K Withdrawal Rules: How To Avoid Penalties

401k plans, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. Its generally wise to avoid withdrawing money from your 401k, as there are often hefty penalties and taxes to consider for early withdrawals.

Sometimes, however, unplanned circumstances force people to withdraw funds from their 401k early. So if you find yourself in a place where you need to tap your retirement funds early, here are some rules to be aware of and some options to consider.

Maintaining A 401 After Retirement

When an employee who has a 401 retires, the plan administrator has several options for handling the retirees account. The account balance may be paid out in a lump-sum distribution, or it may be paid out on a schedule over time. Another option is for the administrator to leave the 401 in place and allow the employee to make withdrawals on their own schedule. If the plan administrator continues to maintain the account, even after the employee has left the job, then it may be possible for the employee to borrow from the account if the administrator allows such loans.

A Note About The Cares Act

Signed into law on March 27, 2020, the $2 trillion dollar Coronavirus Aid, Relief and Economic Security Act emergency stimulus bill was drafted to help those affected by the coronavirus pandemic. Under the act, 401 account owners can make a hardship withdrawal of up to $100,000 without paying the 10% penalty. The bill also grants the account holder 3 years to pay the income tax, rather than it being due within that same year.

Also Check: Can You Move An Ira To A 401k

You Probably Can’t Take Out A Loan Directly From Your Old 401 But There Are Alternatives

Photo: www.TaxCredits.net.

