Tips For Contributing To Your 401

- If youre struggling to get started or stay on track, consider working with a financial advisor. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you switch jobs, you can no longer contribute to a previous employers 401 plan. You dont want to lose the hard work you did to save that money, so you should look to make a direct 401 rollover to your new employers plan.

- A traditional IRA and a 401 offer similar tax benefits. You might wonder whether one is a better option for you. Heres an article to help you think about an IRA vs. a 401.

- You should always avoid early withdrawals from your 401. Not only will you have to pay the income tax, youll have to a pay 10% penalty. There are a couple of ways you could avoid that big penalty though. If you really think you need to withdraw money early, heres more information on 401 withdrawals.

The Maximum You Can Put Into A 401 In 2022

-

If youre under age 50, your maximum 401 contribution is $20,500 in 2022.

-

If youre 50 or older, your maximum 401 contribution is $27,000 in 2022, because you’re allowed $6,500 in catch-up contributions.

For 2022, your total 401 contributions from yourself and your employer cannot exceed $61,000 or 100% of your compensation, whichever is less.

Employers who match employees’ 401 contributions often do so between 3% and 6% of the employee’s salary. So if you make $50,000, and contribute 5% of your salary , and your employer matches that full 5%, you’ll add $5,000 to your balance each year.

Contribution Limits For 403 Plans

| 2021 | |

| $6,500 | $6,500 |

3. This limit includes such contributions to all 401, 403, SIMPLE, and SARSEP plans at all employers during your taxable year. Contributions to 457 plans, if any, are disregarded. Age 50+ catch-up contributions apply if allowed by your plan and you will have attained at least age 50 during your taxable year. Depending on plan rules, age 50+ catch-up contributions may also be made on a pretax or Roth basis.

4. 403 plans of “qualified organizations” may also allow what is known as a “lifetime,” “15 year,” or “special” catch-up, which must be exhausted before using the age 50+ catch-up. Both catch-up contribution types can be used in the same taxable year if eligibility requirements for both are met. The lifetime catch-up may be available at any age upon attaining 15 years of service with the 403 plan sponsor which is a qualified organization. A formula determines the maximum catch-up amount based on contributions in prior years. Total lifetime catch-up contributions in all years are limited to $15,000. Depending on plan rules, lifetime catch-up contributions may be made on a pretax or Roth basis.

Read Also: Can You Take Out Your 401k

What Happens If I Exceed My 401 Limit By Mistake

If you contribute too much to your 401 and notice your mistake before the tax filing deadline, you can probably correct it with your employer. Youll need to notify your plan administrator. Theyll return the excess money to you, and youll get a new W-2 and pay taxes on your new total taxable wages.

If you dont catch the mistake before tax day, you may have to pay taxes twice on the amount you contributed over the limit. Thats because the excess contribution cant be deducted from your taxes in the year it was made, and because the IRS will still count that money as taxable when its distributed too.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Don’t Miss: Can I Invest In My Own 401k

Why Contribute To An Ira

For the most part, IRAs have similar tax rules as 401 plans, but they have different contribution limits.

IRAs also have a few important benefits. They are more flexible, as you control how and where you invest your money, giving you more freedom and control over your investment typesand, more importantly, investment costs.

Roth IRAs also dont have required minimum distributions , which exist in all 401 plans, including the Roth 401.

If you can afford to maximize both investments, read up on how to invest after maxing out your retirement accounts. You may have options, such as investing through a health savings account, a taxable investment account, peer-to-peer loans, real estate and more.

Roth Ira And Traditional Ira Maximum Annual Contribution Limits

| 2021 |

| Less than $10,000 | Less than $10,000 |

11. The limit is generally the lesser of the dollar amount shown, or your taxable compensation for the year. For more information about IRA contributions, please see IRS Publication 590-A or consult your tax advisor.

12. If you will have attained at least age 50 during the tax year, you can contribute an additional amount to your IRA each year.

13. Married can use the limits for single individuals if they have not lived with their spouse at any time during the year.

14. As of 2010, there is no income limit for taxpayers who wish to convert a traditional IRA to a Roth IRA.

Read Also: What Is My Fidelity 401k Account Number

Maximize Your 401 With Percentage

If your company doesnt allow you to make a flat-rate contribution, you need to do some math.

Divide the maximum you can contribute by your total salary. This gives you the percentage you should contribute every paycheck.

For example, if you earn $100,000 per year and can contribute up to $22,500 to your 401, you will need to contribute 22.5% of your salary to maximize your contribution.

If you cannot afford to contribute the maximum, try to at least contribute up to your employers match, if your employer makes matching contributions.

