The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

How Much Money Should You Have In Your 401k

Article 3: How To Make Your Money Work for You: 7+ Ways To Try Today

And, thats with good reason. If you want to be rich, the 401k is one of the most powerful investment tools at your disposal, especially for retirement planning. It is also one of the most misunderstood money-maximizing vehicles, starting with how much you should have in your 401k.

That is a solid question, but it doesnt have a simple answer. To answer that burning question How much should I have in my 401k? we need more details. How much to invest in 401k investments will depend on your age and a few other considerations.

Lets start at the beginning.

Why Contribute To A 401

A 401 is an investment plan sponsored by your employer to help you save for retirement.

If you work for a tax-exempt or non-profit organization, or a state or local municipal government, you may be offered a 403 or 457 plan, respectively which share some common features with 401 plans but there are also differences, so be sure to understand the details before you invest.

The main advantages of 401 plans include:

You May Like: How To Rollover A 401k Into A Self Directed Ira

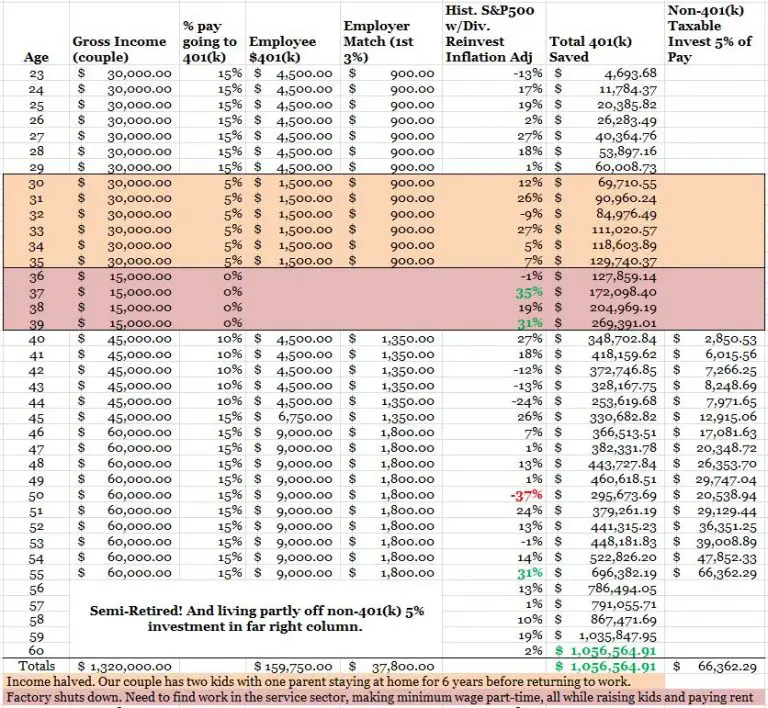

What If You Max Out Your 401 Every Year

Here’s the important part: One critical feature of any successful investment plan is consistency. In other words, the important thing isn’t simply maxing out your 401 this year, although it certainly wouldn’t hurt, but to contribute generously to your 401 every year. Doing so can produce a pretty amazing nest egg by the time you’re ready to retire.

Consider the example of our 35-year-old 401 participant. If that person contributes $18,500 to his or her account every year, and then increases the contributions to $24,500 per year once turning 50, how much could that person have by age 65? Based on 7% annualized returns, these maxed-out 401 contributions could result in a staggering $2.05 million account value.

What’s more, not only does this not include the effects of any employer match, but it assumes that the maximum 401 contribution limit remains constant over time, while in reality it adjusts annually for inflation. If you use each year’s maximum, you’re likely to contribute even more money along the way.

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

You May Like: Can I Transfer My Ira To A 401k

How Much Will Your 401 Be Worth

We all have ideas for how wed like to spend our retirement. Whether you hope to travel the world, buy an RV, or just spend more time with your family, the choices you make today will dictate the options available to you when you retire.

Fortunately, you dont have to fly blind. Use Ubiquitys 401 calculator to get a clear picture of how your savings will stack up when you retire and how much you should be saving now to realize your goals.

Limits For Highly Paid Employees

If you earn a very high salary, you may be considered a highly compensated employee , subject to more stringent contribution limits. To prevent wealthier employees from benefiting unfairly from the tax benefits of 401 plans, the IRS uses the actual deferral percentage test to ensure that employees of all compensation levels participate proportionately in their companies’ plans.

If non-highly compensated employees do not participate in the company plan, the amount that HCEs can contribute may be restricted.

Recommended Reading: What Is A Good Percentage For 401k

Why Am I Losing Money In My 401k

Several factors may be responsible for the loss of money in your 401. One possible cause is a general decline in the value of stocks. Another possible reason that your 401 is losing money is because you have invested in an individual company or industry that has faltered. Finally, losses may also be caused by fees charged by mutual fund companies and brokers.

