Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

Borrowing Or Withdrawing Money From Your 401 Plan Before You Retire

Borrowing or withdrawing money from your 401 before you retire is a big decision. After all, youve worked hard and saved hard to build up your retirement fund. While taking money out of your 401 plan is possible, it can impact your savings progress and long-term retirement goals so its important to carefully weigh the risks, costs and benefits.

How Long Does It Take To Cash Out A 401 After Leaving A Job

Depending on who administers your 401 account , it can take between three and 10 business days to receive a check after cashing out your 401. If you need money in a pinch, it may be time to make some quick cash or look into other financial crisis options before taking money out of a retirement account.

Don’t Miss: How Do You Roll Your 401k Into An Ira

Borrowing From A Roth 401

Although there’s no tax-free way to withdraw tax-free money from your Roth 401 before age 59½, taking a loan from your account is a way to use the funds for current needs without diminishing your retirement savings. Many 401 plans, Roth or traditional, allow for the account holder to take out a loan of $10,000 , but loans cannot exceed $50,000.

Loans must be repaid within five years in generally equal payments made at least quarterly. The benefit is that you are borrowing money from yourself, and all payments and interest charged go directly back into your retirement account. However, failure to repay the loan as stipulated, however, may result in it being considered a taxable distribution. You are also often not permitted to make additional 401 contributions until the loan has been paid off.

Is A 401 Right For Everyone

No. 401 plans might be unavailable for freelancers or those who own businesses. In such cases, you might be better off with an IRA or individual retirement account.

IRAs allow you to invest in mutual funds, exchange-traded funds or ETFs and other investment products that firms usually manage. Similar to 401s, IRAs require you to contribute a certain amount into your account each month or year, and they have certain limits.

For instance, 2022’s traditional IRAcontribution limit was $6,000 annually. Unlike a 401, no one matches your contributions, so you are entirely responsible for funding your retirement account.

On the plus side, you’re also in control of where your investments go. You can tweak your IRA to target fast growth, slow growth, or something in between.

You can also pursue a Roth IRA, similar to a Roth 401: you pay taxes on your contributions immediately but don’t have to pay taxes on withdrawals later.

