Us Department Of Labor Abandoned Plan Search

If your former employer has filed for bankruptcy, gone out of business, or was purchased by another company, your 401 might be in limbo.

In these cases, employers are required to notify you so you can receive your funds. However, if your contact information has changed or youve moved, your plan may have been abandoned.

You can use the Department of Labors Abandoned Plan Search tool to locate your old 401s. You will need to enter basic information about your former employer then, you can narrow your search using your social security number.

Like the National Registry of Unclaimed Retirement Benefits, the DOLâs Plan Search tool only located abandoned plan. Thereâs a good chance your old 401s wonât show up in these results.

You May Like: Can You Move Money From One 401k To Another

Consider The Amount Of Money In Your Old 401 Account

Your past employer doesnt have to keep overseeing your 401 account if your balance is less than $5,000.

At less than $1,000, your old company can just write you a check.

If you hold more than $1,000 but less than $5,000 in a 401 account with a company for which you no longer work, you should receive a request for payout instructions from your former employer. If you fail to respond to those instructions, your former company can roll the money into an IRA of its choice.

You can search the FreeERISA website to find an old IRA. You wont have to pay to use the site, but it does require you to register to search its database.

Americans have reportedly lost or abandoned more than $1 trillion in retirement benefits from previous employers. Fortunately, if youve misplaced retirement account funds, there are more ways than ever to find and claim your money.

In this article, Ill walk you through the steps to take if youre looking for retirement funds. Ill also provide you with resources to help you locate missing 401 accounts and pension plans.

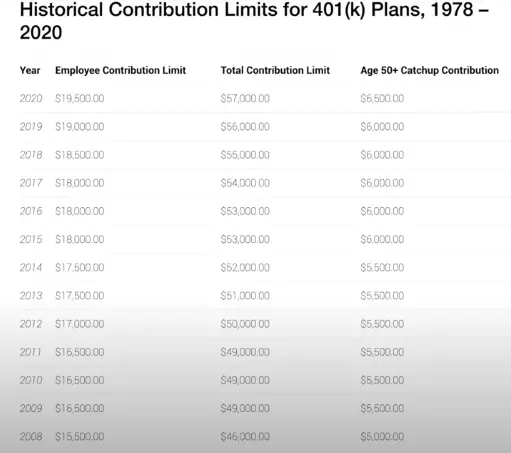

Contributing To A 401 Plan

A 401 is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service .

A defined contribution plan is an alternative to the traditional pension, known in IRS lingo as a defined-benefit plan. With a pension, the employer is committed to providing a specific amount of money to the employee for life during retirement.

In recent decades, 401 plans have become more common, and traditional pensions have become rare as employers shifted the responsibility and risk of saving for retirement to their employees.

Employees also are responsible for choosing the specific investments within their 401 accounts from a selection their employer offers. Those offerings typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as the employee approaches retirement.

They may also include guaranteed investment contracts issued by insurance companies and sometimes the employer’s own stock.

Recommended Reading: What Is Max Amount You Can Put In 401k

Move Your Old 401 To Your New Employers Plan

If you are moving to a new job and you are offered another 401 plan, regardless of whether or not you are eligible to contribute funds out of your paycheck, you should be able to roll your existing 401 balance into the plan. This will be a tax-free event, and you will have to select new funds out of the lineup your plan sponsor offers. You likely will have to call your previous 401 company to initiate this rollover, and in many cases, there is paperwork involved. This allows you to consolidate your assets into one 401 plan for potentially better continuity in your investments.

The downside is that fees may not be lower than your previous plan and the investment lineup will also be different. You could have fewer choices than your last plan, as well, so you will want to do a full side-by-side comparison of each plans investment options, expenses, and documentation to assure that this is the best option for you.

You May Like: When Can You Take Out Your 401k

There Are Fees You Pay For Your 401

Unfortunately, 401 plans come with fees but many savers dont realize this. According to TDAmeritrades January 2018 Investor Pulse Survey, 37% of Americans dont know that they pay any 401 fees, 22% dont know if their plan has fees, and 14% dont know how to determine the fees. Typically larger plans will have lower fees but the number of enrollees and the plans provider can also affect the cost. Typically, fees will range from 0.5% to 2% of the plan assets.