Can You Minimize Taxes On Your 401

That may lead some people to naturally ask the question: âHow can I avoid paying taxes on my 401 withdrawal?â The short answer is that thereâs no way to get out of paying the taxes youâll eventually owe. But there are some specific situations where you might be able to access your 401 money with minimal tax implications, even if temporarily.

-

Taking out a 401 loan. If your company allows it, you may be able to borrow against your 401, and you wonât be taxed on the amount you borrow. However, if you donât pay the loan back on time or default, you will owe taxes and possibly early-withdrawal penalties.

-

Taking a distribution in retirement during a year where your income falls below a householdâs standard deduction.

Outside of those specific circumstances, if youâre planning to make regular 401 withdrawals in retirement, youll have to pay taxes. However, there are strategies to help you manage your tax liability once you start using the savings in your 401.

Also Check: How To Sell 401k Plans

Read Also: When You Quit Your Job What Happens To 401k

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

What Is The Average And Median 401 Balance By Age

401 balances can average roughly $6,000 at the age of 24 to more than $255,000 at the age of 65. Both average and median 401 balances can vary greatly depending on a few factors. This can include how long you have been saving for retirement or whether your company provides 401 matching, which is when your employer contributes to your retirement savings based on the amount of your contribution.

While savings are personal, the idea of a nest egg will likely make you contemplate what your financial future holds. Retirement might seem like a long way down the road, but time flies faster than we realize. And the earlier you start saving for retirement, the better off youll be later in life.

Knowing the 401 average by age can help you figure out where you stand and how you can be better prepared for the future. Heres what you can learn from Vanguards research on How America Saves in 2021:

| Age |

|---|

Read Also: Is There A Limit For 401k Contributions

K Early Withdrawal Penalties

If you take money out of your traditional 401 before age 59 1/2, youll get hit with two big bills when you file your next tax return:

Lets say you make $60,000 a year and you withdraw $20,000 from your 401 to pay for medical bills. Youre in the 22% tax bracket, which means that Uncle Sam pockets $4,400 of your 401 money for income taxes and $2,000 for that 10% penalty. In the end, youre only left with $13,600 of your original $20,000. Thats outrageous! There are better ways to pay the bills.

But taxes and penalties are just the beginning of the money youve lost. Youre also robbing from your future self. Heres what I mean: Lets say you left that $20,000 alone for 25 years and it averaged a 10% annual growth rate in a good mutual fund. That $20,000 would eventually turn into more than $240,000, and youd never even have to lift a finger!

Heres the reality: Your 401 is a retirement account thats designed for long-term wealth building. Its not supposed to pay for emergencies or be your college tuition fund for little Suzy.

Dont Miss: Can I Move Some Of My 401k To An Ira

Contributions: How Much Is Enough

Please fill out all required fields

Email addresses provided will be used only to let the recipient know who sent the web content. The information will not be used for any other purpose by Securian Financial.

Thank you for sharing

Your message has been sent.

When you land your first full-time job, chances are your employer will offer you the chance to contribute to a 401. Should you participate? And, if so, how much should you contribute?

If youre lucky enough to work for a company that offers a 401, most financial experts will recommend that you participate in the plan and that you do so as soon as possible. Heres why.

Also Check: When Can I Sign Up For 401k

Using The Calculator And Comparing The Results

Using this 401k early withdrawal calculator is easy. Enter the current balance of your plan, your current age, the age you expect to retire, your federal income tax bracket, state income tax rate, and your expected annual rate of return.

With a click of a button, you can easily spot the difference presented in two scenarios. A lump-sum distribution may save you on future taxes but it definitely cuts into your asset at the time of distribution. If you roll over your 401k, on the other hand, you may have to shell out a lot of money in future taxes but the growth in the account will make paying those taxes a good problem to have.

Related:Why you need a wealth plan, not an investment plan.

Easy, simple, and straightforward that is what the 401k early withdrawal calculator offers. Unlike other calculators in the market, this calculator puts forward a detailed analysis of what you are getting into. It presents the taxes and penalties that you may incur as well as the opportunities each option brings.

Knowledge is power. Spending a few minutes contemplating the results of this calculator can lead you to make an educated decision resulting in thousands more saved at retirement.

Investing Matters Because Inflation Matters

Lets say you live for 25 years after retiring at 60. You only get to live on $40,000 $100,000 a year on the low-to-mid end. Sounds feasible in todays dollars, but not so much in future dollars due to inflation.

If goodness forbid you live for 35 years after retiring at 60, then you can only live off of $28,571 $71,000. If we use a 2% inflation rate to calculate what $1,000,000 $5,000,000 is worth today, its only worth about $5500,000 $2,355,000.

We know that due to inflation, a dollar today will not go as far as a dollar 30+ years from now. Private university tuition will probably cost over $100,000 a year in 20 years. That is ridiculous since education is now free thanks to the internet.

Then there is the incredible growth of healthcare costs that is the most worrisome for retirees. For example, Ive been paying $23,000+ a year in healthcare premiums for a platinum plan for my family of three. This is despite us all in good health.

