Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. It’s a free service, and it only requires your Social Security number.

What Is The Average And Median 401 Balance By Age

401 balances can average roughly $6,000 at the age of 24 to more than $255,000 at the age of 65. Both average and median 401 balances can vary greatly depending on a few factors. This can include how long you have been saving for retirement or whether your company provides 401 matching, which is when your employer contributes to your retirement savings based on the amount of your contribution.

While savings are personal, the idea of a nest egg will likely make you contemplate what your financial future holds. Retirement might seem like a long way down the road, but time flies faster than we realize. And the earlier you start saving for retirement, the better off youll be later in life.

Knowing the average and median 401 by age can help you figure out where you stand and how you can be better prepared for the future. Heres what you can learn about the average 401 balance by age from Vanguards research on How America Saves in 2021:

| Age |

|---|

You May Like: How Much Can You Put In 401k Annually

Check On Your 401 Periodically

As mentioned, it’s essential to check how much is in your 401 throughout the year. Ideally, more than once, however, annual checks are enough.

The reason to monitor your retirement savings is to keep up with your retirement goals. For instance, as you near retirement, you may want to move your money to safer investments like bonds. Or, if one area has over-performed others, you might decide to reallocate your money to limit your exposure to one category.

Typically these drastic swings in your portfolio won’t happen that quickly. But by scheduling an annual check of your 401 balance, you’ll get a good picture of your 401 portfolio.

Tags

Recommended Reading: Is There A Cap On 401k Contributions

How Do I Receive Money From Moneygram To My Bank Account

MoneyGram allows you to send money directly to a bank account or mobile wallet in select countries. To find out if you can send money to your receivers bank account or mobile wallet, start sending money or estimate fees from the homepage, and select Direct to Bank Account or Account Deposit as your receive option.

Now What What Can You Do About Fees

Unfortunately when you have high fees in your retirement plan, theres not much you can immediately do about it. But just the knowledge of your fees will help you answer questions like:

- Should I consider investing in different funds within my plan?

- What should I do with investment dollars after I reach my company 401K match?

- Should I leave my companys 401K plan because of the absurdly high fees?

- Should I divert funds to a discount online stock brokers?

- What should I do with those funds once I leave my job?

Luckily, the tide is turning, and we are seeing new pressure from U.S. lawmakers to make this fee information more apparent. Sites like BrightScope are also doing a good job of exposing the truth about the company 401K plan.

This guest post is from PT Money: Personal Finance. Follow along as PT discusses things like the best places to store your short-term cash, how to spend your money wisely, and the best cash back credit cards to earn more money on your spending.

Read Also: Where To Roll Over My 401k

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

Why Should I Use One

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a company match, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual salary. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual 401k contribution limit is $20,500 for tax year 2022, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older.