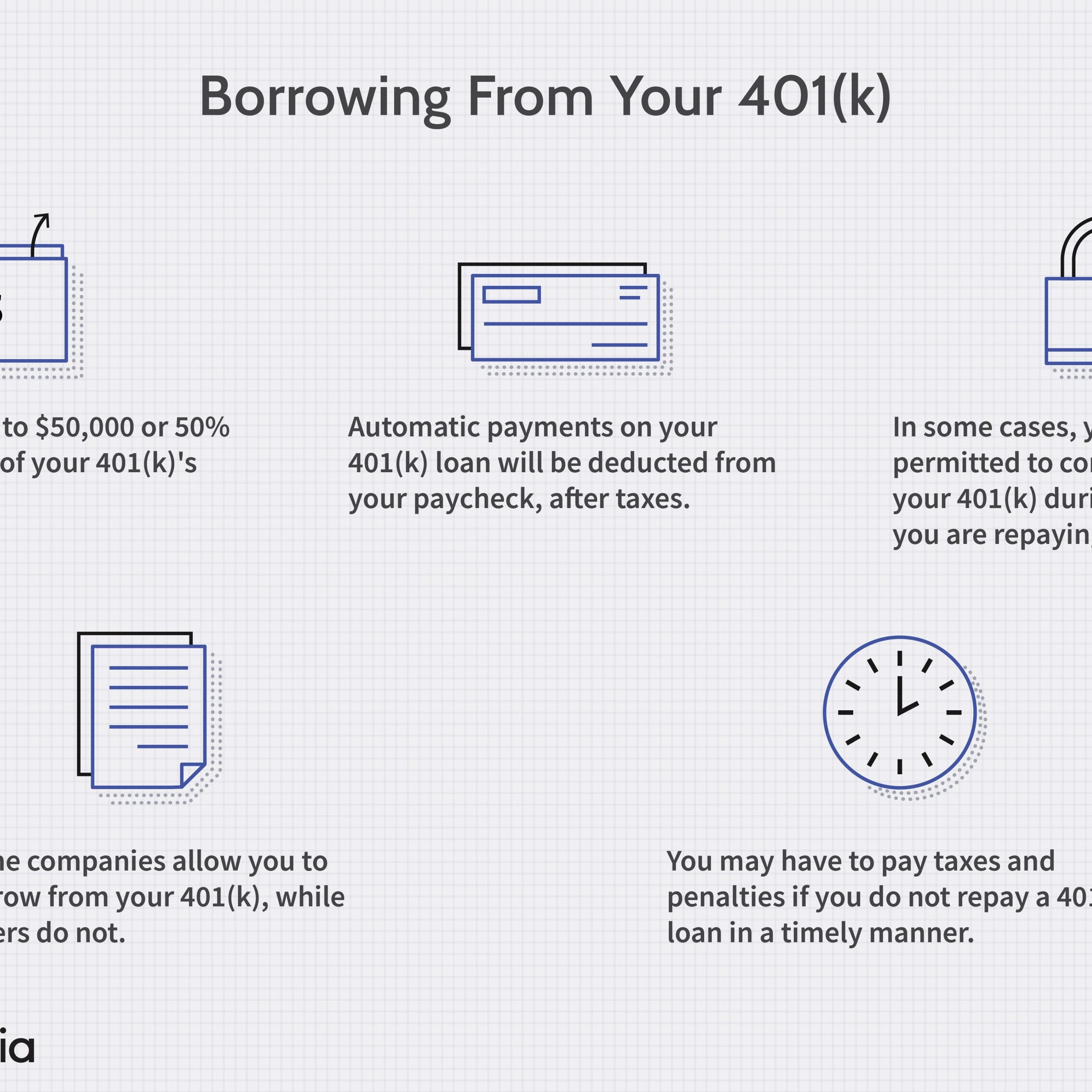

A 401 is the most common type of retirement plan offered by private-sector employers, and many of these plans offer the ability to take out a loan against the assets in your plan. However, this can be challenging to do once you no longer work for the employer sponsoring the plan. Here’s what you need to know about post-employment 401 loans, and other options that may be available.

The short answerMost, if not all, 401 plans do not allow former employees to take out loans from their accounts, and actually require that any previously outstanding loans be paid back within a short period of time after leaving employment.

It’s easy to understand why — after all, while you’re receiving paychecks, the “lender” is guaranteed that you’ll repay your 401 loan as agreed. Once you’re no longer receiving those paychecks, you become much more of a credit risk. In fact, about 10% of borrowers default on 401 loans, primarily because of a job change.

While you’re technically borrowing the money from yourself, there are still legal reasons why you need to pay it back. Specifically, the tax benefits you get with a 401 are based on the assumption that you’ll leave the money alone until you retire. If you fail to pay back a 401 loan, it’s considered to be a distribution, and you’ll face the same taxes and penalties as if you simply withdrew money.

In short — 401 loans are generally made exclusively to current employees.

What Is The 401 Loan Interest Rate

Borrowing from your own 401 and paying the money back in the same account does not sound like a normal loan. To some people, it sounds like moving money from your account to another account of yours.

Your 401 loans come with an interest. The interest rate you will pay and the principal amount will go back into your own account. That is you are paying interest to yourself by moving money from one account to another.

You cannot skip a payment or avoid interest charges because you are making payments in your own account.

How much should you expect to pay in interest?

According to Debt.org, you should expect to pay one or two points above the prime rate. One point stand for 1% and two points mean 2%. In other words, the 401 loan interest rate will be between 1 percent to 2 percent above the prime rate.

For example, if the prime rate is 6%, your 401 loan interest rate will be between 7% and 8%.

A prime rate is an interest rate financial institutions such as banks, credit unitions, mortgage lenders, etc. charge their best customers. Being the best customer means that you have the best credit, good credit score, low debt to income ratio, stable income, have enough assets, and you are more likely to meet all terms of the loan compared to other groups of borrowers.

Many people take 401 loans due to consistency in interest rates regardless of . In addition, 401 loans are more attractive because all payments go back to the employee instead of the bank.

Don’t Miss: How To Withdraw My 401k From Fidelity

Using Your 401 Funds To Buy A Home Has Pros And Cons

Marcus Reeves is a writer, publisher, and journalist whose business and pop culture writings have appeared in several prominent publications, including The New York Times, The Washington Post, Rolling Stone, and the San Francisco Chronicle. He is an adjunct instructor of writing at New York University.

