Don’t Panic You Can Weather The Storm By Following These Tips

You invest in your 401 to make your money grow over time, but it doesn’t always work out that way. When you notice your savings losing value, your first instinct may be to sell everything, but this usually isn’t your best option. Here are four things you can try to get your savings back on track.

How Much Should You Contribute

Everyone has different financial needs, but heres a golden rule: Whatever percentage your employer is willing to match, try to take full advantage of it. Anything less, and you could be leaving money on the table. Additionally, if financially possible, you may want to max out your 401 year after year.

How A 401 Works After Retirement

There are 401 plan rules that designate the age you are eligible to get your retirement funds and how theyre distributed. Here are a few facts to keep in mind:

- The IRS lets people who retire after the age of 59½ begin taking money out of their 401.

- You are still eligible to withdraw funds from your plan before you turn 59½, but doing so will result in a 10% early withdrawal penalty in most circumstances.

- Those who are 55 and older but not yet 59½ may avoid the 10% early withdrawal penalty with their retirement plan. This applies if you have money in a 401 from an employer you just left.

- You can receive your retirement plan funds via lump-sum distribution or annuity or installment payments after you turn 59½.

- A lump-sum distribution gives you everything youve earned during your plan at once.

- An annuity or installment plan, on the other hand, allows you to receive incremental payments for a set period.

- You dont need to start taking money from your 401 as soon as you retire. Some people prefer to work past the age of 59½, for example, and forgo plan distributions until later.

You May Like: When You Quit Your Job What Happens To Your 401k

How To Better Manage Your 401 For Retirement

To better manage your 401k, you must first understand the reality of the financial landscape.

With the way the government loves to spend our money, I wouldnt be surprised if the retirement age for distribution without penalty increases beyond 59.5. Alternatively, the government could impose a distribution tax to take more of our money.

After all, with a massive government budget deficit due to the global pandemic, taxes will be going up to pay for all the stimulus spending. That said, we can hope for the best by reducing our mutual fund expenses and creating different scenarios to better prepare for our future.

The best way to increasing our odds for retirement success is to run various 401K investment scenarios. To do so, , the #1 free financial tool. Ive used PC since 2012 to manage my finances and analyze my 401K for excessive fees.

I will run three investment scenarios using the free 401k investment analyzer by Personal Capital.

Regardless of whether you are retired or not, I encourage everybody to perform at least these three scenarios and write down some notes.

Early retirees need to be extra diligent given we are more dependent on our investments to survive. If you have years to go before retirement, I suggest you pretend you are retired now so you can develop a fire to be all over your money!

Keep Some Cash On Hand

Some financial professionals recommend retirees have enough cash or cash equivalents to cover three to five years worth of living expenses. Having cash reserves can help pay for unexpected expenditures that a fixed income may not otherwise be able to cover.

Cash on hand can also mitigate whats called sequence of returns risk. Thats the potential danger of withdrawing money early in retirement during market downturns and, thus, permanently diminishing the longevity of a retirement portfolio. By selling low, the longevity of the investors portfolio is jeopardized. However, with cash reserves, retirees can withdraw less money from their 401 during a market decline and use the cash to cover living expenses.

Also Check: Can You Rollover Roth 401k To Roth Ira

What Is A Withdrawal Buckets Strategy

With the buckets strategy, you withdraw assets from three buckets, or separate types of accounts holding your assets.

Under this strategy, the first bucket holds some percentage of your savings in cash: often three-to-five years of living expenses. The second holds mostly fixed income securities. The third bucket contains your remaining investments in equities. As you use the cash from the first bucket, you replenish it with earnings from the second and third buckets.

Potential advantages: This approach allows your savings to continue to grow over time. Through constant review of your funding, you also benefit from a sense of control over your assets.

Potential disadvantages: This approach is more time-consuming.

Learn To Love The Index Fund

Some people love the appeal of stock picking. Finding the next Google or Tesla that will return hundreds of percentage points over a relatively short amount of time is thrilling, but according to research, the gamble generally doesnt work that well.

An index fund simply follows a market index. A fund that follows the S& P 500 rises and falls with that index. Theres no guessing which stock will outperform the market, and the fees you pay for index funds are almost always much cheaper than those for funds that try to pick the next great stock. Theres plenty of research that shows index funds outperform actively managed funds over the long term, too.

A plan geared toward building a nest egg is better suited to allocating large amounts to index funds.

If you fancy yourself a Wall Street trader, do it with money outside your 401 it’s best not to make short-term decisions with a retirement account.

Don’t Miss: Can You Borrow Against Your 401k

Stay On Top Of Your Fundsdon’t Just Contribute And Forget About It

Today, many companies use 401 plans for creating retirement accounts for their employees. A portion of your paycheckoften along with a little matching-fund incentive from your companygoes into an account and you are charged with managing the allocation of those funds into an offering of investment products.

Gaining a grasp of some of the 401 plan foundations will help you manage your fund with greater authority and ease. With the right basic principles in place, you’ll be better positioned to make the decisions that relate to your individual financial situation.

