What Reasons Can You Withdraw From 401k Without Penalty

Heres how to get an unpunished withdrawal from your IRA or 401

- Unpaid medical bills.

- If you owe it to the IRS.

- First time home buyers.

- Higher education expenses.

- For income purposes.

Need 401k withdrawal difficulties? You just have to be more discriminating with the help you render toward other people. The provision for financial hardship allows for retirement only for immediate needs, Stone said.

Cashing Out Your 401 After Leaving A Job

LAST REVIEWED Feb 18 20219 MIN READ

Based on the amount of money in your 401 account, your employer may allow you to leave the account with them. However, you will not be able to contribute any more to your old account.

Leaving your account with the old employer may not be prudentespecially when you have access to more flexible Individual Retirement Account plans from most brokers. You may roll over your 401 account to your new employer or transfer the funds into an IRA. If you meet the age criteria, you may start taking distributions without having to pay any penalty for early withdrawal.

How Are 401 Withdrawals Taxed

If a rollover-eligible withdrawal is made to you in cash, the taxable amount will be reduced by 20% Federal income tax withholding. Non-rollover eligible withdrawals are subject to 10% withholding unless you elect a lower amount. State tax withholding may also apply depending upon your state of residence.

However, your ultimate tax liability on a 401 withdrawal will be based on your Federal income and state tax rates. That means you will receive a tax refund if your actual tax rate is lower than the withholding rate or owe more taxes if its higher.

If a 401 withdrawal is made to you before you reach age 59½, the taxable amount will be subject to a 10% premature withdrawal penalty unless an exception applies. This penalty is meant to discourage you from withdrawing your 401 savings before you need it for retirement. You can avoid the 10% penalty under the following circumstances:

- You terminate service with your employer during or after the calendar year in which you reach age 55

- You are the beneficiary of the death distribution

- You have a qualifying disability

- You are the beneficiary of a Qualified Domestic Relations Order

- Your distribution is due to a plan testing failure

A full list of the exceptions to the 10% premature distribution penalty can be found on the IRS website.

Also Check: How Do You Set Up A 401k

How To Take 401 Distributions

Depending on your companys rules, you may elect to take regular distributions in the form of an annuity, either for a fixed period or over your anticipated lifetimeor to take nonperiodic or lump-sum withdrawals.

When you take distributions from your 401, the remainder of your account balance remains invested according to your previous allocations. This means that the length of time over which payments can be taken, and the amount of each payment, depending on the performance of your investment portfolio.

You Will Eventually Be Required To Take Money Out Of Your 401

If you decide not to tap into your 401 early, there will come a time when you will be forced to start taking distributions. Once you turn 72, you must take required minimum distributions . Just like you owe penalties for taking money out of your 401 early, you will owe penalties if you fail to take RMDs and leave money in your 401 too long.

Ultimately, a solid plan for retirement will show you how to use your savings and other financial tools to generate enough money to live comfortably for the rest of your life. A financial advisor can work with you to build a plan that can allow you to generate reliable income for as long as you live.

This publication is not intended as legal or tax advice. Financial Representatives do not render tax advice. Consult with a tax professional for tax advice that is specific to your situation. All investments carry some level of risk including the potential loss of all money invested.

Are you on track for retirement?

See how much monthly retirement income you may have based on what youâre saving now.

Take the next step

Our advisors will help to answer your questions â and share knowledge you never knew you needed â to get you to your next goal, and the next.

Also Check: How Much Does 401k Cost Per Month

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, the penalty will likely be waived if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year.

Tapping Your 401 Early

If you need money but are trying to avoid high-interest credit cards or loans, an early withdrawal from your 401 plan is a possibility. However, before you consider this option, be forewarned that there are often tax consequences for doing so.

If you understand the impact it will have on your finances and would like to continue with an early withdrawal, there are two ways to go about it cashing out or taking a loan. But how do you know which is right for you? And what are the tax consequences you should be expecting?

