To Ira Rollover Methods

The rules regarding retirement account distributions can seem complicated, discouraging some account holders from rolling over their 401s to IRAs. Fortunately, special regulations apply in this situation and if you follow IRA rollover rules, there is no risk to the tax-deferred status of your contributions.

There are multiple ways to complete a rollover without incurring taxes and penalties. The first option is a direct rollover, which takes place when your plan administrator makes your distribution payment directly to your new retirement account. The plan administrator withholds no taxes and sends the check to the IRA custodian, made payable to the new retirement account.

Suppose, for example, that Stacie has $100,000 in a 401 that she wants to roll over to a new retirement account. If the money is sent directly to Stacie, she will receive $80,000, since 20% of the plan funds will be withheld. To avoid any tax penalties, Stacie will have to send the full $100,000 to the receiving account. If she cant come up with the cash, the missing $20,000 will be taxable since the money was never transferred to the new plan.

Fast And Easy Rollover From Schwab 401k To Fidelity Ira

October 22, 2019Keywords: 401k, Fidelity, IRA, rollover, Schwab

Now that my income isnt too high that requires a backdoor Roth , I finally rolled over my 401k from the former employer to an IRA. The 401k money was 100% Traditional. It went into a Traditional IRA. Charles Schwab as the 401k administrator and Fidelity as the IRA custodian did a great job. I was able to complete the rollover in only two days.

This is not a sponsored post. Neither Schwab or Fidelity paid me to write it. Im sharing my personal experience to show how easy it is to do a rollover. If you also wanted to rollover and consolidate but you dread the hassle, you will see its not difficult or time-consuming at all. If someone tells you it will take a few weeks to complete the rollover, thats not normal. It should only take a few days, not a few weeks.

When you transfer from one IRA to another IRA, you start from the receiving end because the financial industry has standardized the transfer process. When you do a rollover from a 401k, you start from the sending end because each plan has its own process and requirements. Some 401k administrators take the request online. Some administrators require a signed paper form. Some even require a signature from someone at your former employer.

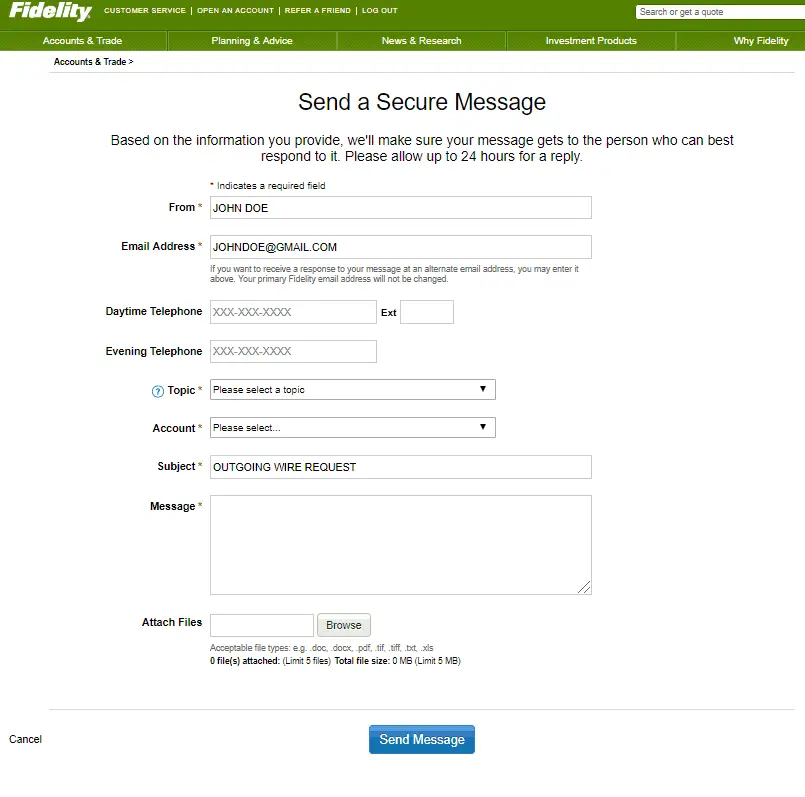

You need to find out from the receiving IRA custodian how they want the check made out to. I was rolling over to an IRA at Fidelity. Fidelity says on their website:

Say No To Management Fees

Rolling Over To A New 401

The first step in transferring an old 401 to a new employers qualified retirement plan is to speak with the new plan sponsor, custodian, or human resources manager who assists employees with enrolling in the 401 plan. Because not every employer-sponsored plan accepts transfers from an outside 401, it is imperative for a new employee to ask if the option is available from the new employer. If the plan does not accept 401 transfers, the employee needs to select one of the three other options for the 401 account balance.

