Do You Need To Deduct 401 Contributions On Your Tax Return

You do not need to deduct 401 contributions on your tax return. In fact, there is no way for you to deduct that money.

When employers report your earnings at the end of the year, they account for the fact that you made 401 contributions. To give you an example, lets say you have a salary of $50,000 and you contribute $5,000 into a 401 account. Only $45,000 of your salary is taxable income. Your employer will report that $45,000 on your W-2. So if you try to deduct the $5,000 when you file your taxes, you will be double-counting your contributions, which is incorrect.

Also Check: How Do I Use My 401k To Start A Business

How Can You Avoid Paying Taxes On A Large Sum Of Money

6 ways to cut your income taxes after a windfall

What Are The Penalty

The Internal Revenue Service permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these exceptions, but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal: for costs directly related to the COVID-19 pandemic.

Youll still owe regular income taxes on the money withdrawn, but you wont get slapped with the 10% early withdrawal penalty.

Don’t Miss: How Many Days To Rollover 401k

Home Equity Line Of Credit

Instead of fixed-term repayment, you get a variable repayment and interest rate. You may opt for an interest-only repayment, but most often that comes loaded with a balloon payment, Poorman says, and may be tough to afford. Keep in mind that with a variable interest rate loan, you could see your rates go up over time.

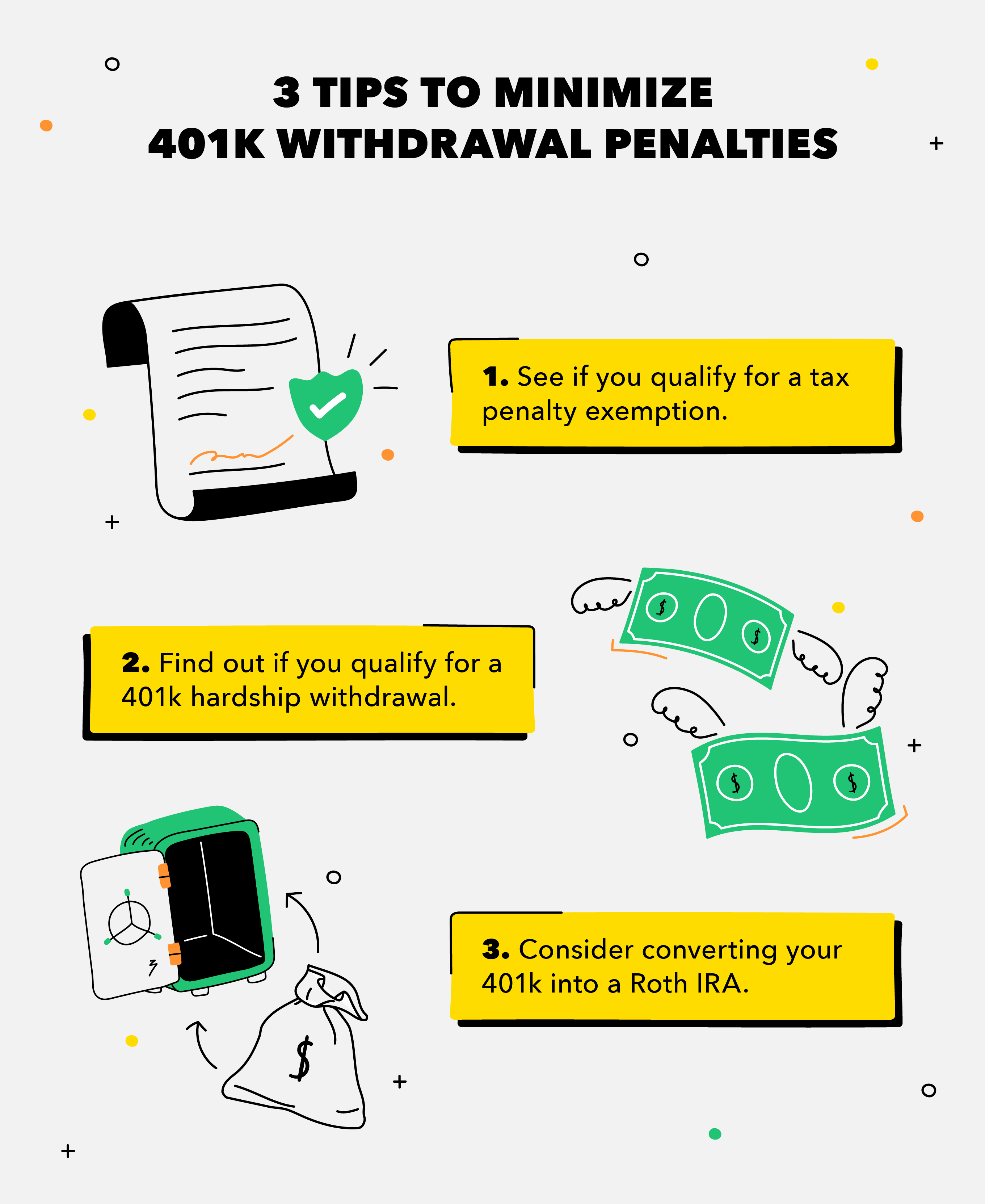

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

|

no promotion available at this time |

You May Like: How Can I Track My 401k Check

Withdrawing Money From A : Taking Cash Out Early Can Be Costly

An unexpected job loss, illness or other emergencies can wreak havoc on family finances, so its understandable that people may immediately think about taking a withdrawal from their 401. Tread carefully as the decision may have long-range ramifications impacting your dreams of a comfortable retirement.

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

Roth contribution withdrawals are generally tax- and penalty-free contribution and youre 59 ½ or older). This is because the dollars you contribute are after tax. Be careful here because the five-year rule supersedes the age 59 ½ rule that applies to traditional 401 distributions. If you didnt start contributing to a Roth until age 60, you would not be able to withdraw funds tax-free for five years, even though you are older than 59 ½.

Use A Portfolio Line Of Credit

You could also consider taking out a portfolio line of credit, which is essentially a loan backed by securities held in your portfolio, such as stocks or bonds. Interest rates on a portfolio line of credit tend to be lower than that of traditional loans or credit cards because theyre backed by collateral that the lender will receive in the event you cant pay back the loan.

However, if the value of your collateral falls, the lender can require you to put up additional securities. The lender could also become concerned with the securities being used as collateral. Government bonds will be viewed as much safer collateral than a high-flying tech stock.

Also Check: Can I Change My 401k Contribution At Any Time

Withdrawals After Age 59 1/2