If you need cash for a down payment for a home, and you have a 401 retirement plan, you might be wondering if you can use these funds.

Typically when you withdraw funds from a 401 before age 59½, you incur a 10% penalty. You can use your 401 toward buying a house and avoid this fee. However, a 401 withdrawal for a home purchase may not be best for some buyers because of the opportunity cost.

Learn how to tap your 401 to buy a home and more about some alternatives for funding a home purchase, such as using a mortgage program or saving up cash.

Can I Take An Additional Loan From My 401

Most 401 plans allow one loan at a time, and this means you must pay back the first loan fully before you can be allowed to take another loan. However, if your plan allows multiple loans at a time, you can take an additional loan at any time within a rolling 12-month period as long as you have not exceeded the loan limit.

For example, if your 401 vested balance is $120,000, your loan limit is $50,000. If you borrowed $30,000 from your 401, you cannot borrow more than $20,000 as a second loan in a 12-month rolling period even if you paid the first loan early.

Also Check: How Can I Use My 401k To Start A Business

When It Makes Sense To Borrow From Your 401

You should do other things first, but sometimes a 401 loan is a valid way to pay down high-interest credit card debt

Tapping your retirement plan to pay off high-interest debt sounds tempting, especially with interest rates on the rise. Then theres the added satisfaction of paying the interest on a 401 loan back to yourself, not the bank.

But theres a whole host of reasons why you shouldnt touch that money. Perhaps the biggest right now is that youre taking money out of the stock market after a major sell-off.

Chances are your account is down right now, so youre locking in a loss, says Lauren Lindsay, a certified financial planner based in Houston.

Thats why financial professionals recommend you explore other options before raiding your 401.

First Id be hammering on the expenses and seeing if theres anything that can be done to get some cash to throw toward the credit card, says Jim Holtzman, a wealth advisor based in Pittsburgh.

Among the strategies Holzman recommends: Call your credit card company and ask for a lower rate. Negotiate with the utilities to get a break for a period of time. Seek a credit counseling agency to negotiate with creditors. Shop at less expensive supermarkets, if you can.

Those arent fun processes to go through but youre really trying to lower that burden, he says.

There are times, however, when a 401 loan makes sense.

Here are some of the benefits of 401 loans:

Repayment Terms For 401 Loans

Just like other loans, funds obtained from a 401 account must be paid back, plus interest. Unlike a loan from a bank, the interest paid goes to the 401 account itself. With the majority of employers, loan payments cannot be extended past a five-year term and are made through paycheck deferrals. In some cases, such as a loan for a down payment on a home, repayment may be extended past the five-year maximum.

If an individual leaves their job prior to repaying the loan, they have until October of the following year to put the money back. If the loan is not repaid within that time frame, it is designated as a premature distribution of funds and is thus subject to income taxes, plus a 10% early withdrawal penalty for borrowers under age 59½.

You May Like: Can I Start A 401k Without A Job

Paying Yourself Back May Be The Least Of Your Worries

How much worse will the cash crunch get?

Congress has just passed the CARES Act, allowing people to borrow more from their retirement portfolio if theyve been hit economically by the crisis.

Its basically doubled, says Robert Neis, tax and benefits lawyer at the law firm Eversheds Sutherland, of the permitted loan limit. Generally, you can only borrow up to 50% of your vested plan balance or $50,000, whichever is less, for a plan participant who has been affected by COVID-19, the limit is increased to the lesser of 100% of the vested account balance or $100,000, he says.

Meanwhile, the new law also waives the 10% early withdrawal penalty for those who take money out for good, although theyll still have to pay income tax.

There are plenty of wrinkles. You have to apply during the next six months, Neis says. And only certain people can benefit from the new rules. They are not available to everybody, he says. You have to be effected by COVID-19. That includes being laid off, furloughed, or working reduced hours for reduced pay, he says. It also includes those who cant work because they cant get child care for their children.

