You Prefer Convenience Over Control

Perhaps you opened an IRA with the intention of putting together a diverse portfolio and actively managing your investments. However, youre now finding that you dont have the time or energy to devote to your portfolio and feel that youre in over your head. Rolling over your IRA to a 401 and giving up some control may better fit your needs as an investor.

Student Loan Debt And Saving For Retirement

One of the more revolutionary changes included in the Secure 2.0 Act of 2022 is the option for employer plans to credit student loan payments with matching donations to 401 plans, 403 plans or Simple IRAs. Government employers will also be able to contribute matching amounts to 457 plans.

This means that people with significant student loan debt can still save for retirement just by making their student loan payments, without making any direct contributions to a retirement account.

The new regulation will take effect in 2025.

Rolling Your Old 401 Over To A New Employer

To keep your money in one place, you may want to transfer assets from your old 401 to your new employers 401 plan. Doing this will make it easier to see how your assets are performing and make it easier to communicate with your employer about your retirement account.

To roll over from one 401 to another, contact the plan administrator at your old job and ask them if they can do a direct rollover. These two words direct rollover are important: They mean the 401 plan cuts a check directly to your new 401 account, not to you personally.

Generally, there arent any tax penalties associated with a 401 rollover, as long as the money goes straight from the old account to the new account.

Although this route may help you stay organized with fewer accounts to keep track of, make sure your new 401 has investment options that are right for you and that you arent incurring higher account fees.

Also Check: How To Withdraw My 401k From Fidelity

Recommended Reading: How To Convert 401k To Annuity

How Long Do I Have To Roll Over My 401 From My Old Job

If you have money sitting in a 401 with your last employer and you decide to leave the money in there, theres no time limit. You can roll those funds into an IRA or your new employers retirement plan whenever you want to.

However, if you have your old 401 money sent directly to you from your retirement plan , the IRS says you have just 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA. Otherwise, you will get hit with taxes and an early withdrawal penalty.

You May Like: Where Do You Check Your 401k

Types Of Ira Transfers

If you cant set up a direct transfer, you can have your financial institution send you a check for the balance. However, youd be responsible for depositing that check with the financial institution that holds your new IRA.

However, you have to make that deposit within 60 days after getting your check or face an early withdrawal penalty unless youre at least 59.5-years-old. That penalty is usually a 10% early-withdrawal penalty in addition to the ordinary income taxes you pay on the transfer.

This is one of the ways you can move assets into an IRA. In total, you have the following three options:

- Rollover: You get a check and you must deposit it into a new IRA within 60 days of receiving it.

- Trustee-to-Trustee Transfer: Your financial institution transfers the balance directly to another financial institution that holds your IRA

- Same trustee transfer: If you have multiple accounts with the same financial institution, you can have these assets moved across different savings vehicle you

As you can see, a trustee-to-trustee transfer is the easiest and safest way to move assets into an IRA.

You May Like: What Can I Use My 401k For

Advantages Of Rolling An Ira Over Into A 401

There are a number of reasons why you would want to move IRA assets into your 401:

Moving investments from an IRA to a 401 account might give you more flexibility when it comes to accessing this money. However, it may well limit your investment options, because many company 401 plans are quite limited in the assets they offer.

Can You Be Required To Roll Over Your 401

Sometimes you have no choice in the matter. You might be required to roll over your 401 if:

⢠You donât meet a minimum balance requirement. For example, if you have less than $5,000 in your 401, your employer can require you to roll your 401 into a different account.

⢠Your old employer changes 401 providers. Depending on your company, your account may not be rolled over and your existing provider may not continue service. If your account is rolled over, the new provider might have requirements you canât meet, or they might not provide the services you want.

Recommended Reading: When Do You Have To Withdraw From 401k

Transfer Money Directly Into The Tsp

Transfers or direct rollovers occur when the eligible plan sends your money to the TSP.