If the new employer plan accepts 401 transfers from other companies, there is often a substantial amount of paperwork that must be completed by the employee. The paperwork is provided by the new plan sponsor or human resources contact and requires the name, date of birth, address, Social Security number, and other employee identifying information.

In addition, the 401 transfer form must provide details of the old employer plan, including total amount to be transferred, investment selections held in the account, date contributions started and stopped, and contribution type, such as pre-tax or Roth. A new plan sponsor may also require an employee to establish new investment instructions for the account being transferred on the form. Once the transfer form is complete, it can be returned to the plan sponsor for processing.

A transfer from one 401 to another is a tax-free transaction, and no early withdrawal penalties are assessed.

Also Check: What To Do With 401k When Laid Off

Choosing The Right Ira

Fidelity offers two IRA products:

Commissions:Invest in:Limitations:Access to Research:Fees:Best if you want:Limitations:Access to Human Advisor:

In order to pick the best account for you, theres one up-front question to answer:

Do you want to make your own investment decisions, or would you rather have the investing decisions made for you so you can just set-it-and-forget-it?

If you want to make your own decisions, then what youll want to open the self-directed Fidelity IRA. That allows you to make your own trading decisions and invest in whichever financial securities youd like.

If you want the investing decisions made for you, then youll be best served by opening a Fidelity Go IRA, which is their automated IRA product . When you open a Fidelity Go account, youll answer a series of questions, known as a risk-tolerance questionnaire, and your answers will be used to create a diversified portfolio that suits your personal and financial situation. That portfolio is then rebalanced automatically over time without you having to do any work. Its a great tool for those who dont want to spend much time managing their investments.

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. Itâs also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, itâs a good way to save money, stay organized and make your money work harder.

Read Also: Can You Pull From 401k To Buy A House

You May Like: Can I Move My 401k To A Roth Ira

Who Is The Owner Of The Empower Retirement Fund Reviews

Empower Retirement is a retirement plan registration company based in Denver, Colorado. It is part of GreatWest Life & Annuity Insurance Company and is an indirect wholly owned subsidiary of GreatWest Lifeco. Empower is chaired by President Edmund F. Murphy III, who reports to Robert L. Reynolds, CEO and President of GreatWest Financial.

How Do You Find Your Expense Ratios

There are lots of companies that sponsor 401ks , and the steps to find the expense ratio are different for each of them. Generally you can find it by signing into your account online, and find the fund youve selected. Once you find the fund, you will see the expense ratio in the details of the fund.

Account -> Fund -> Expense Ratio

It took me about 15 minutes to find the funds and corresponding expense ratios in two different accounts. Remember that the 15 minutes it took to find the expense ratios, then plug them into the calculator above is how I found out I could save 6 figures in fees.

Heres where I found the expense ratios within my Roth IRA at Vanguard and my 401k at Merrill Lynch. Keep in mind that the funds in my account may be different than yours.

Merrill Lynch was a little more complicated. After signing in and selecting my 401k plan, I had to find the Average annual total returns tab under Investment Choices and Selection.

Dont Miss: How Do You Take Money Out Of 401k

Don’t Miss: Can I Rollover Old 401k To New 401k

Rolling Over Into An Ira

Well handle the entire process for you online, for free!

- Well help you choose an IRA provider if you dont already have one

- Customer support available if you have questions along the way

- We get paid by the IRA provider if you open an account so our service comes at no cost to you!

If you have a 401 at Fidelity from a previous job, there are a few options for you to consider when doing a rollover. The process for Fidelity requires a form to sign, a phone call to authorize, and a check to be mailed for you to deposit into the new account.

