What Are Retirement Account Changes For Employers

The retirement account rule changes in the Secure 2.0 Act of 2022 will impact employers at least as much as employees. The biggest change for companies will be that, starting in 2025, any new 401 or 403 plans must automatically enroll workers who don’t opt out.

Contributions from workers automatically enrolled will start at a minimum of 3% and a maximum of 10%. Each year after 2025, those amounts will rise 1% until they reach a range of 10% to 15%. Retirement plans created before 2025 will not be subject to the same requirements.

The retirement rule changes will also give employers the opportunity to offer employees “pension-linked emergency savings accounts” that will act as hybrids between emergency and retirement savings. Employers can automatically enroll workers at up to 3% of their salary, with a contribution cap of $2,500.

Contributions to these emergency accounts will be taxed like Roth contributions and will qualify for employer matching. Employees can make four withdrawals per year from the account with no penalty or additional taxes. If they leave the company, they can withdraw the emergency account as cash or roll it over into a Roth account.

How Are Withdrawals Of Roth 401 Deferrals Taxed

Because Roth 401 deferrals are contributed to your account on an after-tax basis, they are never taxable upon withdrawal. Their earnings can also be withdrawn tax-free when theyre part of a qualified withdrawal. A qualified withdrawal is one that occurs 1) at least five years after the year you made your first Roth deferral and 2) after the date you:

Series Of Substantially Equal Payments

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. This allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account.

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

You May Like: How To Pull Out 401k

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How Is The Ira Tax Credit Changing

The new law will repeal and replace the IRA tax credit, also known as the “Saver’s Credit.” Instead of a nonrefundable tax credit, those who qualify for the Saver’s Credit will receive a federal matching contribution to a retirement account. This change in tax law will start with the 2027 tax year.

Congress also amended the IRS laws for retirement account rollovers from 529 plans, which are tax-advantaged savings accounts for higher education. Currently, any money withdrawn from a 529 plan that’s not used for education is subject to a 10% federal penalty.

Beneficiaries of 529 college savings accounts will be allowed to roll over up to $35,000 total in their lifetime from a 529 plan into a Roth IRA. The Roth IRA will still be subject to annual contribution limits, and the 529 account must have been open for at least 15 years.

You May Like: Are Annuities Better Than 401k

Direct Dividends And Capital Gains To Your Money Market

As you were building your savings, you probably used your earnings to buy more shares of your investmentsthat’s how you benefit from compounding.

But now that you’re spending money from your accounts, consider having your earnings sent to your money market fund rather than reinvested, at least in your taxable accounts.

Here’s why: You’ll incur taxes on these gains when they’re paid out. If you reinvest them and then turn around and withdraw them in a few months, you’ll likely have to pay taxes on them again.

The investment returns you accumulate on the savings in your account.

What About 401 Hardship Withdrawals

401 loans are not to be confused with 401 hardship withdrawals. A hardship withdrawal isnt a loan and doesnt require you to pay back the amount you withdrew from your account. Youll pay income taxes when making a hardship withdrawal and potentially the 10% early withdrawal fee if you withdraw before age 59½. However, the 10% penalty can be waived if you can provide evidence that the money is being used for a qualified hardship, like medical expenses or if you have a permanent disability.

Another key difference between the two is that with 401 hardship withdrawals, you would be unable to pay yourself back what you took from your account. This is not the case with 401 loans.

The qualifications for a 401 hardship withdrawal depend on your plan and the rules of plans administrator, so make sure to check to see how you can qualify for one.

Read Also: What To Ask 401k Advisor

Taxes On Roth 401 Plans

Some employers offer another type of 401 plan called a Roth 401. These savings plans take the opposite approach when it comes to taxation: Theyre funded by post-tax income. This means your contributions wont lower your AGI ahead of tax-filing season.

The biggest benefit of a Roth 401 is that because youre paying taxes on your contributions now, you can withdraw the money tax-free later. A few other important notes:

-

You can begin withdrawing money from your Roth 401 without penalty once youve held the account for at least five years and youre at least 59½.

-

You can withdraw money from a Roth 401 early if youve held the account for at least five years and need the money due to disability or death.

-

Roth 401s also require taking RMDs.

Your Ira And 401 Are Changing In 202: New Rules For Retirement Accounts

Congress’ spending bill for 2023 revises the rules for retirement savings accounts.

Along with providing more aid for Ukraine and modifying to how Congress counts electoral votes, the new $1.7 trillion federal spending bill for 2023 signed by President Joe Biden on Dec. 29, 2022, also makes sweeping changes to the rules for retirement accounts like 401 plans, IRAs and Roth IRAs.