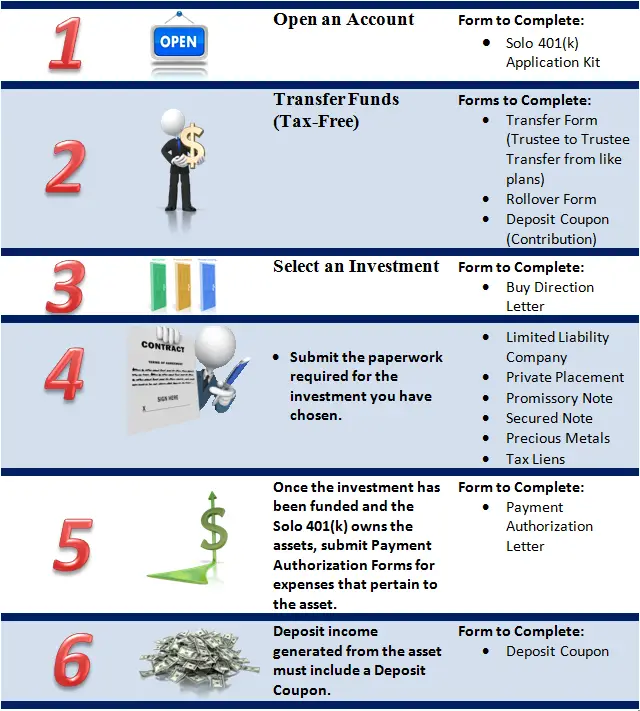

Tax-deferred amounts should be transferred into the TSP using TSP rollover Form TSP-60, Request for a Transfer Into the TSP. You can transfer Roth money into the TSP by completing Form TSP-60-R, Request for a Roth Transfer.

Could You Benefit From Advice

The best path forward for you will depend on several factors. Having a trusted advisor to talk through your options can bring clarity to your process and help you feel confident in your decisions. Some employer-based plans provide access to advice and even cover the advisory fees. If thats the case, you may want to hold on to that benefit and retain some or all your funds in the 401.

If not, a qualified financial advisor or robo-advisor can provide ongoing guidance and help keep your investments on track.

Note: An advisor can help with IRAs but might have limited access to your 401 plan. If youre going to hire someone, Lobel says, find out whether they can offer advice on your plan. It may not be a deal breaker, depending on your situation, but youll certainly want to know before you decide.

You May Like: What Happens To 401k Money When You Quit

Why Might You Consider An In

When you have a 401, you dont have maximum control over the types of assets you can hold, such as mutual funds, stocks, and bonds. You typically have a limited menu of options.

Through an in-service rollover, transferring some or all of your 401 funds to a personal IRA can open up more options for your assets. For instance, you might be able to put money into alternative assets like precious metals . A bonus is that you usually can keep contributing to your employers 401 after youve moved funds to an IRA.

Furthermore, an in-service rollover enables your personal financial advisor to provide more hands-on help since at least some of your assets are in an IRA that you control and not in an employer-sponsored 401 that could come with strings attached.

Plus, some 401 plans have annual fees with their options that are way above average. If youre stuck in one of those, you can minimize your costs by rolling your 401 money into an IRA with a lower-cost fund company, explains Rick Salmeron, a certified financial planner.

On top of that, you might be permitted to make tax-free withdrawals from an IRA that you wouldnt be able to make from a 401.

With your funds in an IRA, you are the account owner and have more control over your assets, free from the restrictions your employer-sponsored plan can impose, Salmeron adds.

How To Transfer A 401k Or Company

With employees changing jobs about every four years, there are many opportunities to roll over company-sponsored retirement accounts into an IRA. And yet, most employers do not provide information about when and how to transfer account funds.

The reality is if you have investments sitting in retirement accounts with a previous employer, and in some cases, with your current employer, there are compelling reasons to complete an IRA rollover.

This article addresses when, why, and how you can transfer retirement funds to an IRA.

