Charles Schwab Solo 401k

Schwab is another discount brokerage that offers a prototype solo 401k plan for free. Since Schwab is continually working to improve their image in the low-cost brokerage space, I was interested to see what they offered.

I was disappointed to learn that Schwab only offers traditional 401k contributions – they do not have a Roth option on their plan . They also do not offer loans under their plan. And finally, they don’t offer elective after-tax contributions to their plan.

It appears that you can rollover a 401k into your Schwab solo 401k, but you cannot do an IRA rollover.

Schwab does offer a lot of investing options, including Vanguard mutual funds and commission free ETFs.

There are no fees to open the solo 401k, and there are no yearly maintenance fees. Inside the 401k, traditional Schwab pricing applies – $0 per stock trade, with $0 on Schwab funds and ETFs.

Learn more about Charles Schwab in our Charles Schwab Review.

K And Ira Contributions Limits For 2021

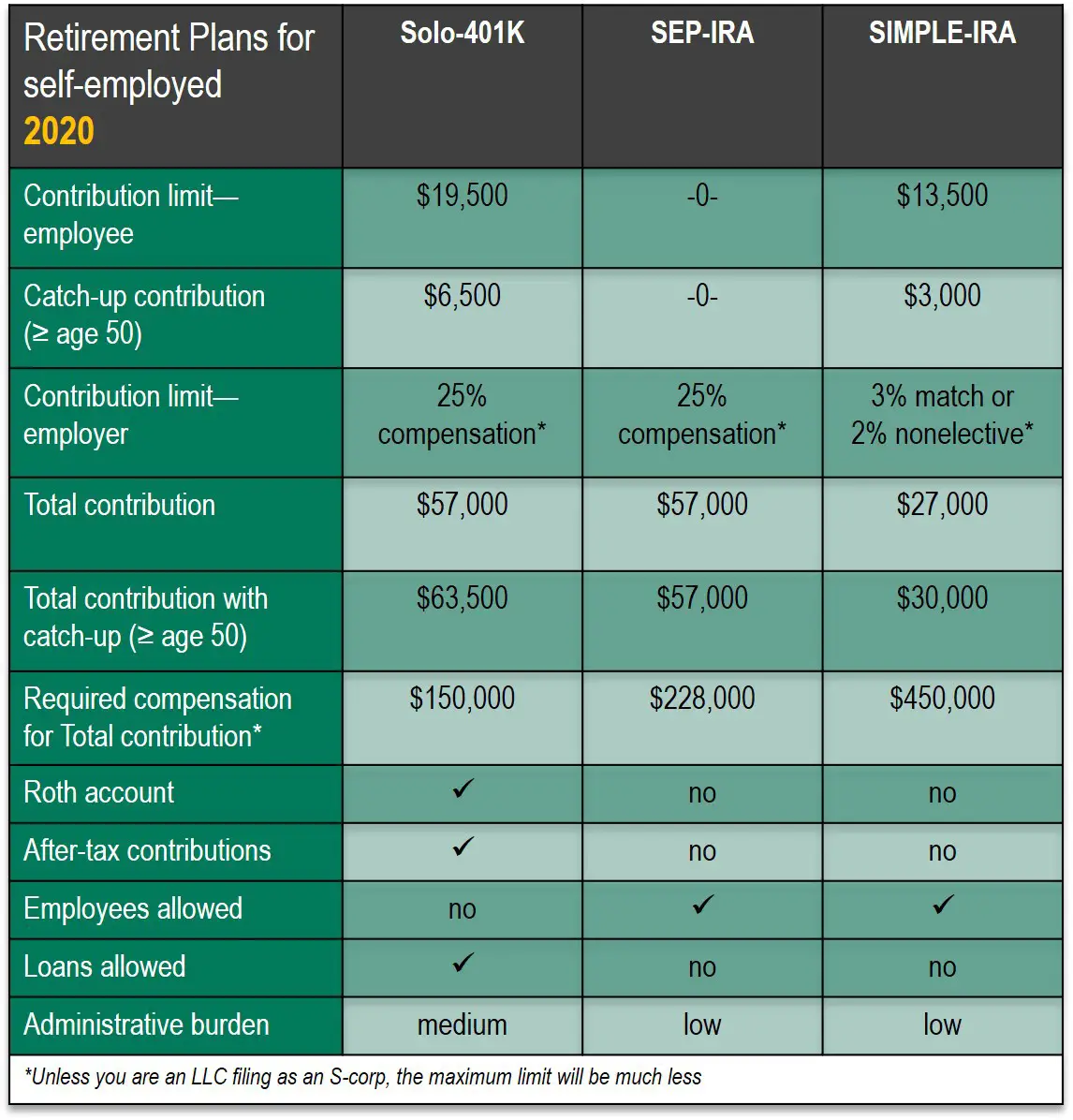

While contributing to both a 401k and IRA is certainly allowed, there are a few considerations to keep in mind. The first is the contribution limits the IRS places on each type of account, which are outlined in the table below.

Contributions

| Made with already taxed dollars. Can contribute up to $6,000 in 2021 .* | |

| Traditional 401k | Made with pre-tax dollars. Can contribute up to $19,500 in 2021. If you are over age 50, you may contribute up to an additional $6,500/year. |

| Roth 401k | Made with already taxed dollars. Can contribute up to $19,500 in 2021. If you are over age 50, you may contribute up to an additional $6,500/year. |

Eligibility

- Read More: 401k Rollover Options

Remember that contribution limits apply to the total of your contributions to all of your retirement accounts, either IRA or 401k. Note that the chart above includes the Roth option which has been available for 401ks and IRAs since 2006.

Paying attention to these limits is important. If you do contribute more to your IRA accounts than is allowed , youll face a penalty in the form of a tax on the excess contributions for each year they remain in the account.

Thankfully, if either of the situations occur, you have until April 15th of the following year to remove the excess funds.

If you miss that deadline, you should work with a CPA to calculate any tax liability.

Also Check: When I Withdraw From My 401k

Can You Have Employees And Open A Single

You cant have any full-time employees, but you can contract with freelancers or employ part-time employees who dont work more than 1,000 hours a year in your business. Note that not all individual 401 plans allow for part-time employees, so be sure to check with your provider before hiring employees.