Pay attention to each funds expense ratio, which is a measure of a funds operating expenses expressed as an annual percentage. The lower the expense ratio, the less youll pay to invest. A total expense ratio of 1% or less is reasonable. Look at your 401 plans website to find a funds expense ratio.

The good news is that your plan may give you access to lower-cost institutional shares, which are cheaper than different share classes of the same investment bought through an IRA. The average equity mutual fund expense ratio for stock funds in 401s was 0.50% in 2020, according to the Investment Company Institute. One way to cut costs: Look to see whether your plan offers index funds, which tend to be cheaper than actively managed funds.

You May Like: How Much Will My 401k Be Worth In 20 Years

Also Check: When I Retire What Should I Do With My 401k

How To Locate A 401 From A Previous Job

If youre trying to locate an old 401 plan from a previous job, youre not alone. Not by a long shot. Roughly $850 million in plan assets owned by 33,000 employees are orphaned each year, held by a financial institution without an employer to oversee the plan . Thats a lot of money being left on the tableroughly two percent of all 401 plan assets.

The good news is that the Department of Labor has established rules for protecting money put into a 401, so the money isnt necessarily lostjust waiting for someone to claim it. However, that doesnt mean your old 401 account will always be easy to track down. It may take some digging, but there are a variety of ways you can find it.

What Are 401 Deadlines For Employers And Employees

To maximize the benefits of your workplace 401 program, you have to keep in mind 401 contribution deadlines for key events, including taking required minimum distributions, last day to contribute to 401, the 401 enrollment period, 401 set up deadline, and 401 open enrollment and more!

Heres a comprehensive list of 401 deadlines for employers and employees, including action items and links where you can find additional information.

Recommended Reading: Can You Transfer Money From An Ira To A 401k

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

You Can Borrow From Your 401

A 401 loan, if your plan offers one, can be an appealing option, with interest rates usually set at the prime rate plus one percent. Plus, that interest goes back to you, since youre borrowing from yourself. Win-win, right?

First, of all, as with any debt, you should think hard about why youre taking it on and how youre going to pay it back. Additionally, there are limits set by the IRS rules that govern 401s: generally, the lesser of $50,000 or 50% of the account balance. Unless theyre for a primary residence, 401 loans must be repaid within five years payments must be made at least quarterly. And heres a big catch: Remember that 401 plans are tied to your employment and your employer. Same goes for the loans. If you leave your job, you generally have to pay back the loan within 30 to 60 days of your last day on the job or youll owe taxes on the balance plus a 10% penalty if youre younger than 55.

Finally, you should also consider opportunity cost: You may be paying yourself 5% interest, but how much more could that money have been making if youd left it invested?