Circumstances That Allow RolloversMost rollovers from a 401K or employer-sponsored retirement account occur after a job change or at retirement. You can also transfer investments from one IRA to another. In addition to these events, most employer plans also allow you to roll over funds even if you remain with the company.

Benefits of Rolling Over a 401k

Consolidation: An IRA can accept funds from multiple 401ks and the same type of IRAs putting most or all of your retirement dollars into a single account, making it easier to manage.

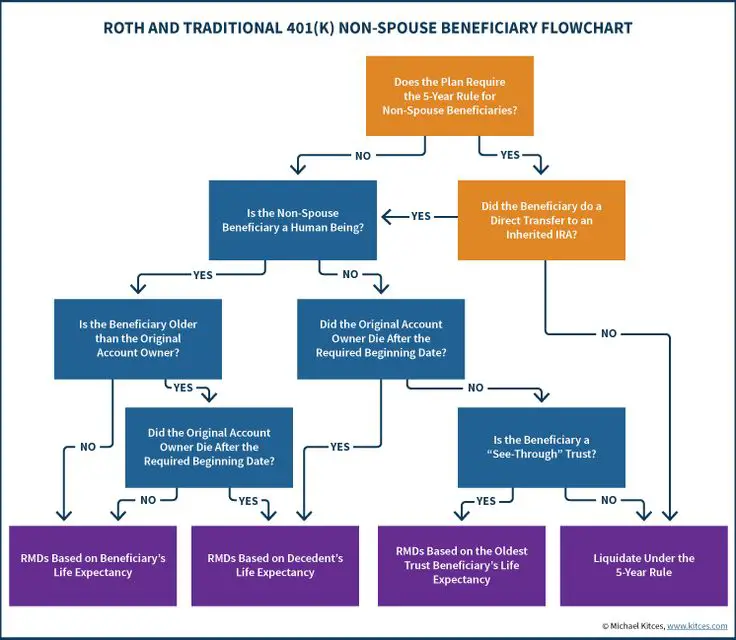

Flexibility with beneficiaries: IRAs allow more beneficiary options. You must follow the custodian rules but are likely to have more flexibility in naming beneficiaries.

Better diversification: One of the disadvantages of 401ks is the limited list of investment options. IRAs allow you to choose any investment not on the IRS list of prohibited transactions.

How to Rollover an Employer-Sponsored Account Into an IRA

Also Check: Is Ira Safer Than 401k

Why Should I Put My Iras Into My Companys 401

This might give you more flexibility when it comes to accessing this money because 401 accounts allow you to take distributions earlier than IRAs, or when deferring these distributions if you are still working. The disadvantage is that 401 accounts generally have much more limited investment options.

Get Help With Your 401 Rollover

Having an investment professional in your corner, someone who can help you find the right investments to add to your portfolio and walk you through all the ins and outs of a 401 rollover, makes this process a lot easier.

Dont have an investment professional? No worries! Our SmartVestor program can get you in touch with someone in your area to help you get started.

Recommended Reading: How To Pull Money From Your 401k

What Are The Disadvantages Of Rolling Over A 401 To An Ira

Despite the benefits, the transfer of a 401 to an IRA while still employed may not suit everyone. Reasons to wait to roll over your 401 include the following:

- Early retirementIf you want to retire and withdraw funds from your retirement savings plan before you turn 59 1/2, you may consider keeping your 401. Many 401 plans allow account holders to withdraw funds at age 55.

- Applicable feesThe increased investment options can result in higher fees than you pay with a 401, depending on the investment vehicles you choose. For example, mutual funds and other managed products often involve extra fees. Your financial planner can help you estimate the difference and costs to help you determine whether rolling over to an IRA is worth it.

- 401 loansIf you need funds while still employed, you may be able to borrow the money from your 401 account, but IRAs dont allow account holders to take out loans from available funds.

You may discuss these benefits with your financial planner to decide whether an IRA rollover suits your situation or whether you should wait for a more appropriate time.

