Borrowing Or Withdrawing Money From Your 401 Plan Before You Retire

Borrowing or withdrawing money from your 401 before you retire is a big decision. After all, youve worked hard and saved hard to build up your retirement fund. While taking money out of your 401 plan is possible, it can impact your savings progress and long-term retirement goals so its important to carefully weigh the risks, costs and benefits.

Withdrawing When You Retire

After you reach the age of 59 1/2, you may begin taking withdrawals from your 401. If you leave your job in the calendar year when you turn 55 or later, you can also begin taking penalty-free withdrawals from the 401 you had with that current company. If you are a public safety worker, this rule takes effect at the age of 50.

Once you reach 72, you are actually obligated to begin making required minimum distributions or RMDs.

You May Like: How To Pull Money From A 401k

Hardships Early Withdrawals And Loans

Generally, a retirement plan can distribute benefits only when certain events occur. Your summary plan description should clearly state when a distribution can be made. The plan document and summary description must also state whether the plan allows hardship distributions, early withdrawals or loans from your plan account.

Recommended Reading: How To Calculate Your 401k Contribution

Different Definitions Of Disability

To receive Social Security disability benefits, you must have a medical condition that keeps you from taking part in substantial gainful activity and that is expected to last at least one year or end in death. Substantial gainful activity is work that brings in more than a specified amount of income for 2022, the cap is $1,350 a month for most disabled beneficiaries.

Social Security further classifies disabilities based on your prospects for recovery, with the following designations: medical improvement expected, medical improvement possible and medical improvement not expected. These categories determine how frequently the SSA will review your condition to see if you still qualify for benefits.

To qualify for penalty-free early withdrawals from a traditional IRA or 401, your disability must be total and permanent, as defined by the IRS meaning that your physical or mental condition leaves you unable to do any substantial work and will be fatal or, in the tax agencys terms, of long, continued and indefinite duration.

That means not everyone collecting SSDI or SSI benefits is eligible for penalty-free withdrawals from a retirement account. For example, someone with the SSA classification medical improvement expected would be less likely to fit the IRS definition than someone classified as medical improvement not expected.

To claim a disability exemption to the early-withdrawal penalty, complete IRS Form 5329 and file it with your federal taxes.

Keep in mind

Alternatives To The Rule Of 55

The rule of 55 is not the only way to take penalty-free distributions from a retirement plan. There’s another way to take money out of 401, 403, and even IRA retirement accounts if you leave a job before the age of 59 1/2. It’s known as the Substantially Equal Periodic Payment exemption, or an IRS Section 72 distribution.

A SEPP plan has a twist. You start by estimating your life expectancy. Then use that to calculate five similar size payments from a retirement plan for five years in a row before the age of 59 1/2. What’s different is that these distributions can occur at any agethey’re not bound by the same age threshold as the rule of 55.

Don’t Miss: How To Check My 401k Plan

Take Out A Personal Loan

Theres also the option of taking out a personal loan to help deal with a temporary setback. Personal loans arent backed by any assets, which means lenders wont easily be able to take your house or car in the event you dont pay back the loan. But because personal loans are unsecured, they can be more difficult to get and the amount you can borrow will depend on variables such as your credit score and your income level.

If you think a personal loan is your best option, it may be a good idea to apply for one with a bank or credit union where you have an existing account. Youre more likely to get the loan from an institution that knows you and they might even give you some flexibility in the event you miss a payment.

When Does The Rule Not Apply

The Rule of 55 doesnt apply to any retirement plans from previous employers. Only the 401 youve invested in at your current job is eligible. Additionally, the Rule of 55 doesnt work for individual retirement accounts , including traditional, Roth and rollover accounts. Youll have to wait until age 59½ to access those assets without penalty.

Theres a way around this, however: You could roll over the funds from your former 401 and IRA plans into your current 401. Note that the process can be complicated, and not all employers accept rollovers. Before initiating a transfer, talk to your human resources representative and consult with a tax advisor to avoid unnecessary headaches. If you are allowed to make the transfer, all the funds in your current 401, including the transferred amount, will be available if you take early distribution using the Rule of 55.