Age 59 1/2 is the magic number when it comes to avoiding the penalties associated with early 401 withdrawals. You can take penalty-free withdrawals from 401 assets that have been rolled over into a traditional IRA when you’ve reached this age. You can also take a penalty-free withdrawal if your funds are still in the 401 plan, and you’ve retired.

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be expensive.

Generally, if you take a distribution from an IRA or 401k before age 59 ½, you will likely owe:

- federal income tax

- 10% penalty on the amount that you withdraw

- relevant state income tax

Calculate It:401k Withdrawals Before Retirement

The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, use this calculator to determine how much other people your age have saved.

Recommended Reading: Can I Move My 401k To Gold

Understanding The Rules For 401 Withdrawal After 59 1/2

LAST REVIEWED Apr 15 20219 MIN READ

A 401 is a type of investment account thats sponsored by employers. It lets employees contribute a portion of their salary before the IRS withholds funds for taxes, which allows interest to accumulate faster to increase the employees retirement funds. Now, if you have a 401, you could pay a penalty if you cash out your investment account before you turn 59 ½.

Heres some more information about the rules you need to follow to maximize your 401 benefits after you turn 59 ½.

What Exactly Qualifies As A Hardship Withdrawal

Financial withdrawals are permitted when a certain event is in a dire need of financial aid. For example, emergency medical procedures fall into this category. The amount that you borrow must be used entirely to cover said hardship. In these circumstances, you wont have to pay any early withdrawal penalties, but youll still have to deal with the taxes.

Dont Miss: Do Employers Match Roth 401k

Recommended Reading: What Happens To My 401k From My Old Job

How Do You Withdraw Money From Your 401 After Retirement

There are a few different ways that you can withdraw money from your 401 after retirement. The most common way is to take out a loan from the account. This is usually the easiest and quickest way to access your funds. Another option is to roll over the account into an IRA. This can be a good choice if you want to keep the money invested for growth. Finally, you can cash out the account entirely. This is usually not recommended, as you will be subject to taxes and penalties on the withdrawal.

A Bank Or Credit Union Loan

With a decent credit score you may be able to snag a favorable interest rate, Poorman says. But favorable is relative: If the loan is unsecured, that could still mean 8%12%. If possible, secure the loan with some type of asset to lock in a lower rate.

Interest is the price of borrowing money. Learn how interest rates work.

Don’t Miss: What Is The Safest Investment For My 401k

Avoid Taking The Cash

When times get tough, it can be easy to see the cash in your retirement account and consider tapping that to help get you through. In fact, in a recent Bankrate survey, about one in four Americans said that they had hit up their retirement savings or planned to do so as a result of the coronavirus-related economic decline.

Taking an early withdrawal comes with a heavy cost. If you take money out of a 401 before retirement age , the IRS will hit you with a 10 percent bonus penalty on top of the taxes that youll already owe. In addition, you may have to sell investments at low prices, and youll lose any potential appreciation over your working years, hitting your nest egg still more.

