A Retirement Plan Built For Your Business

If your state has not instituted a retirement plan, or your looking for a plan that is designed around your business needs, we’ve got the solution:

Connect with us on , , and !

For tips and information regarding retirement plans, contact us.

There’s more where that came from!We have answers to all your retirement planning questions. Check out the rest of our blog content below.

Whats A Typical Employer Match

Regardless of whether or not automatic enrollment is part of a 401 plan, the matching amount contributed by employers varies greatly from one company to the next. According to 401 plan data analyzed by Fidelity Investments, the average match on employee contributions is 4.7% of their annual salary, a record high since 2008s Great Recession. Combined with the average employee contribution of 8.8%, average total 401 contributions over the last ten years have risen to 13.5%, indicating both employers and employees are focused on long-term savings.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Recommended Reading: How To Transfer 401k Without Penalty

What Are The Requirements For Employers And Employees

The requirements for state-mandated retirement benefits largely depend on individual jurisdictions, the size of the organization and how long it has been in business. Generally, employers must enroll their employees in the state-sponsored program if they dont offer another retirement plan and perform the detailed administrative and reporting work necessary under state law. These tasks can be daunting, which is why many employers choose one of ADPs easy-to-manage plans instead.

Employee requirements also may vary. In states that sponsor Roth IRAs, participants must not earn more than the IRS maximum to be eligible for such plans.

How Much Should You Match 401 Contributions

Employers 401 match amounts vary widely. However, all contribution limits and withdrawal regulations must comply with the standards of the Employee Retirement Income Security Act. Otherwise, you can set your 401 contribution rates however you please.

There are two especially common methods for determining how much money you should contribute to your employees retirement accounts:

- As a percentage of an employees wages: Some employers will match all employee contributions up to a contribution limit equal to a percentage of an employees wages. For example, if you set a contribution limit of 4% of an employees income and the employee makes $50,000 per year, you will contribute at most $2,000 over the course of the plan year. Note that if your employee contributes less than $2,000 to their retirement account, you have to match only that amount, not the full $2,000.

- As a percentage of an employees contributions: Other employers will match a percentage of contributions instead. For example, if you choose to match 40% of your employees contributions with the same 4% contribution limit as in the prior scenario, then for an employee with a $50,000 annual salary, your employer contribution limit isnt $2,000 over the course of the plan year. Instead, its $800 .

Did you know?:Self-employed 401 plans may not offer employer matching, but they still allow independent contractors and sole proprietors to save for their retirement.

You May Like: How To Set Up 401k For Self Employed

Are Employers Required To Offer 401 Plans

You may be wondering, Is 401 mandatory for employers to offer? The answer depends on your state, along with factors such as your:

- Number of employees

- Length of time in business

- Current retirement program

For a more in-depth look at whether you need to offer employees a 401 or another qualifying retirement plan, understand your state requirements .

What’s The Difference Between A Traditional 401k And A Roth Ira

The primary difference between a 401k and a Roth IRA is how the savings are taxed. Contributions to a 401k are made before tax deductions, whereas those to a Roth IRA are made after tax deductions. When employees retire, their income from a 401k savings plan is subject to taxes. Qualified withdrawals from a Roth IRA, on the other hand, are tax free.

Also Check: Can I Invest In 401k And Ira

Con #: You Have No Choice In What Funds Your Former Employers Choose

Since your former company administrates the retirement plan, youll only be able to select funds from the options they provide. For example, if youve read some great information about a mutual fund that focuses on sustainable agriculture but your plan doesnt offer it, youll need to go elsewhere to invest in it. Youre losing the flexibility that you could have with a traditional or Roth IRA, adds Markwell.

Also Check: What Happens To 401k If You Leave Job

Who Is Eligible For A 401

To be eligible for 401 benefits under a corporate plan, you must be legally categorized as an employee.

Remember that collecting 401 benefits entails being legally classified as an employee. Non-employees such as consultants, contractors, and 1099 workers are ineligible to participate in qualifying plans since they are required by law to be for the sole benefit of employees.

According to the SECURE Act, long-term, part-time workers who clock at least 500 hours over three years are eligible to participate in 401 programs.

Part-time workers who were previously disqualified because they had not completed a year of service will now be eligible.

Part-time employees who are at least 21 years old and work at least 1,000 hours per year were already qualified previous to the 2019 law.

Because of the new three-year eligibility condition, persons working 500 to 1000 hours per year will not be eligible until at least 2024. This is because 2021 is the first year that may contribute to it. As a consequence, firms should begin logging the hours of their part-time workers, if they havent previously.

You May Like: How Do I Cash Out A 401k

Action Steps For Employers With California Employees

Employers with California employees should take the following actions:

- If a California for-profit or non-profit employer with five or more employees does not offer a qualified retirement savings plan, the employer should register their company on the CalSavers website. Once registered, the employer will add their employees information and then submit employees contributions with each payroll. The CalSavers website offers guided support8 for each step of this process. website. Once registered, the employer will add their employees information and then submit employees contributions with each payroll. The CalSavers website offers guided support9 for each step of this process.

