How To Do A Direct Roth Ira Transfer

If you want to transfer your Roth IRA from one company to another, a direct transfer is likely the easiest path to take. With a direct transfer, you can move your assets straight to the new broker without having to sell them or deal with waiting on a check in the mail.

Usually, the best way to start the process is to talk to the company to which you want to transfer your Roth IRA. Brokers want your business, so they have an incentive to make the process as easy as possible for you.

Your new broker can tell you all the information that it needs and can help you work with your current broker to start the transfer process. In some cases, theyll even communicate for you with the brokerage firm youre leaving.

Youll need to provide some details and confirm with your old broker that you want the transfer to go through. Your old broker may also charge an account closure or transfer fee, so be ready to pay that.

What Systemic Changes Would Congress Make For Retirement Plans

If approved as part of the larger spending package, the SECURE 2.0 Act of 2022 would introduce several broad changes for retirement in America in general. One of the biggest would be a mandate for the Department of Labor to create a national, searchable database of retirement plans to help people find lost or misplaced accounts. The agency would be required to launch the database within two years of the bill passage.

The Employee Retirement Income Security Act of 1974 would also get an update. ERISA establishes minimum standards for administrators of private retirement plans, including communication with participants.

The proposed ERISA rule change would require private retirement plans to provide participants with at least one paper statement annually, unless the participant opts out. The rule wouldn’t take effect until 2026, however, and wouldn’t impact the other three quarterly statements required by ERISA.

You Think Your Tax Rate Is Going To Go Up

If you believe your current tax rate is lower than it might be in the future, you may want to convert your investments into a Roth IRA, pay your fair share of taxes now, and then let that money grow tax-free until you need it.

Converting a pre-tax 401 into a post-tax Roth IRA will trigger a tax bill, but a financial professional might recommend it anyway. Its a way to hedge against the risk of taxes going up in the future, says Hernandez. In a general sense, if youre still in the early stages of your earning career, it makes sense to go ahead and pay the taxes upfront and do the Roth contributions.

Of course, no one knows for sure what their tax rate will look like in the future. Thats why many experts recommend diversifying your long-term investments into different buckets: some in a tax-deferred account like a 401, and others in a post-tax account like a Roth IRA. If all your money is one bucket, a conversion could make sense.

You May Like: How To Borrow From My 401k

Best Roth Ira Accounts Of 2022

Get $100 when you open a new, eligible Fidelity account with $50 or more. Use code FIDELITY100. Limited time offer. Terms apply. Offer Disclosure.

Fidelity, originally known for their outstanding lineup of mutual funds, offers a well-rounded, full-service platform with a wide range of investment options that can be tailored to fit your portfolio preferences. In addition to the extensive array of self-directed investment options, you can also leverage advisor-guided and digital investment advisor portfolio management strategies. Youll find that this blend of investment management flexibility combined with Fidelitys retirement calculators, tools, and reporting features gives a powerful edge to retirement savers at every life stage and level of market experience.

Those just getting started on their retirement journey have access to excellent educational content in a variety of formats that complement effective goal setting tools. If youre closer to retirement, Fidelity provides withdrawal calculators and incorporates Social Security distributions that give better insight into your retirement income approach. Overall, investment management flexibility paired with outstanding tools and low costs makes Fidelity one of the premier places to hold your Roth IRA.

-

No futures, commodities, or crypto trading ability

-

Navigating certain features and tools can be challenging

-

Non-U.S. citizens or non-residents blocked from account opening

Expecting Higher Than Average Returns From An Investment Opportunity

If youre about to make an investment you expect will produce huge returns, then itll be in your best interest to convert to a Roth.Wouldnt you rather pay tax on the smaller investment amounts now? Those larger returns will go back into your Roth IRA or 401k, where they will grow to an unlimited amount and come out tax free.I realize this is hard to predict. After all, if it was easy wed all be rich. However, a situation like this is bound to happen when youre investing in real estate, startups, pre-IPOs, and other investments.

Read Also: How Can I Withdraw My 401k Without Penalty

Learn Which Type Of Retirement Accounts Can Be Combined

The most common types of retirement accounts can be transferred into one IRA and one Roth IRA. For example, once you have left your employer, you can move your 401 to an IRA. This is called a rollover. When you move money from a 401 to an IRA using an IRA rollover, there are no taxes due, as it is considered a direct transfer from one type of retirement account to another. In your new IRA, youll pay taxes only as you take withdrawals. If you are between ages 55 and 59 1/2, make sure you understand the 401 retirement age rules before you decide to move money out of a 401 plan.