Read Also: Can You Roll A Traditional 401k Into A Roth Ira

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

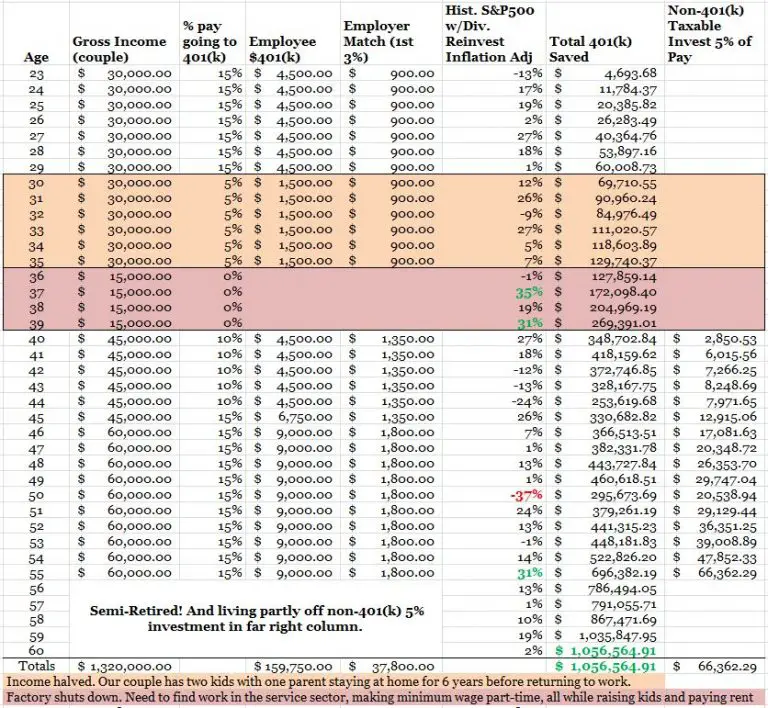

Save Early Often And Aggressively

Yes, saving is hard. Its hard when you are young and not making a large salary, and its hard when youre older and big life expenses get in the way. However, the biggest threat to your retirement is inaction. Even if its uncomfortable to max out your 401k, do it if you can. If you get a salary raise, immediately put 50% of it towards savings if youre able. The earlier and more aggressively you can save, the better off you will be, and you may even surprise yourself with how much you are able to put away. Compounding can do wonders when there is a positive annual return as you can see from the high end of the potential savings chart, so the earlier you can save more, the farther your money will go.

Also Check: What Can I Rollover My 401k Into

While Youre At It Stay Away From Target Date Funds

Theres one type of investment thats gaining in popularity, and I dont think its a healthy development.

Its target date funds.

I dont have a good feeling about them, and thats why I dont recommend them.

In fact, I hate target date funds. Does that sound too strong?

Target date funds are one of those innovations that work better in theory than they do in reality.

They start with your retirement date, which is why theyre called target date funds. If you plan to retire at age 65, theyll have tiered plans .

They have one when youre 40 years from retirement, another when youre 30 years out, then 20 years, and 10 years. That may not be exactly how they all work, but thats the basic idea.

The target dates mostly adjust your portfolio allocation. That is, the closer that you are to retirement, the higher the bond allocation is, and the less thats invested in stocks.

The concept is to reduce portfolio risk as you move closer to retirement.

That all sounds reasonable on paper.

But it has two problems.

That generally makes sense, but not for people who either have a higher risk tolerance, or those who need healthier returns as they move closer to retirement.

Avoid these funds, no matter how hard the pitch is for them.

How To Calculate Your 401k Fees In Under 5 Minutes

RECESSION IS NEAR! ARE YOU PREPARED?

Learn how the drop in the US Dollars buying power affects you personally and gain access to an actionable plan to protect your assets with precious metals.

Do you know how much you are paying in fees each year with your 401K plan? Most investors dont. I certainly didnt always know this information. But over the last few years, Ive discovered that 401K fees can be fairly significant, and can vary greatly based on the 401K administrator and the individual investments you are using.

How significant? Well, if your 401K fees are just a percentage point higher, it could literally mean hundreds of thousands of dollars of difference in the total return your retirement account generates. This also applies to you if youre running your own small business and trying to find a small business 401K plan for you and your employees. Its important to know what your paying. But before we delve into calculating your 401K fees, lets look why these fees are so hard to pinpoint.

Pro tip: You can sign up for a free 401k analysis through Blooom and they will help you understand if youre paying too much in fees. They will also look into how diversified your portfolio is and whether you have the right asset allocation.

Also Check: How Much Can I Save In 401k Per Year

Why You Should Roll Over Your Old 401 Accounts

Once you find forgotten retirement funds, you can make it easier to keep track of your money by simply rolling over your old 401 accounts into an IRA at a brokerage you already have an account with. This way you can manage your nest egg easier since all of your money is in one place.

“It’s beneficial to consolidate your accounts to reduce oversight obligations,” Cavazos says. “Having all of your funds consolidated in one account allows you to keep track of your balance and account performance.”

If you already have an existing IRA, you can roll your 401 balance into that account. Otherwise, it’s easy to open a new IRA at the big-name brokers like Charles Schwab, Fidelity, Vanguard, Betterment or E*TRADE. Rolling over your old 401 plan into an IRA gives you more control over how you invest your retirement funds since you won’t be limited to just the funds that were offered by your former employer. These large brokerages give you thousands of investment options, including mutual funds, index funds and individual stocks.