- If employer does offer a qualified retirement savings plan, the employer will still need to register their company on the CalSavers website, as described above. Once registered, the employer can request an exemption10 from the states retirement program. This process only takes a few minutes to complete.

We have yet to see any enforcement of the CalSavers program for companies already providing a qualified retirement savings plan however, we will likely see enforcement in the coming months.

What Are The Benefits Of A 401 To Employers

Employers offer benefit programs to help employees feel valued and build financial security for themselves and their families through tax-advantaged savings. This helps to attract and retain a qualified workforce. Moreover, as more companies offer this type of plan as a standard benefit, those without it can be seen as lacking. While it can be costly for the employer to manage, oversee, and test the plan, the overriding value of offering a 401 match is to earn the goodwill and loyalty of employees and provide a meaningful benefit.

Employers can also deduct matched contributions from their income taxes, subject to certain limitations. In addition, elective deferrals and investment gains are not currently taxed and enjoy tax deferral until their distribution .

Some employers are required to maintain retirement accounts as part of state legislation. Several states have passed laws that require companies of a certain size to offer retirement plans to their employees or sign up for a private state-run program. For example, the Illinois Secure Choice Savings Program Act states that companies with at least five employees offer their own retirement program or facilitate a Illinois Secure Choice option.

13 states have passed legislation requiring employers with more than a certain number of employees to offer qualified retirement plans like a 401. An additional 17 states have proposed similar laws that have not yet been ratified.

You May Like: How To Manage 401k Investments

Employer Match Rules: 10 Things For Employers To Know

LAST REVIEWED Dec 11 202013 MIN READ

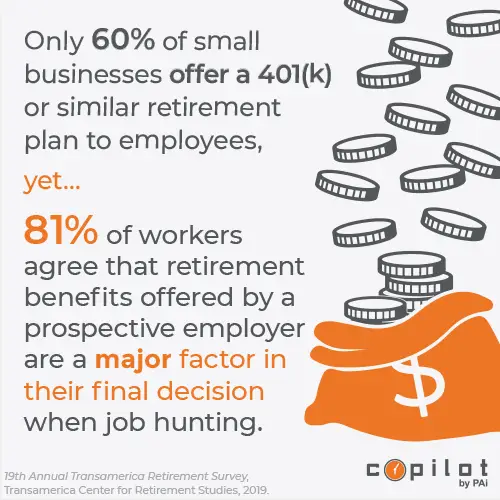

From game tables in the office and flexible work schedules to paid time off for passion projects, employers are continually coming to the table with new and exciting ways to keep workers happy and, ultimately, loyal to a company. However, one traditional benefit remains at the top of many employees must-have lists the 401.

Option : Do Nothing And Leave The Money In Your Old 401

Now, you could just leave the money in your old 401 if youre really happy with your investments and the fees are low.

But thats rarely the case. Most of the time, leaving your money in an old 401 means youll have to deal with higher fees that cut into your investment growth and settle for the limited investment options from your old plan. Most people come out way ahead by doing a direct transfer rollover to an IRA .

Read Also: How To Sell 401k Stock

What Companies Offer The Best Employer Match

Not all matches are created equal they vary widely. According to Vanguard, the top 16% of plans provide employer matches worth 6% or more of pay. A few standout examples include:

-

Boeing: Written up time and time again, Boeing is consistently known for a strong 401 offering, including an employer match. Employees can contribute between 1% and 30% of their salaries, and the company matches 75% of the first 8% of the employees contribution. Theres also a discretionary contribution by the company of between 3% and 5% per year based on the employees age.

-

Amgen: It makes a 5% contribution upfront whether or not the employee makes a contribution to the plan. In addition, the company matches employees contributions up to 5% of their salary for a total contribution of 10%.

Us Bureau Of Labor Statistics Report

In a 2018 article titled “The benefits of working for a small business,” the U.S. Bureau of Labor Statistics reported that defined contribution plans, such as 401-style plans, were available to 47% of workers in small businesses while access to defined benefit plans, like pension plans, was lower at 7%. While small businesses offer a wide variety of benefits, retirement plan options generally aren’t one of them.

Some companies used to offer 401 plans but decided to drop them. This sometimes happens because a company is losing money and scrambling to reduce expenses. Other times, it’s because new management came in and is looking for a different option, or because workers aren’t participating in the plan and it’s no longer sensible to keep it open.

Also Check: Can You Have Your Own 401k

Can The Calsavers Plan Automatically Enroll Employees

California state law requires that the CalSavers Plan automatically enroll participants. For example, if the employee does not set up their account within 30 days after their employer provides the necessary information, then the CalSavers Plan will automatically enroll the employee into the CalSavers Plan.