Related: 4 Ways to Save for Retirement Without a 401

Read Also: How Do I Cash Out My 401k After Being Fired

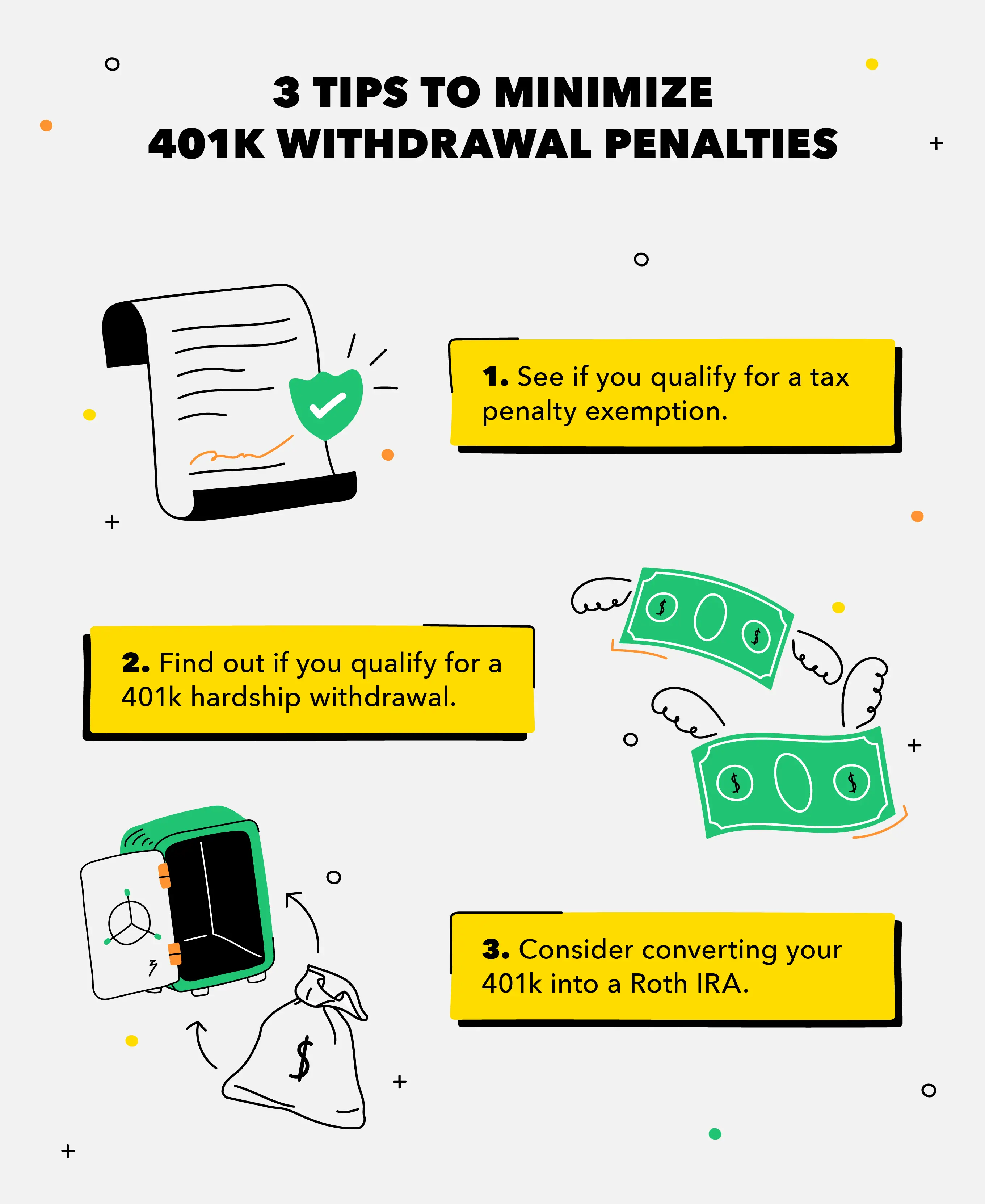

Hardship Withdrawals Allowed With Taxes And Penalty:

Withdrawing When You Retire

After you reach the age of 59 1/2, you may begin taking withdrawals from your 401. If you leave your job in the calendar year when you turn 55 or later, you can also begin taking penalty-free withdrawals from the 401 you had with that current company. If you are a public safety worker, this rule takes effect at the age of 50.

Once you reach 72, you are actually obligated to begin making required minimum distributions or RMDs.

Recommended Reading: Should I Rollover My Old 401k To New Employer

How Much You Can Withdraw

You cant just withdraw as much as you want it must be the amount necessary to satisfy the financial need. That sum can, however, include whats required to pay taxes and penalties on the withdrawal.

The recent reforms allow the maximum withdrawal to represent a larger proportion of your 401 or 403 plan. Under the old rules, you could only withdraw your own salary-deferral contributionsthe amounts you had withheld from your paycheckfrom your plan when taking a hardship withdrawal. Also, taking a hardship withdrawal meant you couldn’t make new contributions to your plan for the next six months.

Under the new rules, you may, if your employer allows it, be able to withdraw your employers contributions plus any investment earnings in addition to your salary-deferral contributions. Youll also be able to keep contributing, which means youll lose less ground on saving for retirement and still be eligible to receive your employers matching contributions.

Some might argue that the ability to withdraw not just salary-deferral contributions but also employer contributions and investment returns is not an improvement to the program. Heres why.

What Is A Required Minimum Distribution And Why Should I Care About It

An RMD is the smallest amount you must withdraw from your tax-deferred retirement accounts every year after a certain age. At some point in your life, you may have put money into tax-deferred retirement accounts, such as Individual Retirement Accounts and 401 workplace retirement accounts. The key words here are tax-deferred. You postponed taxes on your contributions and earnings you didnt eliminate them. Eventually, you must pay tax on your contributions and earnings. RMDs make sure that you do that.