Read Also: What Will My 401k Be Worth In 20 Years

When You Leave A Job

When you leave a job, you generally have the option to:

- Leave your 401 with your current employer

- Roll over the funds to an IRA

- Roll over the funds to your new employer’s 401.

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but this will trigger early withdrawal penalties if you are under 59 1/2 .

Do I Pay Taxes On 401k Withdrawal After Age 60

Traditional 401 withdrawals are taxed at an individual’s current income tax rate. In general, Roth 401 withdrawals are not taxable provided the account was opened at least five years ago and the account owner is age 59½ or older. Employer matching contributions to a Roth 401 are subject to income tax.

Don’t Miss: Does Mcdonald’s Offer 401k

Whats The Penalty For Cashing Out My Retirement Account Early

If you cash out your retirement savings early, you may have to pay a penalty. Heres how to figure out yours. The early withdrawal penalty and its exceptions In general, if you make a withdrawal from your retirement accounts before you reach age 59 1/2, the IRS will assess a 10% early withdrawal penalty.

When do you have to take money out of 401k?

Youre age 59 ½. The IRS encourages long-term saving and growth by levying a 10% early withdrawal penalty on money taken out of 401 accounts prior to participants reaching 59 ½ years of age. However, once you reach that magic number, you can feel free to take withdrawals to cover living expenses and other financial needs.

How to calculate what my penalty will be if I cash out my 401k?

If all of your contributions were made on a pre-tax basis, such as with a 401 or traditional IRA, the calculation is easy. As long as you dont qualify for an exception, your penalty is 10% of the entire amount you withdraw early.

Requesting A Loan From Your 401

If you do not meet the criteria for a hardship distribution, you may still be able to borrow from your 401 before retirement, if your employer allows it. The specific terms of these loans vary among plans. However, the IRS provides some basic guidelines for loans that won’t trigger the additional 10% tax on early distributions.

Whether you can take a hardship withdrawal or a loan from your 401 is not actually up to the IRS, but to your employerthe plan sponsorand the plan administrator the plan provisions they’ve established must allow these actions and set terms for them.

For example, a loan from your traditional or Roth 401 cannot exceed the lesser of 50% of your vested account balance or $50,000. Although you may take multiple loans at different times, the $50,000 limit applies to the combined total of all outstanding loan balances.

Don’t Miss: How Do I Check My 401k For Walmart

Circumstances Where Only Iras Permit Penalty

Note: Withdrawals from 401 plans may be allowed for these events, but they will incur taxes and penalties.

- To pay for educational expenses. Funds can be pulled from an IRA ahead of retirement age to pay for qualified higher education expenses.

- To make a first-time home purchase. Qualified homebuyers can withdraw as much as $10,000 from an IRA to put toward their first home purchase, without penalty.

- To pay health insurance premiums. An IRA owner who is unemployed can take early withdrawals to pay for health insurance premiums without incurring a penalty fee.

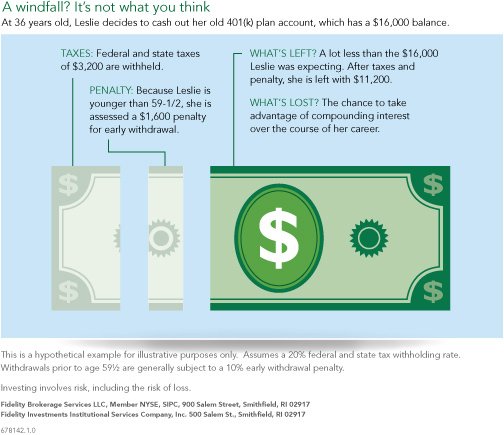

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be expensive.

Generally, if you take a distribution from an IRA or 401k before age 59 ½, you will likely owe:

- federal income tax

- 10% penalty on the amount that you withdraw

- relevant state income tax

Calculate It:401k Withdrawals Before Retirement

The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, use this calculator to determine how much other people your age have saved.