Recommended Reading: How Do I Invest In My 401k

Read Also: How Do You Find Out Your 401k

When Is An Ein Unnecessary

While EINs are necessary for corporations and partnerships, most sole proprietorships actually do not need them.

Similarly, single-member LLCs do not need EINs either, unless the LLC is required to file excise tax returns or employment tax returns. When an EIN is not required, the LLC is said to be a disregarded entity because the business income and expenses are reported on the sole owners tax returns, so a separate tax return is not necessary.

Although trusts is one of the common types of entities that obtain EINs, you will probably not need an EIN if you have created a revocable living trust. That is because these types of trusts typically use the grantors Social Security Number during his or her lifetime. When the grantor dies, his or her revocable living trust will become irrevocable and will require an EIN at that time.

Disadvantages Of Having A 401 And Ira

Under most circumstances, the IRS permits you to make tax-deductible contributions to your IRA up to the annual limit.

But contributing to a 401 account may lower the amount of your IRA contribution that is tax deductible , depending on your modified adjusted gross income and whether your spouse is covered by an employer-sponsored retirement plan. This might be something youll want to go over with a financial planner or financial advisor.

The tables below explain IRA tax deduction rules depending on different circumstances.

| 2020 IRA Tax Deduction Limits If You Have a Workplace Plan |

| Filing Status |

| No deduction |

You can access more information about IRA contributions and rules by visiting IRS Publication 590-A.

But you can explore the pros and cons of each plan to decide whether you should contribute to both.

Don’t Miss: How Do You Get A 401k Plan

What Is An Individual 401k

The Individual 401k plan is sometimes referred to as a “Solo 401k”, “Single”, Uni-k, Personal 401k or “Self Employed 401k”.

The Individual 401k is a powerful retirement savings plan for the self employed. This plan is available due to the Economic Growth and Tax Relief Reconciliation Act of 2001 that went into effect on January 1, 2002. The Individual 401k is only available for owner-only businesses, owner and spouse businesses or if the business is a partnership that employs only the partners and has no W-2 employees. The 2022 Individual 401k contribution limit is $61,000 or $67,500 if age 50 or older. The 2021 limit is $58,000 or $64,500 if age 50 or older.