These new changes to retirement regulations follow in line with the amendments of the Secure Act of 2019 and are collectively called the Secure 2.0 Act of 2022.

The biggest changes for most Americans with retirement accounts are the extension of the age for required minimum distributions and increased “catch-up” limits for people over 60. But there are more than 90 different retirement changes overall in the giant spending package.

With Biden’s signing, some retirement account changes will take effect immediately, while others will start beginning 2024. Here’s what you need to know.

You May Like: Is 401k A Good Investment

How Contributions Affect Rmds

When you calculate an employee’s RMD, consider any contributions that you make for that employee. For defined contribution plans, calculate the RMD for an employee by dividing his or her prior December 31 account balance by a life expectancy factor in the applicable table in Appendix B of Pub. 590-B. A defined benefit plan generally must make RMDs by distributing the participant’s entire interest as calculated by the plan’s formula in periodic annuity payments for:

- the participant’s life,

Use A Portfolio Line Of Credit

You could also consider taking out a portfolio line of credit, which is essentially a loan backed by securities held in your portfolio, such as stocks or bonds. Interest rates on a portfolio line of credit tend to be lower than that of traditional loans or credit cards because theyre backed by collateral that the lender will receive in the event you cant pay back the loan.

However, if the value of your collateral falls, the lender can require you to put up additional securities. The lender could also become concerned with the securities being used as collateral. Government bonds will be viewed as much safer collateral than a high-flying tech stock.

Recommended Reading: How Can I Look At My 401k

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Periodic Distributions From 401

Instead of cashing out the entire 401, you may choose to receive regular distributions of income from your 401. Usually, you can choose to receive monthly or quarterly distributions, especially if inflation increases your living expenses. If the 401 is your main source of income, you should budget properly so that the distributions are enough to meet your expenses.

For example, if you have accumulated $1 million in retirement savings, you can choose to receive $3,330 every month, which amounts to approximately $40,000 annually. You can adjust the amount once a year or every few months if your 401 plan allows it. This option allows the remaining savings to continue growing over time as you take periodic distributions.

Recommended Reading: Can I Roll My Roth 401k Into A Roth Ira

Can The Penalty For Not Taking The Full Rmd Be Waived

Yes, the penalty may be waived if the account owner establishes that the shortfall in distributions was due to reasonable error and that reasonable steps are being taken to remedy the shortfall. In order to qualify for this relief, you must file Form 5329PDF and attach a letter of explanation. See the instructions to Form 5329PDF.

How To Take 401 Distributions

Depending on your companys rules, you may elect to take regular distributions in the form of an annuity, either for a fixed period or over your anticipated lifetimeor to take nonperiodic or lump-sum withdrawals.

When you take distributions from your 401, the remainder of your account balance remains invested according to your previous allocations. This means that the length of time over which payments can be taken, and the amount of each payment, depending on the performance of your investment portfolio.

Also Check: Where Does My 401k Go If I Quit My Job

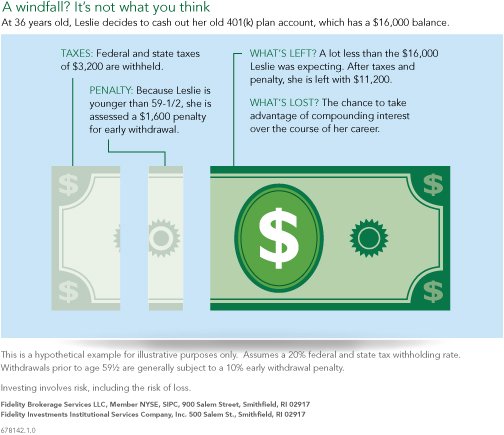

What Hardship Withdrawals Will Cost You

Hardship withdrawals hurt you in the long run when it comes to saving for retirement. You’re removing money you’ve set aside for your post-pay-check years and losing the opportunity to use it then, and to have it continue to appreciate in the meantime. You’ll also be liable for paying income tax on the amount of the withdrawaland at your current rate, which may well be higher than you’d have paid if the funds were withdrawn in retirement.

If you are younger than 59½, it’s also very likely you’ll be charged at 10% penalty on the amount you withdraw.

What Happens If A Person Does Not Take A Rmd By The Required Deadline

If an account owner fails to withdraw a RMD, fails to withdraw the full amount of the RMD, or fails to withdraw the RMD by the applicable deadline, the amount not withdrawn is taxed at 50%. The account owner should file Form 5329, Additional Taxes on Qualified Plans and Other Tax-Favored AccountsPDF, with his or her federal tax return for the year in which the full amount of the RMD was not taken.

