxes on qualified withdrawals when you retire).

What’s more, if you open a 401 when you are young, it has the potential to earn more money for you, thanks to the power of compounding. The benefit of compounding is that returns generated by savings can be reinvested back into the account and begin generating returns of their own. Over a period of many years, the compounded earnings on your 401 account can actually be larger than the contributions you have made to the account. In this way, as you keep contributing to your 401, it has the potential to grow into a sizable chunk of money over time.