Recommended Reading: Can I Use My 401k To Buy Gold

Converting A 401 To An Ira

You cannot contribute to a 401 after you leave your job, so if you want to continue adding money to your retirement funds, youll need to roll over your account into an IRA. Previously, you could contribute to a Roth IRA indefinitely but could not contribute to a traditional IRA after age 70½. However, under the new Setting Every Community Up for Retirement Enhancement Act, you can now contribute to a traditional IRA for as long as you like.

Keep in mind that you can only contribute earned income, not gross income, to either type of IRA, so this strategy will only work if you have not retired completely and still earn taxable compensation, such as wages, salaries, commissions, tips, bonuses, or net income from self-employment, as the IRS puts it. You cant contribute money earned from either investments or your Social Security check, though certain types of alimony payments may qualify.

To execute a rollover of your 401, you can ask your plan administrator to distribute your savings directly to a new or existing IRA. Alternatively, you can elect to take the distribution yourself. However, in this case, you must deposit the funds into your IRA within 60 days to avoid paying taxes on the income.

Traditional 401 accounts can be rolled over into either a traditional IRA or a Roth IRA, whereas designated Roth 401 accounts must be rolled over into a Roth IRA.

Do I Pay Taxes On 401k Withdrawal After Age 62

Asked by: Isidro Fay

Once you reach age 59.5 you can withdraw money from your 401. If you dont need the money yet, you can wait until you reach age 72 (70 ½ if you reach 70 ½ before Jan. Like with a Roth IRA, money is put into these accounts after taxes, so the distributions are generally untaxed.

Dont Miss: Can You Move Money From Your 401k To An Ira

Read Also: How To Invest In A 401k Plan

What Are Retirement Account Changes For Employers

The retirement account rule changes in the Secure 2.0 Act of 2022 will impact employers at least as much as employees. The biggest change for companies will be that, starting in 2025, any new 401 or 403 plans must automatically enroll workers who don’t opt out.

Contributions from workers automatically enrolled will start at a minimum of 3% and a maximum of 10%. Each year after 2025, those amounts will rise 1% until they reach a range of 10% to 15%. Retirement plans created before 2025 will not be subject to the same requirements.

The retirement rule changes will also give employers the opportunity to offer employees “pension-linked emergency savings accounts” that will act as hybrids between emergency and retirement savings. Employers can automatically enroll workers at up to 3% of their salary, with a contribution cap of $2,500.

Contributions to these emergency accounts will be taxed like Roth contributions and will qualify for employer matching. Employees can make four withdrawals per year from the account with no penalty or additional taxes. If they leave the company, they can withdraw the emergency account as cash or roll it over into a Roth account.

Which Assets Should You Draw From First

You may have assets in accounts that are taxable , tax-deferred s, and tax-free . Given a choice, which type of account should you withdraw from first?

The answer isit depends.

- For retirees who don’t care about leaving an estate to beneficiaries, the answer is simple in theory: withdraw money from taxable accounts first, then tax-deferred accounts, and lastly, tax-free accounts. By using your tax-favored accounts last, and avoiding taxes as long as possible, you’ll keep more of your retirement dollars working for you.

- For retirees who intend to leave assets to beneficiaries, the analysis is more complicated. You need to coordinate your retirement planning with your estate plan. For example, if you have appreciated or rapidly appreciating assets, it may be more advantageous for you to withdraw from tax-deferred and tax-free accounts first. This is because these accounts will not receive a step-up in basis at your death, as many of your other assets will. A step-up in basis is used to calculate tax liabilities for your beneficiaries.

Read Also: Can You Transfer A 401k Into A Roth Ira

Is An Employer Required To Make Plan Contributions For An Employee Who Has Turned 72 And Is Receiving Required Minimum Distributions

Yes, you must continue contributions for an employee, even if they are receiving RMDs. You must also give the employee the option to continue making salary deferrals, if the plan permits them. Otherwise, you will fail to follow the plans terms, causing your plan to lose its qualified status. You may correct this failure through the Employee Plans Compliance Resolution System .