401s, 403s, SEP accounts, SIMPLE accounts, KEOGHs, individual 401s, and some 457 plans can all be transferred into one IRA account. Having everything in one account makes it easy to update and change beneficiaries, manage investments, and take withdrawals. When you reach age 72, you are required to take a minimum withdrawal amount, and that can be challenging to manage if your accounts are spread out.

If you have after-tax contributions in your 401 plan or other retirement accounts, those can usually be transferred into a Roth IRA account. Alternatively, you may find it advantageous to convert a portion of your pre-tax 401 contributions to a Roth IRA. Doing so will trigger an immediate tax bill, but future tax-free growth may position you better for the long term. A financial advisor and/or tax professional can provide some guidance on that front.

Recommended Reading: Who Qualifies For A Solo 401k

The Penalty If You Deposit To The Wrong Account

You have 60 days to deposit the funds into the appropriate account when you receive a rollover check. Your rollover won’t count as a rollover if you miss the 60-day deadline. It will become taxable.

Exceptions to the 60-day rollover time frame are hard to come by unless your financial services company makes a gross error. It’s important to have a clear plan for where your rollover funds are going and to make sure your financial advisor or plan administrator knows exactly where to put the money.

Also Check: When Can You Access Your 401k

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

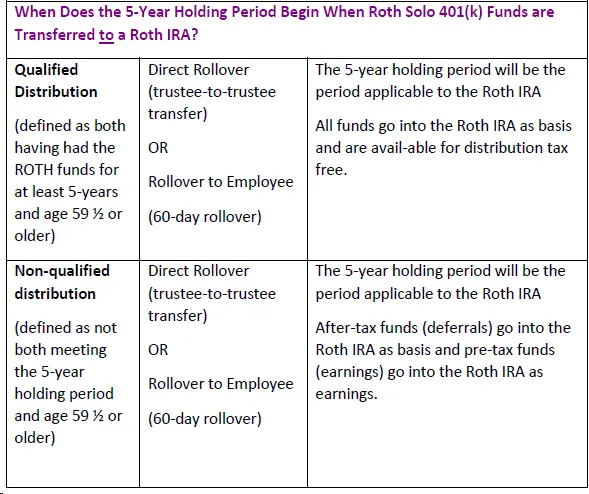

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

If You Follow The Rules You Can Avoid Taxes And Penalties

If you have a Roth IRA and want to transfer your account to a new custodian, taxes and penalties can be avoided if you follow some relatively simple rules. To start, dont close out your old account before finding and making arrangements with a new custodian. That would result in receiving a distribution and could subject you to those taxes and penalties, particularly if you are younger than age 59½ or the Roth account has not been open for five years or more.

Among the options to accomplish the switch from one Roth account to a new one is by a direct transfer, which is the safest way.

Don’t Miss: How To Convert My 401k To Gold

What Are The New Retirement Rules For Required Minimum Distributions

Currently, Americans must start receiving required minimum distributions from their 401 and IRA accounts starting at age 72 . If approved, the SECURE 2.0 Act of 2022 would raise the age for RMDs to 73, starting on Jan. 1, 2023, and then further to 75, starting on Jan. 1, 2033.

The new retirement rules would also reduce the penalty for failing to take RMDs. The previously steep 50% excise penalty would be reduced to 25%, and lowered further to 10% if the error is corrected “in a timely manner.” The penalty reductions would take effect immediately after the passage of the law.

What Are The Benefits Of A Roth Individual Retirement Account

A major benefit of a Roth individual retirement account is that, unlike traditional IRAs, withdrawals are tax-free when you reach age 59½. You can also withdraw any contributions, but not earnings, at any time during the contributed tax year, regardless of your age.

In addition, IRAs typically offer a much wider variety of investment options than most 401 plans. Also, with a Roth IRA, you dont have to take required minimum distributions when you reach age 72.

You May Like: When Can You Start To Withdraw From 401k

Direct And Indirect 401 Rollovers

Before you roll over your 401, youll need to open an IRA account. You can do this at virtually any major brokerage firm, mutual fund company or robo-advisor. Do some research, then head to your financial institutions website to open your account. At some point, youll want to talk to a customer representative to find out whether the rollover and conversion can be done at once or if they are done sequentially. If its the former case, youll just have to pick your investments once. If its the latter, youll want to keep the money liquid in the IRA before converting to a Roth.

Once youve opened the IRA, you can contact the company managing your 401 account to begin the rollover process. You can do this online or over the phone. Your 401 plan administrator will then transfer your funds into your new IRA account. This is called a trustee-to-trustee or direct rollover, and its the easiest way to do it.