Employer matches are free money you can put toward your future. Dont leave these dollars on the table. You should be able to change your 401 contribution amount, your tax withholding and other payroll deductions through your human resources department.

Irs Announces 401 Limit Increases To $20500

IR-2021-216, November 4, 2021

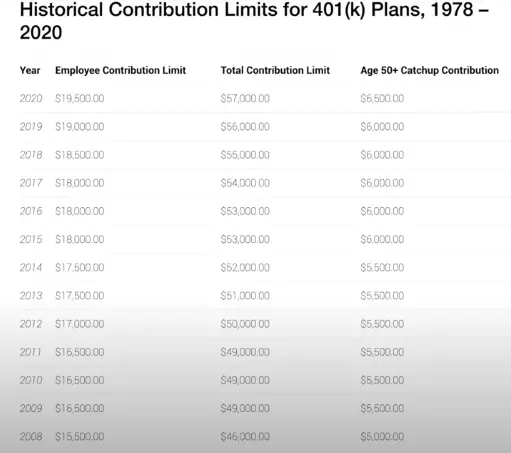

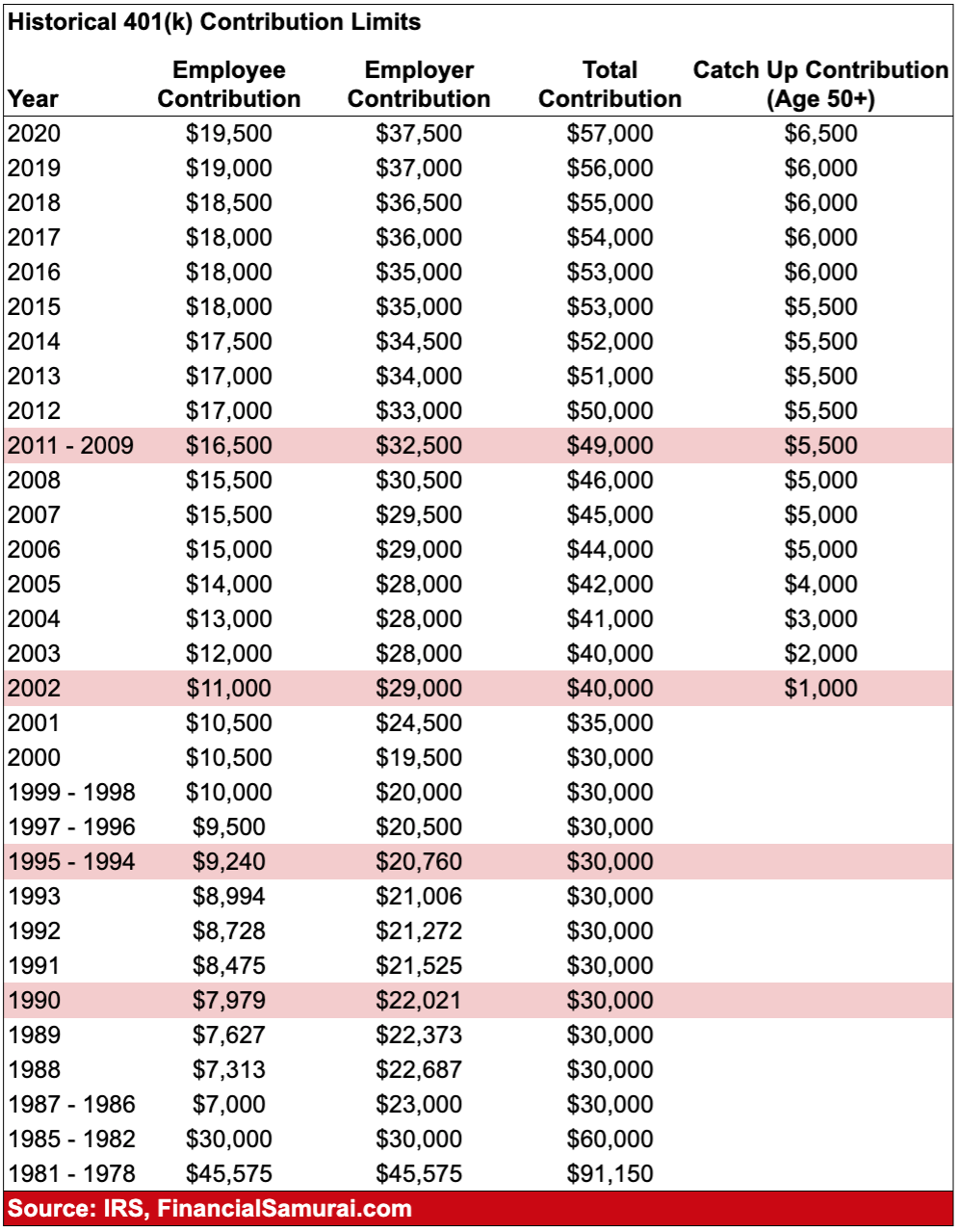

WASHINGTON The Internal Revenue Service announced today that the amount individuals can contribute to their 401 plans in 2022 has increased to $20,500, up from $19,500 for 2021 and 2020. The IRS today also issued technical guidance regarding all of the costofliving adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2022 in Notice 2021-61PDF, posted today on IRS.gov.