Weve laid out a step-by-step guide to help you roll over your old Fidelity 401 in five key steps:

Questions To Ask Your Former Provider

| What to ask | What to know |

|---|---|

| Is a distribution form required? |

It might be. If additional paperwork is required, have them send it to you, and we can help you complete it if needed. |

| If a distribution form is required, who, aside from myself, needs to sign it before I send it back to you? |

It’s most often a spouse, and sometimes, Fidelity. |

| Is a Letter of Acceptance required? |

Quite often, it is. But we will automatically generate one for you. |

| Does my account include company stock? |

If you have shares of company stock included in your old 401, it’s easiest to give us a call at 800-343-3548 so that we can discuss how to include them in your rollover. |

| Where will you send my distribution check? |

It’s fine to send it directly to us or to you. However, how the check is made out is very importantplease ensure your provider follows the guidelines in Step 3. |

Also Check: Can I Roll My 401k Into An Annuity

Confirm A Few Key Details About Your Fidelity 401

First, get together any information you have on your Fidelity 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following items:

STEP 2

Dont Miss: How Do I Know If I Have Money In 401k

How Can I Find Hidden 401k Fees

The fees arent actually hidden, but are in fact disclosed in the prospectus that is given to new customers when they enroll in a plan. This prospectus is updated yearly, reflecting any change in fees. Disclosing fees is not optional, and is a requirement of the U.S. Department of Labor. To check fees, look through your 401 statement or prospectus for line items such as Total Asset-Based Fees, Total Operating Expenses As a %, and Expense Ratios.

Read Also: When Can You Draw Money From 401k

How Old Are You

If your client is 59½ or younger, theres typically a 10% early withdrawal penalty for both IRAs and 401s . Fortunately, CRA allows the 10% penalty to be claimed as a FTC on the Canadian return in addition to the 15% withholding. On a $100,000 plan, thats $75,000 net the client would also need to owe at least $25,000 in Canadian tax for the transfer to be tax-neutral.

If your client is 70½ or older, she must start withdrawing from the U.S. plan by April 1 of the year following the year the client reached that age. If youre comfortable with where the money is and how its being invested, its probably better to leave it tax-deferred as long as you can, says Altro. You can even withdraw the IRA at a slower pace than a RRIF the minimums are lower than they are in Canada.

If your client is 71 or older, she must convert her RRSP to a RRIF, and its no longer possible to contribute to the RRIF.

What Type Of Ira Should I Open

During the process of opening your new account, you may get asked which type of IRA youd like to open. You might see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Heres how to pick the right one:

- If you had a Traditional 401 pick a Rollover IRA or, if thats not available, Traditional IRA or, if thats not available, just IRA. The only exception would be if youre considering a Roth conversion, but this is an advanced tax planning strategy that most people dont need to worry about.

- If you had a Roth 401 pick a Roth IRA. Youll need to match the Roth 401 to a Roth IRA for tax reasons.

- If your 401 has mixed assets youll need to open two IRAs, one Roth and one Traditional to for their respective assets.

STEP 3

Don’t Miss: Can You Get A Loan Using Your 401k As Collateral

Finish Any Last Transfer Steps

Chances are that by this stage youre done, and your 401 provider has initiated the process of rolling over your 401 into your new Fidelity IRA. If so, congrats on getting to the finish line!