What Is The Benefit Of Adding A Spouse To A Solo 401

A married couple with a Solo 401 can contribute a maximum of $114,000 per year for retirement as both employer and employees. If you and your spouse are over 50 years of age, total contributions can reach $127,000. Once the plan reaches $250,000 or more in assets, Form 5500-SF will need to be submitted to the IRS.

Get Your Complimentary Guide to Solo 401 plans

Read Also: What’s The Difference Between A Roth Ira And A 401k

How Much Can You Contribute To An Individual 401

According to Allec, the contribution limits have both an employee and employer component. You fill both those roles. In 2022, an employee can contribute up to $20,500 if they are under 50. For those 50 or older, the maximum is $27,000. The $6,500 difference is a catch-up provision, meaning older individuals can save more for their retirement.

As for the employer component, you can make a nonelective contribution to the 401 of 25% of your Form W-2 wages. For example, if you earn $100,000 in wages in 2022, you can contribute $20,500 as an employee and $25,000 as an employer for a total of $45,500. For a sole proprietorship, the employer component is 20% of your net income from self-employment, which is calculated as your self-employment income as reported on Schedule C, less your deduction for half of the self-employment taxes paid.

When you contribute as both an employee and an employer, the threshold amount in 2022 is $61,000 if youre under 50 and $67,500 if youre 50 or older.

These limits usually change every year, and typically they go up to adjust for inflation. The increase is usually a round number, not a percentage.

If your spouse works for your business and is compensated, they can participate in your businesss solo 401 at the same limits as above.

I Participate In A 401k Through My Primary Employer And I Have A Part Time Business Can I Have An Individual 401k For My Part Time Business

Yes. You are eligible to establish an Individual 401k for a side business even if you participate in a 401k, 403b, 457 or Thrift Savings Plan through your primary employer. It is important to note that contributions made to the employers 401k, 403b or Thrift Savings Plan will impact the contributions for the Individual 401k. Contributions to the employers 401k, 403b or TSP count towards the Individual 401k salary deferral limit. The 2022 salary deferral limit is $20,500 and $27,000 if age 50 or older.. Contributions made into a 457 plan do not count towards the salary deferral limit. In addition to a salary deferral contribution, a business owner can also make contributions to the profit sharing portion of an Individual 401k.

Example: Jennifer is age 40 and works as a W-2 employee for ABC accounting firm and contributes $10,000 to the 401k. In addition to working at the accounting firm, Jennifer is the owner of an S corporation. She is the only employee and pays herself a $100,000 W-2 salary in 2022.

Based on this information Jennifer would be eligible to make a contribution of $10,500 in salary deferrals plus make a profit sharing contribution of $25,000 for a total of $35,500 in Individual 401k contributions in 2022.

You May Like: Does A 401k Rollover Count As A Contribution

What Are The Pros And Cons Of A Solo 401

One of the biggest benefits of opening a solo 401 is that it comes with some of the highest contribution limits. Since you can make contributions as an employer and an employee, you can maximize your contributions.

And while you do have to be self-employed to open a Solo 401, it doesnt have to be your only source of income. If you have a full-time job and consult on the side, youre eligible to open a solo 401.

You can also choose from a much broader range of assets than you can with a traditional employer-sponsored 401. For instance, you can invest in index funds, mutual funds, exchange-traded funds , stocks, and bonds.

However, there are some downsides you should consider. Like most retirement plans, youll get hit with taxes and fees if you withdraw the funds before the age of 59½.

One disadvantage is that you must have a triggering event, usually retirement or ending employment, to take a distribution, says deMauriac.

And youre responsible for managing the plan and handling the paperwork on your own.

|

Pros |

|

|

|

What Is A Solo 401

Just because you are a one-person outfit, a freelancer, or an independent contractor doesn’t mean you have to do without a retirement savings plan or the tax benefits that accompany them.

One option If you are self-employed is the solo 401, also known as an independent 401 plan. In fact, the Solo 401 has some benefits over other types of retirement accounts available to the self-employed.

Recommended Reading: How Much Can I Put In 401k

Understand The Eligibility Requirements For A Solo 401

Because the IRS limits solo 401 plans to only one participant, theyre a good choice for self-employed individuals and small business owners with no full-time employees. They can cover just a business owner with no employees or that person and their spouse.

Solo 401 plans require a plan administrator, also known as an investment provider, to help with regulatory paperwork. If you plan to hire employees in the future, a solo 401 plan can convert to allow full-time employees within the companys 401 plan.