Recommended Reading: Can I Transfer Money From 401k To Ira

How Much State Tax Do I Pay On 401k Withdrawal

Because payments received from your 401 account are considered income and taxed at the federal level, you must also pay state income taxes on the funds. The only exception occurs in states without an income tax. Your 401 plan may offer you the opportunity to have taxes automatically withheld from a withdrawal.

What Are My 401 Options After Retirement

Generally speaking, retirees with a 401 are left with the following choicesleave your money in the plan until you reach the age of required minimum distributions , convert the account into an individual retirement account , or start cashing out via a lump-sum distribution, installment payments, or purchasing an annuity through a recommended insurer.

Read Also: Should I Roll My 401k Into My New Job

Series Of Substantially Equal Payments

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. This allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account.

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

Does 401k Income Affect Social Security

The amount of money you’ve saved in your 401k won’t impact your monthly Social Security benefits, since this is considered non-wage income. However, since your Social Security benefits increase if you delay retirement, it may be beneficial to rely on 401k distributions in the early years of retirement.

Also Check: How To Fill Out A 401k Enrollment Form

Can You Make An Early Withdrawal From Your 401 Plan

Yes, you can make an early withdrawal but just because you can, it doesnt mean that you should. Cashing out from your 401 plan early can come with several financial consequences such as loss of interest growth or penalties. This is why its not recommended to cash out the 401 until you are at least 59 years old.

Considerations For An Old 401

When changing jobs or leaving the workforce, you have four options when deciding what to do with an old 401(k account. To determine whats right for you, consider whether youre changing jobs or retiring from your career, as well as your financial circumstances and long-term goals, says Judith Ward, CFP®, a thought leadership director with T. Rowe Price. Keep in mind that preserving the tax benefits of your investments when you leave your job may substantially improve your ability to build wealth over the long term. Consider the following options:

Read Also: How To Withdraw Fidelity 401k

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

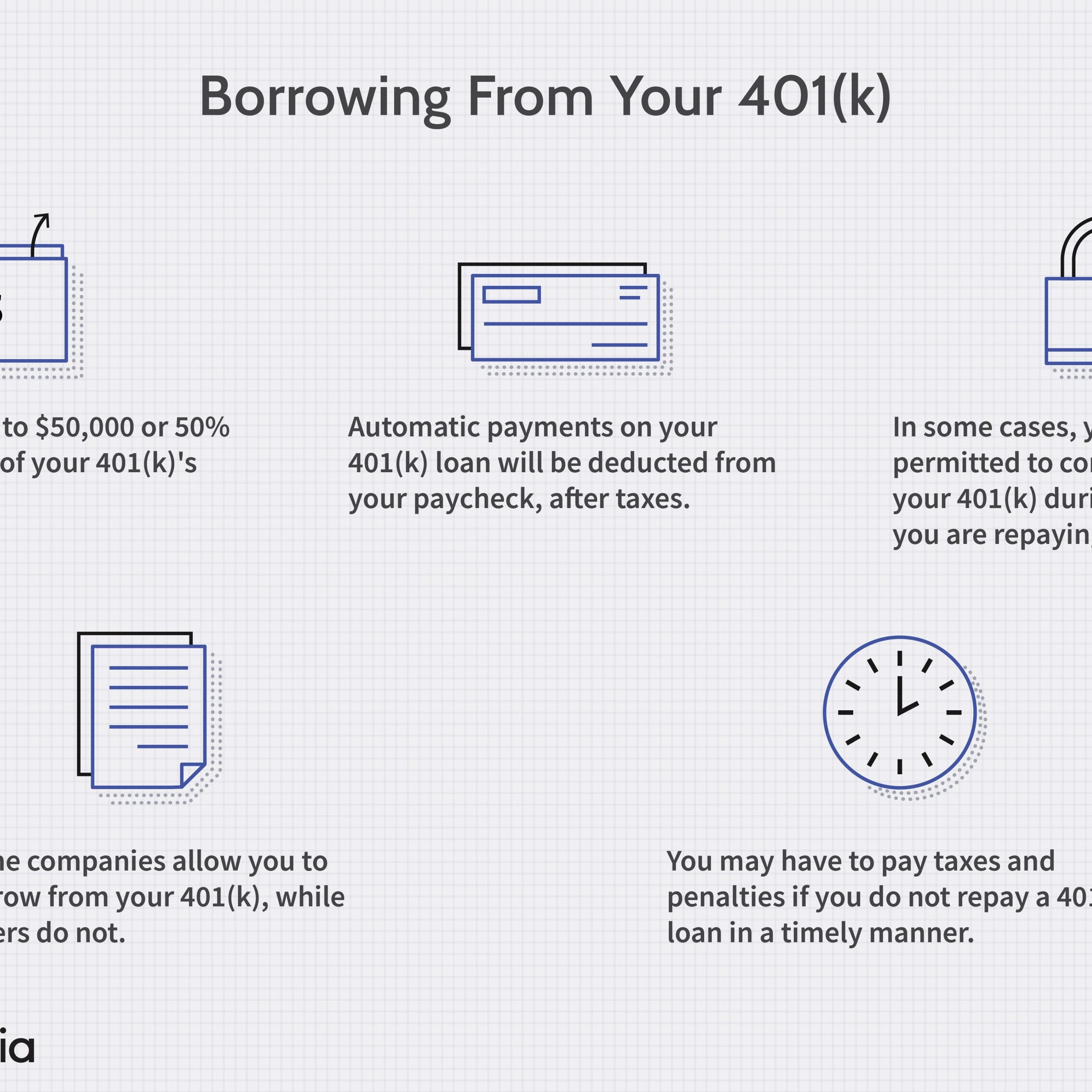

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

What About 401 Hardship Withdrawals

401 loans are not to be confused with 401 hardship withdrawals. A hardship withdrawal isn’t a loan and doesn’t require you to pay back the amount you withdrew from your account. You’ll pay income taxes when making a hardship withdrawal and potentially the 10% early withdrawal fee if you withdraw before age 59½. However, the 10% penalty can be waived if you can provide evidence that the money is being used for a qualified hardship, like medical expenses or if you have a permanent disability.

Another key difference between the two is that with 401 hardship withdrawals, you would be unable to pay yourself back what you took from your account. This is not the case with 401 loans.

The qualifications for a 401 hardship withdrawal depend on your plan and the rules of plan’s administrator, so make sure to check to see how you can qualify for one.

Also Check: When Can I Rollover My 401k Into An Ira

Reasons To Proceed With Caution

Experts suggest moving slowly with any withdrawal. Here are three things to consider.

Hardship withdrawals are still subject to income taxes. Since your savings went into your retirement plan on a pretax basis, youll be paying income taxes on the contributions and earnings withdrawn.

You get a three-year period to pay the taxes to Uncle Sam, said Paul Porretta, partner at Pepper Hamilton LLP in New York.

Plan ahead to cover the tax bill and spread it over that period of time, perhaps out of your cash flow.

Know your 401 plans rules. Be aware that a workplace retirement plan may allow hardship distributions from participants savings, but it isnt required to do so.

Youll need to talk to your human resources department or your plan administrator before you proceed.

A 401 plan or a 403 plan, even if it allows for hardship withdrawals, can require that the employee exhaust other sources of money before taking a withdrawal, said Porretta.