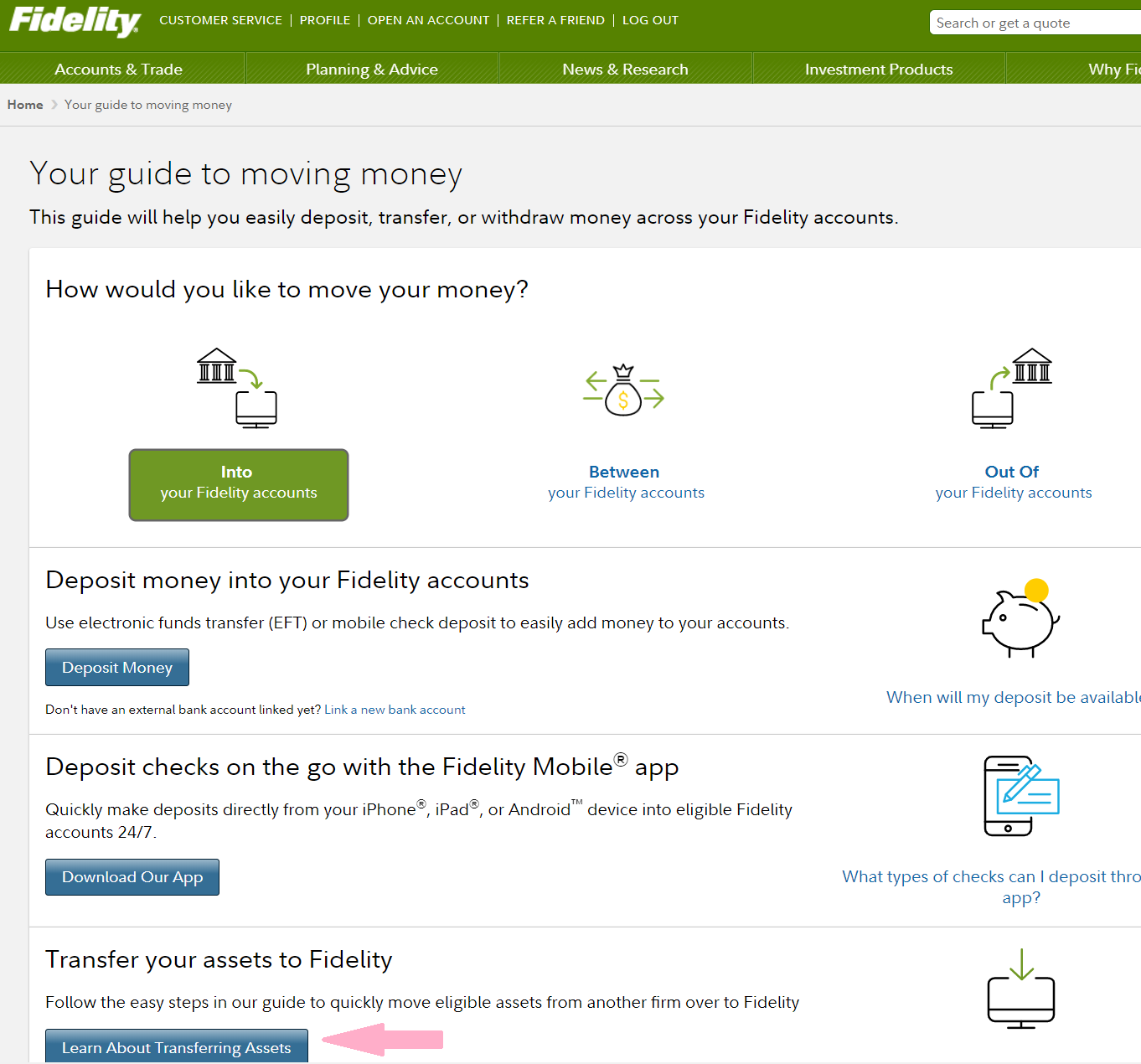

But there can sometimes be a small extra step at this stage. Thats because some 401 providers will only distribute your 401 funds to you, not to another institution. If thats the case then theyll send a check with your money to your mailing address. Its then up to you to deposit the check to your Fidelity account. Fidelity offers a few methods for depositing a check:

More People Than Ever Are Investing 401 Savings In Bitcoin

Here are seven reasons why.

Before you can take advantage of these rollover benefits, there are specific details you need to know, and three steps you must take.

Dont Miss: Can You Use 401k To Buy Investment Property

You May Like: How Can I Borrow Against My 401k

What Is A Rollover Ira

A rollover IRA is an account used to move money from old employer-sponsored retirement plans such as 401s into an IRA. A benefit of an IRA rollover is that when done correctly, the money keeps its tax-deferred status and doesn’t trigger taxes or early withdrawal penalties.

Rollover IRAs can also provide a wider range of investment options and low fees, particularly compared with a 401, which can have a short list of investment options and higher administrative fees.

Taking The Cash Distribution May Cost You

Avoiding cash distributions can save you from taxes and penalties, because any amount you fail to roll over will be treated as a taxable distribution. As a result, it would also be subject to the 10% penalty if you are under age 59 1/2.

Since the taxable portion of a distribution will be added to any other taxable income you have during the year, you could move into a higher tax bracket.

Using the previous example, if a single taxpayer with $50,000 of taxable income were to decide not to roll over any portion of the $100,000 distribution, they would report $150,000 of taxable income for the year. That would put them in a higher tax bracket. They also would have to report $10,000 in additional penalty tax, if they were under the age of 59 1/2.

Only use cash distributions as a last resort. That means extreme cases of financial hardship. These hardships may include facing foreclosure, eviction, or repossession. If you have to go this route, only take out funds needed to cover the hardship, plus any taxes and penalties you will owe.

The CARES Act, enacted on March 27, 2020, provided some relief for those who need to make withdrawals from a retirement plan. It lifted penalties for withdrawals made through December 2020 and provides three years to pay back any early withdrawals.

Don’t Miss: Can A 401k Be Used To Purchase A Home