Don’t Miss: Where Can I Find My 401k Balance

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 or 10% of that $10,000 withdrawal in addition to paying ordinary income tax on that money. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

You may lock in your losses. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona. That may mean less money for your future.

Withdrawing Money From A : Taking Cash Out Early Can Be Costly

An unexpected job loss, illness or other emergencies can wreak havoc on family finances, so its understandable that people may immediately think about taking a withdrawal from their 401. Tread carefully as the decision may have long-range ramifications impacting your dreams of a comfortable retirement.

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

Roth contribution withdrawals are generally tax- and penalty-free contribution and youre 59 ½ or older). This is because the dollars you contribute are after tax. Be careful here because the five-year rule supersedes the age 59 ½ rule that applies to traditional 401 distributions. If you didnt start contributing to a Roth until age 60, you would not be able to withdraw funds tax-free for five years, even though you are older than 59 ½.

Also Check: How To Do Your Own 401k

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

Read Also: Can I Open A 401k On My Own

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

Also Check: How To Close My 401k And Get My Money

How Much Can I Withdraw Using The Rule Of 55

Under the rule of 55, you can take penalty-free distributions from your most recent employer-sponsored 401 or 403 if you’re age 55 or older and were laid off, fired, or quit your job. The amount you can withdraw will depend on the amount of money in your 401 or 403 account, and it is limited to your compensation multiplied by the number set for that tax year .

What Happens If I Stop Contributing To My 401k

If you are considering stopping contributions to a 401k, you would be better served to merely suspend those contributions. A short-term suspension will slow the performance of your retirement fund, but it wont keep it from growing. It also will lessen the temptation to simply withdraw all the funds and wipe out retirement savings in the process.

Don’t Miss: How To Pull Out 401k Without Penalty

Medical Expenses Eviction Threats

Under IRS rules, hardship withdrawals can only be for the amount “necessary to satisfy that financial need.” The person taking the money out of their 401 must pay tax on the funds, but they don’t have to repay the money to their account. Such withdrawals can be made in response to a number of financial issues, ranging from medical expenses to payments necessary to avoid eviction, according to the IRS.

There are other options for people to tap their 401s before retirement without necessarily invoking financial hardship. For instance, people can request a loan against their retirement fund, although the money must be paid back, or they can simply take an early withdrawal while paying a 10% penalty.

Although financial professionals generally recommend against early withdrawals from retirement accounts, some workers may nevertheless need to take a partial distribution when facing financial stress, Stinnett added. At the same time, companies that offer retirement plans to their employees can take some steps to help their workers stick with their long-term goals, such as offering financial counseling.

“Sometimes people need a coach and need to be reminded of the long-term benefits of keeping your money in a retirement plan,” Stinnett said. “Talking about decades of compounding, and then there is the opposite side of the coin that’s what you lose when you pull that money out.”

How Much Will I Get If I Cash Out My 401k

If you withdraw money from your 401 before you’re 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 of that $10,000 withdrawal. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

Also Check: What The Limit On 401k Contribution

A 401 Loan Or An Early Withdrawal

Retirement accounts, including 401 plans, are designed to help people save for retirement. As such, the tax code incentivizes saving by offering tax benefits for contributions and usually penalizing those who withdraw money before the age of 59½.

However, if you really need to access the money, you can often do so with a loan or an early withdrawal from your 401 just remain mindful of the tax implications for doing so.

Take An Early Withdrawal

Perhaps youre met with an unplanned expense or an investment opportunity outside of your retirement plan. Whatever the reason for needing the money, withdrawing from your 401 before age 59.5 is an option, but consider it a last resort. Thats because early withdrawals incur a 10% penalty on top of normal income taxes.

While an early withdrawal will cost you an extra 10%, it will also diminish your 401s future returns. Consider the consequences of a 30-year-old withdrawing just $5,000 from his 401. Had the money been left in the account, it alone would have been worth over $33,000 by the time he turns 60. By withdrawing it early, the investor would forfeit the compound interest the money would accumulate in the years that follow.

Recommended Reading: Can I Convert My 401k To A Roth