Read Also: What Does Vested Mean In 401k

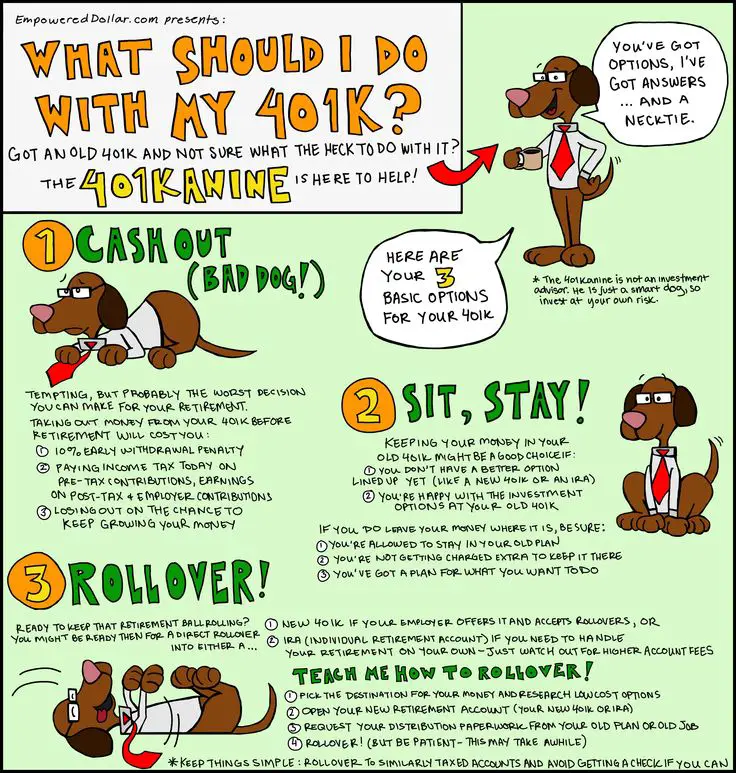

Leave Your Assets Where They Are

If the plan allows, you can leave the assets in your former employers 401 plan, where they can continue to benefit from any tax-advantaged growth. Find out if you must maintain a minimum balance, and understand the plans fees, investment options, and other provisions, especially if you may need to access these funds at a later time.

Check A National Plan Database

For 401 plans that have been left with employers for a significant amount of time, companies have the option of sending these accounts off to their stateâs treasury department.

Although not the best option, leaving it with your former employer is an optionâfor now. You shouldnât plan to leave it alone for too long.

Most 401 plans will cash your 401 out and mail it to you if the balance is under $1,000, subjecting it to penalties and taxes. If the balance is over $1,000 but less than $5,000, they can transfer it over to an IRA of their choosing.

Once youâve found an old 401, make a plan to do something with it soon before the planâs administrator does something with it you donât want.

Read Also: When Should I Roll Over My 401k

A Plan For Stabilizing Your 401 Retirement Savings

To do well and endure the economic storm that has apparently been unleashed on the markets and funds that 401 savings are invested in, you must make some decisions about how your funds will be invested in both the short- and long-term. It would be prudent to develop a strategy for overcoming the time-consuming challenges linked with analyzing and changing your savings rate or method.

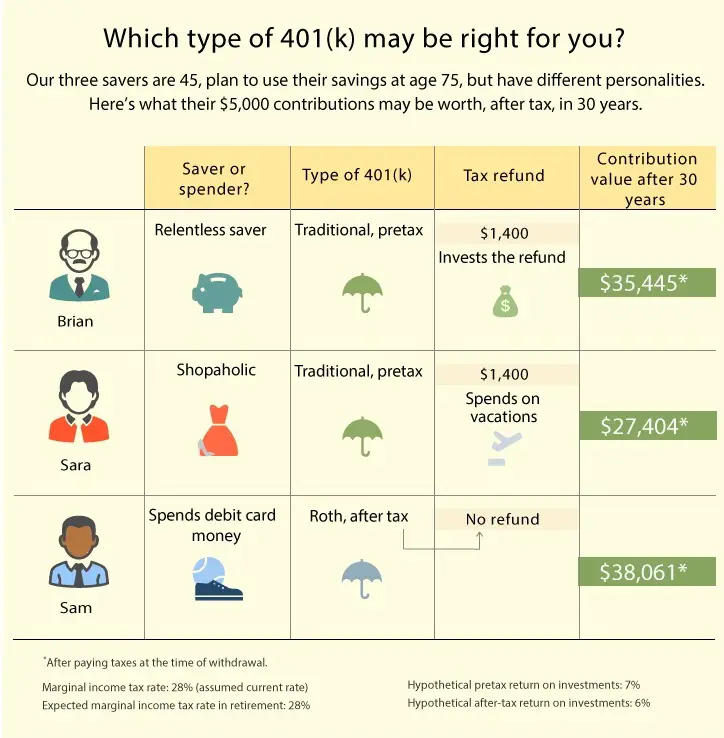

What Is A Roth 401

Like a traditional 401, the Roth 401 is a type of retirement savings plan employers offer their employeeswith one big difference. Roth 401 contributions are made after taxes have been taken out of your paycheck.That way, the money you put into your Roth 401 grows tax-free, and youll receivetax-free withdrawals when you retire.

The Roth 401 was introduced in 2006 and combines the best features from the traditional 401 and the Roth IRA. With a Roth 401, you can take advantage of the company match on your contributions, if your employer offers onejust like a traditional 401. And the Roth component of a Roth 401 gives you the benefit of tax-free withdrawals.