Where Is My 401

When you leave your employer you have three options for the money youâve accumulated in your old 401 account. You can either:

- Leave it alone and keep it in the same account

- Roll over the funds to your new employerâs 401 plan or

- Roll over the funds to an IRA.

Most people leave their 401âs alone, either from neglect or they donât bother with facilitating the transfer.

You can rollover your old 401 funds to an IRA as soon as youâd like. If your IRA is already set up then it can accept the funds immediately.

However, if your new employer implements a waiting period before you can participate in their 401 program, then you have no choice but to leave it alone until youâre eligible.

This is where things fall through the cracks. Unattended 401âs can end up in a few different places: the old account you have with your former employers, an automatic safe harbor rollover account set up by your plan, the unclaimed property department in the state, or your old 401s could have been cashed out already if the balance was less than $5,000 when you left the job.

You May Like: Can Anyone Open A 401k

Average 401k Balance At Age 45

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2022. So if you contribute the annual limit of $20,500 plus your catch-up contribution of $6,500, thats a total of $27,000 tax-advantaged dollars you could be saving towards your retirement.

Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is easy.

Recommended Reading: How Is My 401k Doing

Why 401 Fees Matter

Small differences in the 401 fees that you pay on your plan can be more significant than you might imagine.

As an example, lets look at the difference in the value of two 401 plans, each with a current balance of $100,000, and an expected annual rate of return of 8 percent. The only difference between the two plans is that Plan A pays an average annual rate of 2 percent in 401 fees, while Plan B pays just 1 percent.

How will the difference in 401 fees affected the value of each plan after 30 years?

The State Of American Retirement It Needs Improvement

According to an article released by CNBC, which looked at data from Northwestern Mutual and Gallups 2018 surveys, 21% of Americans have no retirement savings, and the average amount that Americans have saved is $84,821.

A wide majority of those surveyed, 78%, expressed concern that they will not have a substantial amount of retirement money to live on, meaning they will continue to work past retirement age.

Many people do not realize what an advantageous opportunity a 401 plan offers. It is the most generous of all retirement plans, one that could alleviate much of the concern Americans are expressing over their financial future.

Recommended Reading: Can You Roll Over A 403b Into A 401k

Could You Increase Your 401 Contribution

How often you can adjust your 401 or 403 contribution is generally determined by your employer and your retirement planit may be once a year or as often as youd like.

If youre able, reducing non-essentials or allocating new income could allow you to bump up the amount youre saving.

A 1% increase only makes a small difference in your paycheckbut may make a big difference down the road. Consider the example below for a $35,000 annual income:1

| Additional contribution |

|---|

1 This example is for illustrative purposes only. It assumes $35,000 in annual income, 3.5% annual wage growth, 30 years to retirement, 7% annual rate of return and a 25% tax bracket. Estimated monthly retirement income calculations assume a 4.5% annual withdrawal in retirement. The assumed rate of return is hypothetical and does not guarantee any future returns nor represent the return of any particular investment option. Reduced take-home pay is accurate for the initial year and would change based on participants annual pay. Estimated savings amounts shown do not reflect the impact of taxes on pre-tax distributions. Individual taxpayer circumstances may vary.

2 Contributions are limited to the lesser of the annual plan or the IRS limit as indexed annually.

3 Some plans may not allow catch-up contributions to the plan.

This document is intended to be educational in nature and is not intended to be taken as a recommendation.

Investing involves risk, including possible loss of principal.

Nice Jobcongratulations On Taking Advantage Of Your Companys Employer Match To See How Your Money Is Going To Grow Over Time Try Out Our Compounding Calculator

This calculator is intended as an educational tool only. John Hancock will not be liable for any damages arising from the use or misuse of this calculator or from any errors or omission in the same.

Employer match is not available for all plans. See your Summary Plan Description for availability and information about your employers vesting schedule.

John Hancock Retirement Plan Services ⢠200 Berkeley Street ⢠Boston, MA 02116

NOT FDIC INSURED. MAY LOSE VALUE. NOT BANK GUARANTEED

Read Also: How Does 401k Show On Paycheck

Don’t Miss: How To Max Out 401k Calculator