What Happens To Your 401 If You Leave Your Job

Its entirely dependent on your circumstances. If your 401 balance is less than $5,000, your company may remove you from their plan and send you a check, unless you elect otherwise to roll this money into an IRA or your new employers 401 plan both of these options are not taxed. If you receive and cash a distribution check and are younger than 59½, youll pay both federal and state taxes, as well as a 10% penalty imposed by the IRS.

Also Check: Can You Roll A 401k Into A Simple Ira

Figuring Out Your Taxes On A Traditional 401

Distributions from a regular, or traditional, 401 are fairly simple in their tax treatment. Your contributions to the plan were paid with pre-tax dollars, meaning they were taken off the top of your gross salary, reducing your taxable earned income and, thus, the income taxes you paid at that time. Because of that deferral, taxes become due on the 401 funds once the distributions begin.

Usually, the distributions from such plans are taxed as ordinary income at the rate for your tax bracket in the year you make the withdrawal. There are, however, a few exceptions, including if you were born before 1936 and you take your distribution as a lump sum. In such a case, you may qualify for special tax treatment.

The situation is much the same for a traditional IRA, another tax-deferred retirement account thats offered by some smaller employers or may also be opened by an individual. Contributions to traditional IRAs are also made with pre-tax dollars, and so taxes are due on them when the moneys withdrawn.

Also Check: When Can I Take Early Retirement

Everything You Need To Know About A 401

Weve all heard of a 401, but how much do you really know? A recent CNBC survey reported that 63% of Americans are confused by 401 plans and its hard to blame them.1

After all, between contribution amounts, fund allocations, employer matching2, tax implications, and rollovers, participating in a 401 can sound more like a headache and less like a helpful path towards a successful retirement. Thankfully, it doesnt have to be.

To help get you started and alleviate any stress we spoke with John Hancocks Head of Financial Planning, Misty Lynch, CFP®, to get the 411 on 401s.

Recommended Reading: How To Manage 401k Investments

The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

Common Pitfalls Of Using Your 401 After Retirement

You ultimately have three options for how to use your 401 after retirement: Receive your funds, keep them intact, or move them to a different type of retirement account. The ideal way to use your retirement plan depends on your financial situation and how you want to use your money, so consider all options carefully.

Failure to conduct a thorough review of retirement fund options can cost you hundreds or thousands of dollars. It can also cause you to face tax penalties or miss out on other potentially high-value investment opportunities.

Meeting with an independent investment advisor can provide an excellent starting point for getting the most value out of your 401. They can help you assess the pros and cons of the myriad ways to use your retirement funds. They can also produce a personalized plan to ensure you can accomplish your financial goals in retirement.

Don’t Miss: How To Get A 401k Without An Employer

Private Sector Employees Can Invest For Retirement With A 401 Plan

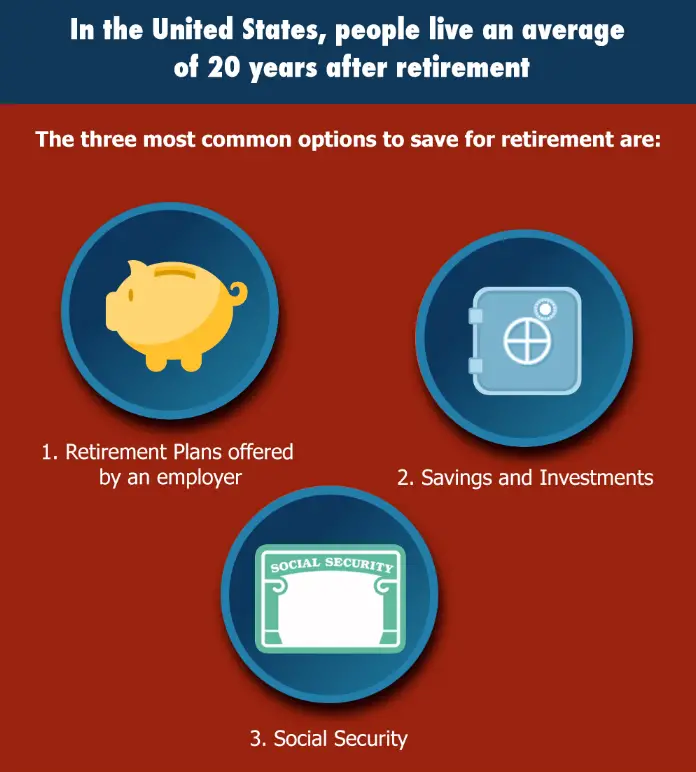

A retirement plan may be one of the most valuable benefits of employment. Used effectively, it can deliver a long-term impact on your financial well-being. See how a retirement plan works and learn about the power you have to control your financial future.

In general, a 401 is a retirement account that your employer sets up for you. When you enroll, you decide to put a percentage of each paycheck into the account. These contributions are placed into investments that youve selected based on your retirement goals and risk tolerance. When you retire, the money you have in the account is available to support your living expenses.