Does that sound affordable for the average American household who makes $68,000 a year? Absolutely not, which is why employees should not underestimate the value of their overall work benefits.

In fact, inflation is the reason why it takes $3 million to be a real millionaire today. Make sure you own assets like stocks, real estate, and more to let inflation work for you!

You May Like: How Much Do They Tax Your 401k

How To Check 401k Balance

Knowing how to check how much is your 401 can help calculate your net worth. Additionally, checking your 401 balance ensures your investments are performing, helping you reach your retirement goals.

Monitoring your finances should be cemented in your overall personal finance strategy. Whether it be your budget, credit profile, or retirement accounts, knowing where you stand is essential in determining your financial health. Some, like your bank accounts and credit, are relatively easy to monitor. However, figuring out how to check 401 balances can be more difficult.

Like your car, your 401 needs regular maintenance. Without it, it may not perform as well or will no longer fit your overall investment strategy anymore.

You can find your 401 balance by logging into your 401 plans online portal and check how your 401 is performing. If you donât have access to your account online, contact your HR department and make sure your quarterly statements are being sent to the correct address.

Checking your 401 too frequently can cause overwhelm and panic when the market isn’t performing well. Dips and peaks are typical for any long-term retirement investment. Checking your 401 balances at least once a year will help you gauge how it fits in your retirement strategy.

Letâs look into how to check how much is in your 401, what to look for, and how often you should be checking.

What Percentage Of My Income Should I Contribute To My 401

You can use the 401 calculator to get straightforward, dollars-and-cents answers to many important questions about your retirement. When it comes to how much you ought to be saving, however, things arent quite so simple. It depends on your age, how many years you plan to work and, ultimately, on the kind of lifestyle you want to have after you retire.

Some advisors recommend saving 10-15% of your income as a general rule of thumb. If you save that much from the time you first start working in your 20s until you retire, that may be fine. If youre starting your retirement savings later in life, however, you will want to save more than that to try to catch up. While there are few hard and fast rules on exactly how much you should save, here are some general guidelines:

Read Also: What Can I Rollover My 401k Into

Consult With A Tax Professional

Speak with both the 401 plan administrator and a tax professional to make certain that you understand your total tax obligations. I have seen many people who thought they had accounted for all taxes owed, only to find out that they owed a lot more, once the return was prepared. For instance, a large 401withdrawal can raise the total income for the year to the point where the taxpayer falls into a higher income tax bracket. When that happens, the amount that the taxpayer was having withheld from his or her regular paychecks may prove to be insufficient to cover the tax obligation at the new, higher tax rate.

Even worse, if a person files an incorrect return, understating the taxes owed, it may take years for the IRS to catch the error. Once the IRS does correct the error, it is the taxpayer who will owe the taxes plus years of interest and penalties.

I hope this information helps you Find. Learn & Save.

Best,

Recommended Reading: What Is The Current Interest Rate For A 401k Loan

How Much Should I Contribute To My 401

Some folks have ambitious retirement goals, from those dedicated to the Financial Independence, Retire Early, or FIRE, movement to those who are aiming to save $1 million in their 401. What if you dont fall into, or anywhere near, those categories?

No matter your ambitions, there are still limits to guide your contribution plans.

Starting in 2023, here are the new 401 contribution limits.

- Under age 50: $22,500

- 50 and over: $30,000

Keep in mind, these are limitsnot numbers you have to meet every year. One of the most widely used guidelines for setting and tracking your savings goals is Fidelitys Age-Based Savings Benchmarks.

Lets break it down:

- Age: 30, Savings: 1 time your salary

- Age: 45, Savings: 4 times your salary

- Age: 50, Savings: 6 times your salary

Remember, this is just a guideline, and the specifics will vary depending on the individual.

Also Check: When You Leave A Job Where Does Your 401k Go

How Would Early Withdrawals From Retirement Accounts Be Impacted By The New Law

The SECURE 2.0 Act of 2022 includes several rule changes that would benefit Americans who need to withdraw money early from their retirement accounts. Normally, withdrawals from retirement accounts made before the owner of the account reaches 59 and a half years old are subject to a 10% penalty tax.

First, Congress plans to add a basic exception for emergencies. Account holders who are younger than 59 and a half could withdraw up to $1,000 per year for emergencies, and have three years to repay the distribution if they want. No further emergency withdrawals could be made within that three-year period unless repayment occurs.

The bill also specifies that employees would be allowed to self-certify their emergencies, that is, no documentation is required beyond personal testimony. The bill would also eliminate the penalty completely for people who are terminally ill.

Americans impacted by natural disasters would also get some relief with the proposed changes. The proposed new rules would allow up to $22,000 to be distributed from employer plans or IRAs in the case of a federally declared disaster. The withdrawals wouldn’t be penalized and would be treated as gross income over three years. If the bill passes, the rule would apply to all Americans affected by natural disasters after Jan. 26, 2021.