Read Also: Can I Transfer My Ira To A 401k

Leave Your 401 With The Old Employer

In many cases, employers will permit a departing employee to keep a 401 account in their old plan indefinitely, though the employee can’t make any further contributions to it. This generally applies to accounts worth at least $5,000. In the case of smaller accounts, the employer may give the employee no choice but to move the money elsewhere.

Leaving 401 money where it is can make sense if the old employer’s plan is well managed and you are satisfied with the investment choices it offers. The danger is that employees who change jobs over the course of their careers can leave a trail of old 401 plans and may forget about one or more of them. Their heirs might also be unaware of the existence of the accounts.

Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

You May Like: How Much Does A 401k Grow Per Year

Search Databases For Unclaimed Assets

If you still cant find information on your lost 401 plans, you can also try searching one of the publicly available databases for unclaimed assets. The National Registry of Unclaimed Retirement Benefits is a good place to start. By entering your Social Security number, you can quickly see if there are any unclaimed retirement funds that belong to you. The money may still be held in the employers plan, or the company may have opened a special IRA account in your name to hold the funds.

You can also search using the National Association of Unclaimed Property Administrators site, which will help you track down unclaimed money you may be owed, not limited to retirement assets. Be sure to check in each state you have lived or worked. The site processes tens of millions of requests each year and has helped return more than $3 billion in unclaimed assets annually.

What Happens To Your 401 When You Change Jobs

You have several options for your 401 balance when you change jobs. Avoid simply cashing out your savingsif youre under 59½ years old, youll get hit with the 10 percent early withdrawal tax penalty, and if its a traditional 401 youll own income tax on the balance.

If you have less than $1,000 in your 401, the plan administrator is empowered to write you a check for the balance. This gives you 60 days to reinvest the money in an IRA or your new companys 401 plan before you are subject to the additional 10% tax penalty and possible ordinary income tax. If you have more than $1,000 but less than $5,000 in your 401, the administrator can open an IRA in your name and roll your balance over into it.

Also Check: When Can I Get My 401k Without Penalty

Reality: 401 Plan Administration Has Improved A Lot Over The Last Decade

While it used to be that the paperwork from starting a plan can overwhelm business owners, who already juggle many responsibilities throughout their day, thats no longer true.

Small and medium-sized businesses can find what they need: a 401 provider that uses automation to streamline the process of setting up and administering a plan with features like:

-

Seamless integration with popular payroll providers

-

Support with compliance testing and filling required IRS forms

-

Reporting functionality to monitor how employees are using and saving with the plan

Move Your 401 To A New Employer

You can usually move your 401 balance to your new employer’s plan. As with an IRA rollover, this maintains the account’s tax-deferred status and avoids immediate taxes.

It could be a wise move if you aren’t comfortable with making the investment decisions involved in managing a rollover IRA and would rather leave some of that work to the new plan’s administrator.

Also Check: How To Transfer 401k To Ira Fidelity

What Do Employers Need To Know: 401 Basics For Employers

If youre an employer who hasnt offered a 401 benefit before or even if you have its important to understand the 401 basics before you decide on a plan provider. How does a 401 benefit the employer? What are 401 rules for employers? Learn the answers to these questions and more in our guide, 401 basics for employers.

How To Check Your 401 Balance

If you already have a 401 and want to check the balance, its pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account. Companies dont traditionally handle pensions and retirement accounts themselves. They are outsourced to investment managers.

Some of the largest 401 investment managers include Fidelity Investments, Bank of America Get Bank of America Corp Report, T. Rowe Price Get T. Rowe Price Group Report, Vanguard, Charles Schwab Get Charles Schwab Corporation Report, Edward Jones, and others.

Once you know who the plan sponsor or investment manager is, you can go to their website and log in, or restore your log-in, to see your account balance. Expect to go through some security measures if you do not have a user name and password for the account.

Much of this should be covered when you initiate the 401 when you are hired or when the retirement account option becomes available to you. Details like contributions, company matching, and information on how to check your balance history and current holdings should be provided.

Finding a 401 from a job you are no longer with is a little different.

Read more on TheStreet about how to find an old 401 account.

Recommended Reading: How Do You Access Your 401k