Read Also: Can You Take From 401k To Buy A House

Contribution Limits In 2021 And 2022

For 2022, the 401 limit for employee salary deferrals is $20,500, which is above the 401 2021 limit of $19,500. Employer matches dont count toward this limit and can be quite generous.

However, the total contribution limit, which includes employer contributions , has increased to $61,000 in 2022, up from $58,000 in 2021.

On top of these amounts, workers aged 50 and older can add up to $6,500 more annually as a catch-up contribution.

The 401 contribution limits also apply to other so-called defined contribution plans, including:

- 403 plans, available to education and non-profit workers.

- Most 457 plans used by state and local government employees.

- The federal governments Thrift Savings Plan.

| 401 plan limits | ||

|---|---|---|

| Maximum salary deferral for workers | $19,500 | |

| Catch-up contributions for workers 50 and older | $6,500 | |

| Total contribution limit, plus catch-up contribution | $64,500 | |

| Compensation limit for figuring contributions | $290,000 | |

| Compensation threshold for key employee nondiscrimination testing | $185,000 | |

| Threshold for highly compensated employee nondiscrimination testing | $130,000 | +$5,000 |

How To Invest 401 Money

Youll also need to decide how to invest your 401 money. One option, which most 401 plans offer, is target-date funds. You pick a fund with a calendar year closest to your desired retirement year the fund automatically shifts its asset allocation, from growth to income, as your target date gets nearer.

These funds also have model portfolios you can choose from and online tools to help you assess how much risk you want to take. You can also decide which fund choices would match up best with your desired level of risk.

You May Like: Can I Move My 401k To A Cd

An Ira Might Be A Better Option

If you are already contributing up to your employer match, another way to invest additional cash is through a traditional or Roth individual retirement account. The IRA contribution limit is much lower $6,000 in 2022 so if you max that out but want to continue saving, go back to your 401.

Some 401 plans, typically at large companies, have access to investments with very low expense ratios. That means youll pay less through your 401 than you might through an IRA for the very same investment. In other cases, the opposite is true small companies generally cant negotiate for low-fee funds the way large companies may be able to. And because 401 plans offer a small selection of investments, youre limited to what’s available.

Lets be clear: While fees are a bummer, matching dollars from your employer outweigh any fee you might be charged. But once youve contributed enough to earn the full match or if youre in a plan with no match at all the decision of whether to continue contributions to your 401 is all about those fees. If the fees are high, direct additional dollars over the match to a traditional or Roth IRA.

Sit Back And Celebrate

Implementing these pretax savings tips helps you reach your other savings goals above and beyond maxing out your 401 or other retirement contributions for the year. And while these ideas to save may not exactly seem like an indulgent splurge, finding new ways to invest in your future may be the best way to celebrate how well you’ve done in your workplace retirement plan.

Also Check: How To Invest With Your 401k

What To Do After Maxing Out Your 401 Plan

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

If you’ve already reached your 401 contributions limit for the year , that’s a problem. You can’t afford to fall behind in the funding-retirement game. Also, losing the contribution’s reduction in your gross income isn’t going to help your tax bill next year, either. These pointers will help you decide how to handle maxing out your contributions and hopefully avoid a large tax burden.

Contribution Limits: 401 Increases To $22500 Ira To $6500

The IRS has released 2023 inflation-adjusted contribution limits, phase-out ranges, and income limits for various retirement accounts.

For 2023, the amount an individual can contribute to a 401, 403, and most 457 plans increases to $22,500, up from $20,500 in 2022. The catch-up contribution amount, for employees 50 and older who participate in these plans, increases to $7,500 from $6,500.

Note. This means participants over 50 can contribute up to $30,000 to one of these plans.

For IRAs, the amount an individual can contribute increases to $6,500 . The catch-up contribution amount remains $1,000.

The amount individuals can contribute to their SIMPLE accounts increases to $15,500 . The catch-up contribution limit for SIMPLE account increases to $3,500 .

Read Also: How To Start A 401k For My Company

Can I Rollover My 401 To My Spouses 401

401 rollover allows participants to move funds from their 401 account to another qualified retirement account without paying income tax and penalties. However, the IRS requires that rollovers can only be made between accounts that share the same owner and taxpayer ID. Therefore, you cannot rollover your 401 to your spouseâs 401 since the two accounts do not have an identical taxpayer ID.