But if you face an emergency cash crunch, should you borrow from you 401? Or is it a disastrous mistake?

Ironically, Congress has made it easier to borrow from your retirement account just as it has become more dangerous.

Even in normal times, there are hidden costs to borrowing from your plan, financial advisers note.

What Happens If You Default On A 401 Loan

When you default on a 401 loan, it’s usually treated as an early withdrawal. Each plan can set its own rules, so you should check with your 401 company to see whether it handles the situation differently. When the remaining loan balance is reclassified as a “deemed distribution,” you will owe all the penalty and income taxes you would owe on any early 401 withdrawal.

Don’t Miss: How To Rollover 401k When You Change Jobs

Stern Advice: Should You Tap Your 401to Buy A House

By Linda Stern

5 Min Read

NEW YORK It makes sense, given the gains workers have seen in their retirement plans and in home prices in recent years, that they would consider tapping their 401 accounts to buy homes. And that is exactly what a growing number of workplace savers are doing, according to a new study from Fidelity Investments.

Over the past year alone, more than 27,000 investors took loans specifically for the purchase of a home, said Fidelity, which looked at data from workplace retirement plans it runs.

The investment firm said workers who borrowed from their 401s for home purchases tended to borrow more $23,500 on average and could be putting themselves at risk of reducing or stopping their retirement contributions.

Millennials who borrow an average of 37 percent of their accounts, or $17,100, might particularly find the loan a stretch for people who are also taking on a mortgage and might be saddled with student debt, Fidelity said.

To be sure, cash-poor workers who borrow to the max to buy a house can get into trouble quickly if they dont have the reserves to handle emergencies. As any homeowner would attest, the boiler will break and the roof will leak when they least expect it.

And a worker who borrows from his 401 and then leaves his job usually has to pay back the loan within a few weeks or face a big tax hit as he is forced to treat the loan as a distribution.

Here are some considerations.

Is There Any Way To Take An Early 401 Distribution Penalty

There are a few situations in which a penalty-free early distribution is allowed:

- You become disabled.

- You die and a payment is made to your beneficiary or estate.

- You pay for medical expenses exceeding 7.5 percent of your adjusted gross income.

- The distributions were required by a divorce decree or separation agreement .

As you can see, the IRS doesnt make it easy to take your 401 money early under any circumstances!

At a Glance : 401 Loans| Pluses |

|---|

Also Check: Can I Buy Stock With My 401k

Those Who Truly Need It

It really comes down to need. If you need to withdraw your money, then withdraw your money. Thats really the essence of the CARES Act. It simply makes a need-based withdrawal less harmful. If you dont need to, then dont, says Brandon Renfro, a financial advisor and assistant professor of finance at East Texas Baptist University.

Its important to consider what things will be like after you take a withdrawal and once things are back to a new normal. Under the CARES Act, you have to repay your withdrawal within three years. If you just need a withdrawal to get you through the next few months before you start earning regular paychecks again, it could be a good option.

Loans & Hardship Distributions

As a participant in the Stanford Contributory Retirement Plan , you may be eligible to take a loan from your account balance held in Fidelity and Vanguard funds. Loans give you the opportunity to borrow from your account balance, and then repay yourself.

You may take out a loan against your account balance in your Tax-Deferred Account and/or Contributory Retirement Account, as long as your funds are with Vanguard or Fidelity. To request a loan you must have a total account balance in these funds of at least $2,000. Fidelity and Vanguard funds are subject to certain rules and restrictions, including those set by the U.S. Internal Revenue Service.

TIAA does not allow loans from their investment options.

NOTE: The following information pertains to ordinary loans and hardship distribution rules you may have alternative options in 2020 as provided in the Coronavirus Aid, Relief, and Economic Security Act. Read more about the CARES Act distribution and loans in this FAQ.