If you must tap your retirement account, see if your plan allows you to borrow against the money in the account. Youll have to repay the funds, of course, but you may be able to avoid the taxes, which is a win in itself. You may also see if you can take a hardship withdrawal.

Roth 401s: The Basics

A Roth 401 includes a combination of the features of a traditional 401 and a Roth IRA. Though not all companies with employer-sponsored retirement plans offer a Roth 401, they are increasingly popular.

Unlike a traditional 401, contributions are made with after-tax dollars and are not deductible. However, you don’t pay taxes on withdrawals when you retire. For 2022, you can contribute up to $20,500 per year , or $27,000 if you are age 50 or older .

Read Also: Can You Transfer Money From 401k To Roth Ira

An Early Withdrawal From Your : Understanding The Consequences

OVERVIEW

Cashing out or taking a loan on your 401 are two viable options if you’re in need of funds. But, before you do so, here’s a few things to know about the possible impacts on your taxes of an early withdrawal from your 401.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

What Are The Pros And Cons Of Withdrawal Vs A 401k Loan

| Pros and Cons of 401k Withdrawal vs. 401k Loan | ||

|---|---|---|

| 401k Withdrawal | ||

|

|

|

| Cons |

|

|

Don’t Miss: What Is An Individual 401k

Withdrawals After Age 72

Many people continue to work well past age 59 1/2. They delay their 401 withdrawals, allowing the assets to continue to grow tax-deferred, but the IRS requires that you begin to take withdrawals known as “required minimum distributions” by age 72.

Those who are owners of 5% or more of a business can defer taking their RMDs while they’re still working, but the plan must have made this election. This only applies to the 401 of your current employer. RMDs for all other retirement accounts still must be taken.

Other Alternatives To Taking A Hardship Withdrawal Or Loan From Your 401

- Temporarily stop contributing to your employers 401 to free up some additional cash each pay period. Be sure to start contributing again as soon as you can, since foregoing the employer match can be extremely costly in the long run.

- Transfer higher interest rate credit card balances to a lower rate card to free up some cash or take advantage of a new credit card offer with a low interest rate for purchases .

- Take out a home equity line of credit, home equity loan or personal loan.

- Borrow from your whole life or universal life insurance policy some permanent life insurance policies allow you to access funds on a tax-advantaged basis through a loan or withdrawal, generally taken after your first policy anniversary.

- Take on a second job to temporarily increase cash flow or tap into family or community resources, such as a non-profit credit counseling service, if debt is a big issue.

- Downsize to reduce expenses, get a roommate and/or sell unneeded items.

Read Also: How Do You Get Your 401k Money Out

Get Financial Guidance From Your 401 Plan Provider

Whether its best to take a lump sum or one of the other options depends on your personal goals and circumstances. Sometimes its best to talk with an expert one-on-one to determine the right course of action. Small business 401 plan provider Ubiquity offers retirement planning and financial wellness resources for both employers and employees to help our clients feel more secure in their futures.

How Long Does It Take To Get Money Out Of My 401k

May 3, 2011 It usually takes a week or two to get money out of your 401, although it can take much longer. The countdown begins when you request payment and ends when you actually receive the money in the form of a check or wire transfer.

Principal 401k phone number What is your 401k plan based on your retirement count?Your 401 is qualified retirement plan Although your donation has been reported in field 12 code D in format W2. You dont need to report them again in TurboTax. If youre going to bring up another issue, youll only answer yes to this question, such as BT IRA or Roth IRA. June 4, 2019 at 11:51 a

Recommended Reading: How Much Do You Have To Withdraw From 401k

Also Check: How To Set Up A Self Employed 401k

Qualified Distributions Are Allowed At Age 59

A 401 plan is an employer-sponsored retirement account that allows employees to contribute a portion of their salary before IRS tax withholding. Companies commonly match a percentage of the employee’s contribution and add it to the 401 account.

Before age 59½, an employee faces an IRS penalty if they withdraw money from a 401 account. The IRS allows penalty-free withdrawals, called qualified distributions, from retirement accounts after age 59½.

At that time, individuals are also permitted to convert their company-sponsored 401 into a more flexible individual retirement account . Withdrawals from a 401 are mandated after age 72 and are called required minimum distributions, or RMDs.

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, the penalty will likely be waived if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year.

Read Also: Should You Always Rollover Your 401k

Withdrawing Funds Between Ages 55 And 59

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan after leaving your job in order to access them penalty-free, but there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure you understand the rules around the age requirement for penalty-free withdrawals. The age 55 rule won’t apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in this case.

The age-55-and-up retirement rule won’t apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59½.