What Are The Hardship Rules For 401 Withdrawal

The rules can vary by plan, and plan participants should always consult their plan documentation to see the specific rules that will apply. Remember that even with a solo 401, you should have your rules written down and documented. However, there are a couple of basic rules that will always hold true when it comes to a hardship 401k withdrawal. First, the withdrawal must be for an immediate and heavy financial need. Next, you are only allowed to withdraw enough funds to cover that immediate need. For example, missing a mortgage payment typically does not qualify as an immediate and heavy need. However, if you have received foreclosure papers and are in danger of eviction, then that constitutes an immediate and heavy need. Again, you should contact your plan administrator with any questions about the hardship requirements for your qualified plan.

Read Also: How To Move Your 401k To A New Job

Also Check: When Can You Start Your 401k

Withdrawal Penalty Before Age 59

If you’re under age 59½, you may have to pay an additional 10% when you file your tax return. If you are still working when you are 59 ½, you can take money out of your 401.

You can take money from your 401 account if you are age 59½ or older. You will not have a penalty. Twenty percent is withheld for federal income taxes. You can also roll money from your 401 to IRA or other qualified plan. Funds that are rolled over are not subject to tax at that time.

The Benefits And Drawbacks Of Buying A House With A 401

Pulling money from your 401 to buy a house seems like a natural fit. A 401 helps save for retirement, and owning a home provides additional stability and security, especially when living on a fixed income. If youre wondering if you should use your 401 to buy a house, first consider these benefits and drawbacks.