Recommended Reading: How To Withdraw My 401k From Fidelity

Recommended Reading: Where Does My 401k Money Go

How Many Times Can You Borrow From 401k

As long as you have a vested balance and your plan allows 401 loans, you may be allowed to take a 401 loan. Find out how many times you can borrow from 401.

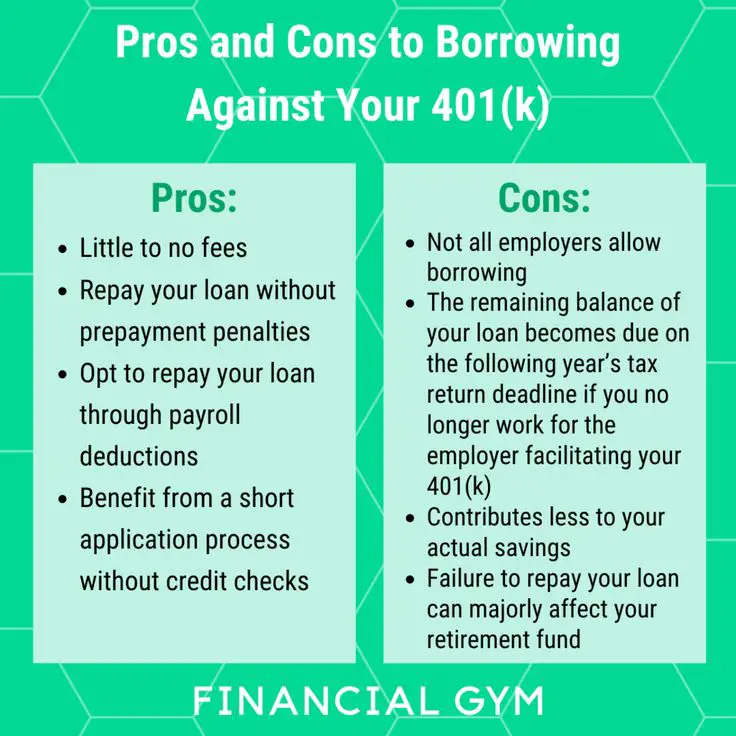

If you are in a tight spot financially, a 401 loan can be a low-cost way to borrow money without contacting a lender. Generally, 401 loans have some of the lowest interest rates in the market, and the interest you pay goes back to your account. If the first 401 loan is not sufficient to meet your needs, you may consider borrowing a second loan to bridge the gap.

You can borrow from your 401 account multiple times as long as you donât exceed the IRS limit. Typically, you can borrow a maximum of $50,000, or half of your vested balance, whichever is lower. If the first 401 loan used up the IRS limit, you may not be allowed to take another loan until you have fully paid the loan. 401 plans place borrowing limitations over a 12-month period.

Why Do People Get 401 Loans

As long as a plan allows it, participants generally can borrow from their 401 for any reason that they deem necessary. Some plans may only allow loans for specific reasons, so be sure to check your plans rules before trying to borrow.

Since youre borrowing your own money, and no credit check is involved, it may be easier to get approved for a 401 loan as long as you meet the plans requirements for borrowing. In some cases, a requirement may be getting approval from your spouse , because your spouse may be entitled to half of your retirement assets if you divorce.

Here are some potential uses for a 401 loan.

- Paying household bills and expenses

- Funding a down payment on a house

- Paying off high-interest debt

- Paying back taxes, or money owed to the IRS

- Funding necessary home repairs

- Paying education expenses

But that doesnt mean 401 loans are always a good idea. In fact, there are some major risks that come with borrowing from your retirement savings. Here are two.

Read Also: Should I Consolidate 401k Accounts

Consider The Impact On Your Retirement Savings

Dont forget that a 401 loan may give you access to ready cash, but its actually diminishing your retirement savings. First, you may have to sell stocks or bonds at an unfavorable price to free up the cash for the loan. In addition, youre losing the potential for tax-deferred growth of your savings.

Also think about whether youll be able to contribute to your 401 while you are paying back the loan. A lot of people cant, possibly derailing their savings even more.