Contact An Expert With Questions About How To Use Your 401 After Retirement

Its natural to approach retirement with questions and worries about how it will work out. Bogart Wealth has built a skilled staff of independent investment advisors who can help you determine how to use your 401, so you can avoid running out of money once you retire.

We have a long track record of helping our clients realize a secure and comfortable way of life after theyre done working. Contact our team today for expert advice on how to use your 401 after retirement.

latest posts

Also Check: How To Rollover 401k To Charles Schwab

Converting A 401 To An Ira

You cannot contribute to a 401 after you leave your job, so if you want to continue adding money to your retirement funds, youll need to roll over your account into an IRA. Previously, you could contribute to a Roth IRA indefinitely but could not contribute to a traditional IRA after age 70½. However, under the new Setting Every Community Up for Retirement Enhancement Act, you can now contribute to a traditional IRA for as long as you like.

Keep in mind that you can only contribute earned income, not gross income, to either type of IRA, so this strategy will only work if you have not retired completely and still earn taxable compensation, such as wages, salaries, commissions, tips, bonuses, or net income from self-employment, as the IRS puts it. You cant contribute money earned from either investments or your Social Security check, though certain types of alimony payments may qualify.

To execute a rollover of your 401, you can ask your plan administrator to distribute your savings directly to a new or existing IRA. Alternatively, you can elect to take the distribution yourself. However, in this case, you must deposit the funds into your IRA within 60 days to avoid paying taxes on the income.

Traditional 401 accounts can be rolled over into either a traditional IRA or a Roth IRA, whereas designated Roth 401 accounts must be rolled over into a Roth IRA.

Convert Your 401 Into An Annuity

Although this option is not widely discussed, 401 plans may offer the option to convert the savings into an annuity. This option is typically called an immediate annuity, which converts a lump sum 401 balance into an income stream of monthly payments right away. The income payout is guaranteed, but this form of income may not be appropriate for all retirees. Keep in mind that guarantees are based on the claims-paying ability of the issuer. Additionally, there could be consequences related to such a conversion, like losing access to principal in case of emergencies and potentially receiving less than the principal amount back through annuity payments due to death.

You May Like: Can You Get Money From 401k To Buy A House

Calculate Your Plan Fees

Find out what fees you are paying as part of your plan. You can ask your employer what those are. Use this information to calculate how much these fees are costing you on an annual basis. Investment, administrative, and other plan fees should ideally hover around 0.2%. You may want to consider getting your plan funds or transitioning to an alternative retirement savings option if the fees approach 1%.

Taxes On 401 Distributions

If you take qualified distributions from a traditional 401, all distributions are subject to ordinary income tax. Contributions were deposited from your paycheck before being taxed, deferring the taxation process until the withdrawal date. In other words, when you eventually tap into your traditional 401 funds, distributions will be treated as taxable earnings for that year, on top of any other money that you made.

On the other hand, if you have a designated Roth account, you have already paid income taxes on your contributions, so withdrawals are not subject to taxation. Roth accounts allow earnings to be distributed tax free as well, as long as the account holder is over age 59½ and has held the account for at least five years.

Also Check: Can You Take Out Your 401k

Investment Choice And Fee Transparency

With our open architecture platform, this means you can choose from thousands of 401 investment options with no proprietary requirements. Fee transparency means you know exactly what youre paying for, and our return of mutual fund revenue share policy gives revenue share payments from mutual funds back to participants.

Leave The Money Or Move It

Your first option for handling your retirement savings is to leave it in your former employer’s plan, if permitted. Of course, you can no longer contribute to the plan or receive any employer match.

However, while this might be the easiest immediate option, it could lead to more work in the future.

“The risk is that you are going to forget about it down the road,” said Will Hansen, executive director of the Plan Sponsor Council of America.

The risk is that you are going to forget about it down the road.Will HansenExecutive director of the Plan Sponsor Council of America

Basically, finding old 401 accounts can be tricky if you lose track of them.

Also be aware that if your balance is low enough, the plan might not let you remain in it even if you want to.

“If the balance is between $1,000 and $5,000, the plan can transfer the money to an in the name of the individual,” Hansen said.

“If it’s under $1,000, they can cash you out,” he said. “It’s up to the plan.”

Your other option is to roll over the balance to another qualified retirement plan. That could include a 401 at your new employer assuming rollovers from other plans are accepted or an IRA.

If you decide to move your retirement savings, you should do a trustee-to-trustee rollover, where the transfer is sent directly to the new 401 plan or IRA custodian.

Also, while any money you put in your 401 is always yours, the same can’t be said about employer contributions.

Don’t Miss: What Is The Most You Can Contribute To A 401k

Make A Plan Before Changing Investments

If you don’t need to make withdrawals from your 401 immediately after you retire, it’s possible that your investment mix won’t need much adjusting. You don’t want to outlive your money, so shifting too early to an investment mix that is too conservative may not be suitable for your situation. Of course, investments cannot guarantee growth or sustainment of principal value they may lose value over time. Past performance is not an indication of future results.