Another path is an indirect rollover. In this case, the balance of the account is distributed directly to you, typically as a check. Youll have 60 days from the date you receive the funds to transfer the money to your custodian or IRA company. If you dont deposit the funds within the 60 days, the IRS will treat it as a taxable withdrawal, and youll face a 10% penalty if youre younger than 59.5. This risk is why most people choose the direct option.

Transferring A 401 Plan And Ira To A Canadian Rrsp

Investment Insight

If youve been living and working in the United States, youd have likely accumulated retirement savings while employed. Now that youve returned to Canada, youre probably considering transferring the retirement savings you accumulated abroad to a Canadian registered retirement savings plan ¹ but are concerned about the tax implications and the logistics associated with such a transfer.

Read Also: Whats The Best Percentage For 401k

Recommended Reading: Can I Open An Ira If I Have A 401k

How Many Roth Conversions Can You Make Per Year

A Roth Individual Retirement Account can offer tax benefits in the form of tax-free withdrawals in retirement. If you have a traditional IRA or 401, you can use a Roth conversion to change the tax status of your retirement savings. Wondering how many Roth conversions per year the IRS allows? The good news is that theyre unlimited, though there are some tax rules to keep in mind when converting retirement accounts.

A financial advisor can help you create a financial plan for your retirement needs and goals.

Rollover To Another 401

If you value the simplicity of having all your retirement funds in one place, are looking to minimize account maintenance fees or want to prepare yourself to take advantage of the Rule of 55, a 401-to-401 rollover can be a good choice. By rolling over an old 401 into a plan with your new employer, you can keep everything in one place. Evaluate investment options carefully, though, to make sure there arenât high fees and that the investments available work for you.

Read Also: Can You Invest Your 401k In Stocks

How To Do A Roth Ira Conversion

The actual process for converting a 401 or traditional IRA to a Roth IRA is simple. In fact, its so straightforward that you can create problems before youre aware that youve done so.

Here are the three basic steps to convert your retirement account to a Roth IRA:

If you manage your own funds, you should be able to find steps to do a Roth conversion on your investment platforms site, says Kerry Keihn, financial advisor at Earth Equity Advisors in the Asheville area, noting that each institution has a slightly different process or forms.

Within a couple weeks and often sooner the conversion to the Roth IRA will be made.

When it comes time to file taxes for the year you made the conversion, youll need to submit Form 8606 to notify the IRS that youve converted an account to a Roth IRA.

How Would The New Retirement Account Rules Impact Taxes

If the sweeping spending bill passes Congress and is signed into law, the law would repeal and replace the IRA tax credit, also known as the “Saver’s Credit.” Instead of a nonrefundable tax credit, those who qualify for the Saver’s Credit would receive a federal matching contribution to a retirement account. This change in tax law would start with the 2027 tax year.

In the proposed legislation, Congress is also amending the IRS laws for retirement account rollovers from 529 plans, which are tax-advantaged savings accounts for higher education. Currently, any money withdrawn from a 529 plan that’s not used for education is subject to a 10% federal penalty.

In the bill, beneficiaries of 529 college savings accounts would be allowed to roll over up to $35,000 total in their lifetime from a 529 plan into a Roth IRA. The Roth IRA would still be subject to annual contribution limits, and the 529 account must have been open for at least 15 years.

Read Also: How To Find Forgotten 401k Accounts

Fund Your New Traditional Ira Account

To complete this step, youll need to work closely with the administrator of your old 401 account. Alternately, your employers HR department might also be able to assist you.

You must make a written request to have your balance transferred to the new IRA account you created in step 2. There may be either paper-based or online forms designated for such transfer requests. Youll need to fill them out and provide necessary account identification details, both for the existing and the new rollover account.

Typically, youll have the following options to fund your new account:

What Happens If I Cash Out My 401

If you simply cash out your 401 account, youâll owe income tax on the money. In addition, youâll generally owe a 10% early withdrawal penalty if youâre under the age of 59½. It is possible to avoid the penalty, however, if you qualify for one of the exceptions that the IRS lists on its website. Those include using the money for qualified education expenses or up to $10,000 to buy a first home.

Don’t Miss: Can I Move My 401k From My Current Employer

What Are The Changes

The new law increases the maximum annual contribution limits for all types of retirement accounts, including Roth IRAs. The current limit is $6,000 per year for individuals under age 50. But in 2023, this limit will increase to $6,500 annually. For those over age 50, the limit will increase from $7,000 a year to $7,500 annually starting in 2023.