Read Also: How To Withdraw 401k After Leaving Job

How Much Money Will I Lose If I Close My 401k

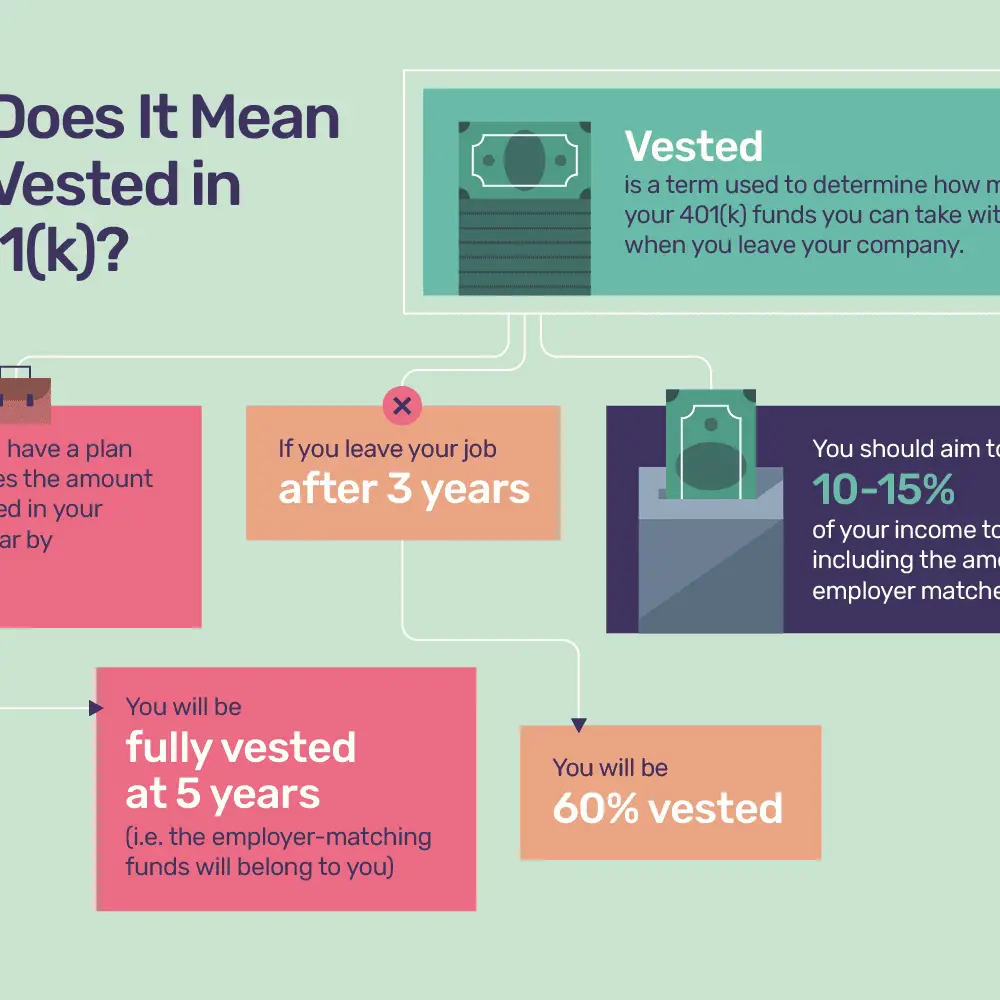

If you remove funds from your 401 before you turn age 59.5, you will get hit with a penalty tax of 10% on top of the taxes you will owe to the IRS. If your 401 balance is composed of equal parts employee and employer funds, you are only entitled to 30% of the $12,500 your employer contributed, or $3,750.

Do You Pay Tax On 401 When Retire

When you retire, you will have to pay taxes on any money you withdraw from your 401. The amount of tax you pay will depend on your tax bracket. Withdrawals from a 401 are considered taxable income. So if you are in the 25% tax bracket, you will owe 25% in taxes on the withdrawal. There may also be penalties for early withdrawal if youre under the age of 59.5, so it is essential to wait until you are eligible to make a withdrawal without penalty.

Also Check: How To Avoid Taxes On 401k

Withdrawing When You Retire

After you reach the age of 59 1/2, you may begin taking withdrawals from your 401. If you leave your job in the calendar year when you turn 55 or later, you can also begin taking penalty-free withdrawals from the 401 you had with that current company. If you are a public safety worker, this rule takes effect at the age of 50.

Once you reach 72, you are actually obligated to begin making required minimum distributions or RMDs.

Reduced Penalties For Not Taking Rmds

The penalties for not taking RMDs are harsh, but the Secure 2.0 Act gives a break to those who fail to take RMDs. Beginning in 2023, the penalty will drop from the current 50% of the amount not taken to 25%. The fine drops to 10% for individual retirement account owners who don’t take an RMD but correct their mistake in a “timely manner.”

You May Like: How Do I Sign Up For 401k

Can I Use My Hsa To Buy Vitamins

Generally, weight-loss supplements, nutritional supplements, and vitamins are used for general health and are not qualified HSA expenses. HSA owners usually cannot include the cost of diet food or beverages in medical expenses because these substitute for what is normally consumed to satisfy nutritional needs.

Withdrawals After Age 72

Many people continue to work well past age 59 1/2. They delay their 401 withdrawals, allowing the assets to continue to grow tax-deferred, but the IRS requires that you begin to take withdrawals known as “required minimum distributions” by age 72.

Those who are owners of 5% or more of a business can defer taking their RMDs while they’re still working, but the plan must have made this election. This only applies to the 401 of your current employer. RMDs for all other retirement accounts still must be taken.

Also Check: How To Stop 401k Contributions

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period.

When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash.

However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount.

This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

Read More: 7 Essential Steps for Retirement Planning

When Does The Rule Not Apply

The Rule of 55 doesnt apply to any retirement plans from previous employers. Only the 401 youve invested in at your current job is eligible. Additionally, the Rule of 55 doesnt work for individual retirement accounts , including traditional, Roth and rollover accounts. Youll have to wait until age 59½ to access those assets without penalty.

Theres a way around this, however: You could roll over the funds from your former 401 and IRA plans into your current 401. Note that the process can be complicated, and not all employers accept rollovers. Before initiating a transfer, talk to your human resources representative and consult with a tax advisor to avoid unnecessary headaches. If you are allowed to make the transfer, all the funds in your current 401, including the transferred amount, will be available if you take early distribution using the Rule of 55.

Don’t Miss: What Do You Do With 401k When You Retire