If you want to transfer money from your 401 and deposit it into your spouseâs 401, you can instead withdraw the money from your 401 and deposit it into the other spouseâs 401. However, this transaction will be considered a distribution, and you will pay income taxes on the distribution, plus a penalty tax if you are below 59 ½.

These Contribution Limits Apply To 401 403 457 401 Plans And Thrift Savings Plan

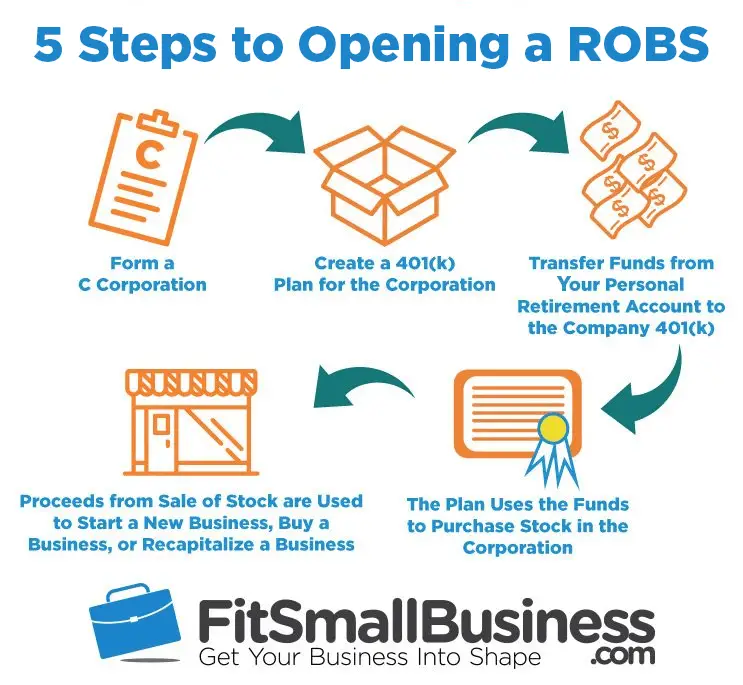

These contribution limits apply to the 401 plan, as well as to several retirement plans that are written into the tax code, such as the Thrift Savings Plan, Roth and Traditional versions of the 401 plan and similar employer-sponsored retirement plans. These limits also apply to Individual 401 Plans, also known as the Solo 401, which is a small business retirement plan).

Look into your specific plan, as there may be slight differences in employer contribution rules, profit sharing or other plan-specific topics.

Also Check: Can I Convert Pre Tax 401k To Roth

Contribution Limits In 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

401 plans are an excellent way to save for retirement, but because 401s are tax-advantaged, the IRS sets a contribution limit on how much you and your employer can put into your 401 per year.

Saving With Your Spouse

Look across the breakfast table. Is your spouse taking advantage of their maximum 401 contribution limit and also an IRA? Making sure your significant other is also saving the max can set up both of you better for the future. Your spouse can contribute to an IRA even if they’re not working outside the home.

Draw up a list of reasons to stay, focusing first on the practical. For example, proximity to school, a good neighborhood, special features that accommodate aging parents, etc. Once that is done, it’s time to consider more emotionally charged reasons, the most common of which include maintaining a sense of continuity for your children. Remaining close to neighbors who are also supportive friends or the garden you cultivate in your “me time” may be other reasons to stay.

You May Like: How To Find Out Where Your 401k Is

Working With Your Financial And Tax Professionals

A 401 plan can become the cornerstone of a personal retirement savings program, providing the foundation for future financial security. Consult your financial and tax professionals to help you determine how your employer’s 401 and other savings and investment plans could help make your financial future more secure.

Important NoteEquitable believes that education is a key step toward addressing your financial goals, and we’ve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matter addressed and you should seek advice based on your particular circumstances from an independent advisor.

What’s the next step for you?

A financial professional can help you decide. Let’s talk.

What Percent Should I Contribute To A 401

Brewer suggests that your contributions should be based on a percentage of your income, depending on your age. She recommends that you stash away between 10 percent and 15 percent of your gross income if youre in your 20s and 30s, or if you started saving during those years. If youre behind in retirement savings in your 40s and 50s, Brewer encourages you to set aside between 15 percent and 25 percent of your income.

If youre not saving anything for retirement right now and want to get started, start with at least 3 percent to get going, Brewer says. Increase your contribution by at least 2 percent each year and do a larger increase in years where you get a big raise until you hit your target savings percentage.

Also Check: How Much Do You Have To Take Out Of 401k