Youll need an EIN before you can open a solo 401 account. You can obtain one online, by fax, or by mail. If you apply online, you can have your EIN in about 10 minutes.

What Investments Can Be Selected In An Individual 401k

The investments that can be selected within an Individual 401k plan depend on the Individual 401k provider and can be divided into 3 general categories:

Learn more about Individual 401k Providers.

Don’t Miss: How To Select 401k Investments

Comparing The Most Popular Solo 401k Options

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

Over 5 years ago I went on the hunt for the best solo 401k providers, did my research, and learned a whole lot. I’ve shared in the past the best options for saving for retirement with a side income, and I’ve leveraged a SEP IRA in the past.

Contribution Limit As An Employer

Wearing the employer hat, you can contribute up to 25% of your compensation.

The total contribution limit for a solo 401 as both employer and employee is $61,000 for 2022, and $66,000 in 2023, or 25% of your adjusted gross income, whichever is lower.

People ages 50 and above can add an extra $6,500 a year as a “catch-up contribution” in 2022 and $7,500 in 2023. In other words, in 2022 you can contribute a total of $61,000 along with a $6,500 catch-up contribution if applicable for a maximum of $67,500 for the year.

You can have a solo 401 even if you’re moonlighting. If you have a 401 plan at both jobs, the total employee contribution limits must be within the maximum for the year, but the employer contribution is not limited. If you’re one of these lucky folks with two retirement savings plans, talk to a tax adviser to make sure you follow the IRS rules.

Recommended Reading: How To Take Out Your 401k

The Ultimate Guide To The Solo 401 Written By A Cpa Who Has One

We may receive a commission if you sign up or purchase through links on this page. Heres more information.

Many self-employed business owners wrongly assume that their retirement options are more limited than those available to employees of large corporations, who often have access to an employer-sponsored 401.

Well, entrepreneurs of America, I have some good news for you: as the owner of your own business, you can contribute to your own solo 401 also known as an individual 401 and the contribution limits are even greater than what a corporate employee would have.

This being said, the solo 401 rules can be a little complicated, but thankfully I have put together this guide for you.

Lets start with the basics.

Dmitriy Fomichenko President Sense Financial

Thats a good question. You will have to check the availability of a 401k plan with your employer. A lot of companies offer a 401k plan, and in your case, youre eligible to open a 401k plan with your employer. If your employer doesnt offer one, you can open an IRA instead.

Here is a resource from Investopedia.com to help you get started.

Read Also: How Much Can You Take Out Of Your 401k

Read Also: How Much Should You Invest In 401k

S To Set Up A Solo 401

There are specific steps that must be taken to properly open a solo 401 plan, according to the Internal Revenue Service .

First, you have to adopt a plan in writing, making a written declaration of the type of plan you intend to fund. The choices are the same as are given to an employee opening a 401 plan: you can choose a traditional 401 or a Roth 401. Each has distinct tax benefits.

A solo 401 must be set up by December 31st in the tax year for which you are making contributions.

Recommended Reading: How To Invest In A 401k Plan

How To Set Up A 401 Plan

Now that you know the landscape, youre ready to set up a plan as an employer or self-employed individual. Whether youre establishing a plan for a large enterprise or or on your own the next steps are:

- If youre self employed, decide if you want a SoloK, SEP, or SIMPLE.

- Decide which plan provisions you want , Safe Harbor, matching, vesting schedules?).

- Choose a vendor .

- Complete the adoption agreement along with other agreements and submit to your vendor.

- Communicate and educate: Inform employees of the plans existence and features.

- Set up individual participant accounts.

- Fund the plan through payroll or any employer contributions.

- Review the plan regularly to ensure its meeting the needs of plan participants.

- Monitor and adjust the plan as regulations change and your needs evolve.

- Provide required information to participants on an ongoing basis.

Also Check: How To Combine Fidelity 401k Accounts

Sole Proprietor / Independent Contractor:

In the case of a sole proprietor or independent contractor , you have earned income from performing personal services and report the income to the IRS on Schedule C, line 31, or Schedule F in the case of farmers and ranchers. Each of these schedules are attachments to IRS Form 1040. An owner of a sole proprietorship is the eligible participant under the employer solo 401k plan. The employer of these individuals is the sole proprietorship . See IRC 401 and IRC 401.