Read Also: How Do I Check My 401k For Walmart

See If You Qualify For A Hardship Withdrawal

A hardship withdrawal is a withdrawal of funds from a retirement plan due to an immediate and heavy financial need. A hardship withdrawal usually isn’t subject to penalty.

Generally, these things qualify for a hardship withdrawal:

-

Medical bills for you, your spouse or dependents.

-

Money to buy a house .

-

College tuition, fees, and room and board for you, your spouse or your dependents.

-

Money to avoid foreclosure or eviction.

-

Funeral expenses.

-

Certain costs to repair damage to your home.

How to make a hardship withdrawal

Your employers plan administrator usually decides if you qualify for a hardship withdrawal. You may need to explain why you cant get the money elsewhere. You usually can withdraw your 401 contributions and maybe any matching contributions your employer has made, but not normally the gains on the contributions . You may have to pay income taxes on a hardship distribution, and you may be subject to the 10% penalty mentioned earlier.

Qualified Distributions Are Allowed At Age 59

A 401 plan is an employer-sponsored retirement account that allows employees to contribute a portion of their salary before IRS tax withholding. Companies commonly match a percentage of the employee’s contribution and add it to the 401 account.

Before age 59½, an employee faces an IRS penalty if they withdraw money from a 401 account. The IRS allows penalty-free withdrawals, called qualified distributions, from retirement accounts after age 59½.

At that time, individuals are also permitted to convert their company-sponsored 401 into a more flexible individual retirement account . Withdrawals from a 401 are mandated after age 72 and are called required minimum distributions, or RMDs.

Recommended Reading: Can I Borrow From My 401k To Refinance My House

Does 401k Income Affect Social Security

The amount of money youve saved in your 401k wont impact your monthly Social Security benefits, since this is considered non-wage income. However, since your Social Security benefits increase if you delay retirement, it may be beneficial to rely on 401k distributions in the early years of retirement.

Also Check: How To Fill Out A 401k Enrollment Form

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

You May Like: Can I Check My 401k Online

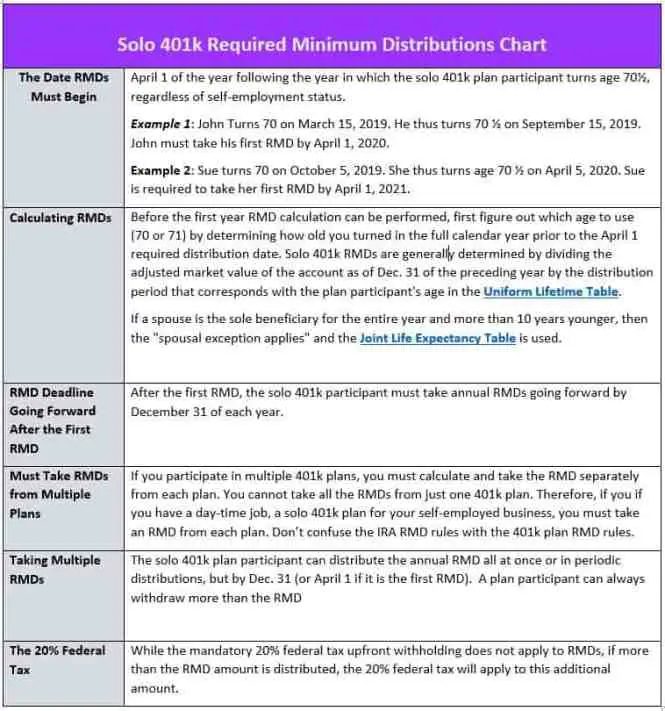

Turning 72 Or 73 This Year Heres What To Do About Your Required Minimum Distributions

Anyone turning 72 years old in 2023 is getting a birthday present from Congress one more year to push back their required minimum distributions from their retirement accounts.

As part of the Secure Act 2.0, account holders subject to required minimum distributions now have until they turn 73 years old to take those withdrawals, up from 72. This gives anyone turning 72 this year who would have otherwise had to take an RMD one more year to take that withdrawal.

The RMD age will increase yet again, to 75 years old, in 2033 as part of the new law.

Its a great benefit, said Timothy McGrath, a certified financial planner and managing partner of Riverpoint Wealth Management. Investors with enough assets can pull money from other sources while letting the investments in these retirement accounts continue to compound, he said.

Read: Whats the best way to take RMDs from your retirement accounts? Experts rate the top 3 strategies.

Taxpayers taking an RMD for the first time have until April of the following year to do so for example, someone turning 73 this year would have until April 2024 to take their first RMD. Account holders turning 72 this year, who expected to take their first RMD by April next year, now have until April 2025 to make their first withdrawal.

Read: Simple ways to supercharge your financial future