How To Withdraw Money From A 401 After Retirement

Shawn Plummer

CEO, The Annuity Expert

When you retire, one of the first things youll want to do is figure out how to access your 401 funds. This can be a little confusing, as there are several ways to go about it. This guide will walk you through the process of withdrawing money from your 401 after retirement. We will also answer some common questions, such as do you pay tax on 401 when you retire? and how do you not run out of 401 money. So read on for all the information you need to make the best decisions for your retirement!

Also Check: When To Convert 401k To Roth Ira

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

How To Roll Over A 401 While Still Working

Some 401 plans allow you to roll them over while still employed with your company.

Anyone can roll over a 401 to an IRA or to a new employers 401 plan when leaving a job. Depending on your plans policies, you might be able to make the rollover while youre still with the company. Unlike a post-job rollover, your plan doesnt have to allow in-service rollovers, but many companies do. However, there are usually significant restrictions.

You May Like: How To Make A 401k Account

Don’t Miss: How Does Taking A Loan From Your 401k Work

Home Equity Loan Or Heloc

If you own a home with equity built up, a home equity loan or home equity line of credit can be a low-interest alternative to a personal loan. This type of loan is often referred to as a second mortgage because the loan is secured by your home. In other words, if you default on the loan, your lender may have a right to foreclose on your home.

One of the major benefits of a home equity loan or HELOC over a personal loan is the interest rate. Loans that are secured by homes including mortgages, home equity loans, and HELOCs often have some of the lowest interest rates on the market. As a result, the loan will cost you less money over the long term.

Its important to proceed with caution if youre considering a home equity loan or HELOC. As we mentioned, these loans are secured by your home. If you cant make your monthly payments, you risk having the lender take your home. As a result, you should avoid this option if you think for any reason you may not be able to repay the loan on time.

Rolling Over Funds In A Roth 401

You can avoid taxation on your earnings if your withdrawal is for a rollover. If the funds are simply moving into another retirement plan or a spouse’s plan via direct rollover, no additional taxes are incurred.

If the rollover is not direct , the funds must be deposited in another Roth 401 or Roth IRA account within 60 days to avoid taxation.

When you do an indirect rollover, the portion of the distribution attributable to contributions cannot be transferred to another Roth 401 but it can be transferred into a Roth IRA. The earnings portion of the distribution can be deposited into either type of account.

Don’t Miss: What To Know About 401k

Withdrawals After Age 59

Tax-advantaged retirement accounts, such as 401s, exist to ensure that you have enough income when you get old, finish working, and no longer receive a regular salary. From time to time, you may be eager to tap into your funds before you retire. However, if you succumb to those temptations, you will likely have to pay a hefty priceincluding early withdrawal penalties and taxes such as federal income tax, a 10% penalty on the amount that you withdraw, and relevant state income tax.

Most Americans retire in their mid-60s. Theres a little more flexibility offered with retirement savings plans, though, including the company-sponsored 401. The Internal Revenue Service allows you to begin taking distributions from your 401 without a 10% early withdrawal penalty as soon as you are 59½ years old.

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer that you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an IRA.

Ways To Withdraw Your 401

There are several ways to go about withdrawing your money in retirement.

- Rollover your funds: Instead of keeping your money in a 401, you can roll it over into a new account to keep it growing in retirement with more investment options.

- Take regular distributions: You can contact the financial institution managing your 401 and set up periodic payments to give you a fixed stream of income, much like a paycheck. You can also opt to take the distribution as you need them, as long as you take out the minimum required amount.

- Purchase an annuity: You can also purchase an annuity to ensure a fixed stream of payments.

- Take a lump sum: This is often not recommended by financial experts, but you have the ability to take out the money all at once.

Which option you pick will depend on your financial situation and goals in retirement. A financial planner can help you develop a plan that fits your needs.

Also Check: How To Withdraw Fidelity 401k