Dont Roll Over Employer Stock

There is one big exception to all of this. If you hold your company stock in your 401, it may make sense notto roll over this portion of the account. The reason is net unrealized appreciation , which is the difference between the value of the stock when it went into your account and its value when you take the distribution.

Youre only taxed on the NUA when you take a distribution of the stock and opt notto defer the NUA. By paying tax on the NUA now, it becomes your tax basis in the stock, so when you sell it , your taxable gain is the increase over this amount.

Any increase in value over the NUA becomes a capital gain. You can even sell the stock immediately and get capital gains treatment. The usual more-than-one-year holding period requirement for capital gain treatment does not apply if you dont defer tax on the NUA when the stock is distributed to you.

In contrast, if you roll over the stock to a traditional IRA, you wont pay tax on the NUA now, but all of the stocks value to date, plus appreciation, will be treated as ordinary income when distributions are taken.

Don’t Miss: How Do I Start A Solo 401k

Youll Pay Higher Tax Rates Later

Theres also a rule of thumb for when a conversion may be beneficial, says Victor. If youre in a lower income tax bracket than youll be in when you anticipate taking withdrawals, that would be more advantageous.

The reason you might be in a higher tax bracket could be anything: living in a state with income taxes, earning more later in your career or higher federal taxes later on, for example.

Lets say that you are a Texas resident and you convert your IRA to a Roth IRA and then in retirement, you move to California, says Loreen Gilbert, CEO, WealthWise Financial Services in Irvine. She points to high-tax California and no-tax Texas as examples. While the state of California will tax you on IRA income, they wont be taxing you on Roth IRA income.

In this example, you avoid paying state taxes on your conversion in Texas and then avoid paying income taxes in California when you withdraw the funds at retirement.

You May Like: How Do I Find My Fidelity 401k Account Number

Rollover To A Roth Ira

Rollovers are a great time to alter the tax treatment offered by your retirement account, such as rolling your 401 funds over into a Roth IRA. Itâs a beneficial choice for many retirement savers, but it may be especially appealing for people with high incomes who may not be able to otherwise save in a Roth IRA.

This type of rollover can also help you avoid required minimum distributions that come even with a Roth 401.

However, there will most likely be tax consequences. Because traditional 401 contributions are made with pre-tax dollars, you will owe income taxes on the funds you convert to a Roth IRA, which holds after-tax contributions.

Also Check: Are 401k And Ira The Same

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Why It Works To Move Your Retirement Plan To A Self

There are numerous reasons people choose to transfer and/or rollover their retirement account to a self-directed IRA. The main reason is to protect their savings from a volatile stock market or unpredictable changes in the economy. By diversifying their investments, they have a greater opportunity to stay on track with their retirement goals.

Self-directed IRAs are also known to perform much better than stocks and bonds. A recent examination of self-directed investments held at IRAR suggests that investments held for 3 years had an ROI of over 23%. This is why most investors are self-directing their retirement.

Recommended Reading: Is It Smart To Roll Over 401k To Ira

Where Should You Transfer Your 401

You have several options on what to do with your 401 savings after retirement or when you change jobs. For example, you can:

The right choice depends on your needs, and thats a choice everybody needs to make after evaluating all of the options.

Want help finding the right place for your retirement savings? Thats exactly what I do. As a fee-only fiduciary advisor, I can provide advice whether you prefer to pay a flat fee or youd like me to handle investment management for you, and I dont earn any commissions. To help with that decision, learn more about me or take a look at the Pricing page to see if it makes sense to talk. Theres no obligation to chat.

Important:The different rules that apply to 401 and IRA accounts are confusing. Discuss any transfers with a professional advisor before you make any decisions. This article is not tax advice, and you need to verify details with a CPA and your employers plan administrator. Likewise, only an attorney authorized to work in your state can provide guidance on legal matters. Approach Financial, Inc. does not provide tax or legal services. This information might not be applicable to your situation, it may be out of date, and it may contain errors and omissions.

Next Up: Curious About Meeting?