Virginia: Will Begin To Enroll Employers In Summer Of 2023

In 2021, Virginias mandatory retirement savings program, the VirginiaSaves Program, was enacted into law. Under the bill, Virginia employees 18 or older working more than 30 hours per week who do not already have access to an employer-provided retirement plan will be automatically enrolled in a state-facilitated individual retirement account savings plan. Tax deductible employer contributions are prohibited without a qualifying private plan in place.

Recommended Reading: How Much Should You Put In Your 401k

What Type Of Retirement Plans Are These

State-sponsored retirement plans are commonly Roth individual retirement accounts . With this type of savings, employee contributions are deducted from post-tax income, which means their money is generally tax free at the time of withdrawal. In comparison, a traditional IRA is funded with pretax payroll deductions, thereby lowering the employees taxable income. When the individual draws from the account, however, the money is subject to taxes.

What Is 401 Employer Matching

401 employer matching is the process by which an employer contributes to an employees retirement account based on the employees contributions. Employers tend to set their 401 contribution limits based on the employees annual salary. In other words, an employers contribution rate may be at most a certain percentage of the employees salary. For example, an employer may be willing to match 50% of an employees contribution, up to 6% of their annual salary. So, if the employee contributed 6% to their 401 plan, the employer would contribute an additional 3% to the employees retirement savings.

Rarely, some employers instead set a contribution limit of a predetermined dollar amount thats unrelated to the employees annual salary. In either case, these contributions are typically made per pay period and reflected on the employees paycheck.

Key takeaway: 401 employer matching is when an employer also contributes to an employees retirement account based on the amount the employee contributes.

Read Also: Can You Move A Rollover Ira Into A 401k

Recourse For Lack Of Information

If a plan participant is unable to obtain any of the required information from the plan administrator, copies may also be obtained through written request to the Department of Labor’s Employee Benefits Security Administration . Participants are charged a “nominal copying charge” for the service if it’s over 100 pages. The address is U.S. Department of Labor, EBSA Public Disclosure Facility, Room N-1515, 200 Constitution Avenue, N.W., Washington, D.C. 20210.

Participants should provide their name, address, and phone number for EBSA to follow up on the request.

Is Backdoor Roth Still Allowed In 2021

In 2021, single taxpayers cant save in one if their income exceeds $140,000. High-income individuals can skirt the income limits via a backdoor contribution. Investors who save in a traditional, pre-tax IRA can convert that money to Roth they pay tax on the conversion, but shield earnings from future tax.

Read Also: Can I Transfer Part Of My 401k To An Ira

Don’t Miss: How Can I Take A Loan From My 401k

What If My Workplace Doesnt Offer A Retirement Plan

One hurdle CalSavers faces, Rhee said, is making small employers aware of the June 30 deadline. They need to be told what their obligations are, she said, but theyre the hardest group to reach.

Its a big marketing challenge, Rhee added. This is where the enforcement piece comes in.

Workers can help on this front too. If your employer doesnt offer retirement benefits, let it know about the deadline you can point your boss to information posted online by state Treasurer Fiona Ma or by any number of employment law experts.

You might also make the argument that a retirement plan can help recruit and retain workers at a time when businesses are struggling to fill open positions. And then there are the penalties for not complying with the mandate: $250 per eligible employee for the initial violation, and an additional $500 per employee if noncompliance continues.

Katie Selenski, executive director of CalSavers, said the program contacts employers that miss the deadline to try to get them into compliance. If after several months an employer still doesnt offer a plan, she said, the board will start imposing penalties.

States are slowly rolling out digital drivers licenses, aiming to give residents more control over their identifying information. California is heading that way too.

Q: What Is A 401k Matching Example

A: Suppose an employee earns $50,000 annually and decides to contribute 10% of his pay to his 401k account, or $5,000 per year. Now suppose his employer matches 100% of employee contributions up to 6% of salary. The employer would make a matching contribution of $3,000. If the employer made a 50% match, the match amount would be $2,500.

Don’t Miss: Should I Let Fidelity Manage My 401k

Which Employers Must Offer The Calsavers Plan

California for-profit or non-profit employers with five or more employees must give employees access to the CalSavers Plan if they do not sponsor a qualified retirement savings plan3. Qualified retirement savings plans include:

- Simplified Employee Pension plans,

- Savings Incentive Match Plan for Employees of Small Employers IRA plans, and

- Individual retirement account payroll deductions

If the employer provides a qualified retirement savings plan, they must notify the state of the exemption from the CalSavers Plan by requesting an exemption4.

If employers did not notify the state by June 30, 2022, they still have time to either offer the CalSavers Plan to their employees or opt-out of the program if they offer a qualified retirement savings plan. However, if an employer receives a notice from the state about its non-compliance with the CalSavers program, then the employer has 90 days to comply before facing a fine.

See more about penalties for non-compliance below.